imaginima/iStock via Getty Images

Investment Thesis

As inflation rages on, the world continues to demand more oil, and geopolitical tensions remain high amid the war in Ukraine, oil prices have surged this year. While higher energy prices hit the consumer and tend to slow economic growth, oil companies remain a large beneficiary due to their ability to pass on costs to customers and increase margins. One company on my radar is Suncor (NYSE:SU), an integrated energy company that (as I argue below) has strong growth prospects ahead and is deeply undervalued. Suncor continues to deliver strong shareholder returns through its strong free cash flow generation, dividend increases, 10% cash yield, and plans to continue deleveraging. Additionally, the company’s AFFO (adjusted funds from operations) increases $200M for every $1 increase in Brent Crude. According to my DCF model, the fair share price of Suncor shares stands at $41.19, ~20% above current levels. I assign shares a strong buy as a result.

Outline Of Business Model

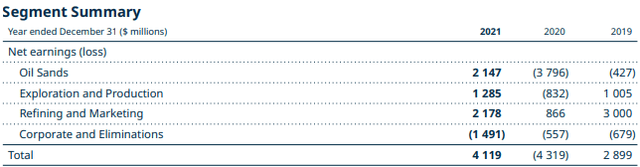

Suncor is an integrated energy company that is headquartered in Alberta, Canada. The company operates through four reportable segments: Oil Sands, Exploration & Production, Refining & Marketing, and Corporate & Eliminations. A breakdown of earnings from each segment can be found below.

Segment Summary – Suncor (2021 Annual Report – Suncor )

Suncor has many duties across these segments, but primarily is focused on refining crude oil into petroleum/petrochemical products, mining/extracting Bitumen from Oil Sands into various forms of fuel, international oil/gas exploration, and renewable energy projects.

For those who are not aware, Bitumen is a molasses-like form of petroleum that is saturated in various sand deposits that can be found in Canada. A map can be found below of the Athabasca Oil Sands deposit (where Suncor has operations).

Oil Sands – Alberta, Canada (wikipedia.org/wiki/Athabasca_oil_sands)

Suncor is able to dig this sand, extract the Bitumen, and refine it into diesel/other fuel for conventional use. It, therefore, makes sense that Suncor is a beneficiary of the rising oil prices that we have seen recently.

A Beneficiary Of Rising Oil Prices

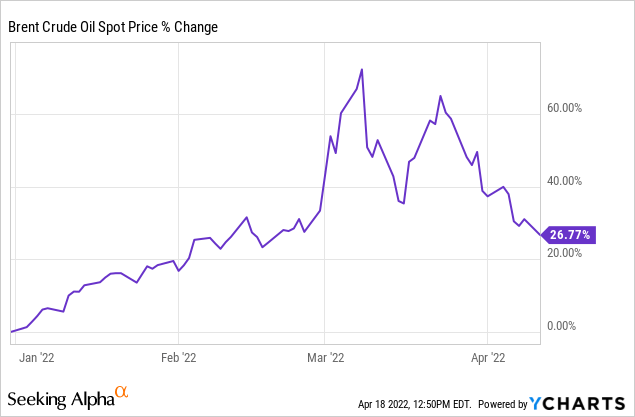

Oil prices have skyrocketed in 2022 as a result of rising inflation and geopolitical conflicts.

Brent Crude is up 26.77% this year, with energy companies performing in sympathy.

