JHVEPhoto

When Teva Pharmaceutical (NYSE:TEVA) responded positively after its second quarter report, the rally did not last. TEVA stock traded briefly at over $11 before falling. Readers are now down ~15.5% since late summer. On Oct. 10, 2022, Teva attracted the scrutiny of the European Union.

The EU found that Teva breached its rules. The Commission accused Teva of shielding Copaxone, related to the treatment of multiple sclerosis, from the competition. How good a case does the EU have against Teva?

Teva Accused of Breaching European Commission Rules

Between October 2019 and March 2021, The Commission carried out unannounced inspections. After conducting the review, the Commission issued a preliminary view that Teva delayed competition to multiple sclerosis.

Teva struggled since 2018 to revive Copaxone’s prospects. In 2018, it failed to defend the long-lasting, 40mg version of the MS drug. More recently, Chief Executive Officer Kare Schultz recognized Copaxone’s drag on the company in the last five years. The drug once brought in nearly $5 billion. For 2022, the firm expects to post $700 million from Copaxone sales. It cut its sales guidance for the drug by $50 million, citing competition.

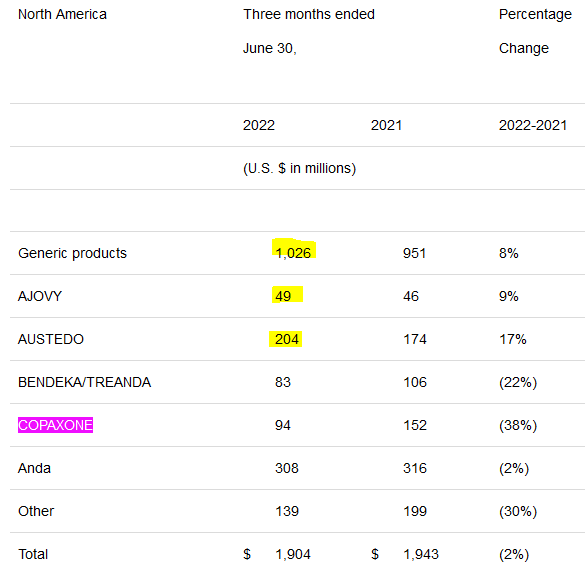

In the table below, Copaxone accounted for just $94 million in revenue. By comparison, Generic products added over a billion dollars in revenue.

Teva Q2/2022 sales (Teva Q2/2022 Press Release)

Teva is counting on Ajovy and Austedo to offset the continued headwinds from Copaxone. The European Commission’s findings and the timing of the accusation are an unnecessary distraction for the company.

Stock Grade

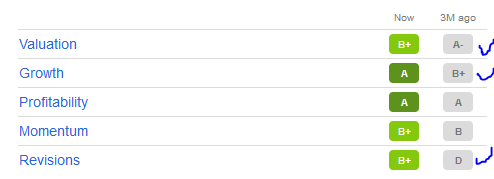

The commission’s scrutiny is poor timing for shareholders. TEVA stock traded between $8.00 and $10.00 since 2019. Fortunately, Teva’s improving second-quarter report raised its stock grades.

SA Premium

Teva’s valuation improved to a B+. Its growth score is now an A, along with its profitability. Analysts had no choice but to issue positive revisions. This improved Teva’s revisions score from a D to a B+.

Opioid Settlement Momentum

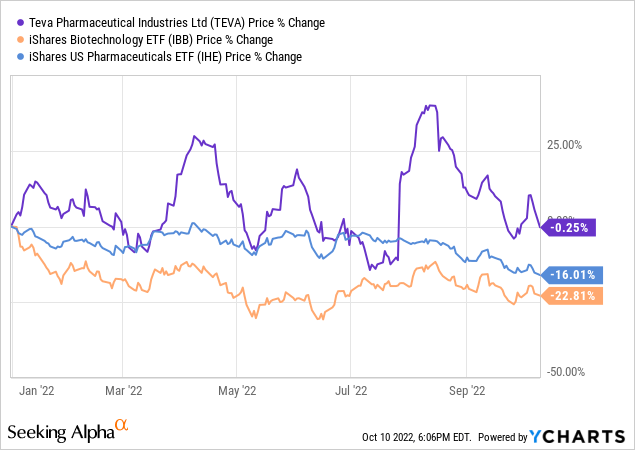

After the settlement, Teva’s over 22% rally on July 27, 2022, is now a distant memory. It had agreed to pay $3.7 billion in cash to settle the nationwide opioid litigation. This sent TEVA stock above $10 for the first time since mid-2021. Still, Nasdaq’s bear market handed markets a reason to take profits.

