ijeab/iStock via Getty Images

Thesis

Skillz (NYSE:SKLZ) announced major operating changes in their Q4 2021 earnings call, including material cost cutting having to do with ineffective marketing spend. This cost cutting is critical. One doesn’t need to look past their Q4 2021 P&L results to figure this out.

But even with cost cutting, bears think this situation is unfixable. That a lot of their revenues were due to “free money” promotions and cutting, these will cause revenues to plummet and the company to still crash and burn. Certainly, the current share price reflects this.

But, tactically, the situation has a straightforward fix. Simply reduce the vig — that is, the fees Skillz charges bettors — from their current (and dispiriting) 50% to the industry standard 10%. Change the vig, change the world.

Bears will counter getting less vig would cause revenues to drop even faster. But they won’t, because when you run the numbers, nothing happens. Well, check that, something important does happen: The revenues become recurring and sustaining.

For my first look at SKLZ, I wrote an overview piece on the company explaining why it was woefully misunderstood and undervalued and tagged it with a “Strong Buy” (and still have that rating). I did so because the company has just too many things going for it to be trading near gross cash levels, including scalable technology, sophisticated infrastructure, a large, established base of paying and non-paying players, a deal with the all-powerful NFL — and now the wildly-popular UFC — partnerships that are sure to attract other top brands, and 3/4 of a billion in gross cash in the bank. But most important for a growth company in this market: An achievable path to profitability.

But it doesn’t have profits right now, which is what the market wants to see. This article examines Skillz’s cost cutting in more detail and its potential effect on profitability, including ways to accelerate profitability 1-2 years ahead of guidance.

Understanding The Other Two Important Numbers In SKLZ’S P&L

Certainly revenues and profits are important numbers in any P&L. But what drives those numbers? And in particular, what drove the gaudy $155 million Skillz spent on Sales & Marketing in Q4 2021?

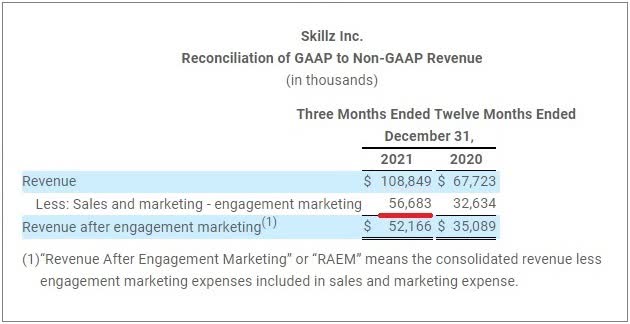

Two things: $85.6 million on New User Acquisition… and $56.7 million on Engagement Marketing. As the company acknowledged, “Candidly, we spent more than we should have in both user acquisition and engagement marketing in Q4”.

User Acquisition marketing costs in Q4 2021. (Skillz Q4 2021 Investor Day presentation materials.)

Engagement Marketing costs in Q4 2021. (Skillz Q4 2021 earnings press release.)

The company is now committed to cutting User Acquisition and Engagement Marketing costs. Which is great and needed news. But the relevant question is why did Skillz feel the need to spend all that money in the first place?

Of course there was great pressure to continue growing its player base. Like many companies, Skillz was simply offering customer incentives in an effort to kick-start players… the same way it did all through 2021… only accelerated in Q4 in an effort to end the year with a bang.

However, what it really was doing — what it has been doing for a long time now — was trying to make a premium but non-standard fee structure work. While throwing gobs of money at players did accelerate the top line for many quarters, the “easy money” environment was also distracting from what was happening to the bottom line: trouncing it.

Every company needs to incent customers, but after spending nearly half a billion on just marketing in 2021 — compared to less than $400 million for all of 2021 revenue — Skillz now has more than enough proof that its old approach doesn’t work. Let’s talk about why.

Engagement Marketing That Didn’t Stand A Chance

I’ve always loved the old joke, “The beatings will continue until morale improves!” It kind of reminds me of Skillz pushing “promotional cash” at players and, like the joke, no matter how much promotional cash Skillz doled out, it just wasn’t improving the bottom line.

That’s because it’s not the amount of promotional cash that’s the main issue — that actually did a fine job getting players to open their wallets (as unnecessarily excessive as it was). It’s Skillz’s vig — their commission — that’s chasing away paying players once they start betting. It’s way too high. Impossibly high. It’s literally that simple. Change the vig, change the world.

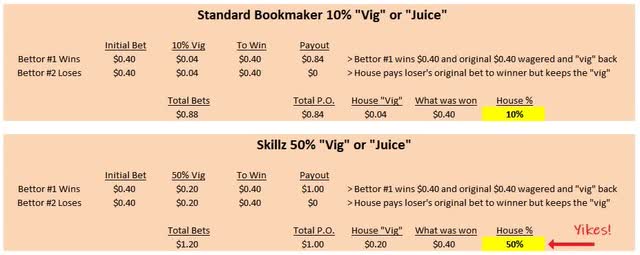

Let’s review: The betting action in a Skillz game — for example, their new NFL 2-Minute Football — is intoxicating… addictive… exactly what you love to see in a legal vice investment. SKLZ is ringing the cash register twice every 60 seconds. Each player wagers a standard $0.60 “entry” fee and Skillz rakes $0.20 every game play. Betting players play on average almost a couple dozen games a day, so the games — and fees — add up fast.

Wow, sounds great if you can get it! But that’s the problem, Skillz isn’t getting it for very long. This is what a Skillz wager looks like to anyone that understands betting — like every NFL and UFC bettor in the world:

Standard bookmaker “vig” vs. Skillz. (The Lone Contrarian’s calculations.)

That graphic says it all, eh? It answers a lot of questions important to the success and/or viability of the business, for example:

Q: Why aren’t players buying in more (i.e., recurring revenue challenges)?

A: Because it’s impossible to win when the house is taking 5x the standard % rake.

Q: Why was Skillz’s Engagement Marketing “free cash” promotions ineffective in incenting players to buy in again?

A: Because whether I play with my money or their free cash, I’m going to stop betting once the money’s gone. Impossible to win. One and done.

Q: Why does Skillz have so many non-paying active players?

A: Because players love their games, but not their fee structure… so when they’re done getting hit over the head with a 5x vig, they just continue playing for free. If you are a Skillz player, you know this to be true.

But this is easily fixable: Just change the vig. That simple. Change the vig, change the world.

Bears are probably screaming now, if you change the vig from 50% to the standard 10%, revenues will crater!

This is why I believe bears don’t really understand this company. That isn’t the way betting works. That isn’t the way mobile gaming works. That isn’t even the way the numbers work. Run the numbers, nothing changes. The revenues stay the same. Well, check that, something important does change, the revenues become recurring. The golden ticket to a sustainable business.

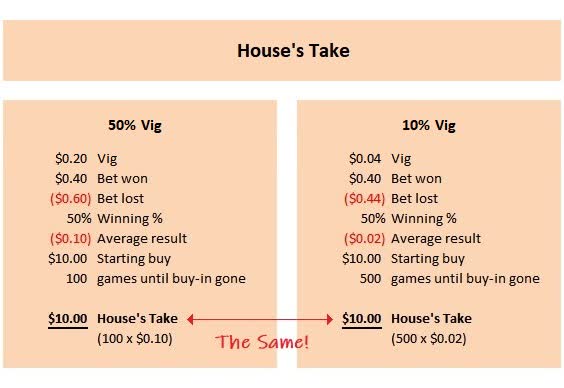

Let’s quickly look at the math: With a 50% vig (what Skillz has today), a $10 buy-in, and evenly-matched games, a bettor playing the $0.60 “Regular Season” game will win $0.40 half of the time and lose $0.60 half of the time. That’s an average loss of $0.10 every game. So $10 buys you 100 plays, not even a day’s action for some players. And at the end of those 100 games, the house’s take is $10. Because the vig is so high — and it becomes apparent that it’s impossible to win — players don’t buy in again. But they do keep playing for free.

If we change the vig to 10%, guess what, the house’s take is still $10. The only difference is it takes more games for the house to earn the same amount of money… but — and this is the critical piece to understand — these are games that are going to be played anyhow whether they’re betting games or on the free practice field… as evidenced by Skillz’s sky-high 84% active-but-non-paying player percentage. Changing the vig won’t even affect the performance of their network… because Skillz is already serving these games.

50% Vig vs. 10% Vig: The house earns the same either way. (The Lone Contrarian’s calculations.)

I’m sure Skillz was hoping it could charge a premium. After all, what they’re doing is so new. And exciting. But it’s just not working. Bettors know better.

Skillz seems to have forgotten the basis of what I consider its break-through business concept: Instead of just making mobile games and struggling — like the zillions of other aspiring game developers — to charge for game play, they tried to solve that problem for the entire industry by creating a development platform that positioned game play as something brand new in gaming: A legal wager. Brilliant!

But critical to that concept: A bettor wants to win money. That’s why they’re betting. But it’s virtually impossible to win against Skillz’s 5x rake in an evenly-matched game. Almost all of the players always lose. And quickly. So it can’t be anything else but one and done. Because betting may not be the smartest thing to do, but even the craziest of bettors figure out when the deck is stacked so completely against them.

So Skillz built a fantastic company with fantastic technology and a fantastic infrastructure, all based on a brilliant idea, and they did all of that and then spent a huge amount of effort and time and cash just getting a player to the money table… only to… what? Chase them away to the free games because of an impossible 5x rake?

