Explora_2005

The media loves showing empty brick-and-mortar stores as proof of the retail apocalypse and the death of the mall. The death of the mall, however, has been greatly exaggerated and this presents a rare opportunity for contrarian investors to make exceptional returns in this much maligned sector.

What is key to understand is that there is a huge difference between Class A malls, and Class B, C, and D. While many of the lower quality malls will likely end up being repurposed, much of their traffic will be split between e-commerce and the surviving Class A malls. The highest quality malls are likely survivors given the human need to socialize and get out of the home from time to time. And as long as Class A malls provide a positive experience, they are likely to survive the e-commerce challenge. These malls are also increasingly being repurposed in ways that resonate more with the experiences people are seeking. Some strategies shopping centers are implementing include adding entertainment centers, offering omnichannel options, and adding great new restaurant concepts. Malls that succeed in reinventing themselves are likely to attract new store from retailers looking to substitute the stores they are closing in their less performing stores in class B and lower malls.

One great way to invest in this contrarian idea is by purchasing shares of Simon Property Group (NYSE:SPG). Simon owns or has an interest in 231 properties comprising 186 million square feet in North America, Asia and Europe. It also has a 22.4% ownership interest in Klépierre (OTCPK:KLPEF), a publicly traded, Paris-based real estate company, which owns shopping centers in 14 European countries.

While the company was significantly impacted by the Covid crisis, it is already well into its recovery with occupancy that was 93.9% at June 30, 2022, compared to 91.8% at June 30, 2021. The company clearly sees value in its shares, with it repurchasing 1.4 million shares of its common stock in the most recent quarter.

Financials

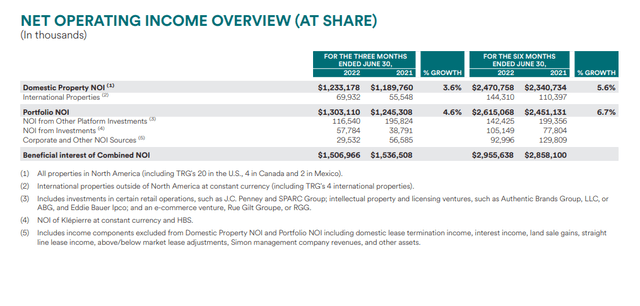

The company is showing growth year over year, with domestic property net operating income increasing 5.6% for the six months ended June 30 2022. The overall portfolio NOI growth was even higher, thanks to international properties, increasing by 6.7%.

Simon Property Group Supplemental

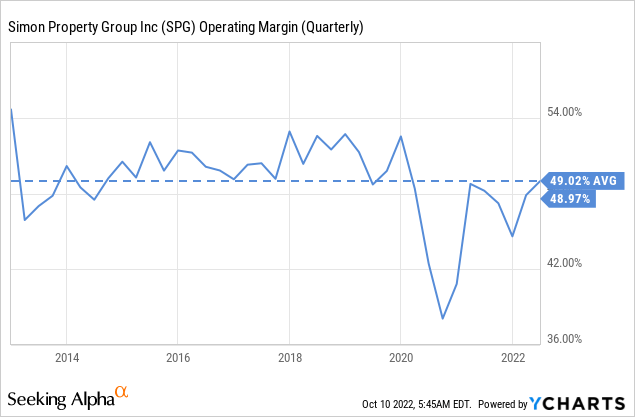

The recovery from the Covid crisis is also visible in its operating margin, which is once again close to its ten-year average around 49%, after taking a significant hit due to the Covid crisis.

Mall Traffic

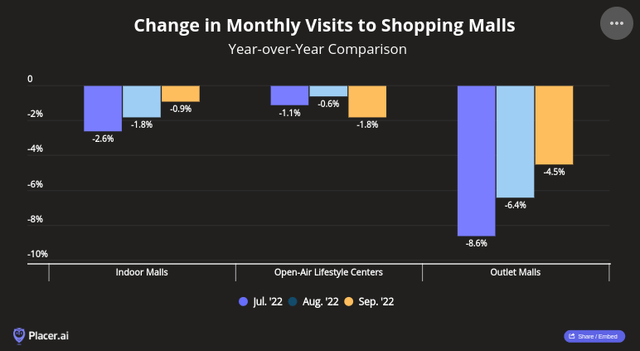

One thing we have to admit is that mall traffic has come down from the pre-Covid era, and also year over year from 2021. A great resource to analyze this is Placer.ai which analyzes data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers and 100 outlet malls across the country. Placer.ai uses anonymized location information from a panel of 30 million devices to make estimations about overall visits to specific locations. In its blog it shares the most recent results for its mall index, showing that September 2022’s foot traffic year-over-year (YoY) for indoor malls decreased to just 0.9%. This shows the resiliency of malls despite the deteriorating economic conditions. It is important to note too that there has been a new pattern post-Covid established where visits to the mall come with more intent and have larger basket sizes.

