Nikada/iStock Unreleased via Getty Images

An important lesson in investing is to constantly reassess the investing strategy and identify mistakes if we made some. I was already bullish on Tencent (OTCPK:TCEHY) a year ago – see article here and here – and that was obviously a mistake, and I was too early with my buying recommendation. Nevertheless, I am still bullish about Tencent, and my investing timeframe is of several years or even decades and not just a few quarters. I will take a closer look at Tencent once again and try to analyze if the company is still a good long-term investment and if the long-term bullish thesis is still intact.

Growth Narrative: Broken For Now?

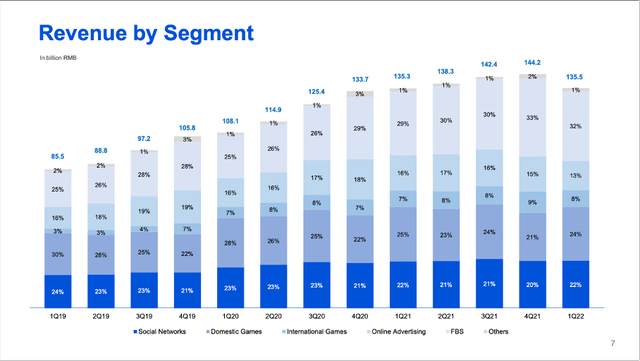

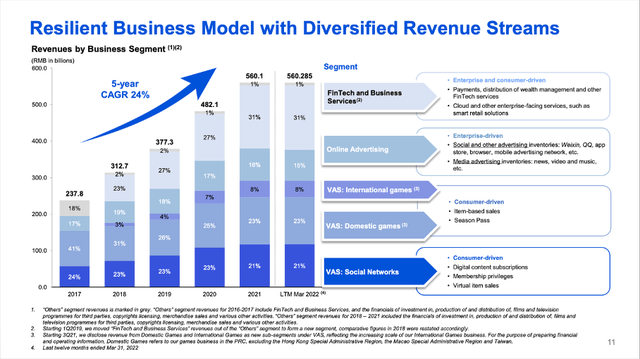

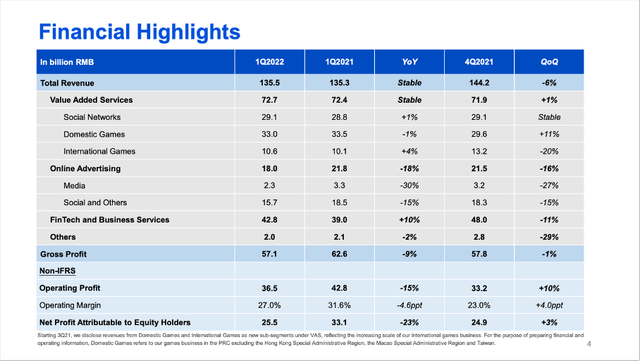

Tencent was one of the great growth stories for several years and could report high growth rates for revenue quarter after quarter. Usually, Tencent would not just report year-over-year growth, but also quarter-over-quarter growth. However, in the last few quarters growth slowed down and while revenue could still grow quarter-over-quarter, the growth rates were not so high anymore. And in the last quarter (Q1/2022), revenue declined compared to the previous quarter.

Tencent Corporate Overview May 2022 Presentation

And while revenue declined quarter-over-quarter, it could still increase slightly when looking at year-over-year results. Revenue increased slightly from RMB 135,303 million in the same quarter last year to RMB 135,471 million – 0.1% YoY growth. Operating profit however declined 33.9% YoY from RMB 56,273 million in Q1/21 to RMB 37,217 million in Q1/22. And diluted earnings per share declined even 51.1% YoY from RMB 4.917 in the same quarter last year to RMB 2.404 this quarter.

And it is not surprising to read, that margins also declined. Operating margin for example fell from 42% in Q1/21 to only 27% in Q1/22.

