BrianAJackson/iStock via Getty Images

Investment Thesis

JD.com (NASDAQ:JD) is cheap as investors become extremely bearish on JD.com. While, for my part, I remain just as bullish as I’ve ever been.

Of course, it’s nearly needless to say that it’s unrealistic to expect the negative market sentiment facing JD.com to turn around quickly. But anyone looking for investing to be a quick and easy process is either new to investing or misguided.

The issue at hand is that President Xi Jinping appears to welcome loyalty over economic prosperity. At least that’s the headline. But I argue that may not be the full story, at least when it comes to JD.com.

What’s Happening Right Now?

Across the board, Chinese stocks are being sold off. Investors simply can’t sell out fast enough.

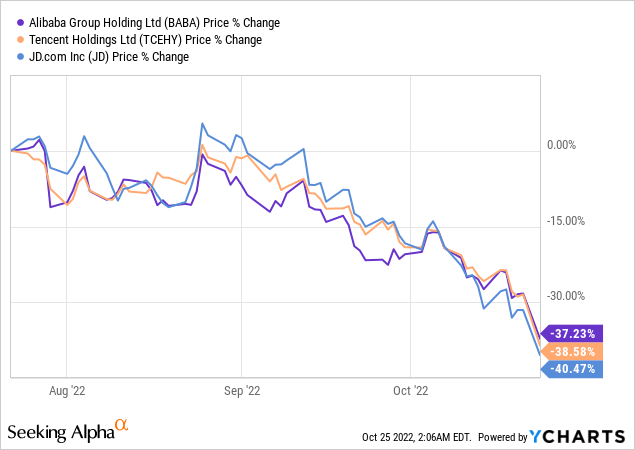

It’s difficult to imagine that Alibaba (BABA), Tencent (OTCPK:TCEHY), and JD.com are down approximately 40% in three months. This is mind-boggling. The pace at which investors are now throwing in the towel on their investments.

When markets are going up, everyone loudly chants ”buy and hold forever” as the key mantra.

When stocks were going up, nobody wanted to get too bogged down in asking questions about their investment. But when stocks go down, people ask a lot of questions. Particularly as we navigate the tax loss season.

Everyone is asking whether or not XYZ has a place in the portfolio. It’s all about what the stock has done for me lately. Nobody is willing to stop and think about the underlying fundamentals of the business.

My contention is simple. As long as JD.com continues to press ahead and make free cash flows, even if the multiple remains depressed, it’s just a matter of time before JD.com uses that excess free cash flow and returns it to shareholders via buybacks.

Next, let’s discuss the bear thesis.

One Meaningful Bearish Argument

China’s economy is widely reported to be slowing down. China’s Covid lockdown policy is ravaging its economy. That means that spending power for the country will come down.

By extension, that will make it very difficult for JD.com to report strong revenue growth rates.

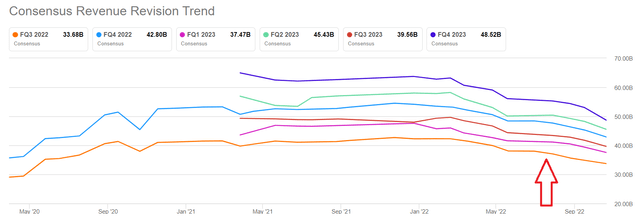

JD revenue consensus estimates

As you can see above, revenue consensus estimates have been coming down since the summer.

That means that looking ahead to Q3 and Q4, there’s a very serious scenario where JD.com’s revenue growth rates will move to negative territory.

Put another way, this time last year, JD.com was a company that was growing at 20% CAGR. While looking ahead, its exit rate from Q4 could be 0% CAGR to possibly negative CAGR.

That means that JD.com will have gone from being a secular growth company to a cyclical growth company, that is now going to be reporting no topline growth.

That will have dramatic implications on the multiple that investors will be willing to put on its stock.

JD Stock Valuation – Difficult to Find Intrinsic Value

Right now, investors are acting with one modus operandi. Sell first. Sell during tax loss season. Sell because of political risks. Sell, sell, sell.

There are not enough buyers in the market right now, so there’s only a deluge of sellers.

But if you cast your mind back a few weeks, remember, China was working with the SEC to ensure that Chinese companies were not going to get delisted.

China wants foreign investment. Yes, they want foreign investments on their terms. But all the same, China very much wants investments. Lest we forget, China is an economic powerhouse. China is a superpower!

Now, at the surface level, I suspect that when JD.com reports Q3 results in the coming few weeks, we’ll see that JD.com is probably priced around 14x to 15x trailing free cash flows.

That may not sound so cheap when we think of all the headaches of having to deal with all these geopolitical tensions.

But I believe that’s at a minimum 50% cheaper than US-based marketplaces. Indeed, still, a substantial proportion of US-based marketplaces still haven’t figured out how to reach sustainable profitability.

The Bottom Line

The amount of pain from a loss is substantially bigger than the gain derived from the same proportional gain.

Recall, when markets are going up, investors think really long-term. And investors start to discount those high rates of return well into the future.

But when markets turn sour, investors only think about the next 90 days at a time.

By my estimates, JD.com’s CEO Liu Qiangdong still holds more than 5% of JD.com. While Walmart (WMT) still holds around 13% of JD.com. Hence, I believe that both of these entities are doing everything in their power right now to figure out how to stabilize the share price through any means possible. And that’s the great advantage of being a free cash flow generating company. It provides you flexibility and firepower when you need it most.

Difficult as it may be, try to think about the underlying business. Don’t focus on the share price.

Be the first to comment