AK2

As 2022 winds to a close, many investors are taking stock of their portfolios and making changes to prepare for the new year. This year saw a few notable trends, namely the sharp rise in interest rates associated with the global hiking cycle. The near-record rate increase led to significant declines in the bond market, notable losses in many stocks (particularly those with higher valuations), and increased volatility in the commodity and currency markets. Since US rates rose much faster than most other countries, the US dollar also rose dramatically compared to most currencies, creating strain in the precious metals market.

If 2021 was the year of inflation and 2022 was the year of global hiking (to slow the economy to combat inflation), it follows that 2023 should be the year of a notable global economic slowdown. Higher interest rates slow or reduce economic demand from businesses and households, reducing the supply-demand imbalance (i.e., shortages) to lower inflation. Of course, due to the massive and persistent declines in US crude oil inventories, economic demand may need to decline by quite a bit to bring the energy market back into balance. I believe this is a highly critical point for assessing 2023 because energy prices are the primary driver of global inflation as long as oil storage levels are falling, inflation’s probability of a “surprise” rise increases.

US commodity prices have moderated this year mainly due to the rise in the US dollar. Now that that trend appears to be ending, commodity funds appear to be particularly attractive bets. The crude oil ETF (USO) is potentially my favorite speculative bet for 2023 due to supportive supply-side factors (including geopolitics and waning US production growth). That said, oil is likely to experience significant volatility due to shifting economic demand outlooks and, as seen in recent months, may suffer losses if demand slows sufficiently.

With that factor in mind, my favorite overall bet for 2023 is silver, which can be traded through the silver ETF (NYSEARCA:SLV). Silver benefits from global inflation persistence (driven by output gaps) and a (seemingly likely) fall in the US dollar and, potentially, economic volatility. Silver has been in a trading range since mid-2020, with its last significant gain occurring at the onset of global Q.E. Silver is also coming off the low end of its range with growing upward acceleration, giving a decent technical indication of a more significant impending rally. With the technical trend and economic fundamentals aligning, I believe it is an opportune time to increase exposure to silver.

Silver Benefits From US Dollar Decline

When I covered SLV last summer, it was trading near its range of lows, and a key reason for my bullish outlook was the immense volatility in foreign currency markets. Silver is one of the oldest forms of “hard” money, making it a strong hedge against vulnerabilities within the fiat currency market. 2022 has seen levels of volatility among developed and established fiat currencies not seen in many decades. Certain currencies, such as the Japanese Yen, have fallen to such extreme lows that its monetary authorities are using direct currency intervention to try to avoid a more significant crisis.

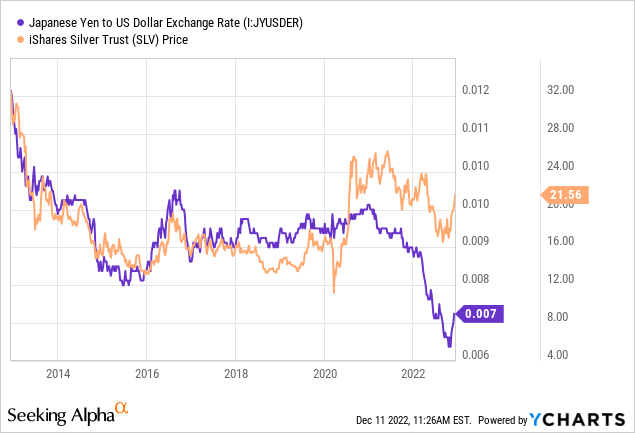

The Japanese Yen is essential for silver since the two are historically significantly correlated, partly due to the Yen’s history of “stability” and Japan’s typically low inflation rate. That pattern broke over the past two years as silver initially rose much faster than the Yen in 2020, and the Yen collapsed compared to the dollar this year. See below:

