Lubo Ivanko/iStock Editorial via Getty Images

Recap

In our last article on Skechers U.S.A., Inc. (NYSE:SKX) titled “What Makes It an Excellent Choice,” we mentioned that Skechers is enjoying solid top-line growth thanks to the expansion of its international presence. The global market remains under-penetrated, and the company has aggressively built new stores, particularly in Asia. Moreover, Skechers’ gross margin was expanding because of its growing international business, which generally provides higher margins. Lastly, Skechers’ earnings multiple is lower than its peers. However, we noted that the company still lagged behind its competitors in digital adoption.

Share Beaten Down, Yet An Opportunity To Buy

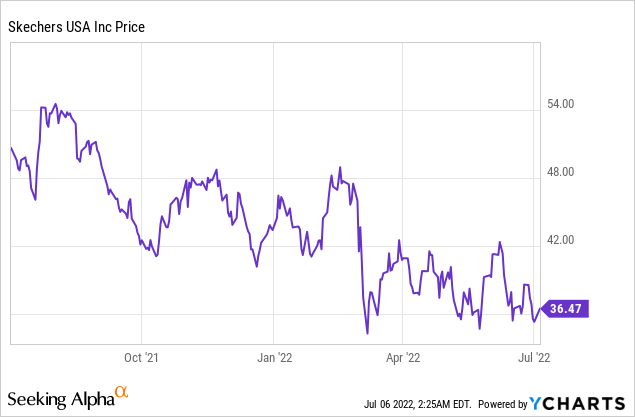

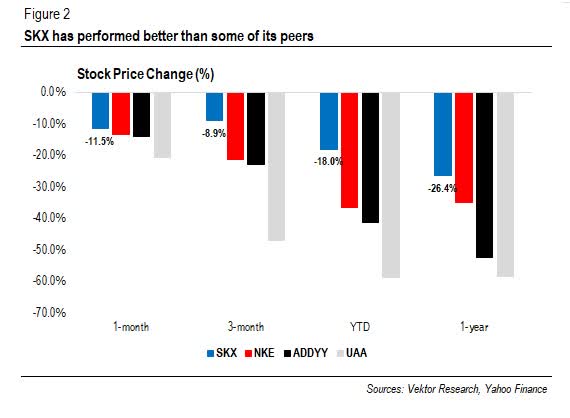

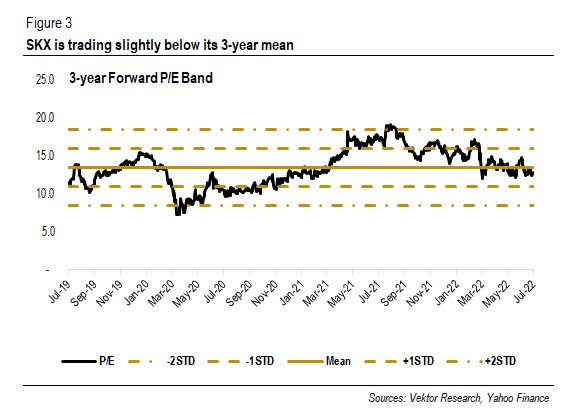

We have all seen how the share price of Skechers, like most of its peers, plunged during the recent sell-off. The share went up from as high as US$56 per share to as low as US$34 per share. However, Figure 2 shows that the stock is not the worst performing one compared with some of its peers. As it stands, the share is trading at a 5% discount from its 3-year mean. So, is SKX still a buy?

Stock Price Change (%) (Vektor Research, Yahoo Finance) SKX Forward P/E Band (Vektor Research, Yahoo Finance)

During the looming economic slowdown and pressures from inflation, we think it is a good idea for investors to buy fundamentally sound companies at a discount. So, what defines a company with sound fundamentals? In our view, it should have a solid top-line growth trajectory, competitive (or expanding) margins, reasonable valuations, and is a cash-generating business. Does Skechers tick all the boxes?

A Bit More Conservative, But Demand Remains Strong

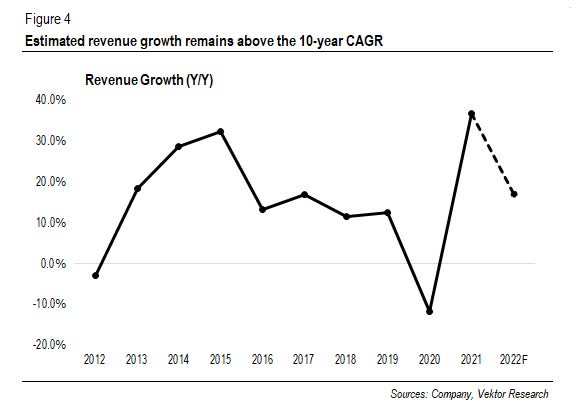

In 2021, Skechers booked US$6.3 billion of revenue (+37% Y/Y), beating our previous estimate of US$6.15 billion. In 1Q22, its revenue grew 27% (Y/Y), driven by domestic (+43% Y/Y) and international wholesale (+26% Y/Y). Besides strong sell-through, the company raised its average wholesale price by 9% (Y/Y) in the quarter. Meanwhile, the direct-to-consumer segment has cooled off but remained growing at a solid rate (16% Y/Y).

The management expects revenue to reach US$7.2 billion to US$7.4 billion-implying a growth rate of “only” 14%-17% compared with the 1Q22’s rate-because of the “external pressures” coming from the shutdowns in China, geopolitical tensions, inflationary pressures, and supply chain disruptions. As a result, we can anticipate some weaknesses in the subsequent quarters, for the management estimates 2Q22 revenue to grow 5%-8% (Y/Y).

But we need to ask ourselves whether the slowdown is permanent or only temporary. The latter seems to be the case, in our view.

Despite such conservatism from the management, it raised its full-year revenue guidance from US$7-7.2 billion presented during the 4Q21 earnings call. Furthermore, we expect Skechers’ revenue to reach US$7.4 billion in 2022F, implying a growth of 17% (Y/Y), higher than the 10-year revenue CAGR of 15%.

SKX Revenue Growth (%) (Company, Vektor Research)

Although the company is reducing promotions, we still see a double-digit growth rate in American and EMEA markets. Please note that Skechers changed its reporting structure, which now discloses geographic sales, to “improve the alignment between our external reporting and our management operations and strategy,” said CFO John Vandemore. Indeed, Asia Pacific sales were flattish (+4% Y/Y) during the quarter because of the COVID-related headwinds. For instance, in China, the company saw store closures and operational restrictions.

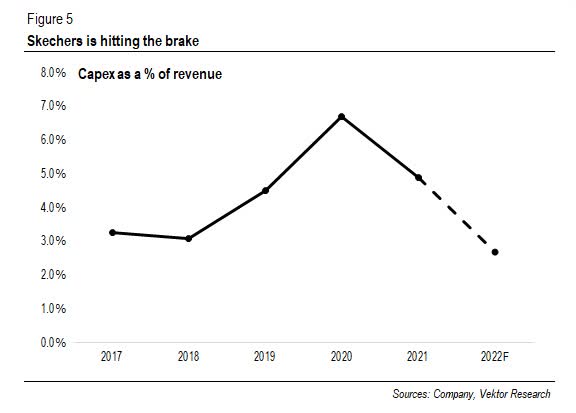

As a result, the management slightly hit the brake by reducing the company’s expected capital intensity by 1%, according to our calculation. Yet, it does not hold Skechers back from expanding its wings. In June, Skechers officially unveiled a new superstore, almost 22,000-square-foot, in New Jersey. Furthermore, the company plans to open new retail stores in Europe, South America, and Southeast Asia. In addition, it continues investing in distribution centers, rolling out e-commerce platforms, and upgrading point-of-sale systems.

Capital Intensity (%) (Company, Vektor Research)

So, what are we trying to imply? We are saying that demand is strong despite looming external pressures. When asked about the impact of inflationary pressures, John Vandemore noted that neither “any significant pullback in consumer discretionary spending for our customer” nor “any decrease in demand” were seen.

Moreover, our model suggests that Skechers will reach the US$10 billion sales mark a year earlier than expected if it maintains its current growth trajectory. Indeed, past performance is not always indicative of future results, as conventional wisdom suggests. But we have seen that Skechers also has flexibility in pricing, in addition to the strong demand. Therefore, we do not think it will be a surprise if Skechers is ahead of schedule.

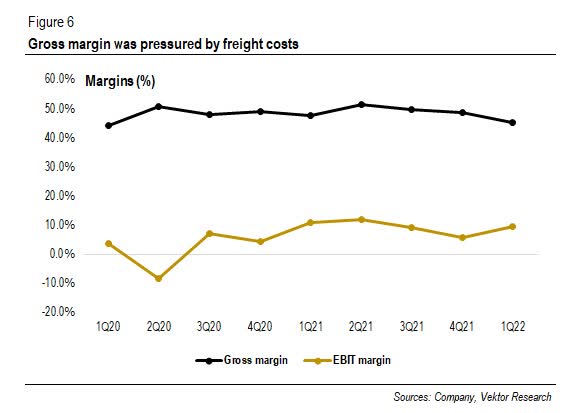

Elevating Freight Costs Pressurized Margins

1Q22 gross margin reached 45.3%, down by 250 bps from 1Q21. The management said that increasing freight costs and “an unfavorable mix impact from higher wholesale sales,” which produced lower margins than the direct-to-consumer segment, pressurized margins. During the 4Q21 earnings call, John Vandemore said that the management expected pressures from freight costs would cool off in the back half of the year. Yet, it described freight as “persistently high and higher than originally planned” during the last earnings call. We expect the 2022F gross margin to reach 47.5%, assuming that the remaining wholesale price adjustments will partially offset the freight costs, but margins will be lower than the 2021 levels.

