erwannmartin35/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the ProShares UltraShort QQQ ETF (NYSEARCA:QID) as an investment option. The fund is managed with an objective to “seeks daily investment results, before fees and expenses, that correspond to two times the inverse of the daily performance of the Nasdaq 100 Index”.

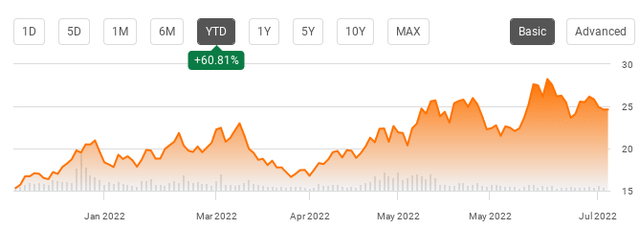

This is a fund I have never owned, but it has come on my radar in 2022 because I do own the Invesco QQQ ETF (QQQ). This is a fund that does track the NASDAQ and has not surprisingly performed very badly this year. By contrast, QID has been a huge winner, since it is an inverse play on the same index. In fact, QID is up over 60% since January 1, as shown below:

QID 2022 Performance (Seeking Alpha)

Given this type of return, it is logical that investors may be interested. After all, who doesn’t like winning this big when the broader market is declining? This led me to look at QID to see if there was still room to run.

After review, I reached the conclusion now is probably not the best time to buy. The fund certainly has momentum, and that could continue. Global markets are rattled right now and there is plenty of downside risk to the NASDAQ. Yet, the opposite is also true. The index hit bear market territory and could just as easily start trending upward if economic conditions moderate or improve. With that balancing act in place, I see too much risk of taking a leveraged position against the market right now. Simply, I think short investors have “missed the boat” for the most part, and I would wait for equity markets to climb higher before starting any type of broad index short position.

So, What Is QID Anyway?

To start, I want to give a quick overview of what QID is. I typically don’t short the market, but if I did I would use inverse funds as a way to do it. This is different than “shorting” a stock outright – which involves borrowing shares to sell and then buying them back to cover the position after (hopefully) the price has decreased. The difference between the price you shorted at and the price you cover at is the profit (or loss). This is a straightforward concept, but one I do not generally recommend for two key reasons. One, timing a particular security is difficult, and I would rather just avoid a stock I don’t like than take on the risk of losses if my outlook is incorrect. Two, borrowing shares to short them involves trading on margin. This has its own costs by way of margin interest. With rates rising, so is the cost of margin, and that eats into potential profits, sometimes in a big way if the position is held for a while. For this reason, I would recommend either options trading or inverse ETFs as a way to short the market because it limits that expense.

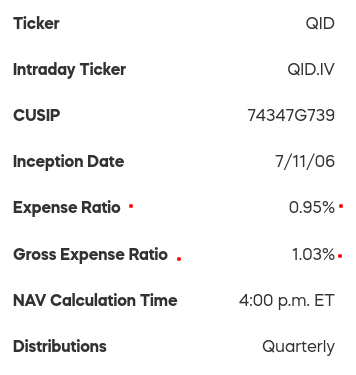

Of course, inverse ETFs have expenses of their own. The fund manager has to place a derivative bet or use the margin themselves. The expense of doing so should theoretically be lower than that of a retail investor who shorts shares. Yet, these expenses still add up, and are passed down via the expense ratio:

QID Expense Ratios (ProShares)

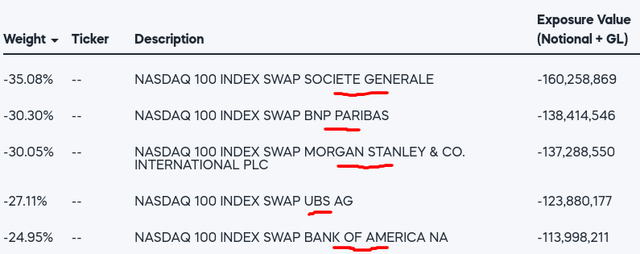

What QID does, in a nutshell, is enter into “swap” agreements, known as derivatives, to position the fund to benefit when the NASDAQ 100 index declines. These are known as equity swap contracts, with returns based on the return of the underlying index – in this case, the NASDAQ 100. In this type of scenario, ProShares is likely paying a fixed amount to another party for the privilege of then being paid (more) if the NASDAQ 100 declines over the agreed time period. In the case of QID, the fund has these swap contracts in place with some of the largest financial institutions in the world:

This is a benefit because it limits counterparty credit risk. What I mean is, a swap contract is only truly realized once it is fulfilled. If you place an option or swap wager, watch it rise in value, only to struggle collecting payment, it has not done you any good. In the case of QID, holding contracts with the largest names in investment banking inherently makes this risk more minimal.

