piranka

The recent announcement of an open-ended buyback program for Prosus N.V. (OTCPK:PROSF) and Naspers (OTCPK:NPSNY, OTCPK:NAPRF) shares (funded by a sell-down of the Tencent stake) represents a major positive surprise, highlighting renewed intent to unlock shareholder value at both entities. For context, Naspers currently has economic ownership of ~41% of Prosus’ underlying investments and operating assets after accounting for cross-holdings.

More broadly, the move reflects a transformational strategic shift – while Tencent share sales have previously been recycled into early-stage investments, the extent of the NAV discounts at the Naspers and Prosus levels have skewed the risk/reward in favor of buybacks. Given the wider market-implied sum-of-parts discount at Naspers, I think going long Naspers at these levels (standalone or via a pair trade with Prosus to hedge out directional risk) makes the most sense, particularly with management incentives now better aligned with shareholders.

Unveiling a New Buyback Program to Close the Discount

Naspers’ decision to raise cash (via a gradual sell-down of its Tencent shares) to fund an open-ended buyback program is the clearest indication yet of its intent to tighten the NAV discount. For context, there had previously been a voluntary lock-up on its Tencent (OTCPK:TCEHY, OTCPK:TCTZF) shares, preventing the company from selling until March 2024. Now that the NAV discount has moved to “unacceptable” levels, though, an “as long as it takes” buyback makes a lot of sense, in my view. The open-ended approach is a good move as well – the company refused to disclose how much cash will be dedicated to the program (i.e., how many Tencent shares would be sold to fund it) nor the discount threshold at which it will run/pause the buyback.

What is clear, though, is that the move will create valuable support for the Naspers stock price should a recession scenario materialize – conservatively assuming a sell-down at a low single-digit % of daily volume (~$50m/day) to ~20% would imply a lengthy ~20-month buyback window.

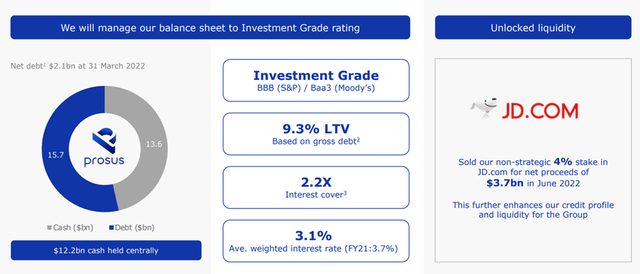

Expanded Balance Sheet Capacity Clears the Path for More Optionality

Alongside the buyback announcement, Naspers/Prosus also confirmed the sale of its entire JD.com (JD) stake worth ~$3.7bn for corporate purposes and to reinforce its investment-grade balance sheet. The cash injection also significantly boosts the liquidity position, paving the way for capital allocation optionality (“systematic and repeatable” value crystallization efforts).

While an expanded buyback is one option, I suspect further simplification of the current Naspers/Prosus group structure is in the cards – this could mean more asset sales or even a buyback of Naspers shares by Prosus. The latter makes good sense, in my view, given the wider Naspers discount (see table below). Plus, management noted any Naspers buyback would be proportionate to the respective economic interests and free floats, suggesting this could be on the agenda as well.

Funding-wise, it remains unclear how Naspers will fund its portion of the buyback given the regulatory limitations – pending approval from the South African Competition Commission to cross the ~50% level (vs. the 49.5% of Naspers currently owned by Prosus), management’s hands are tied. Alternatively, Naspers may sell its ownership of Prosus stock to fund buybacks of its own stock to narrow the prevailing NAV discount. Either way, investors should draw comfort from the new management remuneration policy, which directly incentivizes accretive capital allocation – in contrast to the prior policy of granting long-term incentives to senior management, the Board has instead granted short-term incentives tied to the effective reduction of the NAV discount.

|

USD ‘M |

|

|

Prosus NV @ 40% Ownership |

44,741 |

|

(-) South Africa (Takealot @ 97% + Media24 @ 100%) |

756 |

|

= Implied Naspers Enterprise Value |

45,497 |

|

(+) Net cash / (Debt) |

415 |

|

= Implied Naspers Equity Value |

45,912 |

|

Naspers Current Market Cap |

33,915 |

|

Implied % Discount to Prosus NV |

(24)% |

|

Implied % Discount to NAV |

(26)% |

Source: Market Data and FX Rates at 6th July 2022, Author

Near-Term Headwinds Shifts Focus Toward Profitability

With rates on the rise, the near-term outlook for Naspers’ investee companies looks bleak. Thus, it came as no surprise, in my view, that management refrained from guiding FY23 trading numbers, citing a large segment of losses coming from non-controlling stakes (i.e., associates). That said, there are positives here, given Naspers/Prosus is pushing for a stronger focus on efficiency at its portfolio companies and leaning on accretive organic investments (vs. large-scale acquisitions) to drive future growth. Funding should pose limited issues as well – even the more cash-consumptive associates within the Naspers/Prosus portfolio have well-capitalized balance sheets. In a worst-case scenario, management has ample room to pull back on investments (at the consolidated level) to free up capacity.

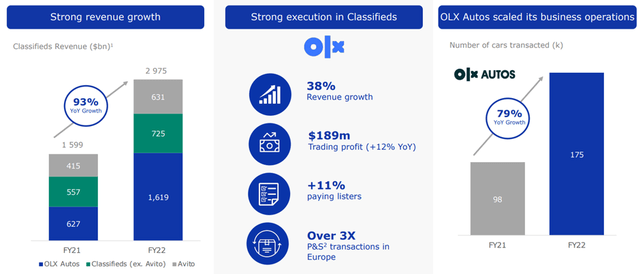

Thus far, this strategy looks to already be paying off for the classifieds/e-commerce portfolio – despite ongoing investments to build capacity for the next growth phase, trading profit was solid at ~$25m in the most recent quarter. The resilience of this portfolio has been a key highlight, holding on to gains from the post-COVID acceleration in digital adoption and retaining its pricing power amid the current inflationary pressures. Assuming this trend holds, there should be ample room to ramp up its pace of investments in the coming years while maintaining the profitability path at a later stage. Similarly, food delivery and payments revenues have held up well (albeit to a lesser extent) despite the elevated inflation, so reducing investment levels should move the businesses closer to breakeven.

A Positive Step Toward Unlocking the NAV Discount

The Naspers/Prosus announcement of a mid-term buyback program represents a significantly positive step to reduce the widening discount to NAV at both entities (close to all-time highs pre-announcement). While the NAV discount has tightened in recent days following the announcement, there remains ample room for further upside from NAV accretion per share from the planned buyback as well as from the portfolio (listed and unlisted assets) over time. Plus, commentary from the latest quarterly call indicates an increasing probability that management acts to simplify the Naspers/Prosus cross-holding structure over the coming years, further justifying a narrowing discount between both entities.

Given the wider market-implied discount at Naspers, I favor buying into Naspers (standalone or via a pair trade with Prosus to hedge out directional risk) at current levels – particularly with management incentives now better aligned with shareholders.

Be the first to comment