janiecbros

Simulations Plus Inc (NASDAQ:SLP) offers specialized modeling and simulation software used primarily in the development of drugs in the pharmaceutical and biotech industries. The company also offers consulting services in support of clinical trials and regulatory submissions. Shares have outperformed the broader market over the past year based on impressive operating and financial trends. Indeed, the company just reported its latest quarterly result which beat expectations highlighted by firming margins and positive guidance.

While SPL trades at a lofty valuation premium, we are bullish on the stock and expect more upside going forward. The attraction here is a global leader with a long-term growth runway and overall solid fundamentals. We like the setup in the stock that appears to be breaking out with a tailwind of momentum.

SLP Earnings Recap

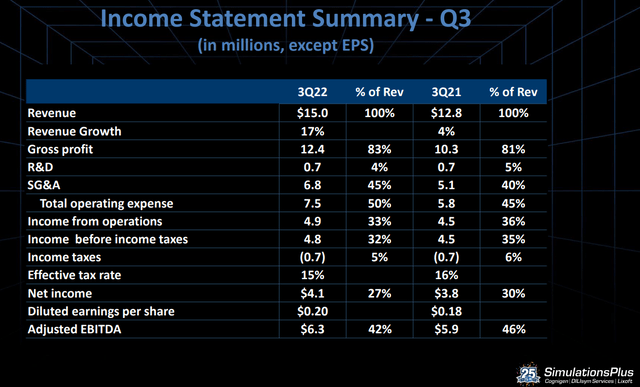

This was the company’s fiscal Q3 earnings with the headline EPS of $0.20 per share coming in $0.02 ahead of estimates and up from $0.18 in the period last year. Revenue of $15.0 million climbed 17.1% year-over-year with the story this quarter being a gross margin of 83%, up from 81% in Q3 2021 and 78% two years ago. Even as SG&A climbed by 45% y/y, based in part on a higher headcount to support growth efforts, Simulations Plus was able to deliver a 9% increase in operating income and 7% higher adjusted EBITDA.

The company is seeing growth across the board. In software, which represents 64% of the business, revenues climbed 16% y/y while services increased 19% y/y considering some normalization compared to pandemic disruptions in 2021 and 2020.

With a 25-year operating history, Simulations Plus has found success in incorporating artificial intelligence which is important in predicting the properties of molecules and also has applications in the agrochemical, cosmetics, and food industries.

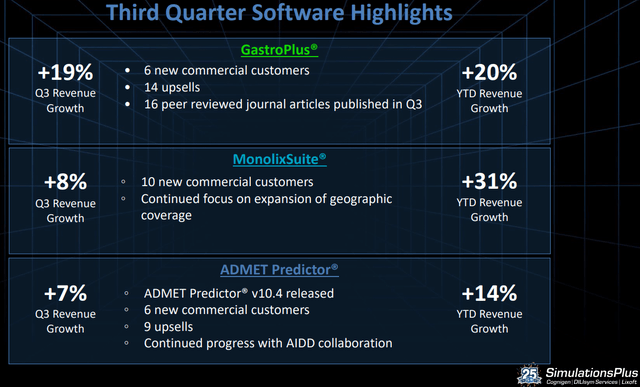

A strong point has been the strength of “GastroPlus”, recognized as its flagship product and one of the most widely used commercial software of its type by industry and regulatory agencies globally according to the company’s annual report. For reference, GastroPlus simulates the absorption and drug interaction of compounds administered to humans and animals. Simulation Plus notes that it won 6 new commercial customers and was featured in 16 peer-reviewed journal articles just in this quarter.

Other developments include an updated “ADMET Predictor” version 10.4 released in Q1 also capturing new customers. Overall, the average revenue per customer across all software products at $95k this quarter has trended higher in recent years from $89k in Q3 2020.

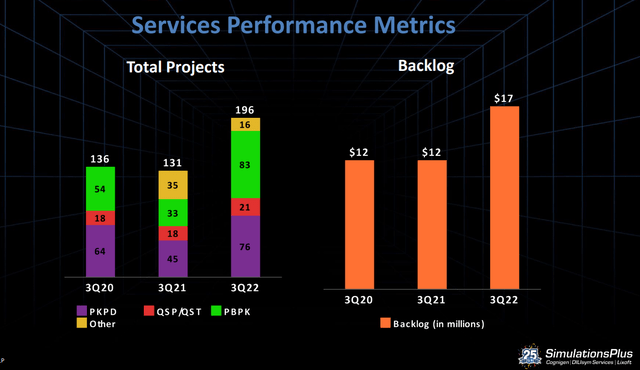

In services, an increase in the number of working projects at 196 is up from 131 last year. Similarly, the order backlog at $17 million, up from $12 million last year provides some confidence that the recent trends can continue. Notably, “PBPK” referring to the “physiologically based pharmacokinetic” studies has gained importance since the FDA issued new guidelines back in 2020 for drug developers to incorporate such data. This in turn has driven strong demand for SLPs’ consulting expertise in the field.

Management is guiding for full-year fiscal 2022 revenue between 12-15%, reaffirming their target from earlier in the year. The expectation is that the software business continues to deliver strong momentum through a growing customer base while services are supported by a robust pipeline of activity. Finally, we note that SLP ended the quarter with $123 million in cash against just $2.7 million in long-term debt. The rock-solid balance sheet is positive in the company’s investment profile.

SLP Stock Price Forecast

There’s a lot to like about SLP as a category leader checking off all the boxes of what makes for a high-quality company. For context, SLP has been profitable in each of the last 10 years which makes it stand out from other more aspirational growth stocks. SLP also pays a small quarterly dividend of $0.06 per share that yields 0.5%

At the intersection of tech and healthcare, there is an understanding that the business here should be relatively resilient to changing macro conditions and a slowing global growth outlook. The company notes that its sales profile has good diversification with a fragmented customer base where the single largest customer represents just 11% of total revenues. Beyond pharma; research universities, regulatory agencies, and other government organizations are increasingly utilizing SLP’s software and services. Over 30% of the business is outside the United States with international markets representing a growth opportunity.

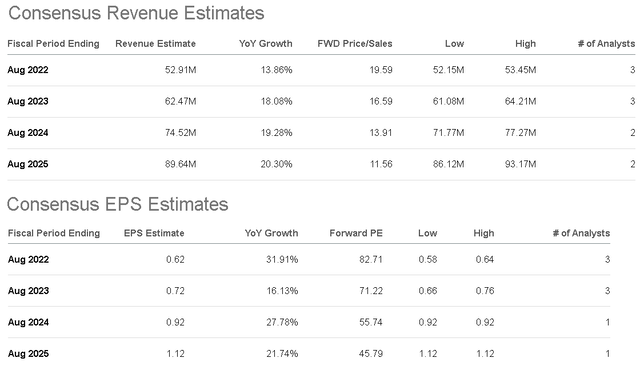

On the other hand, it would be a stretch to call SLP some sort of secret or little-known stock. According to consensus estimates for 14% revenue growth this year and 32% higher EPS to $0.62, shares trade at a forward P/E of 83x. The earnings multiple narrows towards 46x by fiscal 2025 with a forecast for earnings growth to average 22% in each of the next 3 years. Keep in mind that nearly 10% of the company’s current market cap is with a net cash balance sheet position.

Our take is that SLP is pricey by most valuation metrics but our view is that this growth premium is justified considering the company’s unique position and differentiated services. Simulations Plus’s ability to continue outperforming expectations over the next several quarters will drive a narrowing earnings multiple as forward estimates get revised higher.

We also like the trading action in the stock. We mentioned shares are up over the past year and have returned 11% in 2022. While still down from a record high above $90.00 in early 2021, the apparent bottoming action over the last few months sets up another rally. The latest move over $50.00 signals a technical breakout.

Final Thoughts

The bullish case for SLP is that industry adoption of drug development modeling tools and techniques continues to expand. Pharma and biotechs can generate efficiencies and streamline operations by working with Simulations Plus. We rate SLP as a buy with a price target for the year ahead at $72.50 representing a 100x forward P/E on the current consensus 2023 EPS.

A key step will be for overall market sentiment to improve. A rally in the broader tech sector with a stabilizing macro outlook can support stronger momentum in shares of SLP to lead higher. Ultimately, we see upside to current consensus estimates as Simulations Plus consolidates its market share.

In terms of risks, weaker than expected results or a deeper deterioration in the global economic conditions can open the door for another leg lower in the stock. Over the next few quarters, margin levels and the services backlog will be key monitoring points.

Be the first to comment