master1305/iStock via Getty Images

This article was coproduced with Wolf Report.

It’s time for a no-nonsense update on Simon Property Group, Inc. (NYSE:SPG).

By that, I mean we’re going to ignore the noise and evaluate what Simon actually does and how it performs. This is, after all, what we focus on here at iREIT on Alpha.

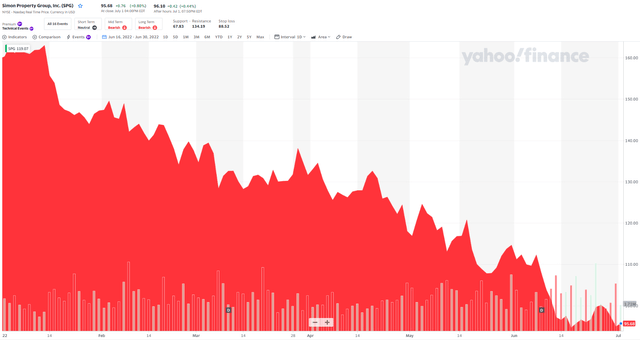

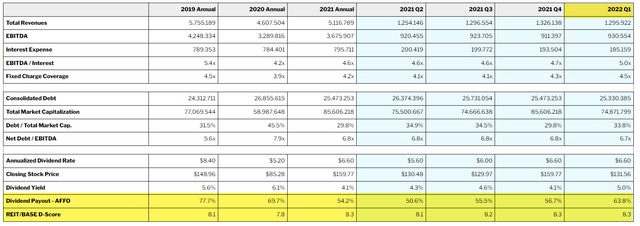

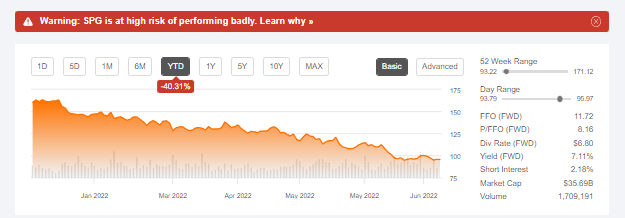

First off then, let’s acknowledge that this real estate investment trust (REIT) is down almost 40% year-to-date. We’re still far off Covid-19-level valuations between $50-$60, mind you…

But investors can now pick up this REIT at a no-nonsense, summer-savings “Buy” level with a 7.11% yield.

(Yahoo Finance)

Keep in mind… that bargain is for one of the best-managed mall REITS in the entire world. It has everything you could possibly want out of an investment of its kind.

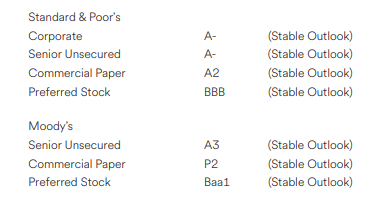

SPG is top-rated in terms of credit, for one thing, by most major credit rating institutions. The amount of credit safety here is not to be underestimated, as it entails some near-ridiculous levels of fundamental safety.

(Q1-22 Supplemental)

Then there’s its properties. Let’s talk about them next.

Simon’s Properties Are Pretty Neat!

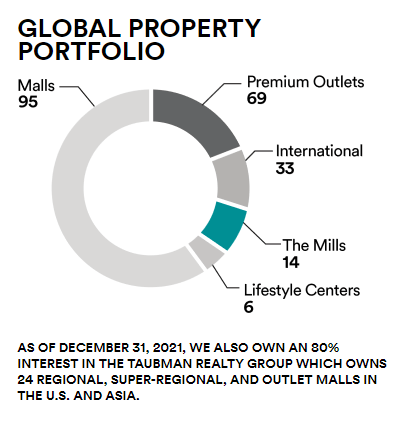

Simon manages a very attractive mix of premier shopping, dining, entertainment, and mixed-use assets. These consist primarily of malls, premium outlets, and The Mills, which are essentially a cross between malls and outlets.

At last year’s end, Simon held interest and/or ownership of 199 income-producing properties in 37 U.S. states and Puerto Rico. These consist of:

- 95 malls

- 69 premium outlets

- 14 mills

- 6 lifestyle centers

- 15 other retail properties.

SPG also owns a majority noncontrolling 80% interest in Taubman Realty – which in turn has interest in 24 regional, super-regional, and outlet malls across America and Asia.

(SPG website)

Speaking of international exposure, Simon owns interest in 33 properties in Asia, Europe, and Canada. It also has a 22.4% equity stake in Klepierre SA (OTCPK:KLPEF), one of the premier real estate businesses in France specifically and Europe in general.