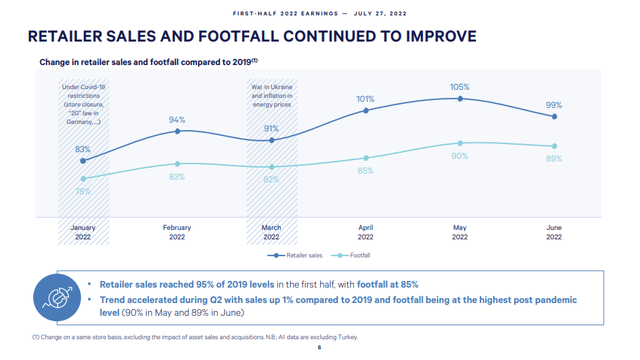

This is not just the case with premium US shopping malls, but also experienced in places like Europe. For example, Klépierre, where Simon Property Group has a ~22% stake, recently shared that visits are about 10% lower compared to the pre-Covid period, but sales are basically at the same levels. Part of the reason for the resilient results is that much as Simon Property Group, Klépierre also focuses on dense, affluent and growing urban areas.

Klépierre Investor Presentation

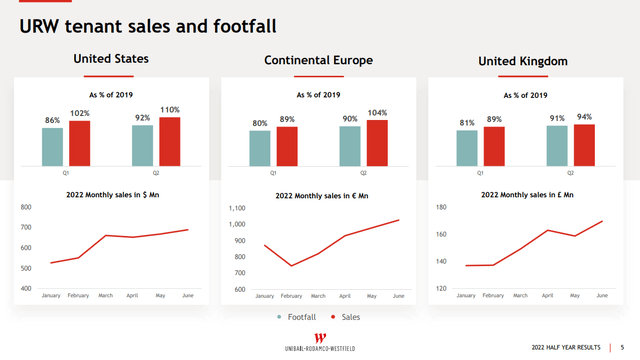

Perhaps the closest international peer to Simon Property Group is Unibail-Rodamco-Westfield (OTCPK:UNBLF). This international mall giant provides a lot of clues as to the fate of Class A shopping malls post-Covid. As can be seen below, both the United States and Europe are already experiencing higher tenant sales than pre-Covid, even though mall visits are ~10% below. Especially US Flagships tenant sales have outperformed pre-COVID levels recently. The UK with all its economic issues, including Brexit and an extremely weak economy has only seen a drop of ~6% in tenant sales. All of this is to say that despite Covid, Class A malls have proven extremely resilient.

Unibail Rodamco Westfield Investor Presentation

Balance Sheet

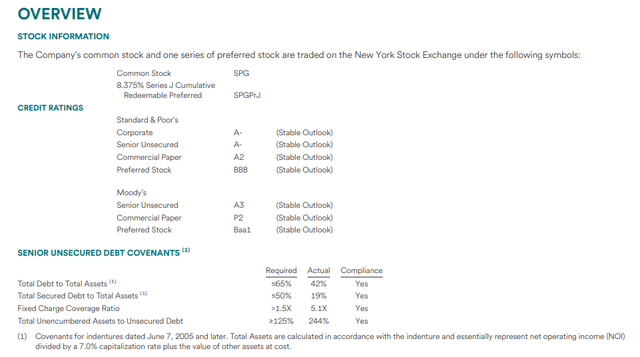

One particularly attractive thing about Simon Property Group, compared to other mall companies, is that its balance sheet is in better shape than most.

Simon was active in the credit markets through the first six months of the year. During the first six months, the Company completed 14 non-recourse mortgage loans totaling approximately $1.6 billion, of which Simon’s share was $958 million. The weighted average interest rate on these loans was 3.75%. This shows that while higher interest rates to fight inflation will be a headwind, the company can still refinance mortgage debt at very reasonable terms.