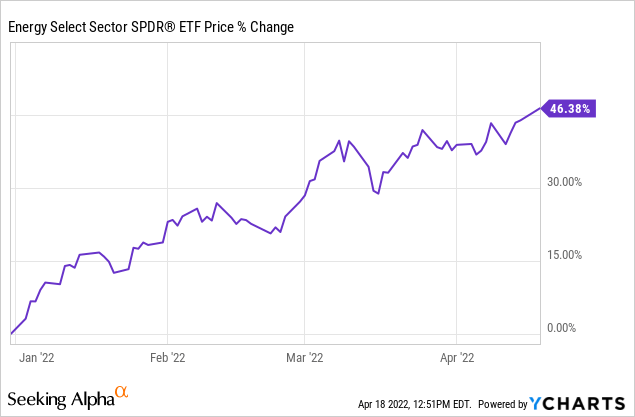

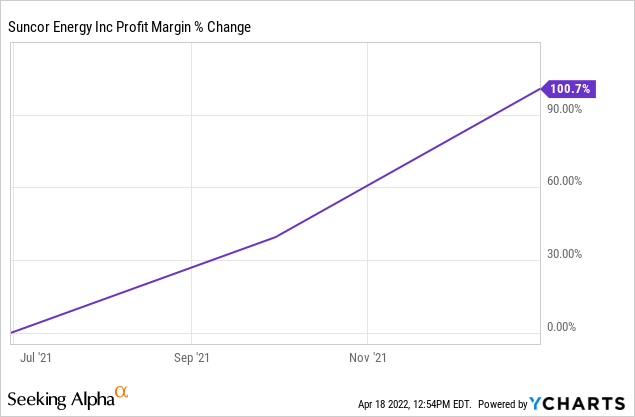

YTD, energy has been the best-performing sector in the S&P 500, up 46.38%. Energy companies improve as oil prices increase due to their ability to pass prices onto their customers and improve profit margins as a result. Suncor has been able to do this, as shown by its net profit margin/free cash flow improvements below.

Suncor Energy’s Free Cash Flow/Margin Improvement

Net margins are up double Y/Y, exemplifying Suncor’s ability to pass on costs to customers.

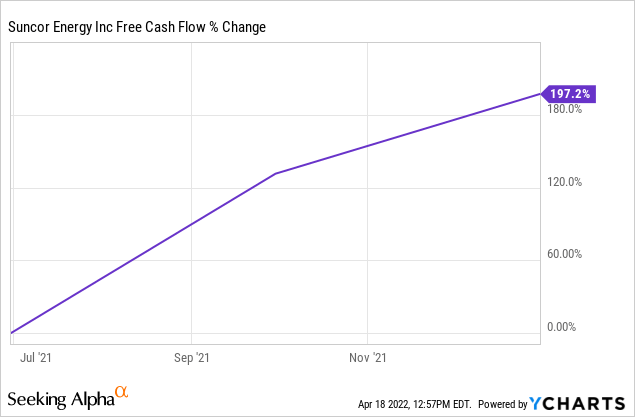

This has led to free cash flow improvements as well which will be crucial to my valuation portion which will be discussed below.

Free cash flow has nearly tripled over the past year. This increase is directly correlated to the increase in crude prices we have seen over the past year. Management noted in its 2021 annual report that for every $1 increase in Brent Crude Prices/bbl, adjusted funds from operations (AFFO) will increase $200m. This is a strong tailwind for the company, especially considering Goldman Sachs’ 2022 Brent Spot forecast of $135 per barrel and 2023 forecast of $115. Both of these numbers are above the current spot price of $97.92 and should act as catalysts for the company moving forward.

Suncor Is Driving Shareholder Value/ Reducing Debt

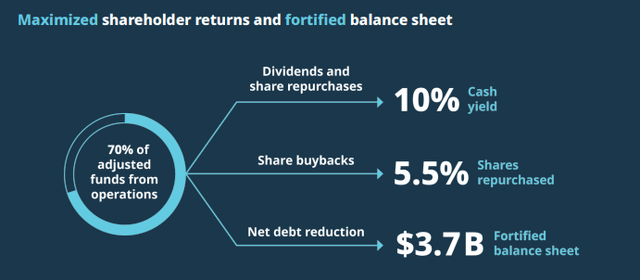

Suncor is continuing to drive shareholder value after doubling its dividend in 2021 to CAD 0.42/share. This gives the company a forward yield of 3.93% at current levels. The company is also repurchasing common stock, repurchasing 5.5% worth of its market cap in 2021. Lastly, net debt decreased $3.7B in 2021, which is a tremendous achievement as the company’s net debt has been growing over the past several years.

Suncor Maximizing Shareholder Returns (2021 Annual Report – Suncor )

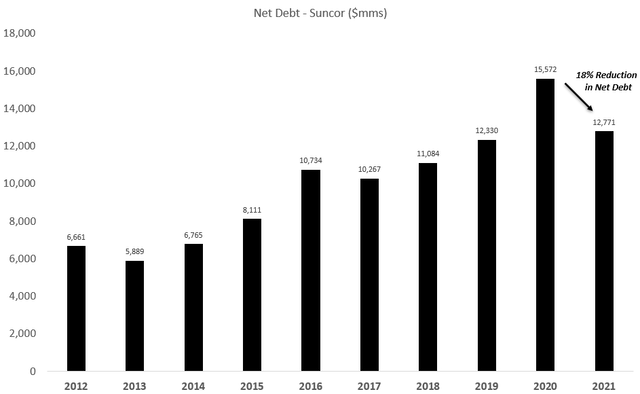

Below you will find a graph of the past ten years of net debt for Suncor.

