DNY59

Co-produced with Treading Softly

Investors love cash, and some horde it for the mother-of-all falls. Others use it to pay for their life’s expenses.

I like to take my cash and put it to work, generating more cash. My army of dollar bills is going out to recruit more dollars, putting them to work generating ever more dollars. Then I can siphon off a bit of income for myself as my portfolio becomes a perpetual dividend machine.

The market has befuddled a great number of gurus and analysts. They expected inflation to be transitory, and then they predicted the collapse of the entire economy because of inflation. They run around throwing out predictions and arguing on 24/7 news channels. Most future predictions are wrong. Even my future predictions. That’s just the reality of predicting the future.

While the market is confused, it has provided a plethora of high-yield opportunities for those willing to put their hard-earned cash to work. Right now is an excellent time to build an income-first portfolio. Yields are irrationally elevated, and there is a clear disconnect between the economy’s health and the market’s mindset.

So in a market filled with opportunities, I want to find investments yielding at least 9% that can pay me excellent dividends for years to come. I might throw my hat in the ring and toss out a few predictions about what the market is going to do over the next year, what the Fed might do, and what inflation will do. After all, that’s what I do.

But the dirty little secret is that it doesn’t matter. I’m buying income whether the market is up, down, sideways, or gyrating. My income will be higher at the end of this year than it was at the beginning of the year. Next year, I’ll work to grow my income even more. Whatever happens in the world might impact the prices of stocks, but it will not prevent me from finding opportunities to increase my income even more.

I’ll give you two income-generating ideas from the list of great ideas available to High Dividend Opportunities members. Let’s dive in!

Pick #1: AM – Yield 8.9%

Antero Midstream Corporation (AM) is a midstream that provides services for Antero Resources (AR) focused on natural gas (‘NG’) and natural gas liquids (‘NGLs’).

AM aims to pay for all capital expenditures and the distribution from free cash flow. A goal they expect to be slightly shy of for 2022. For 2022 cap-ex budget is extremely front weighted, with 70-75% of cap-ex invested in the first half. AM provided guidance that it would not cover the dividend in the first half with FCF (free cash flow), so it isn’t a surprise that it didn’t. It was only a couple million shy in Q2, and AM reaffirmed guidance that it expects to cover the dividend with FCF in Q3 and beyond.

Some investors have been focused on the first half, despite management providing clear guidance. We like a company that provides a clear map of what they are doing and then follows that map. AM has been following it and we look forward to FCF turning positive after the dividend next quarter.

This cap-ex spending is to hook up and service new wells being drilled and completed by Antero Resources. These new wells add additional throughput volume providing new revenues for AM.

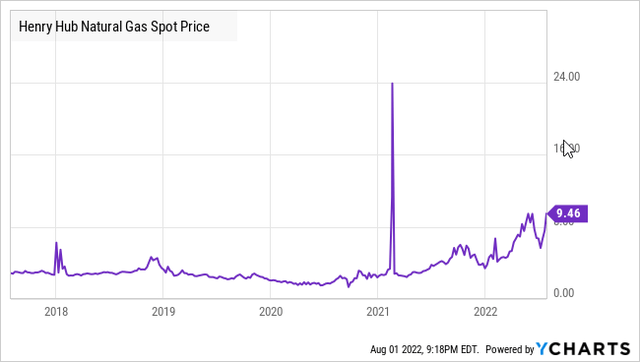

With NG prices very high relative to the past 20 years, AR has been very aggressive at improving its balance sheet and will have ample cash to continue growing operations, AM will grow with it.

Ycharts

Jumping our outlook to 2024, we have even more exciting news on the horizon. AM entered into a fee reduction agreement with AR when it was seemingly on the bounds of bankruptcy. This gave it an infusion of cash flow to service debt. This agreement is saving AR about $350 million between 2020 and 2023. AM should see an infusion of extra cash flow once this agreement expires.

The market is acting like the dip from $8 to $6 was the end of the world for NG. Even though a few years ago, $4 NG was considered “very high”. The NG sector will thrive thanks to structurally high demand overseas and limited supply. AR is thriving, and AM is the best way to collect a high income while benefiting from that growth.

Pick #2: EIC – Yield 9.2%

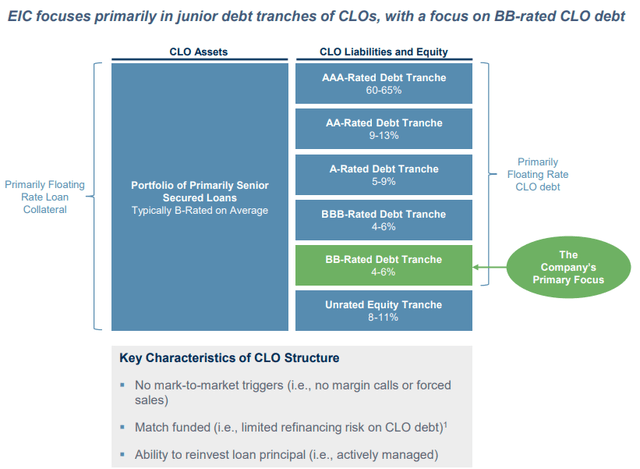

When it comes to CLO investments, the most often negative we hear is that investing in the lowest tranche is too “risky”. It’s true that investing there is the highest risk and thus highest reward proposition. It also historically has provided the greatest returns – losses included. So when looking over the history of CLOs, including the Great Financial Crisis and the crash of its cousin in name only Collateralized Debt Obligations (CDOs), CLOs have been a stellar long-term investment. So what about our more risk-averse friends?

Eagle Point Income (EIC) comes to the rescue. EIC is managed by the same skilled portfolio managers overseeing Eagle Point Credit (ECC). EIC invests in the debt tranches of a CLO. If a CLO was a BDC like Saratoga Investment (SAR), ECC would be buying up the common shares, while EIC would be scooping up the baby bonds.

Quarterly Update – Q1 2022

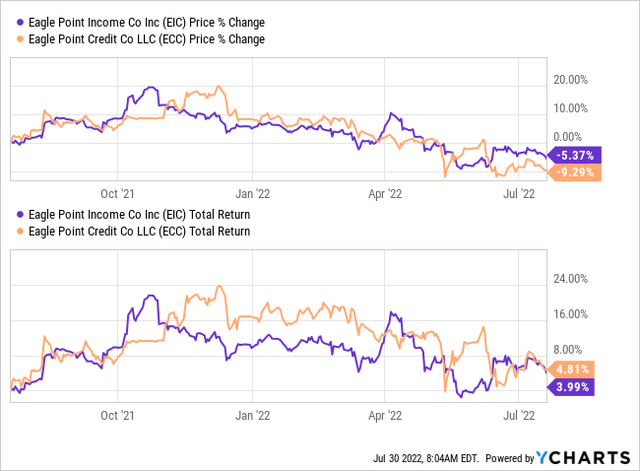

The assumption for buyers of EIC is that it will boast a lower level of volatility while also likely having a smaller distribution payout along with it.

Ycharts

Over the last year, EIC has provided a smaller total return while simultaneously seeing less price volatility. This matches its overall purpose – smaller yield, less potential risk.

We love buying into the CLO sector as it provided much-needed liquidity and capital access to the U.S. economy. Most companies have refinanced their debt during the recent lows over 2020, so this debt will not come due even if we face a recession in the coming years.

So while the market is hesitant about which direction to take, you can scoop this great pick, locking in excellent bond-like income for decades to come.

Dreamstime

Conclusion

With AM, we can benefit from the high prices of NG indirectly. Its parent is looking to move more production, and AM is the path it does so. With AM having frontloaded their CAPEX spending and reductions coming in the following years.

With EIC, we can benefit from the recent slew of debt refinancing and the higher level of security owning CLO debt vs. equity. Like owning a company’s debt, you get priority in payment while passing on additional potential upside. Secure, steady income. EIC has proven to be less volatile than ECC over its lifespan.

This market is primed to provide us high-yield investments and income. We buy income now to get it for decades to come. Don’t neglect to use this time to your advantage. A little effort now can provide years of low-stress income.

That’s the beauty of income investing. That’s the greatness of our Income Method.

Be the first to comment