As of June 30, 2022, Simon had approximately $8.5 billion of liquidity consisting of $1.2 billion of cash on hand, including its share of joint venture cash, and $7.3 billion of available capacity under its revolving credit facilities. This gives us confidence that Simon has the financial strength to weather a recession, should one come soon. The company has an excellent investment grade credit rating of A- with stable outlook, and its preferred stock (NYSE:SPG.PJ) has a BBB rating.

Simon Property Group Supplemental

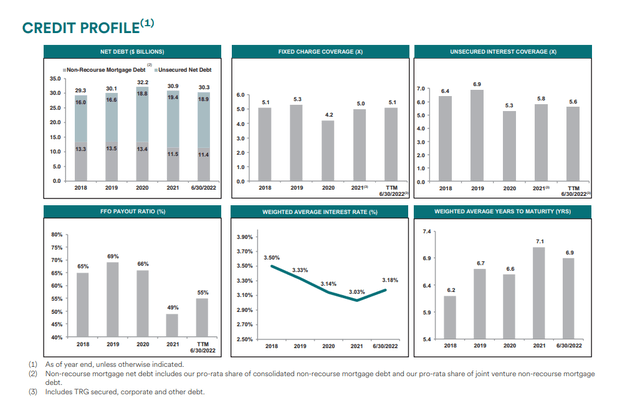

The company has a very high fixed-charge coverage ratio of ~5.1x, much better than the ~4.2x it dropped too during the worse of the Covid pandemic. Importantly, the company is now retaining a lot more of its cash flow for development projects and to reduce leverage. While pre-Covid the company was paying more than 65% of its funds from operation in dividends, for the trailing twelve months this has been only ~55%. As would be expected in the current interest rate environment, the weighted average interest rate is going up, but remains very manageable at ~3.2%.

Simon Property Group Supplemental

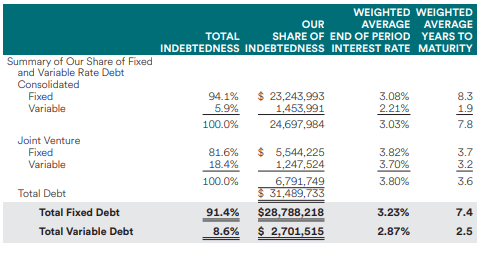

Most of the debt is fixed interest-rate debt, at approximately 91%, with the remaining debt being variable rate debt. The fixed-rate debt is still a little bit more expensive in terms of interest rate, but it has a much higher weighted average years to maturity at close to 7.4 years as compared to 2.5 years for the variable rate debt.

Simon Property Group Supplemental

Development Activity

Construction continues on two new international development projects, including Fukaya-Hanazono Premium Outlets® in Tokyo and projected to open in October 2022. Simon owns a 40% interest in this project. The other one is Paris-Giverny Designer Outlet based in Normandy, France, and projected to open in the first quarter of 2023. Simon owns a 74% interest in this project. Progress continues on several other transformative mixed-use redevelopments.

2022 Guidance

The Company currently estimates net income to be within a range of $5.93 to $6.00 per diluted share and Comparable FFO will be within a range of $11.70 to $11.77 per diluted share for the year ending December 31, 2022. This means the company is trading an extremely low ~8x multiple to expected FFO.