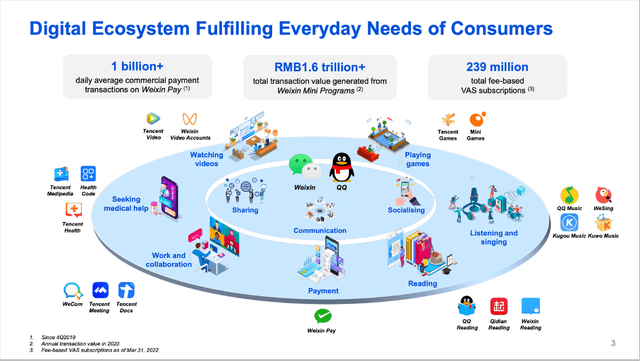

And while these results were not great, Tencent could at least increase the combined MAUs of Weixin and WeChat from 1,241.6 million on March 31, 2021, to 1,288.3 million on March 31, 2022 – an increase of 3.8% YoY. Fee-based VAS registered subscriptions also increased from 225.7 million to 239.1 million in the same timeframe – resulting in 5.9% YoY growth.

Addressing Growth Concerns

Tencent – as well as many other Chinese companies – was struggling again due to the COVID-19 crisis and the resulting lockdowns in many Chinese cities. And although COVID-19 is accompanying us for more than two years, we still must assume this is a rather temporary issue and not a long-term problem for Tencent. During the last earnings call, management mentioned cost control initiatives – which might also be a reaction to the pandemic.

During the challenging first quarter of 2022, we implement cost control initiatives and rationalized certain non-core businesses, which will enable us to achieve a more optimized cost structure going forward.

And while it is not a bad idea to cut unnecessary costs to increase profitability and lead to higher earnings per share, companies are often using cost-cutting measures when the company is struggling. From this point of view, Tencent cutting costs might not be a good sign.

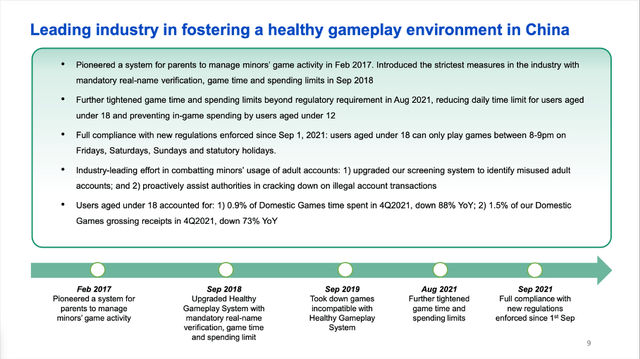

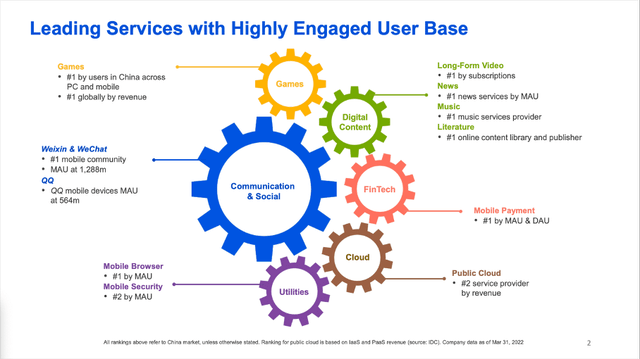

Tencent is also struggling in its games segment. While revenue from international games could grow 4% year-over-year in the first quarter, domestic games revenue was down 1% year-over-year. One of the reasons is the effects of minor protection measures, which impacted active users and paying user accounts. Tencent was also left out of a list of companies that were granted new online gaming licenses by China’s national gaming regulator in June 2022.

