Spencer Platt/Getty Images News

Thesis

FedEx (FDX) dropped sharply after the company announced a profit warning in mid-September. And the stock has not recovered since. Given the close correlation between FedEx’ and UPS’ business, in my opinion, there is an argument to be made that a similar warning will be made from United Parcel Services (NYSE:UPS). The fact that UPS reiterated a strong guidance post-Q3 does not really change the thesis. In fact, a profit warning becomes more dangerous – build on excess optimism.

As a reference for the thesis, I would like to point out what happened to Advanced Micro Devices (AMD). Following a profit warning from Nvidia (NVDA) in August, a similar warning from AMD would have been ‘only natural’. But the market apparently missed to price such a warning until the October 7th, when AMD finally admitted that the demand environment is slowing. AMD stock fell 10% that day.

Investors should consider that UPS is down only 17% YTD, while FDX has lost 34%. Personally, I expect this gap to close.

UPS Q3 Results

UPS reported mixed Q3 results, with revenues below and EPS above analyst consensus. During the September quarter, UPS generated total sales of $24.2 (versus $24.32 expected) billion and EPS of $2.96 (versus $2.86 expected).

But the key data point that I am looking at is the company’s guidance. Together with Q3 results, UPS reaffirmed a relatively strong guidance – too strong in my opinion. For 2022, management continues to expect revenues of approximately $102 billion, and the company targets an adjusted operating margin of about 13.7%.

Already in Q2, UPS said that for FY 2022 management expects consolidated revenues of about $102 billion and an adjusted operating margin of approximately 13.7%. But these assumptions were are also conditional to ‘global GDP growing 2.9% and U.S. GDP growing 1.4%’, which seems somewhat unrealistic, given the latest economic data in the US, China and Europe.

Is Guidance Too Optimistic?

UPS guidance is communicating too much optimism, in my opinion. Investors should consider that the economic environment for online shopping has deteriorated sharply in Q2 and Q3 (reference FedEx) and likely continues to worsen. UPS has already missed revenue estimates in Q3 – in my opinion the leading indicator to EPS.

Notably, also FedEx was quite optimistic about the transportation business in June, but in August the firm needed to unexpectedly reduce market expectations through a profit warning that caused FDX stock to drop by as much as 20% in one trading day. FedEx CEO Raj Subramaniam commented (emphasis added):

Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the US …

… We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first-quarter results are below our expectations.

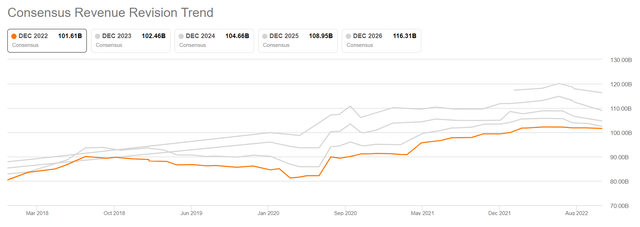

Now, it is important to consider that the same cost and demand pressures that affect FedEx are likely to weigh also on UPS. But analysts have not rally taken note yet. In fact, EPS consensus estimates for UPS FY 2022 are approximately similar to what has been priced in late 2021, when the outlook for the global economy was much better. The reason is that analysts are likely overly reliant on UPS guidance.

In my opinion, the observation that management has been optimistic in Q3 is bearish, not bullish – because it may tempt investors to believe that UPS doesn’t feel an economic slowdown. But what is the likelihood that UPS management will assume a more bearish tone in Q4? Respectively, what would be the likelihood of an early 2023 guidance cut? And most importantly, how will markets react if optimism is replaced by realism, if not pessimism?

Investors should consider that even Amazon (AMZN) is struggling to fight a slowing demand for online shopping. As I have highlighted in a previous article, Amazon’s e-commerce sales have stealthy declined for the past 2 quarters: for reference, in Q2 e-commerce sales decreased by 4.3% year over decrease to $50.9 billion.

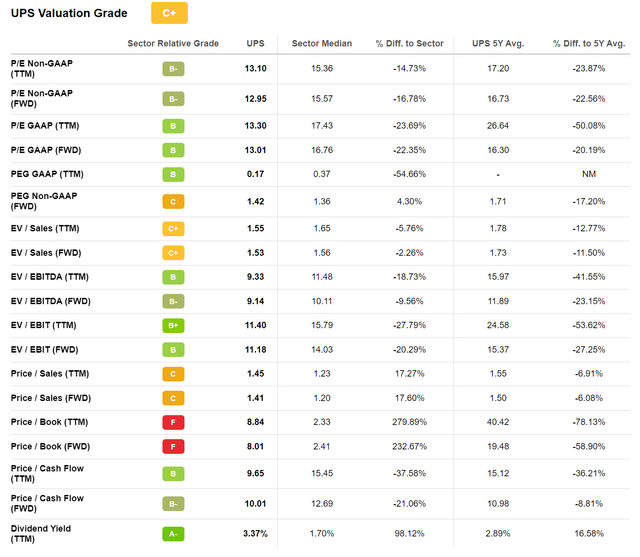

Valuation Is Investable

Although I believe that a profit warning from United Parcel Service is increasingly likely, I don’t argue that UPS is a ‘Sell’. Investors should consider that UPS stock is priced quite attractively – valued at an EV/Sales of x1.5 and a EV/EBIT of x11.2. This compares to an EV/Sales of x0.75 and EV/EBIT of x13.7 for FedEx.

However, a profit warning might adjust analyst forward EBIT estimates down, closer to a multiple similar to FedEx.

Investor Recommendation

In my opinion, signs of a recession are too obvious to ignore. And accordingly, investors are well-advised to avoid investing in industries that are highly sensitive to the strength and weakness of the macroeconomy – industries such as transportation.

FedEx profit warning in September has clearly highlighted, that the environment for the cost and demand drivers that also affect UPS has turned fast and aggressively. And as a consequence, UPS’ optimistic guidance might fail to hold against a deteriorating macro environment. (Reference: Nvidia’s profit warning proceeded AMD’s profit warning with a 2 months’ time-lead). In my opinion, a profit warning from UPS is increasingly likely.

However, if UPS would indeed deliver a profit warning, then the stock might trade 10% lower in the blink of an eye. Such a sell-off would likely provide investors with an attractive long-term risk/reward set-up. But for now, with the profit warning still outstanding, I advise to remain on the sidelines. ‘Hold’.

Be the first to comment