Net Debt Reduction – Suncor (Image made by author using financial data from Seeking Alpha )

As you can see, Suncor has made a massive improvement on deleveraging, decreasing net debt by 18% in 2021. This is the result of several balance sheet improvements which will be discussed below.

Balance Sheet Improvements

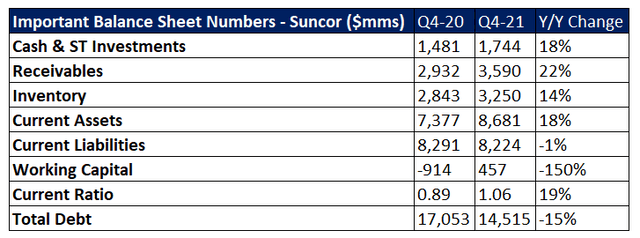

Below is a summary of some of the important balance sheet items for Suncor and their Y/Y changes.

Important Balance Sheet Numbers – Suncor (Image made by author using financial data from Seeking Alpha )

Taking a look at the numbers, cash & short-term investments has improved 18% Y/Y along with other current assets including receivables (22%) and inventory (14%). This has allowed current assets to increase a total of 18% while current liabilities are down 1% Y/Y. This has led the company to have positive working capital of $457M, an improvement of $1.371B. This will give the company ample liquidity in the near term. Cash improvements along with total debt reduction also allowed net debt to increase (not pictured here but shown in the chart above). Overall, the company is improving its financial standing as is shown by these balance sheet improvements.

SU Stock Valuation

In terms of valuation, my model is driven primarily by higher margins (which will be reflective in my free cash flow and EBITDA assumptions) and my top-line revenue forecast.

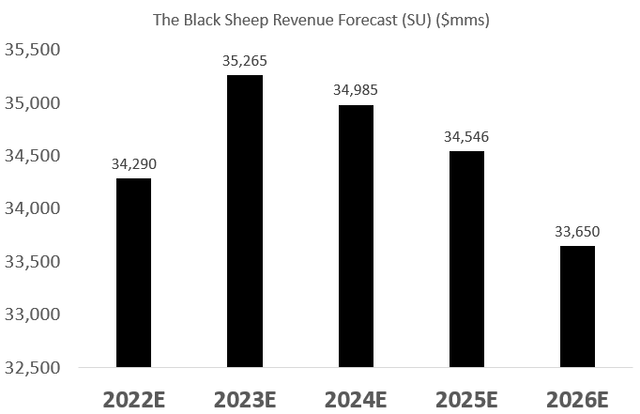

Suncor revenue forecast – The Black Sheep (Image made by author using own forecasts for revenue )

My forecast is driven by higher demand in the near term with stabilization in the market by 2026. Revenues should remain strong as oil pipelines in the United States are slashed due to ESG regulations and consumers will have to look internationally for oil.

This lends itself to my full DCF model which can be found below.

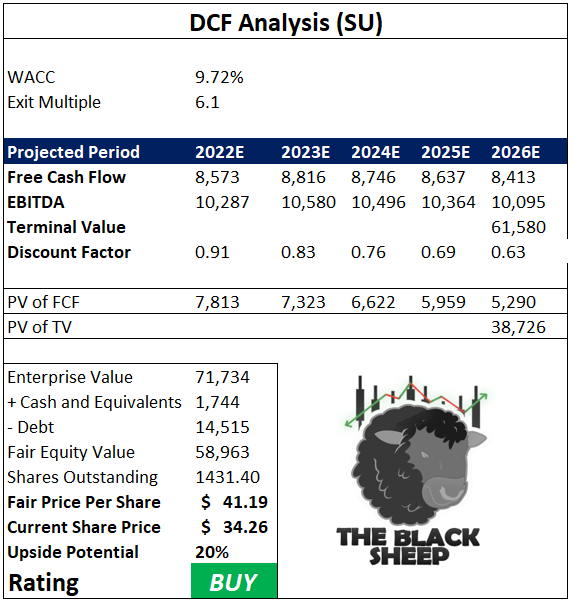

DCF – SU – 20% Upside (DCF made by author using own calculations and assumptions)

Beyond my free cash flow and EBITDA assumptions (which can be found within the model), I also assume a WACC of 9.72%, exit multiple on year-5 EBITDA of 6.1, and ultimately arrive at a terminal value of $57.474B. After discounting the terminal value and all cash flow assumptions, subtracting net debt, and dividing by shares outstanding, I arrive at a fair share price of $41.19, ~20% above current levels.

Risks To Valuation

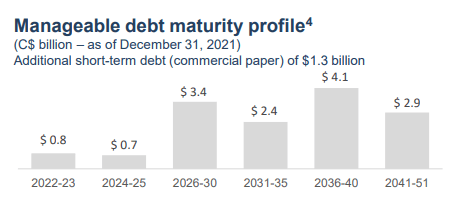

The main risk to my valuation would be a rapid oil sell-off which would hurt Suncor’s margins and change my free cash flow assumptions. This could happen as a result of geopolitical tensions easing, inflation peaking, or oil demand decreasing. Additionally, while the company is deleveraging, the company still has $14.5B of total debt on its balance sheet and cash of only $1.744B. While most of this debt is long-dated (as shown below), the company still will have to pay this off.

Debt Maturity Profile – Suncor (2021 Investor Presentation – Suncor )

Any failure to execute its operations will put its deleveraging advancements in jeopardy.

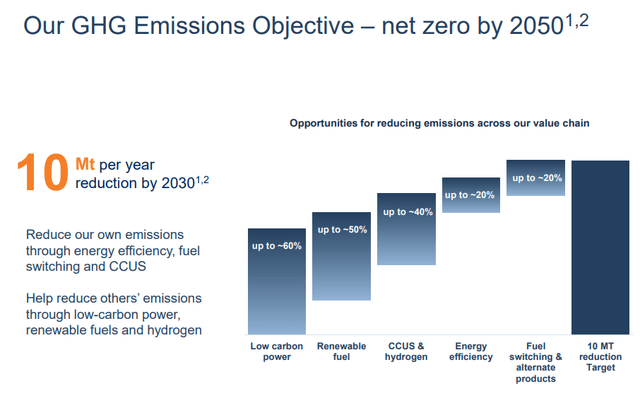

Additionally, while the company plans on being net carbon zero by 2050, ESG regulations are ramping up fast and failure to comply with their plan on reducing emissions could lead to decreases in funding from investors.

Net Zero by 2050 – Suncor (2021 Investor Presentation – Suncor )

This would hurt the company as much of its capital structure is funded by debt.

Peer Analysis

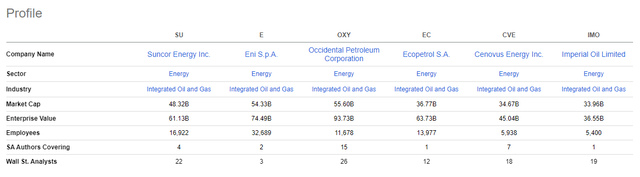

Some of Suncor’s peers can be found below.

Suncor Competitors (Seeking Alpha )

While there are many peers to Suncor, I would argue that there are few direct competitors as Suncor’s main business is very niche (extracting Bitumen from Oil Sands in Canada). This is different from other traditional exploration/mining/drilling companies, creating a solid barrier to entry and a strong economic moat around its operations.

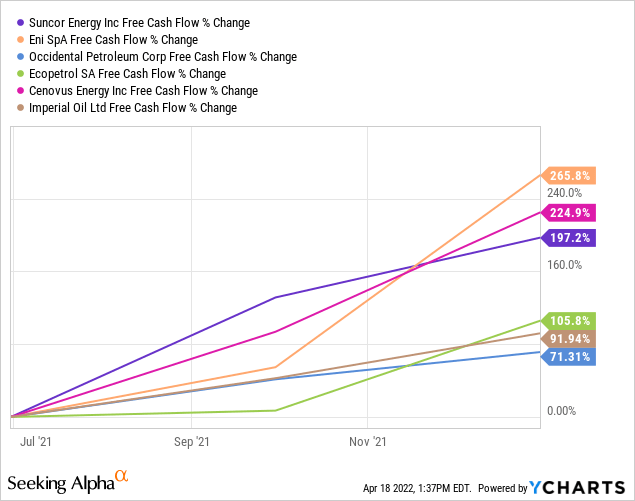

Additionally, below is a graph of its peer’s financial performance as measured by free cash flow growth over the past year.

Suncor falls right in the higher end of the pack in terms of free cash flow generation (off an already strong base) and its prospects look strong moving forward.

Final Thoughts

From a fundamental perspective, Suncor is doing everything right. The company is returning excess capital to shareholders through repurchases and dividend increases whilst continuing to deleverage its balance sheet. For investors that are interested in an energy company that has not seen its valuation fully realized, Suncor is a great option as my DCF model shows it is currently ~20% undervalued. For these reasons, I assign a ‘strong buy’ to shares at current levels and anticipate a fair value for the stock of $41.19.

Be the first to comment