Tencent Corporate Overview May 2022 Presentation

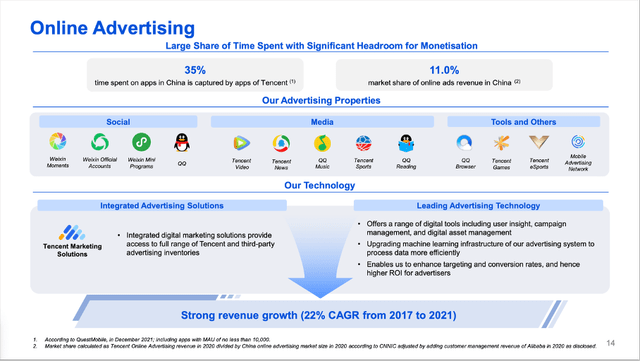

Online advertising also declined 16% quarter-over-quarter and 18% year-over-year in the first quarter of fiscal 2022. Especially advertisers in sectors such as FMCG, eCommerce and travel have reduced their spending significantly. This also led to a declining gross margin for online advertising over the last few quarters. And assuming an upcoming recession, I don’t think online advertising will recover in a meaningful way in the next few quarters. However, I am quite confident that these struggles are only temporary and Tencent will return on the path of growth. And while I don’t think we will see similar growth rates as before (between 2017 and 2021 online advertising grew with a CAGR of 22%), we can probably see growth rates in the low-to-mid teens again.

Tencent Corporate Overview May 2022 Presentation

Considering the upcoming recession, I don’t think these growth issues will be resolved within a few months, but they will most likely not be an issue in two or three years from now.

Tencent Divesting Stakes

And not only did Tencent report mediocre growth rates, the company also had to alter its business strategy in the last few quarters. In the past, Tencent often used the generated free cash flow to invest in other businesses – either by making acquisitions or buying a stake in a (public traded) company. For example, Tencent had rather large stakes in JD.com (JD) or Sea Limited (SE).

In the last few quarters, Tencent diversified some of its holdings. The company announced the sale of $3 billion worth of Sea Limited shares and therefore trimmed its stake from 21.3% to about 18.7%. Aside from cutting the stake in Sea Limited, Tencent also distributed most of its JD.com shares as a special stock dividend to shareholders and therefore reducing the stake from about 17% to 2.3%. And while it is not unusual for businesses to sell shares again, we can speculate that Tencent was forced by the Chinese government to sell shares due to tightened regulations on anti-trust. Tencent converting its stake in Sea Limited to non-voting shares also speaks for this theory.

There are not a lot of different ways to use generated free cash flow – it could remain on the balance sheet, it could be used to buy back shares or it could be used to make acquisitions or buy stakes in other businesses. Considering the rather low share price, Tencent can buy back its own shares more aggressively, however, the best strategy was to use that cash to invest in other businesses. And if Tencent is somehow restricted on doing that (for whatever reason) it will be a drag on the business in the years to come. Tencent was one of the great capital allocators in the past and it remains to be seen how well Tencent can use the generated free cash flow in the years to come.

Intrinsic Value Calculation

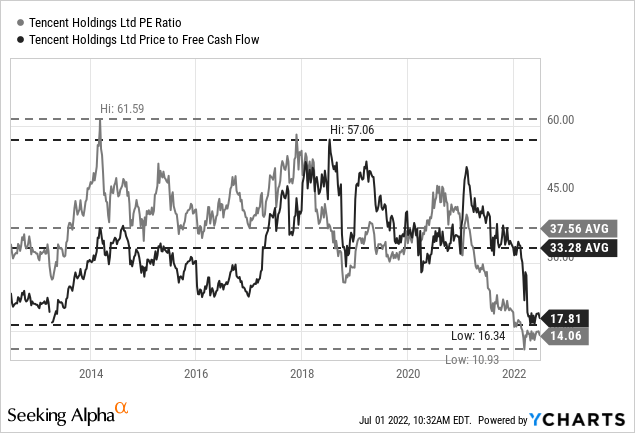

When looking at the simple valuation metrics for Tencent, the stock seems to be extremely cheap. But Tencent is a great example to demonstrate the limitations of simple valuation metrics. Right now, Tencent is trading for the cheapest P/E ratio of the last ten years (it has been cheaper in the last few weeks) and the stock trading for 14 times earnings is clearly below the average P/E of the last 10 years (37.56). And when looking at the price-free-cash-flow ratio, the picture is similar. Tencent is trading for 18 times free cash flow, which is also below the 10-year average of 33.28.