This is all expertly managed by SPG veteran David Simon, the nephew of Herbert Simon, the company’s original CEO. He’s been chairman since 2007, CEO since 1995, and a director there since 1993.

(SPG website)

That all factors into why I’m not afraid of Simon’s dividend, which sits at 7.11%. I’m very careful about recommending high yields, as these can be for suckers.

But in this case, this is a well-covered 7.11%, which was bumped $0.05 cents on the quarter back on May 9. As viewed below, the iREIT REIT Base payout ratio using adjusted funds from operations (AFFO) is 63.8%.

(REIT BASE)

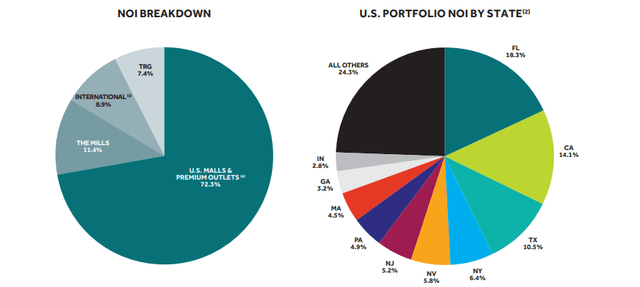

SPG comes in at a very attractive geographical net operating income (NOI) split, with most of the income coming from its premium malls and premium outlets. Its high California exposure may be of concern to some…

But note the increased NOI portion from Florida, Texas, and other geographies.

(Q1-22 Supplemental)

More about that diversification in a moment…

Simon Says (and Does!) It Right!

Some may argue that the company holds no comparative moat. But that’s based in a lack of understanding of Simon’s asset qualities and mix changes over the past few years.

SPG 20 years ago might have been more focused. But today, its previously mentioned mixed-use properties include a wide variety of attractive sectors, including:

- Outlets

- Hotels

- Residential properties/apartments.

(2021 Annual Report)

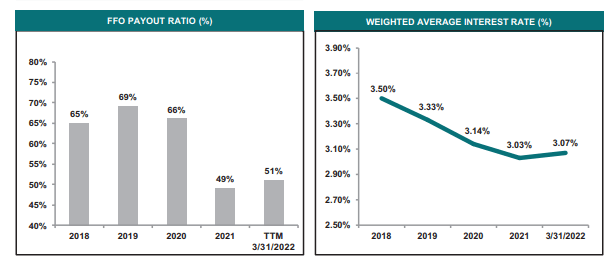

But there’s the rising rates currently wreaking havoc across the market, others might point out. Which is true.

However, it’s important to realize that Simon’s last-known weighted interest rates for debt were still at close to record-low levels. And its FFO payout ratio, or dividend coverage, was at its best level since both before and after the pandemic.

(SPG Credit/Payout Safety – SPG IR)

The company could, theoretically, return the dividend to its original pre-pandemic level of $8.30 without incurring any serious damage to its payout ratio.

There are plenty of reasons why SPG should be able to continue its long-term earnings/NOI growth trend. At this point, it’s been growing at a steady 6% for the past 20 years. And only four out of 20 years have shown negative FFO growth – one of which was during the financial crisis, one of which was during the pandemic, and two of which were less than 7% and 1% respectively.

Mixed-Use and More: Simon Has Something for Many, if not Most

Simon, with its deep pockets and incredibly attractive asset base, is working on redeveloping mixed-use projects – both in the U.S. and internationally – transforming former retail space and square footage into more attractive mixed-use space.

The company already opened 33 specialty tenant spaces in 2021 and expects to open another 40 this year. It’s also working on adding mixed-use components to its centers, a plan that’s already working well.

To be completely clear, by “mixed-use,” I mean things like:

- Luxury hotels

- Luxury restaurants

- Plazas and office buildings

- Athletic and workspaces

- Culinary markets

- New NHL practice spaces and corporate offices

- Medical centers.

In short, Simon is moving away from slapping up malls with your fill-in-the-blank department stores and moving into very specialized square footage developments. And all these redevelopments are being done at very attractive expected yields approaching 6%-10%.

Yet the company’s legacy mall spaces are in no way being slowed down. For instance:

- The number of tenant terminations was the lowest recorded in five years.

- Occupancy is up to 93.2%.

- The average base minimum rent is up too.

In addition, Simon:

- Signed 900+ leases for 3 million+ square feet with significant leases in the pipeline

- Continues to report very strong demand, with mall sales climbing 19% year-over-year and a reported 43% retail sales per-square-foot increase, with 50% year-over-year growth for the Mills

- Executed a very timely set of 10-year fixed dual-tranche senior notes at 2.65%

- Increased its dividend

- Increased its full-year comparable FFO guidance to a high end of $11.75 per share.

Plus, the two aforementioned Simons own over 3.5 million shares with a current valuation of $334 million. That’s what’s known as “skin in the game” or “putting your money where your mouth is.”

Simon’s Valuation and Risks

(Simon Property Group performance – Seeking Alpha)

As we all know, the market has a strong tendency to overreact, and so it’s questioning Simon’s growth.

But a company only needs so much growth to justify a normalized 10x-12x price to FFO multiple. That’s especially true when it has a well-covered 7% yield in a rising rate and inflation environment.

Current forecasts are for FFO growth to average just below 2% for the next three or so fiscal years. That’s below Simon’s guidance and my expectations as well. Though it’s fair to assume the company’s growth rate may not be a consistent 5%-8% over the next few years.

However, at an average P/FFO multiple of 8x, it doesn’t need to grow far. And at an average 8.7x P/AFFO, it simply needs to keep paying out those dividends and wait for reversion.

We believe that reversion will come when the markets calm down and investors realize that there is nothing to fear here.

After all, Simon’s sales and income aren’t down. Neither are leasing demand and demand for mixed-use spaces.

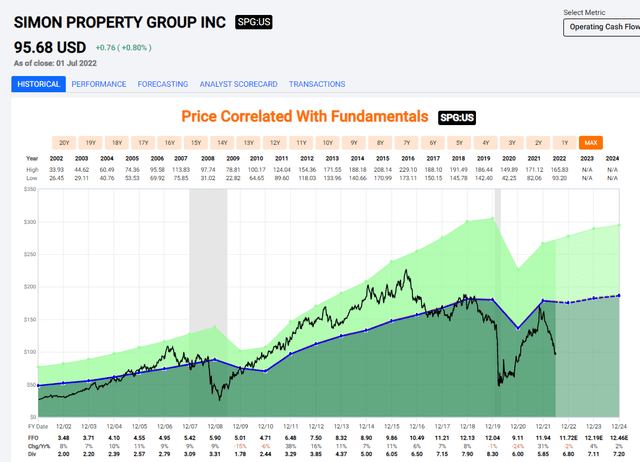

There’s nothing in the company’s 20- to 30-year price history that would suggest consistent, continuing negative earnings from here.

(SPG history – FAST graphs)

Moreover, the only consistency in its share price over that time seems to be the market’s tendency to overreact – both in the face of minor troubles and prolonged stability.

What you see is a potential case study for how you could go about trading or buying/selling SPG. Consistent growth results in long-term overvaluation that peaked, as you can see, back in 2016.

Will we see 20x P/FFO again? Honestly, we doubt it.

But that doesn’t mean SPG is a bad investment. Not at all.

What to Expect From Simon’s Situation

Even assuming a return to bare-bones 10x-11x P/FFO implies an annualized rate of return inclusive of a 22.9% yield, or 67% until 2024. That’s assuming Simon goes back to a P/FFO multiple that’s 4x below its 20-year historical.

We like those odds.

In the case of a 15x P/FFO normalization, shares would probably be closer to $185. Though we doubt it would hit a total RoR of 113% in three years. There’s too little growth apparently in the business.

It’s possible, of course. But we wouldn’t bet on it.

The common denominator in the past 20 years is that investors have been well-off buying in below 10x.

From 2009 until today, for example, you’d have made 450%. And from Covid-19’s onset until today, you’d come close to 90% – despite the company crashing 40%.

Ipso facto, we see Simon as a “Buy” today even if we did lower its price target.

There are very few risks we can see here. Others can, we know. But, again, there’s little to suggest that the trend in demand for SPG’s properties is abating in any way.

In which case, we also disagree with people saying that 2021’s strong results were a one-off.

Admittedly, calling the company cheap at 13x-15x P/FFO is a stretch with these growth rates. However, SPG is no longer trading there: It’s down to recession valuation despite its strong stats.

And that just doesn’t make sense to us.

In Conclusion…

We understand why some investors may be hesitant to push deeper into SPG here. However, remember that the essence of value investing often means going against the grain.

In three years – possibly even less – we think investors will look back at this opportunity and wish they’d have bought into a company that:

- Puts capital to work with A grade safety

- Has a 7%+ yield

- Has a close to triple-digit five-year upside.

That is why we maintain our “Buy” rating for SPG and continue to be long on it. Because the catalysts are there, and the opportunity seems superb.

The market does what it does and will do what it will do. That’s fine with us though since we love seeing quality being undervalued.

That enables us to put money to work long-term. It’s what we’re about here.

Be the first to comment