Valuation Of The NASDAQ Makes Me Reluctant To Short

Now that we know what QID does, and that it had performed so well in 2022, this begs the question – why not buy it?

The primary case against buying now comes down to valuation. This relates to what I said early on in this review. QID has already had an incredible run as the NASDAQ has fallen. To me, buying here is simply chasing returns, and that doesn’t bode well for my comfort level. Of course, the NASDAQ could fall further – this reality is the reason I took a look at QID in the first place. But we have to remember that the NASDAQ is not as risky as it used to be. The top holdings have actual earnings and are cash-heavy. Unlike the non-profitable tech firms in the past, the index is supported by earnings and this is providing a reasonable floor for prices. For support, consider that the NASDAQ 100’s current P/E has been pushed down to the point where it is right near its 10-year average:

P/E Ratio – NASDAQ 100 (Bloomberg)

This is a sign for me that being bearish now is risky. Again, I am not suggesting that the NASDAQ cannot fall further because it can. But the opposite is also true at this juncture. It doesn’t appear overvalued by historical standards, and there is a big potential for losses in a 2X leveraged inverse fund if the market starts to climb again.

Tech & Growth Do Under-Perform During Stagflation

So far I have touched on some reasons why not to buy QID. But a bull case could certainly be made. I don’t want readers to come away with the conclusion I am wildly bullish on this market. Plenty of macro-headwinds exist and while I personally see a bit too much risk in buying a fund like QID right now, I could easily be wrong.

To understand why, let us think about why QID is having such a strong year in the first place. Its rise higher has come about as the NASDAQ has had a terrible year, with investors fleeing anything perceived as risk-on and, just as importantly, higher duration:

NASDAQ YTD Performance (Google Finance)

The duration aspect is important because when interest rates rise investors become less willing to earn returns in the future. This includes sectors within both the equity and fixed-income markets. For example, long-dated bonds are hurt when investors can earn a higher yield in the short term. Similarly, companies considered “growth” also suffer as investors want companies with stable (or growing) earnings now, rather than banking on an opportunity that might pay out in the future if the growth story gains acceptance.

Beyond that, there are other forces at play here. Aside from the rising rates scenario, investors are getting increasingly concerned about recession risk, or at least lower economic growth. This is true in both the U.S. and around the globe. With the NASDAQ 100 being Tech and growth heavy, it is natural then that this sector would sell-off.

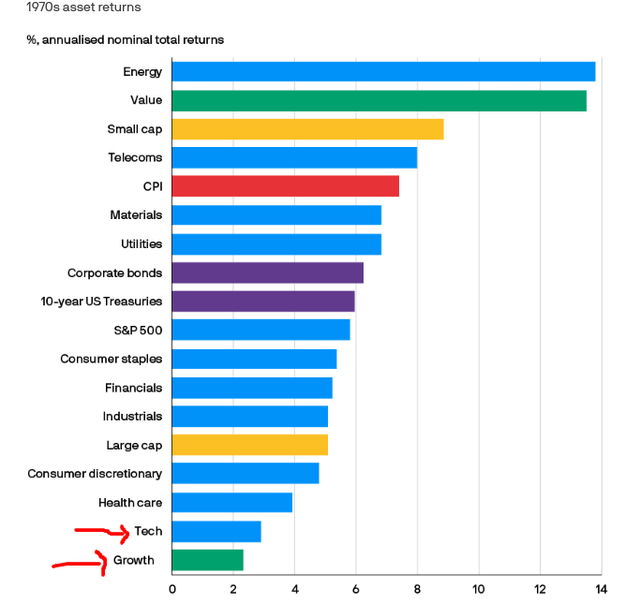

Furthermore, history again suggests this could be an area ripe for under-performance if we do see a higher interest rate / lower economic growth macro-environment. This can lead to a stagflationary situation, which is not ideal for markets. While some sectors can perform well in this type of scenario, Tech and growth are not two areas that do. If we look back to the 1970s, when stagflation persisted, we see Tech and growth are the two weakest performers:

Asset Returns (1970’s) (JPMorgan Asset Management)

With this in mind readers may be asking why I wouldn’t want to pick up QID then. My view is this should be a short-term instrument, so if the NASDAQ rallies going forward, I may be interested. But to pick up this ETF after a large selloff because stagflation might occur and Tech and growth might underperform seems a bit too much of a gamble. The important thing to remember is that over time the market tends to rise. Shorting, whether directly or through inverse ETFs, should be done cautiously and with a more immediate focus. For instance, while Tech and the NASDAQ 100 may suffer during stagflation at the expense of other defensive and cyclical areas, the graphic above still shows slight gains on an annualized basis.

Therein lies the rub. Sometimes the best play for a retail investor is just to avoid a particular area, not short it. While you could pat yourself on the back for selling-off long positions in Tech and/or going under-weight the sector and earning more elsewhere, you wouldn’t have had the same experience if you had actively shorted it. This is why I tend to be a biased long-only investor. It is one thing to get a play wrong and miss out. It is quite another to guess wrong and lose while everyone else is profiting. That can really set you back and reaffirms that positions in QID need to be approached selectively. Under this guise, now does not appear to be the time.

Corporate Margins Have Been Resilient

My final point touches on the broader state of the market. One key reason I noted above on why I would shy away from QID is because the NASDAQ 100 has reached its historical average P/E ratio. However, some readers may suggest that the “E” portion is going to decline in the second half of the year. This means that while the “P” (price) for stocks has come down, they could come down further as the “E” (earnings) also declines. This would leave more downside potential and keep the NASDAQ at its historical average. That is not a great scenario.

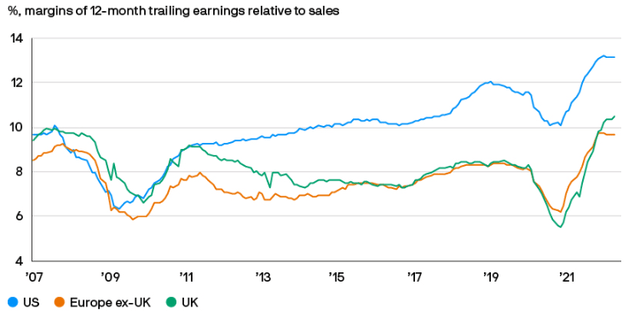

In fairness, there is merit to that thinking. But I personally believe the market is getting too pessimistic here. The NASDAQ is already in the bear market territory and while there are plenty of clouds on the horizon a lot of that seems to have already baked its way into share prices. Furthermore, corporate margins have already held up really well this year, not just in the U.S. but in other developed markets as well. This means the “E” part of the equation could end up holding steady or growing, despite inflationary cost pressures on businesses:

Corporate Margins (12 month trailing average) (S&P Global)

I view this positively for two reasons. One, rising margins are great for corporate health and stock prices. Two, this graphic shows the U.S. leading the charge in this metric. This suggests that if one wanted to take a short position on an index, it may be more opportunistic to select one in the U.K., Euro-zone, or more ideally in an emerging market that is coming under greater financial stress. It strikes me that this is not the time to get bearish on the United States, so QID will remain on my watch list, and not my buy list.

Bottom Line

Volatility will probably be constant in the second half of the year given all the uncertainty in the market. For this reason, I would keep inverse ETFs on the radar in case we see a strong rally in the months ahead. That said, now does not seem to be the time. The market is touching on some pretty low levels, despite underlying health in many areas. These include wage gains, resilient corporate margins, and low unemployment. Plenty of challenges also exist, especially in the NASDAQ which has a more growth focus. Rising inflation and interest rates will pressure this arena, but the truth is much of the pain has already happened.

Shorting QID since the beginning of the year was well-rewarded, but I find it hard to believe those gains will keep coming in. Simply, I don’t see a strong case for shorting the NASDAQ right now, and a leveraged inverse ETF is too risky of a move when a clear thesis is not present. As a result, I will be placing a “hold” rating on this fund, and suggest readers approach any new positions very selectively going forward.

Be the first to comment