Laser1987/iStock Editorial via Getty Images

While EV demand is set to soar, investors still have to be careful with sector related investments. One has to make sure demand matches supply for the particular products of interest. Blink Charging (BLNK) is a prime example of a company where the related product supply is starting to far exceed demand limiting the investment value. My investment thesis remains Bearish on the EV charging stock.

Minimal Service Revenues

As with most of the EV charging station companies, the business models aren’t based on charging station equipment sales falling under the Product category. Most of the companies are selling the actual charging stations at low margins to build out networks and attract more consumers to EVs.

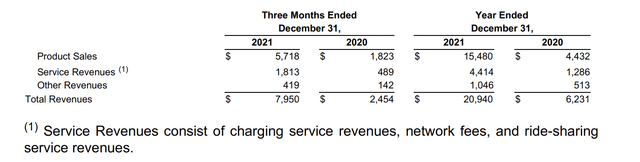

Unfortunately, most of revenues for the sector comes from the Product sales. Blink Charging is no exception with crucial Q4’21 Service revenues of only $1.8 million.

Source: Blink Charging Q’21 earnings release

The majority of the Service revenues come from charging service revenues with additional revenues from network fees and ride-sharing related revenues. The Other revenue category included $120K from grants and rebates leaving the vast majority of revenues from charging stations.

The Product sales only have 20% gross margins and Blink Charging has no real intent to expand these margins despite a decent amount of sales into the home market where the company doesn’t even plan to produce Service revenues. For now, the Service related business actually has negative margins due to the limited business so far.

If one looks at the Service revenue per user, the numbers are extremely low. On the Q4’21 earrings call, Blink Charging discussed 272K registered members had utilized their chargers. On average, these members only contributed $6.67 in revenue for the whole quarter.

On the Q4’21 earnings call, D.A. Davidson analyst Matt Summerville asked Blink Charging about utilization rates. CEO Michael Farkas provided a general answer regarding higher utilization of EV chargers, but nothing regarding higher utilization of existing chargers:

Yes, as you can see in our charging revenues — yes, as you can see, the charging revenues have increased quarter-over-quarter this year and it is a result of a more chargers on our network but also more driving going on. So as the economies have opened up, we’re seeing more usage, more utilization and just a trend of increased usage. So we’re encouraged and we’re anticipating going into 2022 with a continued — with a trend to continue as more EVs get on the road, and more sales and more deployments are on our network.

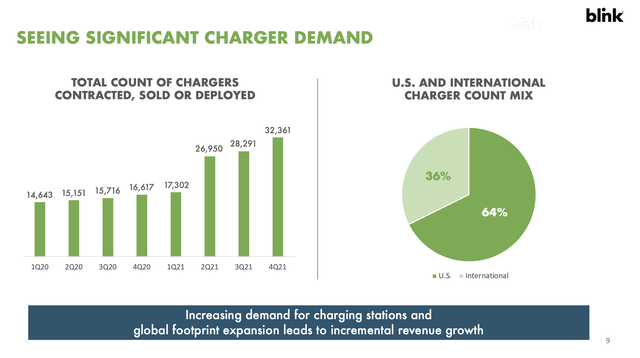

A big issue with EV chargers and other technology designed at replacing fossil fuels is a focus on units sold and stations, not utilization rates of those assets. Just about every EV charging station firm is highly focused on the amount of units deployed and Blink Charging is no different with such slides in the Q4’21 presentation.

Source: Blink Charging Q4’21 presentation

The company now has over 32K chargers contracted or deployed, yet quarterly Service revenue doesn’t even top $2 million. In essence, Blink Charging doesn’t need to deploy more chargers, the company needs to figure out how to drive higher utilization rates of existing chargers.

A lot of the costs of the charging networks and stations are fixed with the construction costs, so higher utilization is what will drive profits. Though, Blink Charging had apparent variable costs for charging costs, network fees and host provider costs combining to top $1 million in cost of revenues. The market will need to see leverage in these costs before the stock ever turns appealing.

Ridiculous Multiples

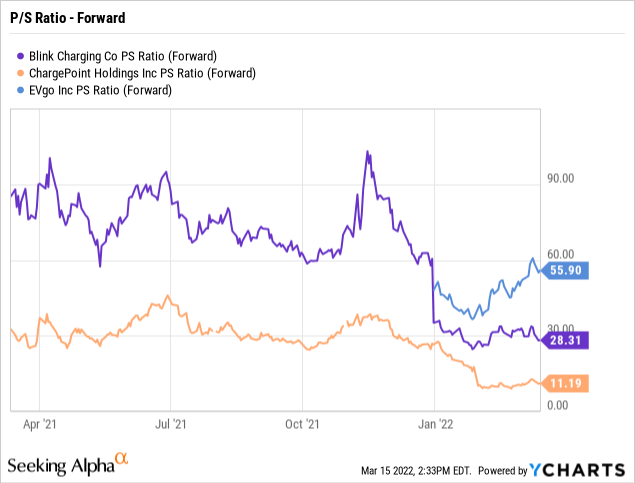

Despite the massive stock market sell off, most of the EV charging station operators sell at ridiculous valuation multiples. Blink Charging still trades at nearly 30x forward revenues while EVgo (EVGO) is actually more expensive. ChargePoint Holdings (CHPT) has dipped to more reasonable levels of 11x forward sales.

As mentioned above, Blink Charging is valued excessively based on total revenues. Investors should strip out most of the Product revenues when valuing the company, as the only business focused on generating decent margins is the Service revenue segment.

This segment only delivered $4 million in 2021 revenues and the current stock valuation of $1 billion is out of touch with this reality. EV owners just don’t regularly utilize EV charging stations outside of home units which limits any business model reliant on usage.

At the same time, Blink Charging spends over $20 million in quarterly operating expenses while gross profits are minimal. The company has a cash balance of $175 million, but the business burned nearly $15 million from operations in Q4’21 alone and capital spending was another $7 million.

The combination is toxic for existing shareholders placing the company on a path needing to raise additional funds before the EV market fully opens up. The recent surging prices for raw materials needed to make EVs is another troubling situation where EV production might trail expectations leaving Blink Charging with fewer cars on the road charging at already built charging stations.

Takeaway

The key investor takeaway is that no one really questions whether the ultimate demand for EV charging will soar over the next decade, but an investor needs to question the business models of the charging station companies reliant on high utilization. Blink Charging is a prime example of where crucial non-product sales are still nearly nonexistent and the companies dodge most questions on actual utilization rates. Similar to gas stations or any other retail operation, the business focus should be as much about comp sales of existing stations as much as the building of new stations.

Investors should continue watching this stock from the sidelines waiting for the business model to actually develop a material recurring revenue stream warranting an investment.

Be the first to comment