Walter Bibikow/DigitalVision via Getty Images

There has been a popular misconception that e-commerce would render physical shopping obsolete and a mall’s relevance would cease to exist. Contrary to popular belief, the mall isn’t dead. In fact, many REITs that specialize in physical retail have rebounded quite well since the country shut down. The aspect of malls that is commonly overlooked is the experience factor. Humans weren’t meant to sit inside all day, and many of us seek out experiences. Simon Property Group (NYSE:SPG) has transformed its properties into destinations rather than a collection of physical brick and mortar stores.

SPG owns, develops, and manages mixed-use destinations which consist of traditional malls, premium outlets, and The Mills. Their destinations have transcended physical retail as they encompass shopping, dining, and entertainment. SPG owns or holds an ownership interest in 199 income-producing properties in the United States, which consisted of 95 malls, 69 Premium Outlets, 14 Mills, six lifestyle centers, and 15 other retail properties in 37 states and Puerto Rico. After comparing SPG to its peers, I think its current price looks relatively inexpensive. SPG also has the largest dividend yield in its peer group as capital returns to its shareholders are high on the management priorities list. It’s been a difficult run as the pandemic had SPG on the ropes, but SPG weathered the storm and is in an excellent position moving forward.

E-commerce isn’t the brick-and-mortar killer many had predicted it would become

When I shared this data with a group of friends, they initially thought the information was incorrect and was perplexed as to how the data could be accurate. Some said they haven’t visited a physical store other than a supermarket in quite some time and do the majority of their ordering online. I am in a similar position as e-commerce is similar and is much more time-efficient than going to a physical retail location.

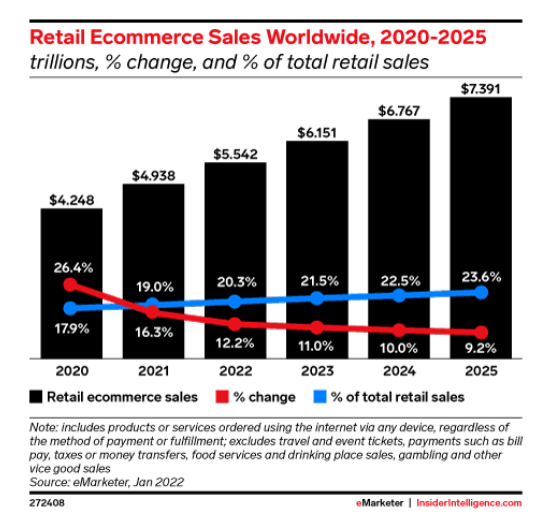

Worldwide, e-commerce accounts for 19% of total retail sales in 2021 and is expected to account for 20.3% in 2022. Insider Intelligence is a leader in e-commerce statistics and indicated that e-commerce would close out in 2022 with roughly $5.54 billion in sales. Over the next 3 years, from 2023 to 2025, e-commerce will grow by $1.85 trillion to $7.39 trillion, yet e-commerce will still only account for 23.6% of retail sales. To many, this seems crazy, and one of the questions I received was, what about the U.S.?

Insider Intelligence

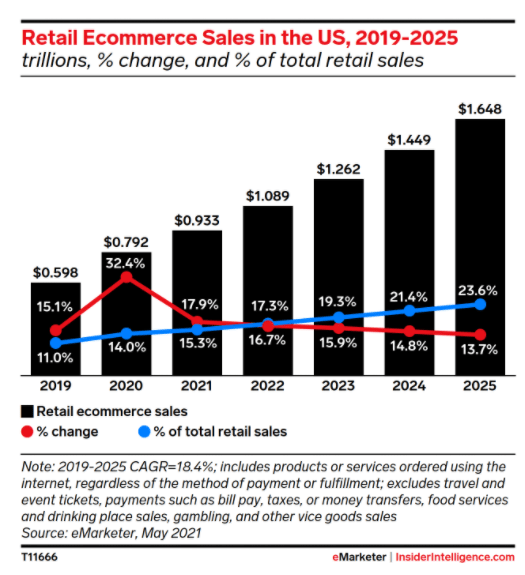

According to Insider Intelligence, the e-commerce sector in the U.S is expected to crack the $1 trillion mark for the first time in 2022, ending the year with $1.09 trillion in sales. Interestingly enough, this is only 17.3% of the projected retail sales in 2022. By the end of 2025, e-commerce in the U.S is expected to increase to $1.65 trillion in sales, which will still only account for 23.6% of retail sales in the U.S.