SKX Margins (Company, Vektor Research)

But the question we ask earlier remains: will such pressures stay in the long run? Or are they just temporary? We have mentioned how Skechers managed to raise prices without at least significantly compromising demand, and the price adjustments for wholesale have not yet been fully reflected. In other words, when pressures from freights finally wind down, we should see margins expansion.

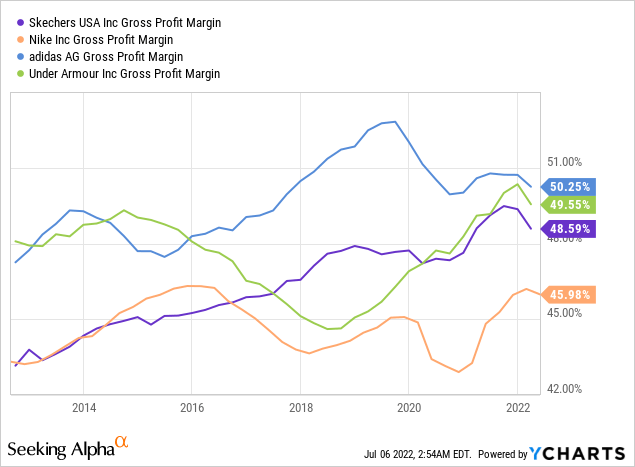

In addition, Figure 7 shows that Skechers has a competitive gross margin compared with some of its peers, besides the fact that it has been expanding for years.

Reasonable Valuations

Skechers’ P/E stands at 12.8x, slightly below its 3-year mean after the recent sell-off. Looking forward, we estimate Skechers’ 2023F EPS to reach US$3.4 per share (+21% Y/Y), slightly below the consensus EPS of US$3.6 per share. Strong wholesale and direct-to-consumer sales, flexibility in pricing, and margins recovery will underpin EPS growth, in our view. In addition, a forward P/E of 13.4x (3-year mean) brings a 12-month estimated fair value of US$46 per share (27% upside potential). Therefore, we reiterate our BUY stance on SKX.

Final Thoughts

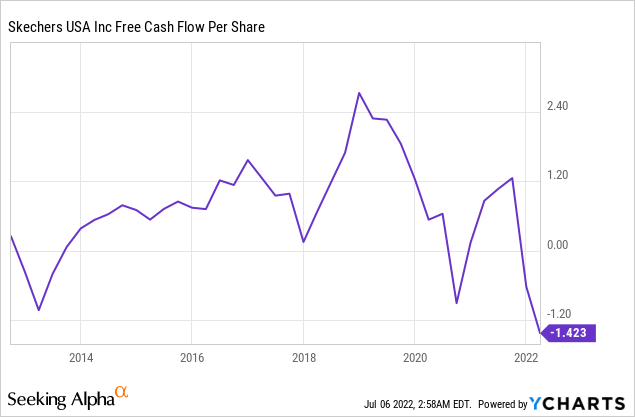

As the threat of the so-called stagflation-high inflationary pressure and low growth-looms, the stock market, seen as a riskier asset class, plunged. But this also presents an opportunity to buy fundamentally strong companies at a discount. Again, what constitutes a company with sound fundamentals? In our view, it should have a solid top-line growth trajectory, competitive margins, consistent positive cash flows, and reasonable valuations.

Skechers checks all the boxes:

- Although it reduced promotions, Skechers still recorded solid revenue growth amid inflationary pressure. We expect Skechers to be ahead of schedule (US$10 billion in sales by 2026) if it can maintain its current growth trajectory.

- It also can command price increases, which in part will offset rising freight costs.

- As seen in Figure 8, Skechers consistently generates positive free cash flows, apart from during COVID pandemic.

- Its earnings multiple is now trading at slightly below the 3-year mean.

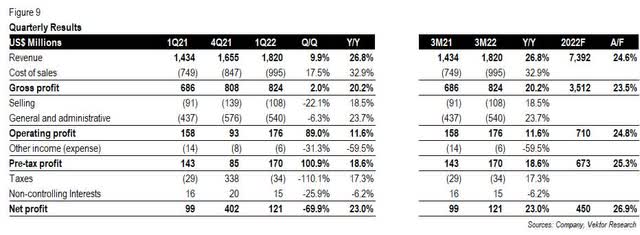

Quarterly Results (Company, Vektor Research)

We can’t really time the market. But we can choose to believe in companies with sound fundamentals. If you have any thoughts, please do not hesitate to comment below.

Be the first to comment