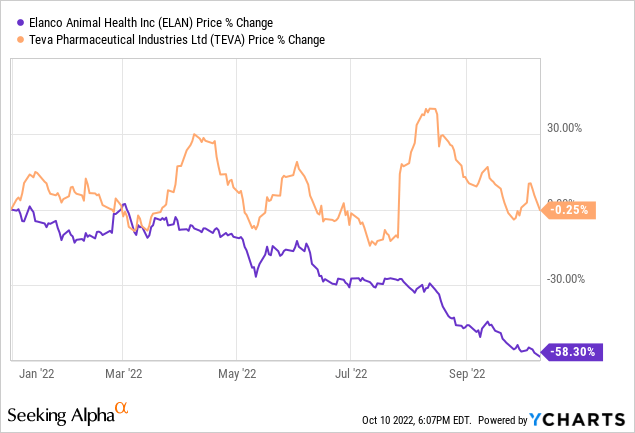

Compared to the index, TEVA shares are performing better. Teva stock is flat in 2022. Conversely, iShares Biotechnology ETF (IBB) lost 24.7% this year. Similarly, Teva beat the iShares U.S. Pharmaceuticals ETF (IHE), which is down by 16% year-to-date.

The Federal Reserve’s aggressive interest rate hikes are partly to blame for the current bear market. However, the Fed must clean up the economic system from excess cash. After 10 years of quantitative easing, the easy access to money created inflation in the economy. Biotechnology firms with no product on the market are at the highest risk.

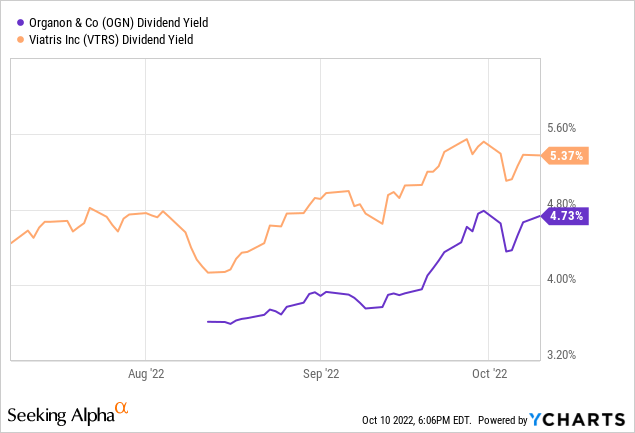

Pharmaceutical firms are lower-risk investments. The generous dividend yield from peers like Organon (OGN) and Viatris (VTRS) might limit their downside risks.

Above: As OGN and VTRS stock fall, the dividend yield rises.

Elanco (ELAN), an animal health drug supplier, is at lows never seen before. Investors who buy the stock have a steep margin of safety. Its forward price-to-earnings ratio of 9.4 times.

Opportunity

Teva may grow its generics business by at least 4% annually. Investors should expect revenue of at least $4 billion. Its global biosimilar business will add a modest single-digit percentage growth. In addition, its specialty business has strong long-term prospects.

The company’s opioid settlement removes a long-standing distraction. Although traders took profits after the settlement news, Teva management may turn its focus on Ajovy and Austedo. Already, the combined sales of both drugs exceed that of the declining sales of Copaxone.

CEO Schultz outlined several long-term targets on its conference call. The three targets are stronger margins, higher cash earnings, and reduced debt. Fortunately, Teva does not need higher revenue growth to meet those three targets.

In the Research and Development line item, Teva will focus on neuroscience and immunology. It said last quarter that it would keep R&D spending as a percentage of revenue. Chances are low that the European Commission’s case will have no impact on this important spending item.

Technical Chart Risk

Trading volatility is Teva’s greatest risk. Trading momentum often commands Teva’s share price. When the stock rallies, the stock has enough buying interest to take shares to new yearly highs. When bad news mounts, Teva cannot shake off selling momentum.

Your Takeaway

Teva traded sharply below the $8.50 level again. The stock might re-test yearly lows in the weeks ahead. Investors who ignore stock charts should wait for Teva’s next quarterly earnings report. When it posts results on Nov. 3, 2022, investors will have a clearer understanding of the related costs to the Commission’s accusations.

Be the first to comment