Insider Intelligence

The other question I received was how do I know this data is correct? At first, I thought the same thing, so I looked for other sources. Shopify (SHOP) recently published a Global E-commerce report, and their numbers were just about identical. In the report, SHOP states that the global e-commerce market is expected to be $5.55 trillion in 2022 and that e-commerce is expected to make up 21% of retail sales in 2022 and grow to 24.5% in 2025. As SHOP provides one of the largest e-commerce platforms for merchants to utilize, I hold their projections in high regard. This leads me to believe that physical retail isn’t going away, as, in 2022, e-commerce represents a much lower portion of retail sales than I would have expected.

Simon Property Group looks inexpensive at these levels

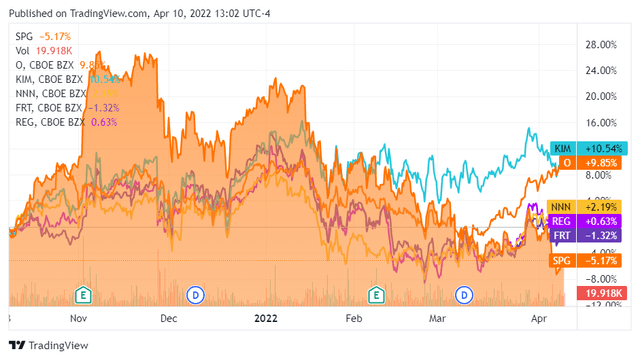

Since November 2021, shares of SPG have fallen $43.65 (25.51%) from their 52-week highs. The declining share price has pushed SPG’s yield over 5%. According to Seeking Alpha, SPG’s peers include Realty Income (O), Kimco Realty (KIM), Regency Centers (REG), Federal Realty Investment Trust (FRT), and National Retail Properties (NNN). Over the previous 6-months, SPG has performed the worst in its peer group, declining by -5.17%, while KIM has appreciated by 10.54%. This made me very interested in how SPG stacks up against its peers using the metrics I look for when evaluating REITs.

I need to identify my primary objective and work backward when it comes to investing. When it comes to investing in REITs, I am looking for income and a large dividend. If this capital was slated for capital appreciation, I would rather put it in Meta Platforms (FB), Alphabet (GOOGL), Amazon (AMZN), or Apple (AAPL), all of which I am a shareholder. REITs are strictly an income play for me where I want large amounts of income being generated. Now that the objective of income is clear, I need to work backward.

