JHVEPhoto/iStock Editorial via Getty Images

Shares of Comerica (NYSE:CMA) were pummeled on Wednesday, falling about 9%, after reporting disappointing Q3 earnings. The company reported a messy quarter, and it appears that there is no further upside from higher interest rates. Still, the company has substantial earnings power of nearly at least $8 per share, leaving the stock in a tricky situation of lacking catalysts but also being quite cheap. I see better opportunities elsewhere in the sector.

In the company’s third quarter, Comerica earned $2.60, which was actually ahead of consensus by $0.03, on revenue of $985 million. This was up from $1.90 last year thanks to higher interest rates. Comerica generated a 1.6% return on assets. Net interest margin (NIM) rose by 80bp to a robust 3.50%. Rates drove 76bp of this increase with mix shift the other 4bp. As a consequence, net interest income rose nearly 50% from last year to $707 million and was up 26% sequentially. This led to the substantial increase in earnings.

Comerica’s average loans grew by 2% sequentially to $51.1 billion led by commercial loan growth. Because its loans are largely floating rate, their average yield rose an impressive 100bp sequentially to 4.64%.

It has grown its security portfolio from $19 billion to $20.5 billion and seen yields rise 16bp to 2.08% sequentially. The portfolio has a 5.32 year duration and contains fixed-rate mortgage securities, so its yield moves much more slowly than its loan book. Comerica also is sitting on a $3.1 billion pre-tax loss from these securities, which flows into accumulated other comprehensive income and is significantly distorting book equity values given its size (CMA’s entire market capitalization is about $9.5 billion).

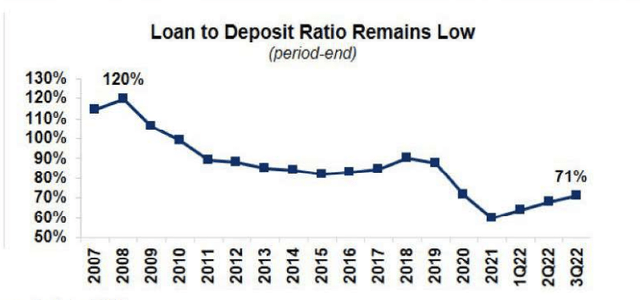

What is particularly troubling is that deposits plunged 4.6% to $74 billion on average during the quarter. The company only raised deposit rates to 0.20% from 0.05%, which is a lower average rate than most other banks have reported. Comerica appears to be intentionally letting some deposits leave the bank as it has tried to pass through just 11% of higher interest rates to customers, whereas most other banks have reported deposit “betas” of 0.15-0.25x. Management has cited the fact its loan book is low relative to its deposits, which allows them to let the deposit base shrink.

Deposits though can be a bank’s cheapest, most stable form of funding, and so this attrition is noteworthy. Comerica does expect deposit betas to pick up if interest rates move higher than projections-potentially to 0.25x if there is an incremental 100bp rise in rates beyond current projections. While Q4 can have seasonal noise, on the earnings call, management said to expect further deposit declines and is assuming a 5% decline in Q4. Deposit run-off could continue throughout 2023 if the Fed continues QT. While some deposit shrinkage is okay, if it continues for too long, that can begin to cap loan growth or squeeze interest margins.

Additionally, CMA has been a tremendous beneficiary of higher interest rates, as noted net interest income has risen nearly 50% over the past year. After years of low rates, CMA is trying to lock in its current interest margin. While the bank expects an incremental $30 million in interest income in Q4, this may represent the peak. The company has been entering swap agreements to lock in this level of interest rates through 2024 and may extend action into 2025. As a consequence, 2023’s NIM is likely to be similar to Q4’s if deposit rates do not rise or be somewhat lower if they do, barring very big rate moves. In other words, the rate upside that has boosted CMA’s EPS is largely done.

Now, the good news is that if the Fed does an about face and starts cutting rates, Comerica has protected its bottom line from falling. On the negative side, the benefit from higher rates is now essentially over, and if it needs to raise deposit rates more quickly to minimize attrition, CMA could lose a bit from higher rates, upending one of the primary reasons to own bank stocks during a hiking cycle. While its swap strategy reduces earnings volatility, its deposit strategy is creating some uncertainty, and that juxtaposition drove the poor market response to the earnings report.

On other items, this was a solid report. Noninterest income was flat from last year and up nearly 4% sequentially, thanks to higher derivative income and brokerage fees. Credit performance is also solid. Net charge-offs were just 10bp. Its $28 million credit provision rose from $10 million last quarter but remains modest. Its allowance for losses account for 1.21% of its outstanding loans. Nonperforming assets actually declined by $4 million to $262 million. Its loan loss allowances provide 2.4x coverage of existing nonperforming assets.

Comerica has a CET1 ratio of 9.9%, up 20bp from last quarter vs a target of about 10%. The company did not buy back stock during the quarter, and until this ratio gets above 10%, meaningful buybacks appear unlikely. Book value per share fell from $56.55 to $35.70 over the past year. This is due to the unrealized losses on its security portfolio. Adjusting for this, book value is $63.11. Management conceded its low equity value when including the unrealized loss is an “optics” problem but that it is not driving decision-making as it is not an economic problem.

With management expecting interest income to rise in Q4 and noninterest income to fall, earning should be about $2.50-$2.70 next quarter, similar to this quarter’s performance. Even if net interest margins contract by 35bp next year due to worse than expected deposit betas, the company would have over $8 in EPS. Credit losses would have to triple to get below $7 in EPS, which I don’t expect to occur barring a significant recession. At $68, this stock has a prospective multiple of just 8x. At 8x, CMA is too cheap to call a “sell” as there are no solvency concerns, or anything draconian like that. However, I would encourage investors to look elsewhere in the regional space.

For instance, Citizens Financial (CFG) has a single-digit multiple and grew deposits last quarter, providing a cleaner fundamental story. While CMA is cheap, its deposit attrition combined with a peak in NIM create a significant sentiment problem that is unlikely to reverse anytime in the near future. While it has positioned itself well for a rate decline, if rates stay steady or rise further, there are better opportunities at low multiples, and I would rotate out of CMA and into them.

Be the first to comment