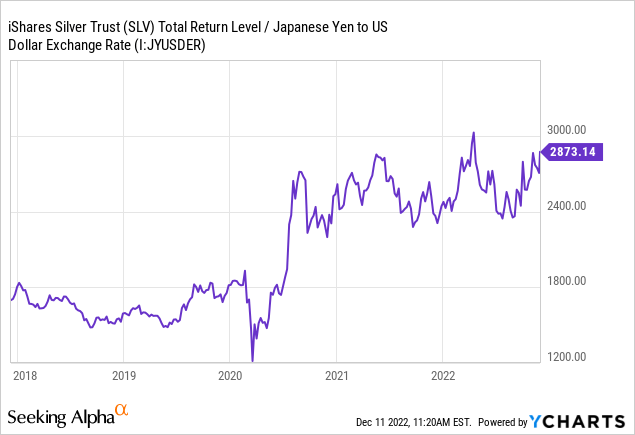

Silver’s route this year was generally small compared to the Yen, particularly given the Yen’s low historical volatility level. Both silver and the Yen have risen since Japan began FX intervention in October (selling its US dollar assets to buy Yen), spurring US dollar declines against most currencies. In my view, the Yen may see some stability over the coming months as its central banks try to avoid a more significant crisis, likely benefiting silver – particularly given the indirect benefit the effort has on the Euro, Pound, and other currencies). That said, silver, priced in Yen, is at the high end of its trading range, indicating a potential breakout. See below:

I believe the Yen is critical for investors, analysts, and speculators to keep an eye on over the next year. For one, despite its shock on global markets, the Yen’s significant decline (and the extreme rise in the US dollar) received relatively little US media attention this year, opening the door to market inefficiencies.

More importantly, Japan is, to an extent, a poster child for the broad economic issues in developed markets. Japan has extremely high government debt-to-GDP (nearly twice the US’s in GDP terms) and more “zombie” banks and conglomerates that are dependent on (chronic) government stimulus. Japan is also extremely import-dependent on critical commodities resources, giving it a considerable inflation risk in the event of global commodity shortages (namely, oil). The country also has a highly inverted population pyramid, hampering its long-term economic potential.

The US, Europe, and virtually all other developed countries suffer from the same core economic issues as Japan, but Japan’s are comparatively more extreme. As such, if there is a significant decline in the value of developed-world fiat currencies, it will likely begin in Japan – associated issues are most concentrated there. I believe the severe volatility in the Japanese monetary system this year indicates this catalyst. Silver is breaking out compared to the Yen, but now that the US dollar is pulling-back, I believe silver has a superior upside against the dollar.

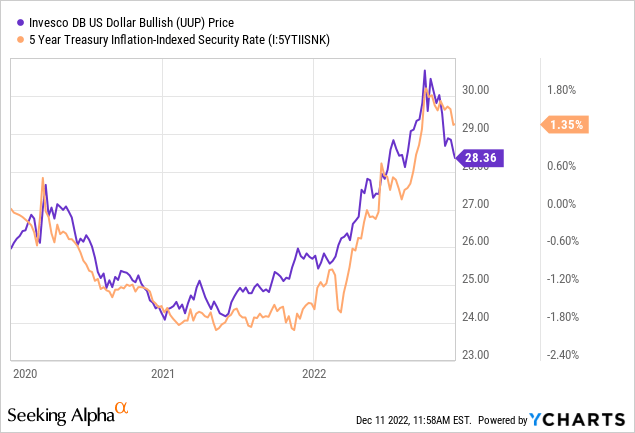

The US dollar has also been closely correlated to the US inflation-indexed Treasury rate or the interest rate on Treasury bonds after expected inflation. The inflation-indexed rate is very high today and indicates an aggressive tightening cycle. As the economy slows, interest rates will likely fall below inflation, exacerbating a reversal in the strong dollar. See below:

Precious metals are the best hedge against fiat currencies. This year’s initial crash in the Japanese Yen may soon spread to the US dollar and other fiat currencies. If that trend becomes large enough, there may be a significant increase in global demand for precious metals. This “fiat decline” inflation does not require a strong economy as does “normal” inflation since it primarily relates to a loss of confidence in monetary and fiscal policy. Indeed, the slowing US and global economy may be silver’s greatest catalyst.

Silver To Benefit From Economic Slowdown

Silver typically declines with stocks as a decline in economic demand lowers the industrial demand for silver. That said, investment demand for silver is far higher today, with spreads for physical silver bullion reaching record levels. Today, it is difficult for physical investors to find American Eagle silver coins below $40/oz, although silver is technically only worth ~$23/oz. This ~75% spread is unheard of in the silver market and indicates extremely high physical investment demand and an immense physical shortage for silver, likely offsetting industrial demand declines.

In 2020, silver initially declined with the stock market but quickly rose far higher as the Federal Reserve began to float its massive QE program. That change also kicked off the rise in physical silver spreads. Fundamentally, when global central banks initiated record fiat money-creation in response to the economic decline, it indicated a disregard for their defense of fiat currencies as doing so would likely create massive inflation (as seen today). In my view, the Federal Reserve and its peers seek to lower inflation but will quickly abandon that policy, for QE, in response to a sufficiently large recession. Thus, if a recession should arise again, silver may see another wave higher as aggressively dovish policies return.

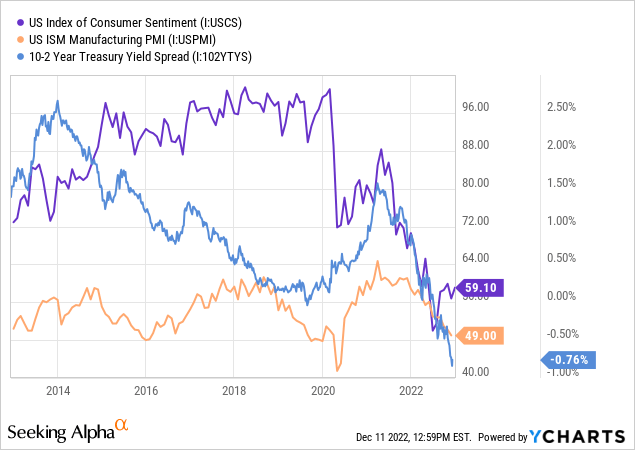

The significant decline in US consumer sentiment, manufacturing PMI (business growth indicator), and the US yield curve (a strong economic indicator) signal a sharp economic slowdown next year. See below:

As the economy slows rapidly in 2023, I expect corporate revenues to fall and unemployment to rise. Thus far, this trend is already occurring among technology companies, which saw immense increases in layoffs in November. For now, this phenomenon is very industry-specific, but it seems likely to become more significant next year in light of broader trends. Inflation may remain persistent due to energy shortages, but the Federal Reserve may shift toward dovish policies if unemployment spikes. In my opinion, that potential would be highly bullish for silver since it would warrant a more significant loss in confidence in monetary stability.

The Bottom Line

The most considerable risk in SLV may be the discrepancy between physical bullion prices and silver futures prices. Although SLV is technically physically backed, its “backing” is subject to counterparty risks associated with the bank’s ability to deliver physical silver. Given the shortage of physical silver, this counterparty risk is potentially large if there is a large increase in demand for physical silver. As seen by immense spreads, that already appears to be the case. In many ways, physical silver bullion is superior because it has no counterparty risk (since it is possessed).

That said, I believe SLV is a suitable investment for portfolio allocation. It is far more liquid than physical bullion, has essentially no spread, and closely tracks silver futures’ prices. It may be wise to have some bullion, but SLV is far easier to manage for a larger amount of money investors seek to keep liquid. For the same reasons, SLV is also superior for speculators wishing to take advantage of the short-term technical trend and fundamental support in the silver market.

Overall, I am very bullish on SLV and believe it is the strongest candidate for investors in 2023. Silver is slightly depressed today due to the US dollar’s strength. However, as the US economy slows, real rates reverse, and foreign central banks defend their currencies, the US dollar appears likely to decline back toward its normal range. However, its fundamental value may deteriorate even faster if inflation remains persistent despite the slowdown. All precious metals can benefit from this situation, but I believe silver offers the best overall upside-for-risk tradeoff.

Be the first to comment