RiverNorthPhotography

A substantial drop in mortgage banking income amid a rising rate environment will lead to a fall in Glacier Bancorp’s (NYSE:GBCI) earnings this year. On the other hand, strong loan growth will likely support the bottom line. Further, the margin will likely slightly expand due to the up-rate cycle as well as the addition of new loans at higher rates. Overall, I’m expecting Glacier Bancorp to report earnings of $2.82 per share for 2022, down 2% year-over-year. Compared to my last report on the company, I’ve slightly reduced my earnings estimate because I’ve decreased my estimate for mortgage banking income. For 2023, I’m expecting earnings to grow by 13% to $3.17 per share. The year-end target price suggests a small downside from the current market price. Based on the total expected return, I’m maintaining a hold rating on Glacier Bancorp.

Tapering of Mortgage Banking Activity to Hurt Earnings

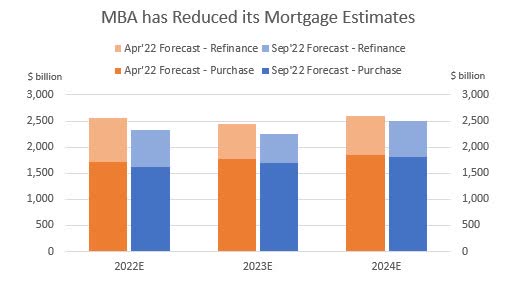

Due to high interest rates, mortgage volume has fallen sharply so far this year and is likely to continue to fall. This sharp fall is worse than previously anticipated. As shown below, the Mortgage Bankers Association (“MBA”) has reduced its estimate of mortgage originations for 2022 over the last six months.

Mortgage Bankers Association

Mortgage banking income is an important revenue segment for Glacier Bancorp. Gains from sales of mortgage loans made up 12.9% of total revenues in 2020 and 7.8% in 2021. In comparison, gains from mortgage loan sales made up 4.9% of total revenues in 2018 (before the latest rate cut cycle). Due to its size, the fall in mortgage activity this year will have a significant impact on earnings.

Gains on sales of mortgage loans had already fallen to 2.3% of total revenues in the second quarter of 2022. Therefore, I’m not expecting a further sequential decline. However, on a year-over-year basis, I’m expecting mortgage banking income to plunge.

Meanwhile, I’m expecting the other fee income to continue to grow at a normal rate. Overall, I’m expecting the non-interest income to fall by 17% year-over-year in 2022 to $120 million. In my last report on Glacier Bancorp, I estimated a non-interest income of $135 million for 2022. I’ve reduced my non-interest income estimate because I have a worse outlook on mortgage activity now. My decision is also partly influenced by the downward revision of the MBA’s estimate.

Loan Growth to Drive the Topline

Glacier Bancorp’s loan portfolio grew by a remarkable 5.0% in the second quarter of 2022, or 19.8% annualized. The management is expecting loan growth for 2022 to be between 12% to 15%, as mentioned in the latest conference call. This target seems achievable as the loan portfolio has already grown by 7.3% in the first half of this year.

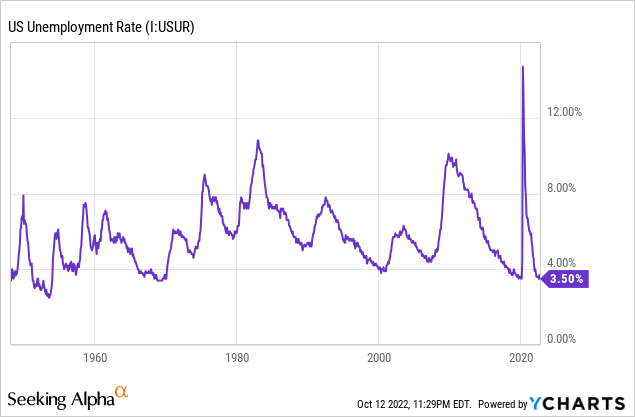

Further, strong job markets are likely to sustain loan growth. Glacier Bancorp operates in the Rocky Mountain area across several states. As these states have varied economies, it’s best to consider the national average to gauge credit demand. As shown below, the national unemployment rate is currently near record lows.

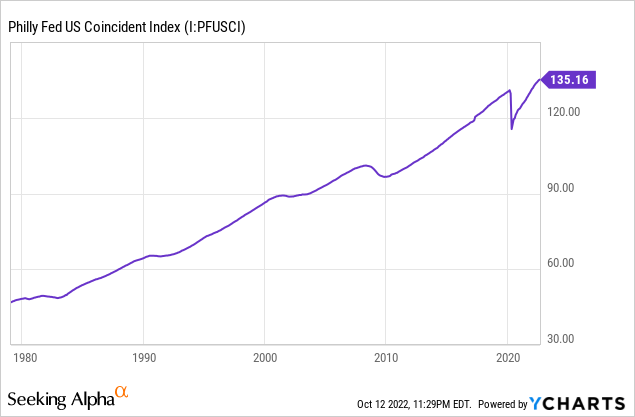

Further, the coincident index indicates that the national economy is recovering at a satisfactory rate.

On the other hand, high borrowing costs are likely to hurt the growth of loans, especially residential real estate loans. Further, the management mentioned in the conference call that pipelines were indicating a slowdown in loan growth.

Overall, I’m expecting the loan growth to slow down to 2.5% in the third quarter of 2022 and remain at this level till the end of 2023. For the full year of 2022, I’m expecting loan growth of 12.7%, which is at the lower end of management’s guidance.

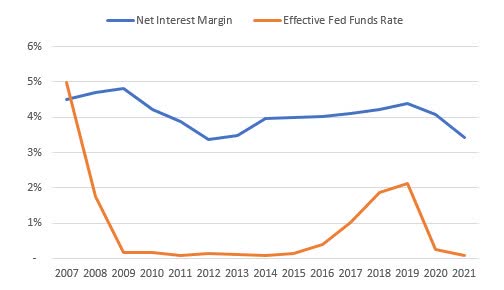

Apart from loan growth, the margin will also support topline growth, albeit to a lower extent. Glacier Bancorp’s margin has been only loosely correlated with interest rates in the past, as shown below.

SEC Filings, St. Louis Fed

The margin’s low rate sensitivity is attributable to a real-estate-heavy loan portfolio and a large balance of variable-rate deposits (interest-bearing demand, NOW, savings, and money market accounts). The results of the management’s interest-rate sensitivity analysis given in the last 10-K filing showed that a 200-basis points hike in interest rates could boost the net interest income by 4.63% over twelve months.

Further, new loan additions provide an opportunity to lift the margin. Glacier Bancorp originated new loans at a rate of 4.59% in the second quarter, as mentioned in the conference call. This is a bit higher than the average portfolio yield of 4.52% during the second quarter of 2022, as mentioned in the latest 10-Q filing. Therefore, it is safe to assume that new loan additions will further boost the margin in the remainder of the year.

Overall, I’m expecting the margin to grow by 20 basis points in the second half of 2022, and by a further 10 basis points in 2023.

Earnings to Dip by 2%

The anticipated decline in mortgage banking income will contribute to a fall in earnings this year. On the other hand, strong topline growth will support earnings. Overall, I’m expecting Glacier Bancorp to report earnings of $2.82 per share for 2022, down 1.7% year-over-year. For 2023, I’m expecting earnings to grow by 12.5% to $3.17 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 433 | 503 | 600 | 663 | 801 | 913 |

| Provision for loan losses | 10 | 0 | 40 | 23 | 18 | 26 |

| Non-interest income | 119 | 131 | 173 | 145 | 120 | 117 |

| Non-interest expense | 320 | 375 | 405 | 435 | 517 | 571 |

| Net income – Common Sh. | 182 | 211 | 266 | 285 | 312 | 351 |

| EPS – Diluted ($) | 2.17 | 2.38 | 2.81 | 2.86 | 2.82 | 3.17 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

In my last report on Glacier Bancorp, I estimated earnings of $2.86 per share for 2022. I’ve slightly reduced my earnings estimate because I’ve decreased my non-interest income estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Further Attrition of Book Value Likely

Glacier Bancorp has a large balance of available-for-sale (“AFS”) debt securities which have racked up mark-to-market losses amid the rising rate environment, thereby eroding the equity book value. As of the end of June 2022, AFS debt securities made up a little over a quarter of total earning assets. As interest rates increased, the value of fixed-rate AFS securities fell, leading to unrealized losses. These losses went directly to the equity account without hurting the income statement. The equity book value has already dipped by 8.9% over the first half of the year.

Further equity book value erosion is likely for the third quarter because the Federal Reserve has increased the fed funds rate by 150 basis points during the third quarter of 2022. The Fed projects a further 125 to 150 basis points hike in rates till the end of 2023, which will further decrease the equity book value. I’m expecting mark-to-market losses to decrease the equity book value by 3% in the second half of the year. On the other hand, retained earnings will likely lift the book value.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 8,156 | 9,388 | 10,964 | 13,259 | 14,947 | 16,499 |

| Growth of Net Loans | 26.5% | 15.1% | 16.8% | 20.9% | 12.7% | 10.4% |

| Other Earning Assets | 2,980 | 3,001 | 5,934 | 10,670 | 10,255 | 10,462 |

| Deposits | 9,494 | 10,776 | 14,798 | 21,337 | 22,886 | 25,262 |

| Borrowings and Sub-Debt | 989 | 777 | 1,178 | 1,198 | 1,765 | 1,800 |

| Common equity | 1,516 | 1,961 | 2,307 | 3,178 | 2,880 | 3,069 |

| Book Value per Share ($) | 18.1 | 22.2 | 24.3 | 28.7 | 26.0 | 27.7 |

| Tangible BVPS ($) | 14.0 | 16.3 | 18.3 | 19.3 | 16.7 | 18.4 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Current Market Price is Close to the Year-End Target Price

Glacier Bancorp has increased its dividend every year over the last decade. Given the earnings outlook, it’s likely that the company will maintain the dividend trend next year. Therefore, I’m expecting the company to increase its dividend by $0.01 per share to $0.34 per share in the first quarter of 2023. I’m also expecting the company to continue to pay $0.10 per share as a special dividend annually. The earnings and dividend estimates suggest a payout ratio of 46% for 2023, which is below the five-year average of 58%. Based on my dividend estimate, Glacier Bancorp is offering a dividend yield of 2.9%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Glacier Bancorp. The stock has traded at an average P/TB ratio of 2.63x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 13.0 | 14.0 | 16.3 | 18.3 | 19.3 | |

| Average Market Price ($) | 35.5 | 41.2 | 41.5 | 37.9 | 55.4 | |

| Historical P/TB | 2.74x | 2.94x | 2.55x | 2.07x | 2.87x | 2.63x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $16.7 gives a target price of $43.9 for the end of 2022. This price target implies a 12.7% downside from the October 12 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.43x | 2.53x | 2.63x | 2.73x | 2.83x |

| TBVPS – Dec 2022 ($) | 16.7 | 16.7 | 16.7 | 16.7 | 16.7 |

| Target Price ($) | 40.6 | 42.2 | 43.9 | 45.6 | 47.2 |

| Market Price | 50.3 | 50.3 | 50.3 | 50.3 | 50.3 |

| Upside/(Downside) | (19.3)% | (16.0)% | (12.7)% | (9.4)% | (6.1)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 18.6x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 1.50 | 2.17 | 2.38 | 2.81 | 2.86 | |

| Average Market Price ($) | 35.5 | 41.2 | 41.5 | 37.9 | 55.4 | |

| Historical P/E | 23.7x | 19.0x | 17.4x | 13.5x | 19.4x | 18.6x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.82 gives a target price of $52.4 for the end of 2022. This price target implies a 4.2% upside from the October 12 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 16.6x | 17.6x | 18.6x | 19.6x | 20.6x |

| EPS 2022 ($) | 2.82 | 2.82 | 2.82 | 2.82 | 2.82 |

| Target Price ($) | 46.8 | 49.6 | 52.4 | 55.2 | 58.0 |

| Market Price ($) | 50.3 | 50.3 | 50.3 | 50.3 | 50.3 |

| Upside/(Downside) | (7.0)% | (1.4)% | 4.2% | 9.8% | 15.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $48.1, which implies a 4.2% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 1.4%. Hence, I’m maintaining a hold rating on Glacier Bancorp.

Be the first to comment