At this point, we conclude that Tencent is a screaming buy. But the simple valuation metrics don’t take into account that Tencent was growing with a high pace a few years ago when the stock was trading for 40 times earnings or free cash flow, and it is struggling to grow right now. And I think it is obvious for everybody that Tencent should deserve a different valuation multiple if it is not able to grow at a similar high pace as before.

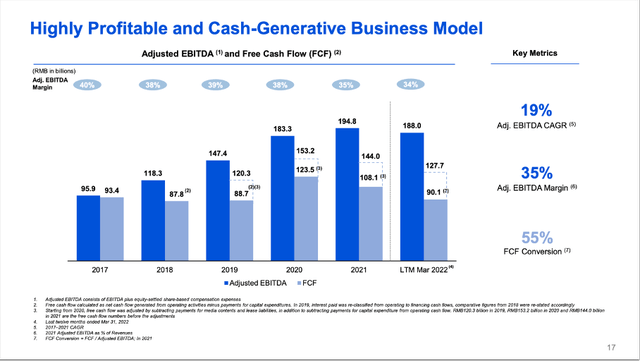

Instead, we can use a discounted cash flow calculation which enables us to include growth assumptions for the different years. As a basis for our calculation, we often take the free cash flow of the last four quarters, but here it gets a bit tricky. In fiscal 2020, Tencent adjusted the free cash flow by subtracting payments for media contents and lease liabilities, in addition to subtracting payments for capital expenditures. This leads to an adjusted free cash flow of RMB 90.1 billion in the last four quarters while free cash flow without adjustments was RMB 127.7 million.

Tencent Corporate Overview May 2022 Presentation

Now we can argue which number to use for our calculation and I would actually argue to use the higher number as I don’t see payments for media content as “real” capital expenditures that are necessary to keep the basic business running. As a basis for our calculation, we therefore use a free cash flow of RMB 127.7 billion.

However, it is not just the question what free cash flow numbers are more reasonable. We also must answer the difficult question: what growth rates are realistic for Tencent? The business shifted within a few quarters from a high-growth company to a company having troubles to grow at all – and we must determine if this is just a temporary phase or if the business model is somehow broken. As a realistic assumption, we can take the free cash flow of the last four quarters (RMB 127.7 billion) and due to a potential recession, we assume that Tencent will also stagnate in fiscal 2023. But in fiscal 2024, we will assume high growth rates again (15% growth) and assume growth will slow down over the next decade to only 6% growth till perpetuity. This would lead to an intrinsic value of RMB 418 (assuming 10% discount rate and 9,689 million in outstanding shares). And as Tencent is trading in Hongkong dollars, the intrinsic value would be around HKD 489 right now, meaning Tencent is undervalued.

Of course, we can also be rather skeptical if Tencent is able to continue growing with a high pace; and Tencent must grow in order to be fairly valued. If Tencent should not be able to grow its top and bottom line, the stock would be extremely overvalued – despite the stock price declining more than 50%. When assuming only growth rates in the low-to-mid-single digits, the company is still overvalued at this point.

When calculating a bear case scenario, we can also calculate a bull case scenario. This scenario assumes that Tencent will be able to grow 20% again in fiscal 2023 (after it struggled in fiscal 2022) and over the next decade growth will slow down to 6% growth till perpetuity. This leads to an intrinsic value of RMB 537 and results in an intrinsic value of HKD 629 and Tencent is trading more than 40% below its intrinsic value.

