Pgiam/iStock via Getty Images

Atai Life Sciences N.V. (NASDAQ:ATAI) is a German-headquartered developer of medicines for mental health disorders. Atai is backed by billionaire investor Peter Thiel. It takes up compounds already known to be safe and effective in humans, as well as psychedelic compounds with known activity in humans, and then forms small affiliate companies around these drug candidates (it also forms affiliates to support some of its platforms, like intranasal delivery). The concept is novel, however, this is still at an early stage.

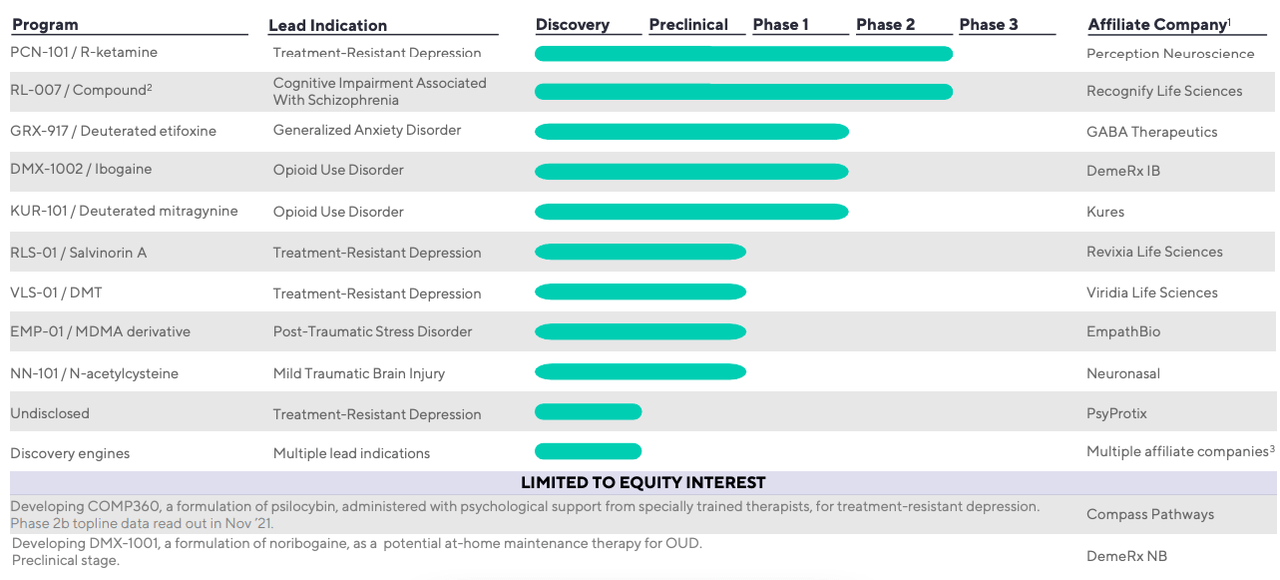

The company’s drug candidate pipeline looks like this:

ATAI Pipeline (atai website)

Lead program is PCN-101 / R-ketamine targeting Treatment Resistant Depression or TRD. Second program is RL-007 targeting Cognitive Impairment Associated With Schizophrenia. These two programs are currently running phase 2 trials. The company claims 17 active programs, four of which are “enabling technologies” focused on compound classes with prior evidence in humans, and 13 drug discovery programs in various stages.

Atai operates in a decentralized manner. It has an affiliate of 18 small companies – some of these are listed in the diagram above. These companies, although decentralized, have access to shared resources, and are allocated capital accordingly. They have operational autonomy to develop compounds, with core guidance from the co-founders. I don’t think I have seen exactly this model anywhere before.

Lead indication is treatment-resistant depression, which is diagnosed after two failed doses of antidepressants. This amounts to a third of all depression patients. The economic burden of depression is huge, running into hundreds of billions of dollars. There are over 300 million people worldwide diagnosed with depression. There are very few treatment options. Only 6 drugs have been approved in the last 5 years.

Atai has 2 clinical stage assets targeting TRD, and multiple preclinical ones. The most advanced asset is COMP360, which is being jointly developed with Compass Pathways (CMPS). Atai has a 22.5% stake. This asset toplined a phase 2b trial last year. In that study, COMP360 demonstrated efficacy in reducing depressive symptom severity with rapid and durable response. In November, the 25mg cohort from this study attained the primary endpoint. In a scale to measure the disease called MADRS, those who received 25mg showed a -6.6 difference vs. the comparator group at week 3 (p<0.001). COMP360 is an oral reformulation of Psilocybin, a psychoactive ingredient found in some species of “magic mushrooms.”

PCN-101, in which Atai has a 58.9% stake, completed a phase 1 study which showed safety and tolerability of R-ketamine at doses of up to 150mg. They now have a proof of concept phase 2 trial ongoing. Earlier, a phase 1 trial showed a distinct superiority of R-ketamine over S-Ketamine, suggesting that the former can be used at home. It was observed that the onset of dissociative and psychotomimetic effects occurred at fourfold higher doses than the equimolar doses of S-ketamine. The equivalent CADSS scores are from 12 to 15, scores that were observed in the 30mg and 60mg doses of PCN-101. The company has thus decided to use these two doses in the phase 2 trial. These doses may potentially be given at home.

RL-007 has safety and tolerability data. An ongoing Phase 2 trial showed pro-cognitive potential of RL-007 in 180 patients with diabetic peripheral neuropathic pain. Earlier data also showed improvement in learning and memory. One good thing to Atai’s approach of using previously-tested molecules is that they can use some of that old data in their trials. However, this may lead to lower competitive hurdles. Atai owns 51.9% of this asset. The company needs to work very hard to protect its intellectual property.

The other assets lack any data at this time.

Financials

ATAI has a market cap of $591mn, down from the $1bn valuation it had last year after IPO; and a cash balance of $335mn. Research and development expenses were $15.5 million for the three months ended March 31, 2022, while G&A were $18mn. That leads to a long cash runway of some 10 quarters and shows ATAI to be a “well-funded, … mental health company,” as the company says.

Bottom Line

Atai has a lot of ambitions. The plan seems to become the leading developer of psychedelic drugs with therapeutic uses, with a long line of affiliates and partnerships. The plan will work as long as their trials do not produce surprises. However, the entire thing will quickly unravel – because it is too spread out – if there’s a major trial setback.

I will watch the company closely, but no plans to invest. I will tell myself, even Mr. Thiel hasn’t really done anything very productive – investing wise – since his Facebook (META) billion a decade ago. So, we should wait for more data here to see if this investment is different.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment