Mission: Possible for Jack Ma’s Alibaba Group?

Kevin Lee/Getty Images Entertainment

Alibaba, The Enigmatic And Contentious Stock Of The Chinese Internet Sector

Alibaba Group Holding Limited (NYSE:BABA) is covered by a large contingent of Wall Street analyst teams and writers like I. Nonetheless, BABA stock continues to be an enigma among market players. On 14 March 2022, esteemed JPMorgan analyst Alex Yao threw in the towel, downgrading his rating on Alibaba and slashing his price target on the company’s stock to $65 a share from $180. BABA stock subsequently fell to a low of $76.76 a day later. However, the next day, BABA staged a remarkable rebound.

The “sum of all fears” moment evaporated, as though the triggers never surfaced. It would be irresponsible as a writer to neglect to mention the contributors to the negative sentiment, as much as bulls and shareholders would like to bury these bad memories forever. Unfortunately, the nightmare ain’t over.

Just a few days before JPMorgan’s ultimate downgrade of the Chinese Internet space, there were three major pieces of bad news. First, on 8 March 2022, The Information released a report saying the initial public offering [IPO] of Ant Group, the financial technology arm of Alibaba Group, would be delayed indefinitely. Ant Group’s IPO was previously anticipated by bankers to be in the second half of this year or early 2023 and was a much-touted catalyst for BABA stock.

Second, on 10 March 2022, the Securities and Exchange Commission [SEC] named five companies from China that could be delisted for failing to abide by U.S. accounting regulations. It was the first time the SEC had warned companies that their shares were at risk of being delisted for violating the Holding Foreign Companies Accountability Act [HFCAA] which went into effect in late 2020.

While BABA and none of the Chinese Internet ADRs were included, their share prices were similarly dragged lower. The SEC had given the five companies until March 29 to submit evidence disputing the Commission’s charges. The short allowance, less than three weeks, spooked investors. It was only a matter of time before the rest of the affected ADRs, including BABA, got themselves onto the warning list.

Third, on 11 March 2022, news that DiDi Global (DIDI) had to put off the listing of its shares in Hong Kong sparked a broad selloff in the Chinese Internet sector. Even stalwarts like Alibaba, Baidu (BIDU), and Tencent Holdings (OTCPK:TCEHY) (OTCPK:TCTZF) were not spared, despite Alibaba and Baidu already having secondary listings in Hong Kong and Tencent’s primary listing in the autonomous city.

It is fair to say that DIDI’s woes had partially contributed to BABA’s fall on the same day. The long-embattled DIDI stock plummeted over 40% that day, prompting speculations that SoftBank (OTCPK:SFTBY) (OTCPK:SFTBF), which owned about 20% of DIDI, could once again trim its Alibaba stake to fill its funding shortfall. SoftBank had sold around 20 million Alibaba Hong Kong shares in the fourth quarter of 2021, the latest in a series of stock sales of the Chinese e-commerce and cloud giant. Alibaba is also a substantial shareholder of the Chinese ride-hailing giant.

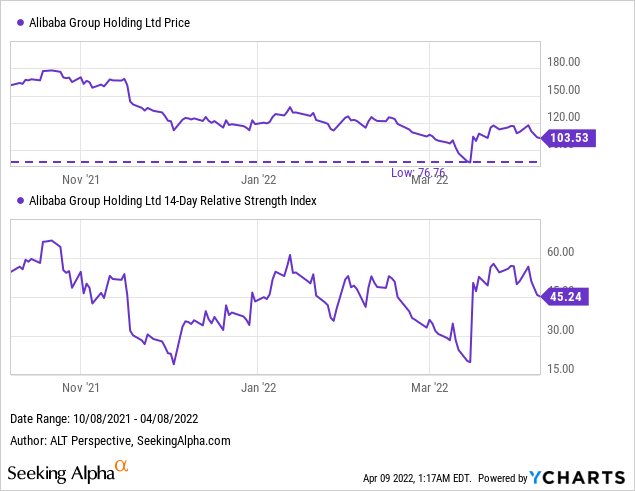

With the price decline in BABA lasting more than a year, I had thought the remaining shareholders were “diamond hands”-type, much more capable of resisting the onslaught of bearish developments. How wrong I was! BABA’s Relative Strength Index [RSI] fell to a record low on 15 March 2022, indicating an extremely oversold position.

Alibaba share price and relative strength index RSI (YChart)

Why Is Alibaba Doing A Stock Buyback?

Following this treacherous backdrop and the plunge in BABA stock, Alibaba stunned the market on 22 March 2022, expanding its share buyback program to $25 billion, up from $15 billion. With Alibaba having already bought back $9.2 billion of shares, the boost raised the remaining firepower from $5.8 billion to $15.8 billion. This represents 5.5% of Alibaba’s current market capitalization of $289 billion.

There may be some who question why Alibaba executives didn’t use up the $5.8 billion remaining in the original buyback program during the bear mauling to scoop up shares on the cheap before announcing the revitalized package. It does seem logical for them to do so but who can guarantee BABA stock wouldn’t fall further to a level that an eventual announcement of a $10 billion fresh injection of funds for share buyback wouldn’t be able to reverse?

A delay in the enhanced share buyback program would have risked a deeper deterioration in the share price, leading to forced selling by those unable to meet margin calls as well as further panic selling by retail investors and fund managers alike. Likewise, if the share price of BABA had dived lower than it did on March 15, many shareholders who had set up stop-loss selling levels, whether in the system or mentally (manual tracking), would have sold their BABA stakes.

Not only would the faith of these shareholders be possibly permanently damaged, but their sales could also exacerbate further selling resulting in a death spiral. Nothing the company announced subsequently could then change their mind, like the numerous comments on Seeking Alpha I read along the lines of: “I have finally gotten rid of my BABA shares. Never again am I going to touch BABA or any Chinese stocks.”

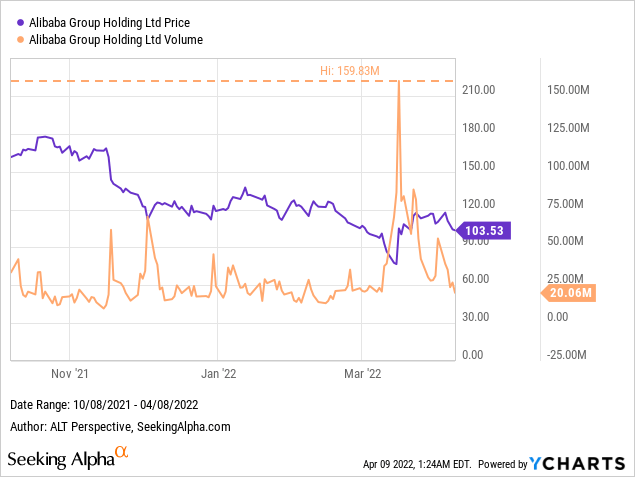

If more and more shareholders become ‘burnt’ by BABA, even the additional $10 billion may not be sufficient to stem the tide. On March 15, the volume traded was around 75 million. Taking an estimated $85 as an average for the day, the transaction value would have been $6.4 billion. Assuming that Alibaba was left as the main buyer, the company could only sustain three days of such heavy selling.

Alibaba share price versus trading volume (YChart)

Hence, I reckon the sending of the message for the motivations for an expanded buyback program is more effective in bolstering investor confidence than the buyback itself. This might have been the conclusion of the board of directors at Alibaba Group. After all, the eventual share buyback could sustain the positive momentum following the favorable announcement. This is akin to a ‘having your cake and eating it too’ moment.

What are the motivations? First, the idea that the executives of Alibaba Group believed BABA shares were undervalued, leading to the desire for a boosted buyback program to correct the situation. Second, their wish to squash criticism that the huge cash hoard of Alibaba Group was only on paper and isn’t real.

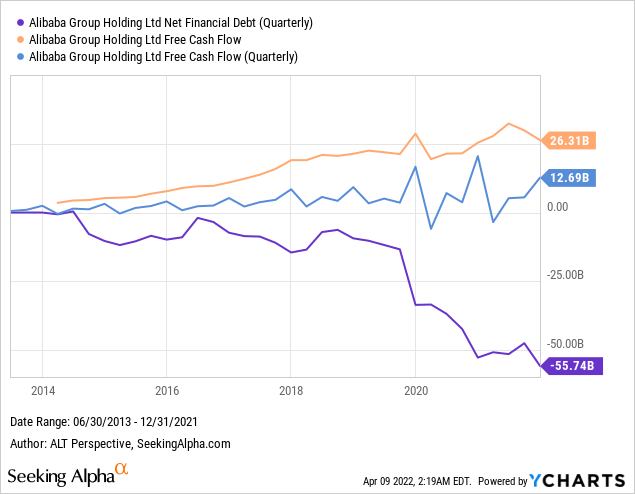

That’s right, Alibaba Group has loads of cash and cash equivalents. On a net cash basis, Alibaba has $55.7 billion (note that a negative net financial debt means net cash). Furthermore, BABA’s free cash flow is also growing steadily (the long-term uptrend remains intact). Alibaba achieved a whopping $12.7 billion of free cash flow in the final quarter of 2021, the third-highest ever in its operating history, amid fears that its ‘compliance’ with Beijing’s Common Prosperity call would “squeeze the company dry.”

Alibaba free cash flow and net cash position (YChart)

What Is BABA Stock Forecast?

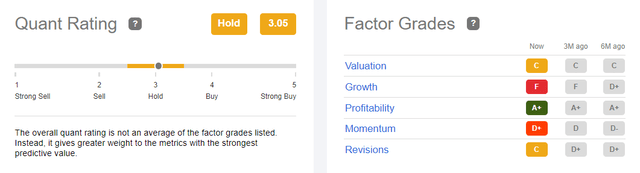

Seeking Alpha’s quant rating on BABA has been a Hold for over a year. Nevertheless, there are signs things could improve. Compared with three months ago, BABA’s Momentum score has notched up one grade to D+ from D. It’s hard to fathom with analysts’ downgrades getting the limelight but BABA’s Revisions score has done better, rising two grades to C from D+.

BABA stock quant rating (Seeking Alpha Premium)

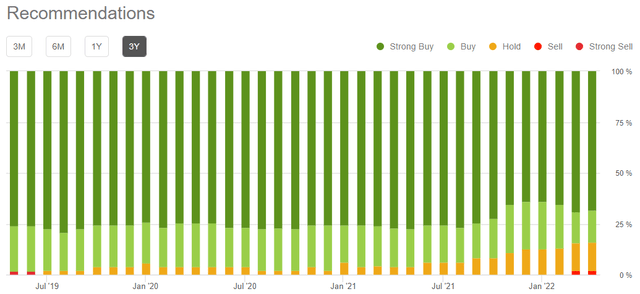

Indeed, the analyst ratings score on BABA has fallen to 4.50. It is no doubt still an enviable Strong Buy but 4.50 is the lowest in the last five years, and a steep fall from the ~4.72 level it enjoyed in the first half of last year.

BABA stock analyst ratings history (Seeking Alpha Premium)

Yet, while there is now a Strong Sell call versus none in February, the number of Strong Buy calls has increased by two. Citi analyst Alicia Yap, who lowered her price target on BABA last week to $177 from $200 but maintained the firm’s buy rating, argued that the stock is near a “historical trough,” making shares “attractive.”

BABA stock analyst recommendations (Seeking Alpha Premium)

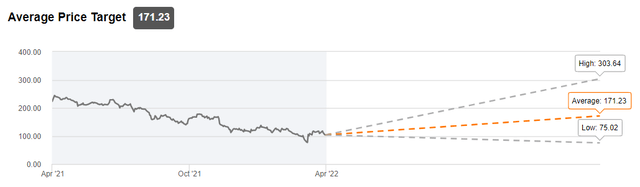

Despite the spate of target price cuts in the past months, the prevailing average price target at $171.23 provides an upside of 65%. Since price targets are typically issued on a 12-month basis, if BABA indeed hits the average price target, shareholders stand to enjoy over 60% of gains within a year. That’s a respectable alpha!

BABA stock average price target (Seeking Alpha Premium)

Is BABA Stock A Buy, Sell, Or Hold?

I consider BABA stock a Buy and offer four arguments for it, on top of all the benefits accruing from the expanded stock buyback program.