Wide Economic Moat

We certainly must take the issues mentioned above very seriously. Tencent not being able to invest its generated free cash flow in an effective way and growth rates slowing down could be a serious problem. However, we should not forget the wide economic moat Tencent has around its business and as long as the Chinese government doesn’t destroy that moat, I think Tencent will perform quite well.

Over the years, Tencent generated a complex and dense digital ecosystem, and the company is profiting from several types of competitive advantages. Not only is Tencent profiting from network effects, it is also embedding several different other applications in its ecosystem and therefore generating switching costs that are hard to overcome. And of course, Tencent is also profiting from cost advantages.

Tencent Corporate Overview May 2022 Presentation

In an article published about two years ago, I described the economic moat of Tencent in more detail and first I focused on describing the network effect:

In its essence, Tencent is a huge (social) network with over 1 billion users, and over the past few years, Tencent has created a very complex and dense network, where every user can – at least in theory – connect with every other user, and this creates a very valuable asset, which is difficult to replicate for other companies. And it is not enough to replicate just a small part of the network – some nodes and connections – but as the network gets its true value mostly from its complexity and density, a competitor would have to duplicate the entire network. And network-based businesses tend to form monopolies rather quickly, and Tencent is also on its way to become a monopoly – at least in China. And the reason for this tendency is rather simple: As the value of a service or product increases with the number of people using it, the most valuable service or product will be the one the most people are using. Over time, we see a winner-takes-it-all effect, and smaller networks are squeezed out by the bigger competitors. This effect is often referred to as the Matthews Effect. The network effect also plays a big role for TenPay, the company’s FinTech business. This is basically a 2-sided network with customers (demand) and retailers/sellers (supply). For the supplying side, the network gets more valuable with every additional node on the demand side, and for the demand side, the same is true for every additional node on the supply side. Today, Weixin Pay is the number one mobile payment platform in China with over 500 million commercial transactions per day.

When looking at the number of DAUs, we saw growing numbers in the meantime and Tencent still has the pole position in most of its business segments.

Tencent Corporate Overview May 2022 Presentation

In the same article I also described the switching costs and embeddedness:

But Tencent is not only relying on the network effect, but also on switching costs and the embeddedness of many different services, applications, programs or other forms of content into a bigger structure. In order to get access to games, mini programs or chat programs, one has to use WeChat or Weixin, and this creates high switching costs. It is simply not possible to just use one single product, but users have to participate in the whole “Tencent universe” and might easily get sucked into other subscription services or are forced to use some other services they don’t want to in order to get access to a service they want to use. Tencent will focus on deepening the stickiness via broadened product offering, meaning that Tencent will try to increase the switching costs for the customers and will try to embed new content into the existing applications, making the moat deeper and deeper.

And management has proven in the past that they are great capital allocators, and I would also estimate that management is understanding quite well how important it is to widen the economic moat. In several of the last earnings calls, management spoke about embedding mini programs and widening the moat. In the last earnings call, Martin Lau commented on mini programs once again:

Mini Programs exceeded 500 million DAUs and sustained rapid growth in GMV year-on-year, with particularly notable growth in retail and restaurant categories as we enhance the functionalities for customer services and operational analysis. With more public — such as health and municipal services available through Mini Programs, we’re able to cultivate user habits in accessing essential services through Mini Programs.

Overall, I still think Tencent is a very resilient business, and I don’t know if we can return to a revenue CAGR of 24% like in the last five years, but I am highly confident Tencent can grow with a solid pace going forward given its diversified revenue streams and wide economic moat based on network effects and switching costs.

Tencent Corporate Overview May 2022 Presentation

Conclusion

Although Tencent is struggling right now, I remain confident that Tencent will grow with a solid pace in the years to come. And if we do not assume that Tencent can only grow in the low-to-mid-single digits from now till perpetuity, the stock seems to be undervalued. And considering the wide economic moat Tencent has around its business, I see it highly unlikely that Tencent can only grow in the low single digits from now till perpetuity.

Be the first to comment