AnaBGD/iStock via Getty Images

The Canadian company released its quarterly results (Q1/2023) just a few days ago.

I have reported on this name several times in the past: The following is an update based on recent developments resulting from the last earnings call. Having followed this company extensively, I would like to see an improvement in its business performance.

Unfortunately, even this time there is little to celebrate for BlackBerry (NYSE:BB) shareholders: revenue fell 3.5% year-on-year, as did net income (this time a loss of $181 million was posted, largely due to litigation). FCF is consistently in negative territory (this time minus $43 million), and as a result, the net cash position shrank from $405M last quarter to $356M at the end of May 2022.

BlackBerry’s first quarter results and outlook

Revenue came in at $168 million, down slightly from a year ago. The IoT business grew 19% year over year but was virtually flat quarter over quarter. Cybersecurity grew 5% year over year and declined 7% quarter over quarter. The full-year forecast (fiscal 2023) was not changed, meaning Cybersecurity will be flat and IoT is expected to grow up to $205 million (midpoint). This is quite disappointing to me, considering the current times are very favourable for this business. In fact, the cybersecurity market is forecast to grow at a 10% CAGR through 2026, and BB is not a particularly large player (so theoretically with more room to grow).

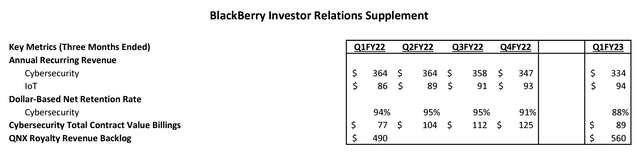

Moreover, this business is still likely to be unprofitable, given its multi-year trend and with low margins for a software company (53% of gross profit margin): consequently, it would need strong growth to generate reasonable profits in the coming years, which simply will not be the case with the current trend (and for the management’s guidance itself). IoT is a better story, but in the middle of the FY2023 forecast, the segment has yet to reach the levels of four years ago, as I discussed here. Also, ARR accounts for less than half of total revenue (see chart below), which should be a concern.

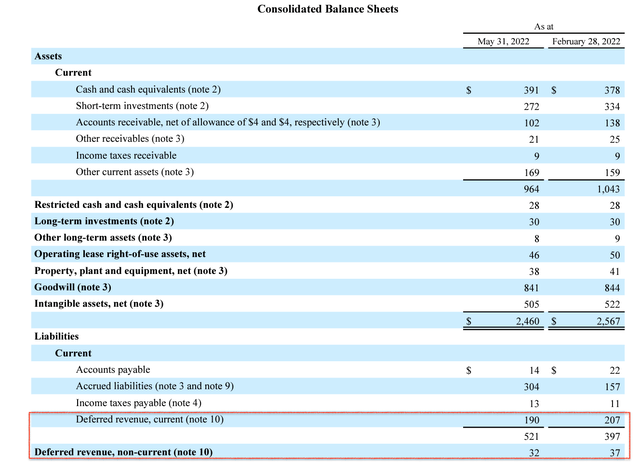

Even though the company shows one (frankly obscure) metric: the QNX royalty backlog, trending upward (QNX is part of the IoT division), unfortunately, the 9% decline in deferred revenue in just 3 months is much more significant in my opinion.

As usual, the BB’s PR division has made several statements in recent months about all sorts of new partnerships and collaborations, of which the one with Chrome is probably the most notable. This company has stunned investors with literally dozens of such announcements over the last 5-10 years, but none of them have really managed to change the course of a small, flat/regressive and mostly unprofitable company. Maybe because in the real world, it’s not the number of partners that counts but the number (and size) of customers!

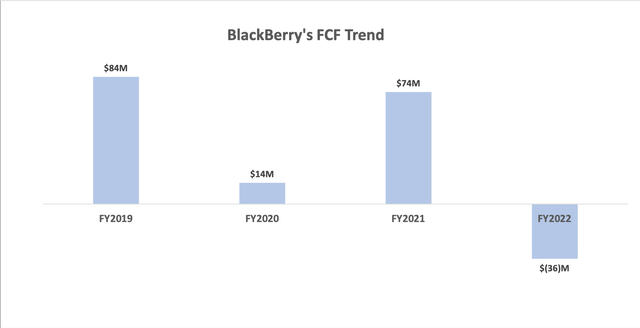

Sadly, the reality is that this company is losing money from its business. From my point of view, the trend that really counts is completely uninspiring (see figure below)

And the new fiscal year has not started any better: BB used $42 million from operations in the most recent quarter and spent another $1 million on its investments. It’s probably also worth noting that these capital expenditures appear too low, so the case could be made that the company does not make up the loss it suffers from the depreciation of its assets with new investments. One of the main causes of the hemorrhaging of cash over the last year or so is the strange story of the sale of BB’s patents, which, by the way, has no clear end in sight.

As a reminder, BB has been trying to sell its collection of technology patents for a couple of years. After a long period in which the entire transaction was under strict scrutiny and BB shareholders could only look at the division’s quarterly declining revenues, a (modest) deal was announced with an unknown counterparty for total proceeds of $450 million (plus $150 million in regular installments that the company will collect in a decade or so). As I explained here, the deal, which is very tenuous in any case, since patent monetization was strong and steady until two years ago, is far from done. Indeed, the bidding consortium called Catapult came to the negotiating table with no money and is now trying to borrow it to finance the acquisition. As John Chen himself explained at the last cc:

The buyer Catapult is working to secure their financing, and we look forward to the completion of the transaction. At the same time, as we are no longer under exclusivity with Catapult, we are free to explore new options as they come our way.

The problem is that this consortium of investors wants to borrow up to $400 million, but to secure those funds, it would have first to raise $90 million in equity: It’s probably not that simple a proposition. What is amazing is that they have had about two years (since they started exclusive negotiations with BB) to solve this problem: if they have not done it by now, I would be very worried that they ever will.

Obviously, John Chen is now looking for alternative options: I would say good luck with that! If BB had other ways to divest its patents, why even engage in exclusive negotiations with a counterpart that has no business or financial pedigree? And at a very modest overall price, I might add. For comparison, BB paid $165 million last quarter for a one-time settlement of a 2013 lawsuit: that sum represents about 40% of what the Canadian company hopes to receive from the sale of its patents. I expect that BB will find another buyer offering much less than Catapult, since the patents are now two years old and their monetization potential has been reduced to virtually zero (just $4M in the last quarter).

Honestly, in my opinion, the only hope for this company is that its IoT division performs great in the coming years and QNX finally gains traction somehow (although the multi-year forecast from management at BB is decent but not amazing) and/or IVY proves to be a revolutionary platform. The problem is: how much can we price in hopes? Because if we take them out of the equation, BB is trading at 4.5 times projected revenue with no serious growth in sight, relatively low margins (for a software company) and no profit: definitely too much.

Bottom Line

BlackBerry reported another unimpressive quarter. Things are not improving much for the company, and the patent sale impasse only adds to the overall sense of chaos surrounding this company. Management has issued a multi-year forecast to provide some optimism for the company’s shareholders and supporters. However, even this forecast assumes that the company might not be profitable in the next two years: unfortunately, John Chen’s contract will expire before that date. That means he will end his career as CEO of BB, having failed to even reach profitability after a 10-year tenure.

All in all, I would avoid this name at the moment, no matter how low the share price has fallen in the last few years.

Be the first to comment