It’s time to share the key insight here: Skillz players want to bet. They just invested a lot of time becoming hot stuff at a Skillz game. All SKLZ has to do is not stack the deck against them. Give them a standard vig — one that every bettor is used to — and one that’s been in use since betting was invented, a vig that every bettor thinks they can overcome. If I don’t feel like the deck is stacked against me, I like to compete (that’s why I’m playing video games in the first place) so I’ll buy-in again… because playing for money is just more fun than playing for fun. Buying in again… and again… and again… is the very definition of healthy recurring revenues (as ironic as that may sound!).

The good news is Skillz can easily change their vig — without affecting revenues — literally overnight. And the $56.7 million they spent on Q4 Engagement Marketing? Most of that gets saved overnight, too.

From a revenue point of view, there’s another enthusiastically welcomed upside: SKLZ has 3 million active, non-paying players… and many might love to bet again if the said deck wasn’t stacked against them. Bringing a big chunk of those 3 million active, non-paying players back into the betting fold would put a JOLT into revenues, eh?

But also MONUMENTALLY important: Skillz must lower the vig before the mass of NFL bettors enter the picture. The sooner the better. Because NFL bettors are savvy and won’t stand for paying a 5x rake. The NFL opportunity will otherwise be D.O.A. and Skillz will have snatched defeat from the jaws of victory.

We Don’t Need No Stinkin’ New Customers*

(*A nod to Mel Brook for a variation of a famous quote from his 70’s classic, Blazing Saddles!)

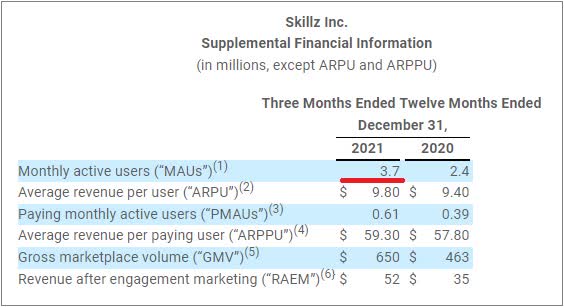

Skillz Monthly Active Users exited Q4 2021. (Skillz Q4 2021 earnings press release.)

Why did SKLZ spend almost $86 million on new customers when it has about 3 million unmonetized players — players who love their games enough to still play actively? They might have also forgotten that the easiest customer to get is an existing customer.

Let’s put this in perspective: If they figure out how to get 1-in-5 to pay the average, they could double revenues. Organically. Sustainably. As suggested above, changing the vig can do this all by itself (and more). But there’s more revenue to be found here.

Because while this may sound odd to bettors, there are some people that don’t want to bet… they only want to play free games. So figure out how to make money from their free play. It’s not like that’s new or anything, much of the mobile gaming industry already relies on monetizing free play. For example:

* How about that time-tested approach, having players watch a rewarded video before a free play? (Maybe give them a 30-day grace period, get ’em hooked, then start showing ads.)

* And that other time-tested approach, paying a cheap monthly subscription so you don’t have to watch ads. This is the subscription generation after all.

* In your multiplayer games, how about selling game skins, Leaderboard animations, dances, badges, and such? That seems to work nicely for free games like Fortnite.

* Even something as trivial as a tip jar can turn out to be a revenue contributor.

But maybe as important: How about creating new kinds of money games… designed to attract non-bettors?

Maybe enter a $1 non-bracketed tournament that happens every hour… where I can play 120 other evenly-matched competitors. We all play three games and the top 10 averages divvy up $100… spreading it out a little bit just creates more excitement, happiness, and engagement. Maybe the next 10 participants get Ticketz (Skillz’s virtual currency)… and — as all gamers know — there are bragging rights for making a Top 20 Leaderboard. As a player myself, I love those odds for a buck. I just took a break from writing this article, played three games, and kicked butt.

How about a “Daily Subscription Tournament”? Pay $9.99 and your subscription gets you into a month of daily non-bracketed tournaments — that’s just $0.33 a day. Same as above, everyone plays three games, but the top 10 averages divvy up $1,000 and the next 90 participants get Ticketz. More bragging rights, happiness, and engagement.

Feel free to shorten the $1 Tourney cycle time, or run a different Subscription Tournament for each hour of the day as participation dictates. By holding these daily tournaments, you just know I’m going to be on the free practice field a lot, so that supports the other monetization techniques discussed above, too.

With over 3 million active, non-paying players, Skillz doesn’t have to look beyond its own registration list to get new paying players. And shouldn’t. If for no other reason, they could have their hands full with new players come this fall when their NFL partnership kicks in. Right now, though, keep cutting most of your $85.6 million User Acquisition spend, it’s not needed. This literally could turn the entire quarter around by itself.

So What Does This All Mean For The Numbers?