The Chinese discount could narrow substantially on better appreciation of Beijing’s intentions and greater patience

First, I think non-Chinese investors will come to appreciate Beijing isn’t out to kill the Chinese Internet giants and the Chinese discount could narrow substantially. In a recent interview with Bloomberg TV anchor Haslinda Amin, Katherine Tai, the 19th United States Trade Representative, said that (emphasis mine) “for the people who are criticizing our trade policy, it is either because they are not hearing us when we describe what our objectives are, which is to bring a new approach to trade that ensures that trade policy can be and is a force for good. She added, “And I think that some of the other critics are impatient.”

Similarly, perhaps the critics of Beijing’s regulatory crackdown and policies like “Common Prosperity” either aren’t ‘hearing’ the rationale or are impatient that the process has gone on for over a year and still showing no signs of ending. It’s no wonder that BABA stock shot up following a statement declaring Beijing’s support (content in Chinese) of the Chinese economy and the capital markets following a meeting of the top finance policy body chaired by Chinese Vice Premier Liu He.

On the much-feared delisting risk, critics also chose to ignore the positive signals sent out by the Chinese securities regulator. Last year, the China Securities Regulatory Commission [CSRC] reiterated its implicit support for the VIE structure and reassured investors several times of their continued effort to reconcile the demands of the SEC with Beijing’s national security needs.

The cautious (or perhaps simply playing hard to get) SEC Chairman Gary Gensler recently toned down speculation of a potential imminent deal for Chinese companies listed in the U.S. to comply with the HFCAA. Gensler let out that conversations had been “thoughtful, respectful [and] productive,” but he did not know what the talks would lead to. The contrasting levels of optimism reminded me of my younger days when I was confident that my relationship with a then-girlfriend was going great but I realized belatedly that she had thought otherwise.

On April 2, the Chinese regulators finally confirmed plans to revise confidentiality rules to give U.S. auditors full access to the U.S.-listed Chinese firms’ audit reports. Bloomberg had reported a day earlier that the change could happen as soon as the middle of this year. Hopefully, that is not too long for the impatient shareholders.

BABA ain’t alone in the tech slowdown and geopolitical woes

Second, given the bloodletting in the global tech space, partly due to the slower growth as companies lapse the pandemic-fueled revenue boost, market players should come to appreciate Alibaba Group isn’t alone in disappointing shareholders. At the same time, investors are worried about the negative impact U.S.-China political tensions can cause the Alibaba Group.

However, non-Chinese companies like Sea Limited (SE) have also found themselves in trouble with foreign governments. For instance, Sea Ltd.’s Indian e-commerce operations had to deal with complaints from the country’s trade association. Sea Ltd.’s popular game Free Fire was recently banned in India.

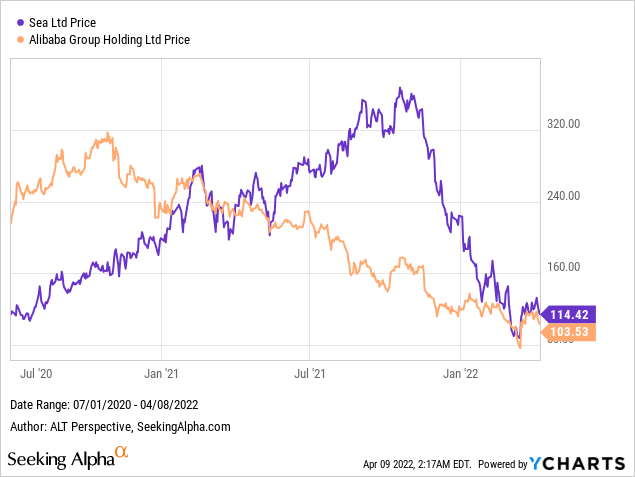

Although the decline in BABA stock has incurred the vitriol of shareholders, SE stock has fallen more and much faster than the former but it continues to receive favorable mentions.