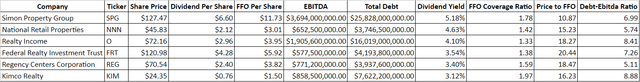

Seeking Alpha, Steven Fiorillo

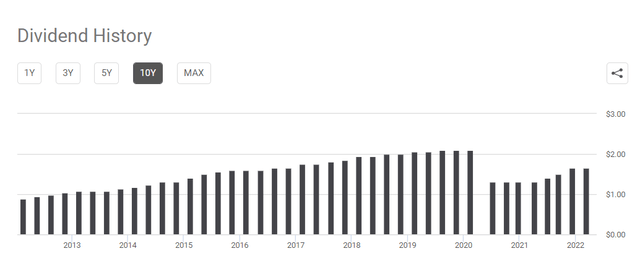

SPG has the largest dividend yield of the group as it’s the only company that exceeds a % yield. SPG is generating a forward yield of 5.18%, while NNN comes in 2nd with 4.63%, and O rounds out the top three at 4.1%. From a dividend standpoint, SPG is certainly the most interesting, so I need to look at the dividend history. From 2012 thru 2020, SPG had a large growing dividend. Investors had feasted on a quarterly dividend which grew by 135.96% over an 8-year period from $0.89 to $2.10. We all know what happened in Q1 of 2020, but SPG got right back on the horse and started paying a reduced dividend in Q2 of 2020 of $1.30 per share quarterly. Since then, SPG has provided shareholders with 3 dividend increases going to $1.40 in Q2 of 2021, $1.50 in Q3 of 2021, and $1.65 on the quarterly dividend in Q4 of 2021. Today SPG is paying $6.60 per share, and based on its recent dividend increases, there is no reason why it can’t reclaim the $2.10 quarterly dividend it paid pre-pandemic.

With the dividend maintaining my interest, I need to establish if it’s well covered. Funds from operations or (FFO) represent the actual cash generated from the REIT’s operation. It is a widely used ratio for valuation purposes as it has become the primary earning metric in REIT. FFO = Net Income + Depreciation and Amortization+ Loss on Sales of Asset – Gain on Sales of Asset+ Interest Income. When it comes to REITs, you want to see the FFO coverage ratio rather than going by the EPS.

SPG generates $11.73 in FFO, an FFO coverage ratio of 1.78x. There is more than enough FFO being generated per share to pay its large dividend. SPG is currently paying out 56.27% of its FFO, which leaves enough room for future dividend increases.

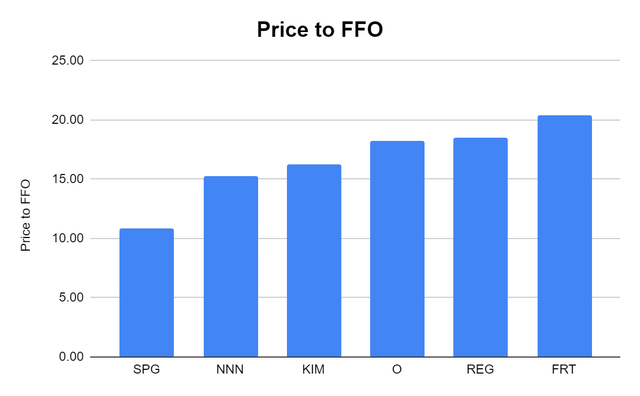

Next, I want to see SPG’s share price to FFO ratio and how it stacks up with its peers. SPG is currently trading at 10.87x it’s FFO, while the closest peer trades at 15.23x. SPG’s peers range from trading at a 15.23x – 20.44x price to FFO, indicating that SPG is currently inexpensive. Today, you can pay a much lower ratio for the FFO that SPG generates, which could indicate that shares are undervalued.

The last metric I want to see is SPG’s EBITDA to total debt ratio. The EBITDA to total debt ratio when evaluating REITs, provides the best way to assess the debt level of REIT. From its peers, SPG has the largest level of debt, but they also generate the largest amount of EBITDA. SPG has an EBITDA to total debt ratio of 6.99x, which is the middle of the pack. REG has the lowest ratio at 5.11x, and KIM has the largest ratio at 8.88x. I am not concerned with a 6.99 ratio as SPG is well-positioned to meet its obligations while making future investments into its organization.

Final Thoughts

SPG has moved up significantly on my watch list. Traditional brick and mortar aren’t dead, and e-commerce isn’t going to make it disappear. SPG’s properties are more than just retail, their destinations which bring together shopping, dining, and entertainment. I think the sell-off in SPG has created an interesting opportunity as SPG has been trailing its peers in appreciation over the previous 6 months. Today you’re getting a 5% dividend from SPG that is fully covered with more than enough room for future dividend increases. Compared to its peers, you’re paying considerably less on a price to FFO methodology for shares of SPG. I will be watching SPG closely and may start a position in the future.

Be the first to comment