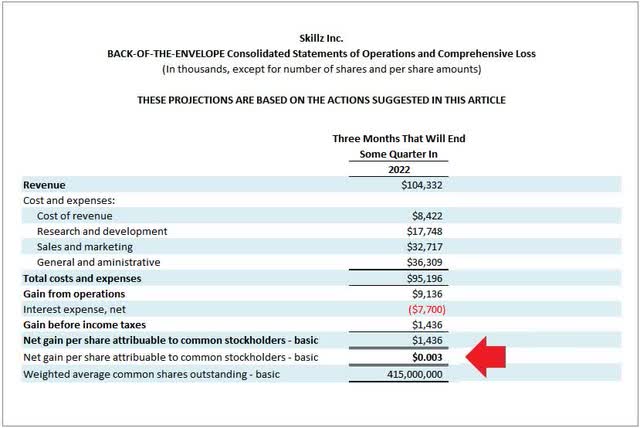

Glad you asked. Here’s what 2022 Q4… Q3… or even Q2 could look like:

Back-Of-The-Envelope P&L Projections for SKLZ in some quarter of 2022 based on the actions suggested in this article. (The Lone Contrarian’s projected calculations.)

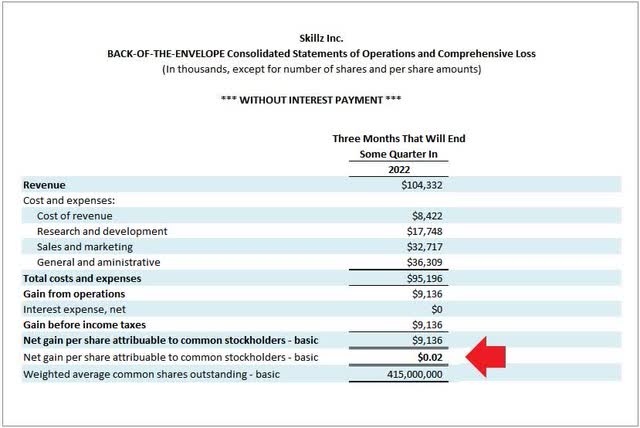

Same Back-Of-The-Envelope P&L Projections as above but without interest expense. (The Lone Contrarian’s projected calculations.)

Assumptions:

* Baseline revenues are Q4 2021’s RAEM (Revenue After Engagement Marketing) and to be conservative I assume no increase (vs. Skillz guidance of “above 30%” growth). Recall that this metric is essentially “net revenues,” i.e., doesn’t include any promotional money in the tally.

Reducing the vig means getting to invite past betting players to wager again. I’m assuming 1-in-5 will try their betting hand again… remember, these are players that want to bet again. So that doubles revenues to $104 million.

I am not, however, including any other recurring buy-ins, digital advertising revenues, newly created cash games, or any revenues from the NFL partnership. Note: I am not including these because the goal was to see the effect of cost-cutting activity on profitability. Clearly, though, I feel strongly that all of these efforts can drive additional, significant revenues.

* I’m using costs from the December 2021 quarter as a baseline.

* Revenues are decreasing from Q4 2021 but we’ll still keep Cost of Revenues at Q4 2021 level.

* Baseline costs include a 10-15% increase in employee compensation, New User Acquisition cut by 80% (and, per company comments, Aarki to save 30% on the remaining 20% that is being spent), and Engagement Marketing cut by 80% (and Aarki again to save 30% on that remaining 20%, too).

* The company recently registered almost 16 million additional shares.

* I added $7.7 million per quarter for their Dec 2021 $300 million financing that carries a 10.25% interest rate.

* For this back-of-the-envelope exercise, I’m not including any “Change in fair value of common stock warrant liabilities”, “Other income (expense), net”, or “(Benefit) provision for income taxes”.

What’s It All Mean?

Profits!

OK, to be clear, it’s back-of-the-envelope and just $0.003 per share for whatever quarter they decide to change their vig, which isn’t even rounding error to a penny. But given that the average Wall Street analyst is predicting a loss of about -$0.15 per share per quarter… any profit should quiet those that believe the company is going to run out of cash soon.

As important: Without their big interest payment, they have a profit per share of $0.02.

Fun to think what adding more recurring revenue (especially from the 3 million active but currently non-paying players), digital ad revenue, revenue from newly created cash games, and NFL revenue (!) can do to SKLZ’s top line. Jumps by leaps and bounds, as does its bottom line. But that is for a future article.

But it all starts with reducing the vig. Change the vig, change SKLZ’s world. In this case, the results could be moving up profitability guidance 1-2 years.

I like the Skillz exec team and for all I know they’re way ahead of me with all of this. Or have figured out an even better cost-cutting and monetization approach. But what I wanted to illustrate in this article is with just a few easy levers pulled, we can already see a dramatic difference to SKLZ’s bottom line in a short period of time. It’s why I continue to think this company is woefully misunderstood and undervalued.

Be the first to comment