Alibaba versus Sea Limited share price chart (YChart)

Meanwhile, Reuters reported that Europe’s competition watchdog has proposed charging major online platforms a fee based on their global net income in order to ensure compliance with content enforcement rules. The European Commission is progressing with a plan to charge big platforms like Google (GOOG) (GOOGL), Meta Platforms (FB), and Twitter (TWTR) up to 0.1% of their global annual net income. EC chief Margrethe Vestager guided the “supervisory fee” could raise €20 million-€30 million ($22 million-$32.8 million) annually.

Critics like to challenge, saying Western governments threaten but proposals have to go through a transparent legal process, implying that they may not be implemented in the end. However, the same Reuters news said (emphasis mine): “Vestager’s proposal is likely to get the nod from member states and EU lawmakers, which are scheduled to meet on April 22 for the fourth round of negotiations and widely expected to result in a deal.”

Sometimes, I wonder if the critics realize they are indirectly complimenting Beijing’s ability to get policies enacted productively while denigrating the Western system. In any case, Europeans have proven their ability to get their act together in squeezing money out of American companies. Apple Inc. (AAPL) was levied with 10 fines totaling €50 million (~$55 million) for failing to satisfy the order of the Netherlands Authority for Consumers and Markets [ACM] for its monopolistic practices regarding the payment mode used in dating apps.

If this happened in China, all sorts of negative labels would be piled on Beijing, and fear-mongering would be in overdrive, painting the nightmarish scenario of Apple being penalized for all categories of apps. The “supervisory fee” that the EC is pushing for could be misconstrued akin to how “Common Prosperity” has been maligned.

My point, though, is that investors could realize not only Chinese companies are subjected to political headwinds. Furthermore, the fines levied by the Chinese authorities are one-off and appropriately sized for the offense. For instance, when the Chinese regulators issued fines on several internet players, the penalty was only 500,000 yuan ($78,000) each, a tiny fraction of the annual revenues posted by the affected companies.

BABA is trading at very low valuation relative to historical levels

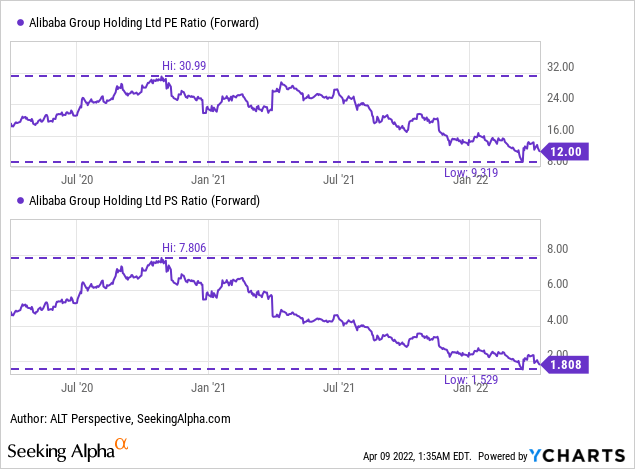

Third, I may be beating a dead horse here but it’s undeniable that BABA stock is trading at very depressed valuations currently. Alibaba’s P/E ratio on a forward basis has shrunk from a high of 31 times in the fourth quarter of 2020 to a mere 12 times presently. Alibaba’s PS ratio on a forward basis has compressed from a high of 7.8 times in the fourth quarter of 2020 to a mere 1.8 times presently.

Alibaba Group Holding Ltd PS and PE ratio on a forward basis (YChart)

Sure, BABA stock can still go lower. Its valuations had indeed hit more incredulous levels just in mid-March. Nonetheless, the powerful rebound after hitting the trough could be an indication that bargain hunters deemed those multiples (PS ratio of 1.5 times and PE ratio of 9.3 times) to be the ultimate floor for BABA stock.

Alibaba continues to find new ways to monetize its large users across its ecosystem

Fourth, even as market players fear a revenue slowdown at its core e-commerce units, Alibaba Group continues to find new ways to monetize its large users across its ecosystem. Alibaba’s workplace collaboration platform DingTalk recently launched paid versions after securing a large user base during the pandemic. DingTalk’s President Ye Jun revealed that corporate users have to pay 9,800 yuan ($1,530) a year for a version of the platform including corporate digital asset storage services. Another version offering more customized services will start at 100,000 yuan annually, 10 times the previous package.

In summary, I rate BABA stock a Buy.

Be the first to comment