Overview

The last year has seen the strong adoption of Medallia’s (MDLA) Cloud CX/customer experience platform. Subscription revenue growth increased by 400 bps to 26% YoY compared to prior year growth. Sales execution was solid overall as the company ended 2019 with 757 enterprise customers, which represents a 39% YoY growth. The other fundamental metrics are also showing that the company is moving towards balancing growth and profitability. As the company expects to post its first-ever non-GAAP operating profit in FY 2021, we continue to be a believer in the company’s long-term vision. The company’s strong enterprise sales expertise and positioning will be the key growth factors.

Catalyst

For many years, Medallia has focused its sales effort on the very high-end segment of the enterprises, the so-called Global 2000. This is an area where many cloud software players want to enter. The attractive enterprise market offers higher switching costs, initial deal size, and expansion potentials, though it can be quite challenging to convert these customers. To acquire enterprise customers well, it most often requires a comprehensive enterprise-grade offering and high-touch sales expertise.

(source: Medallia’s earnings call slide)

Having won many deals in the Global 2000, Medallia’s sales team has been built, trained, and organized around the culture of converting enterprise deals across different verticals. This is an important point in the enterprise market, given the customers’ tendencies for use case specialization and best-practice adherence. In Q4, this practice continues to do well as 70% of new enterprise customers purchased the vertical best-practice solution package. Furthermore, the Global 2000 sales expertise has become a moat that is highly transferable to the sales execution across large and mid-size segments of the enterprise market, which is where it is going for next. There are over 100,000 potential customers that represent a $68 billion TAM in those segments. So far, the move downmarket has been promising. As of Q4, new user acquisition has progressed well, and we expect this to continue. The company achieved a 40% increase in sales productive capacity and added 50 new enterprise logos such as AkzoNobel, Cloudera, Ryder, and Freddie Mac. This drove both the 44% growth in RPO / Revenue Performance Obligation and also the accelerated 26% growth in SaaS revenue.

(source: Medallia’s earnings call slide)

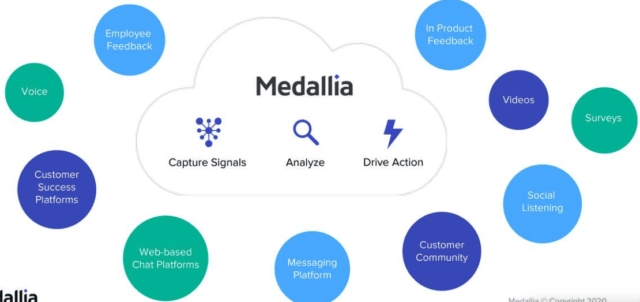

As Medallia is moving downmarket, it has also enriched its offering by investing in R&D and making acquisitions. In FY 2020, it made 5 new acquisitions. Among them, LivingLens, Crowdicity, and Zingle were the key ones. Zingle is a business text messaging module that allows for sending automated and personalized texts to the customers’ mobile phones. Crowdicity helps businesses to improve CX by gathering insights from crowdsourced ideas. Last but not least, LivingLens is a unique video-based survey platform that can capture any insights within the video feedback sent by customers. We believe that the enriched offering will increase the attach rates, which eventually drive net expansion rates and growth through upselling. Module integration is one of the key expansion drivers for Medallia due to its positioning as a platform that generates CX insights through data consolidation across vendors. All the relevant expansion metrics have been strong as of Q4. 50% of renewals were multi-year contracts, whose value increased by 2.5 times from the prior year. This further boosted the already best-in-class net expansion rate of 119%. The number of modules has also increased to 12 while the average attach rate for one customer is 3, though as many as 25% of customers are using 4 or more modules.

Risk

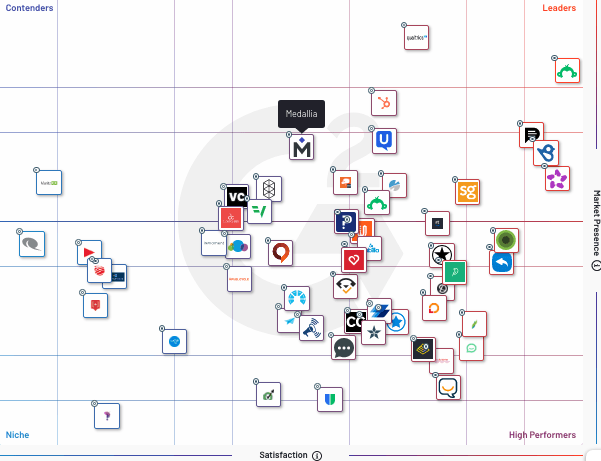

The $68 billion TAM presents an interesting opportunity, though the competition downstream is arguably more intense than in the Global 2000 segment.

(source: G2crowd)

Medallia has dominated the high-end enterprise niche, while SurveyMonkey (SVMK) is still considered ahead of many other competitors such as Qualtrics, AskNicely, and Wootric. While we see a path to market leadership for Medallia considering the enriched offering and unique positioning, it is still too early in the game to conclude on anything. Medallia mainly focused on converting new enterprise clients in the absence of an existing digital CX platform. Therefore, there may be uncertainty on how it converts mid-market customers that potentially have seen and used the competitors’ CX platforms.

Valuation

Nonetheless, a business like Medallia has a solid moat due to its inherent go-to-market focus in the enterprise. The company has delivered strong results in recent times, driven by the increase in product and module adoptions by the high-end enterprise customers. It has consistently beaten all of its revenue guidance by mid-single-digit margin since its IPO in 2019.

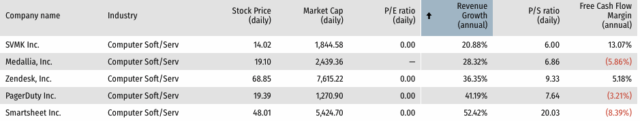

(ZEN vs. SVMK vs. SMAR vs. PD vs. MDLA. source: stockrow)

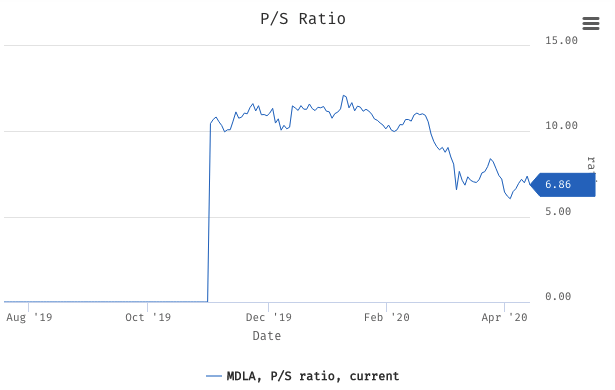

With a 6.86x P/S, Medallia is the cheapest stock in the peer group. In that regard, the relatively lower revenue growth and negative FCF/Free Cash Flow margin may have a role to play in the discount. Indeed, 2019 was a busy year for Medallia as it acquired and integrated 5 different companies while investing aggressively in the downstream go-to-market. SurveyMonkey, which mostly focuses on the survey feedback product that traditionally targets SMEs and mid-market, provides a good long-term model here. With a fully-ramped up product and high-velocity sales process, its ~13% FCF margin is by far the best in the group. Medallia, however, has the potential to maintain its growth above SurveyMonkey’s. Based on the earnings results in the last three quarters, we have the impression that the Medallia’s management prefers to under promise and overdeliver with its guidance. It is likely that upon another string of successful executions, we will potentially see a YoY growth rate that exceeds the 22% upper range guidance in FY 2021.

(source: stockrow)

The FY 2021 will also see the company’s first-ever Non-GAAP operating profit while the management projects a $472 million revenue. This represents a conservative view given the implied 20% YoY growth. As it stands, the revenue still grew at 28% YoY in 2019. Furthermore, the cloud subscription revenue is expected to reach $387 million and will continue to drive the growth.

Post COVID-19 selloff, the stock is now trading at ~7.3x P/S, which is ~64% off its YTD-high of ~12x P/S. The hospitality businesses, which are severely impacted by the COVID-19 outbreak, also make up less than 10% of Medallia’s customers. Upon the expectation of a broad market rebound in the second half, we have come to a target price of ~$30 per share at the end of FY 2021, based on the midpoint of 5.41x forward P/S and 12x YTD-high P/S and the 133.9 million shares outstanding. Our view on the stock remains bullish today, mainly driven by the unique positioning and the strong enterprise sales execution in a $68 billion market. The end result here is a visible moat that creates a competitive advantage over its competition.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment