Jean-Luc Ichard/iStock Editorial via Getty Images

After our recent update on Uniper (OTCPK:UNPRF) in which we emphasized the ongoing challenges and the transaction details following the German government intervention, today we are focusing on ENGIE (OTCPK:ENGIY). Last week, the French natural gas and electricity supplier released its half-year numbers. Our readers know that at a very unfortunate time, we provided a buy rating a few weeks before Russia’s invasion of Ukraine and after that, we assigned a neutral rating reflecting the very wide range of outcomes that the company was facing.

On one hand, our internal team still believes in ENGIE’s restructuring plan, and the company is delivering on its promises. On the other hand, uncertainties linked to the energy turmoil are still in place. Thus, it is always complicated to provide a future picture but this time is even harder. Let’s try to be factual and here below is our Q2 comment analysis.

Q2 Results

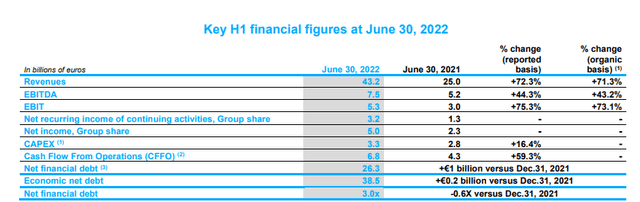

The company’s performance was mostly driven by higher energy selling prices. In the first half, the group’s top-line sales grew by 72.3% arriving at €43.2 billion. EBITDA came out at €7.5 billion and the group’s EBIT amounted to €5.3 billion, up 75.3% year-on-year. Compared to the same period of the past year, ENGIE’s recurring net income almost tripled, reaching at €3.2 billion.

According to the FactSet consensus, analysts expected EBITDA, EBIT and net income at € 7.45 billion, €5.2 billion and €3.1 billion, respectively. ENGIE managed to beat consensus expectations in all the P&L lines.

But now let us leave the numbers aside. Looking at the divisional level, ENGIE energy trading and the GEMS division delivered a very good set of numbers. A good performance was also recorded in ENGIE’s nuclear activities in Belgium. The former division almost quadrupled the results from last year, and the latter increased by nearly €700 million the group’s EBIT result. ENGIE’s renewable arm also posted a rise of almost 70%. A positive contribution was also added by the Veolia acquisition.

Russia implication and other relevant news

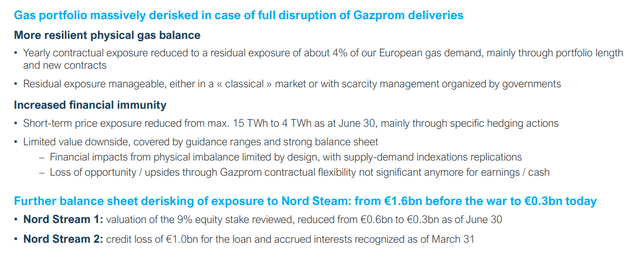

- Over the months, ENGIE has reduced its Russian gas exposure to 4 terawatt hours compared to a maximum exposure of 15 terawatt hours announced last March.

- Moreover, ENGIE’s CEO reaffirms that the company is ready to serve its customers without Russian gas. Looking at the half-year presentation, ENGIE’s residual gas volume of Putin’s country stands now at 4%. The CEO also commented that there is gas market optionality too. Looking at the latest Snam Q2 results, we see two acquisitions for LNG transports.

- Cross-checking the numbers, B2B customers are reducing their gas consumption. This poses a threat to the future economic outlook.

- Due to energy price shocks, ENGIE has announced that its precarious clientele will be supported with €100. For the company, this contribution will represent an expense of €90 million and it will be made this November.

- In addition, ENGIE will also set up a recovery fund of €60 million for SMEs.

- The company is actively looking to increase its gas storage. They are now at a 77% capacity rate.

- Moreover, at the country level, France and Germany signed a collaboration agreement in case of energy shocks, exchanging gas and electricity in case of needs.

Conclusion and Valuation

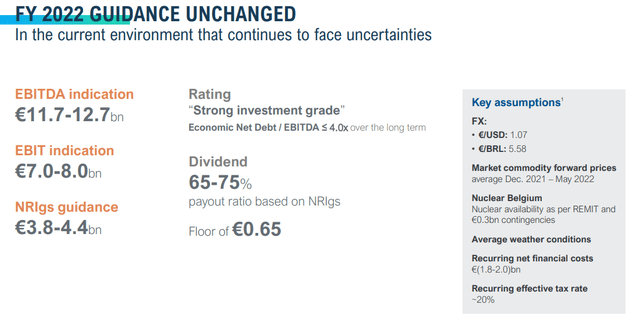

The leading gas supplier posted a record result in the first half of 2022 and from what we understood the group is ready to face winter without Russian gas deliveries. Despite this, the company reaffirmed its 2022 objectives.

“If market conditions and the price environment (as of June 30, 2022) were to continue in the second half, this would result in an additional contribution to net recurring income group share of €0.7 billion,” the group said in a statement.

ENGIE valuation is attractive and looking at the discount compared to the peers is even more pronounced. According to our calculation and looking at the numbers, ENGIE is trading at a P/E of 10x and an EV/EBITDA of 7.5x in comparison with the integrated competitors at 13x and 9x, respectively. Downside risks are equally important, and as we already did last time, we follow the management’s prudent guidance and reaffirm our hold rating.

Be the first to comment