Dividend

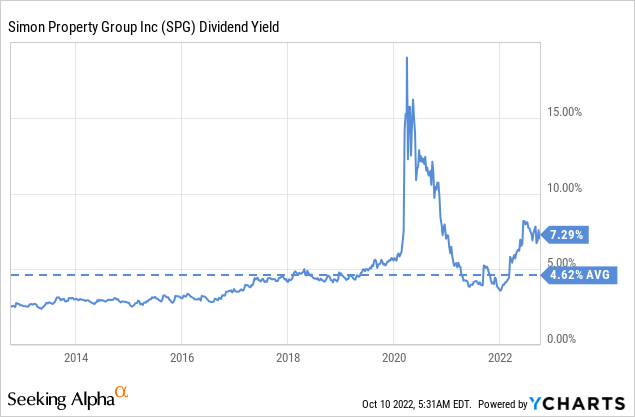

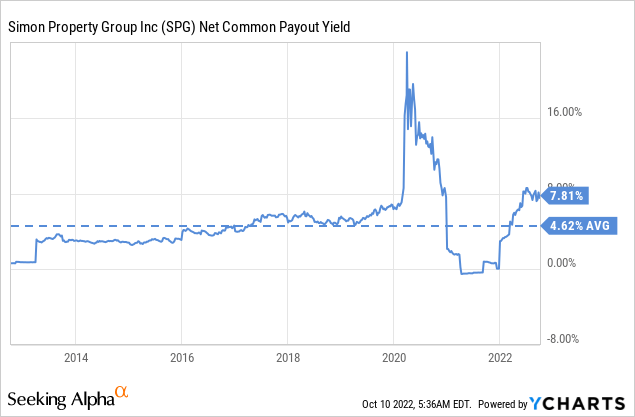

The dividend gives a clue as to just how undervalued shares currently are, with a dividend yield of ~7.3%. This is particularly surprising given how well-covered the dividend is, with the company only having to spend ~55% of its FFO on the dividend, which leaves a big margin of safety should economic issue arise in the future, or to increase the dividend in the future.

Valuation

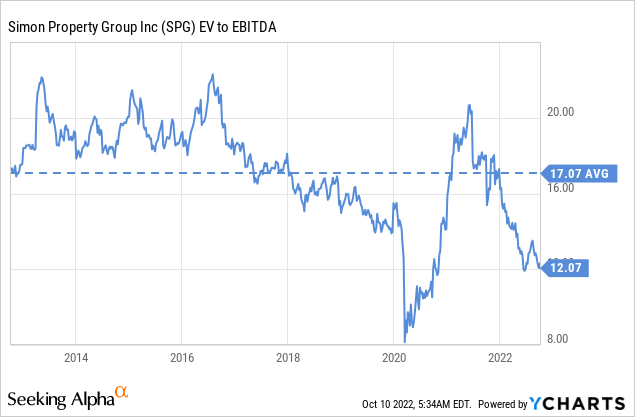

We can also see the significant under-valuation compared to the company’s own historical valuation. Its ten-year average EV/EBITDA is ~17x, and the company is currently trading about at third cheaper, at only ~12x this ratio.

It is important to appreciate that Simon Property Group is not issuing shares to help finance the dividend or development projects, but instead it has been buying back shares in recent quarters. This can be seen with a net common payout yield that exceeds the dividend by about 50bps. In other words, combining share repurchases and the dividend, the company is currently yielding close to 8%.

Risks

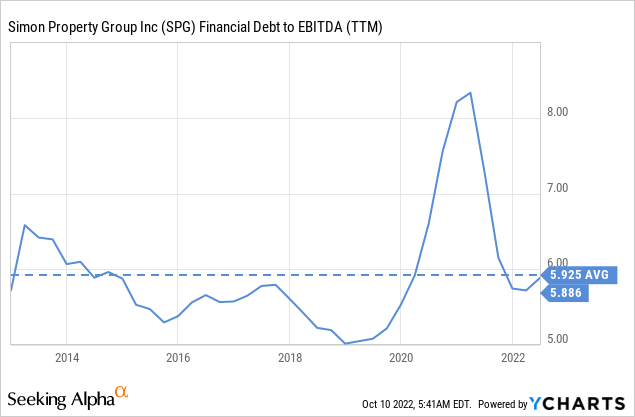

While a very compelling contrarian investment, at an extremely attractive valuation due to the pessimism despite the clear signs that the company has been resilient, there are still risks. For one, as most REITs, Simon has high leverage, which can become quite dangerous during extreme economic downturns. Right now it is at a very manageable ~6x, but during the worst of the Covid crisis it reached more than 8x, which we would argue was a very dangerous level.

Conclusion

While the death of malls has some truth in that Class B and below are unlikely to survive for the most part, it is clear that Class A destination/flagship malls still have a future. As we have shown, malls have been extremely resilient, quickly recovering from the Covid crisis and so far showing good results despite the increased economic uncertainty. Class A malls are also reinventing themselves, getting creative with tenant selection, and focusing more on providing a great experience to visitors, and not just being a place to shop. Despite this reinvention and resilience, all the negativity surrounding malls in general has created some very compelling valuations for the likely survivors, one of which we believe will be Simon Property Group.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment