Vertigo3d

Opendoor (NASDAQ:OPEN) is a company on a mission with a singular focus. Their goal is to revolutionize the process of buying or selling a home and make it seamless, frictionless, and simple. They are seeking to disrupt one of the most entrenched, archaic, and complicated industries there is: the residential real estate market. They are expanding at incredible triple digit growth rates, constantly opening up new markets, seeing extremely positive user reviews, and just posted their first GAAP profitable quarter. Despite all of this, many doubt that the model can keep up as the real estate market cools and potentially declines, that margins are too thin, that it’s too capital intensive, or that real estate is too cyclical. Those people don’t understand that Opendoor has significant competitive, structural, cultural, and operational advantages and multiple levers to make sure they come out on top. Opendoor is misunderstood, and that’s what makes it a buy.

The Elevator Pitch

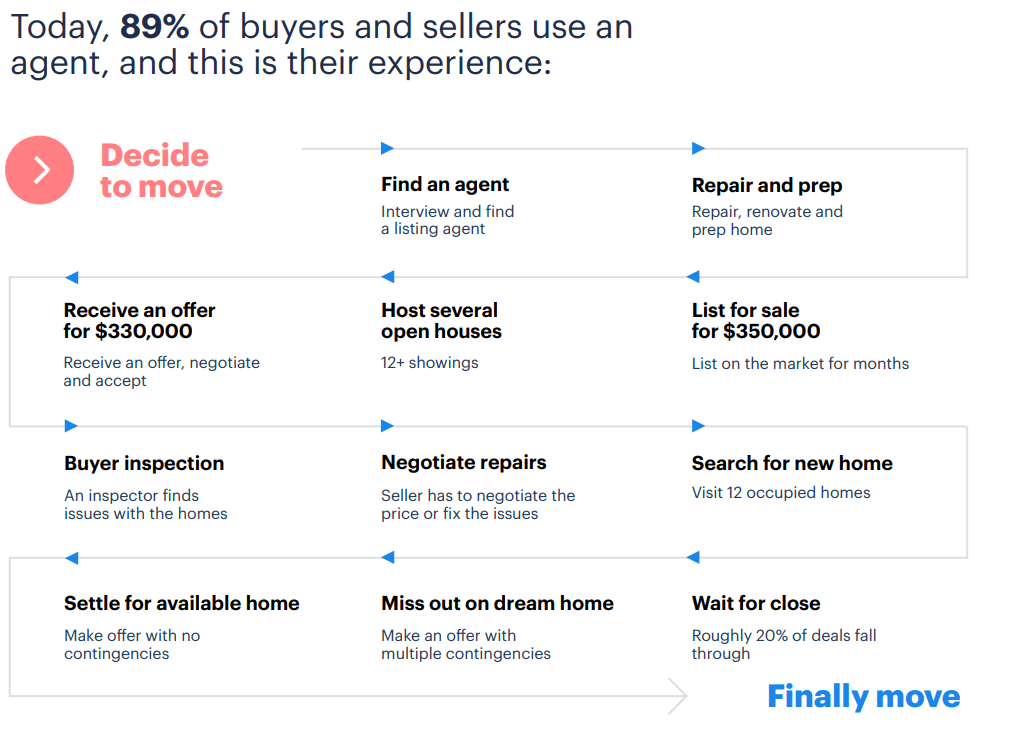

Opendoor’s elevator pitch is pretty simple. Everything about selling a home is cumbersome. Finding an agent whom you trust and who has your best interests at heart, cleaning, renovating, repairs, staging, choosing a listing price, open houses, waiting for offers to come in, selecting between offers, contracts, title, escrow, earnest money, inspections, pictures, seller’s agent fee, buyer’s agent fee, the deal falling through, the list goes on and on. It’s stressful and even in the best case scenario it takes at least 2 months. If you’re buying at the same time and trying to time the sale and purchase of a new home it’s even worse.

Opendoor

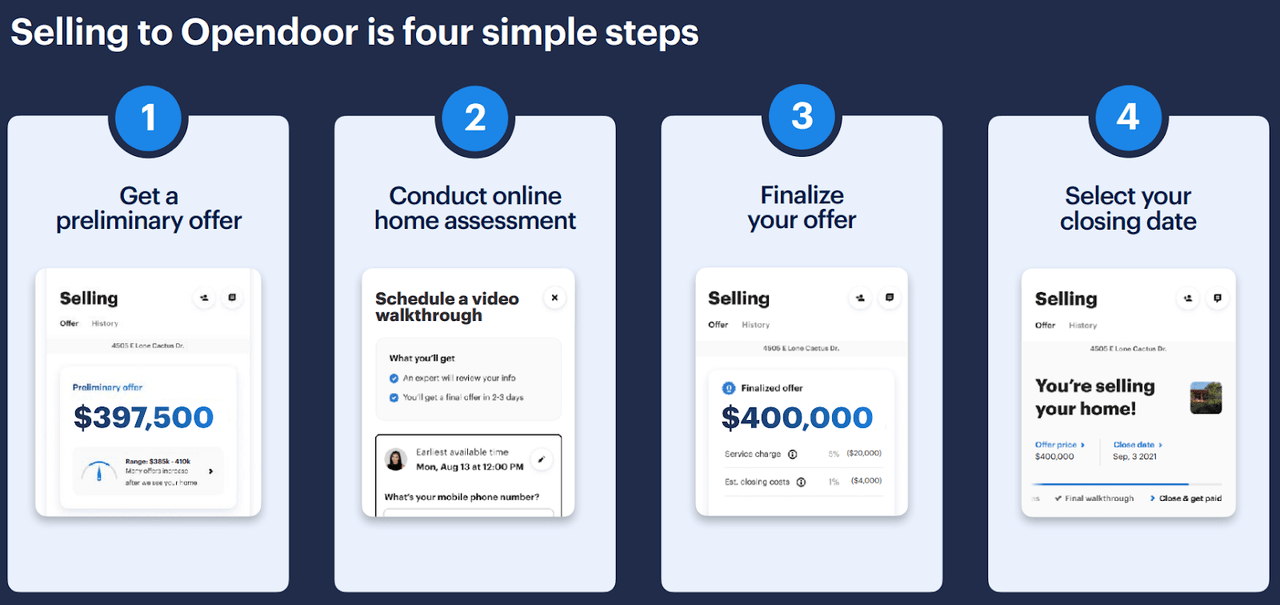

Opendoor removes all the friction and makes it simple and easy. You get a preliminary offer in minutes on the website, do a 30 minute or less video call walkthrough, and Opendoor uses their machine learning algorithms to give you a firm offer in a day or so. They close on your schedule, and ask for a 5% fee, which is slightly less than the standard fee you’d pay when selling with real estate agents. It’s the no fuss, all online, totally digital way to sell a home and people love it.

Opendoor

Opendoor’s NPS score is above 80 in an industry where average NPS is 30 (NPS is a metric used to measure customer loyalty and satisfaction). For reference, Bain & Company (the creators of NPS) suggests a score above 0 is good, above 20 is favorable, above 50 is excellent, and above 80 is world class. Opendoor’s customer experience is world class.

Growth is Incredible

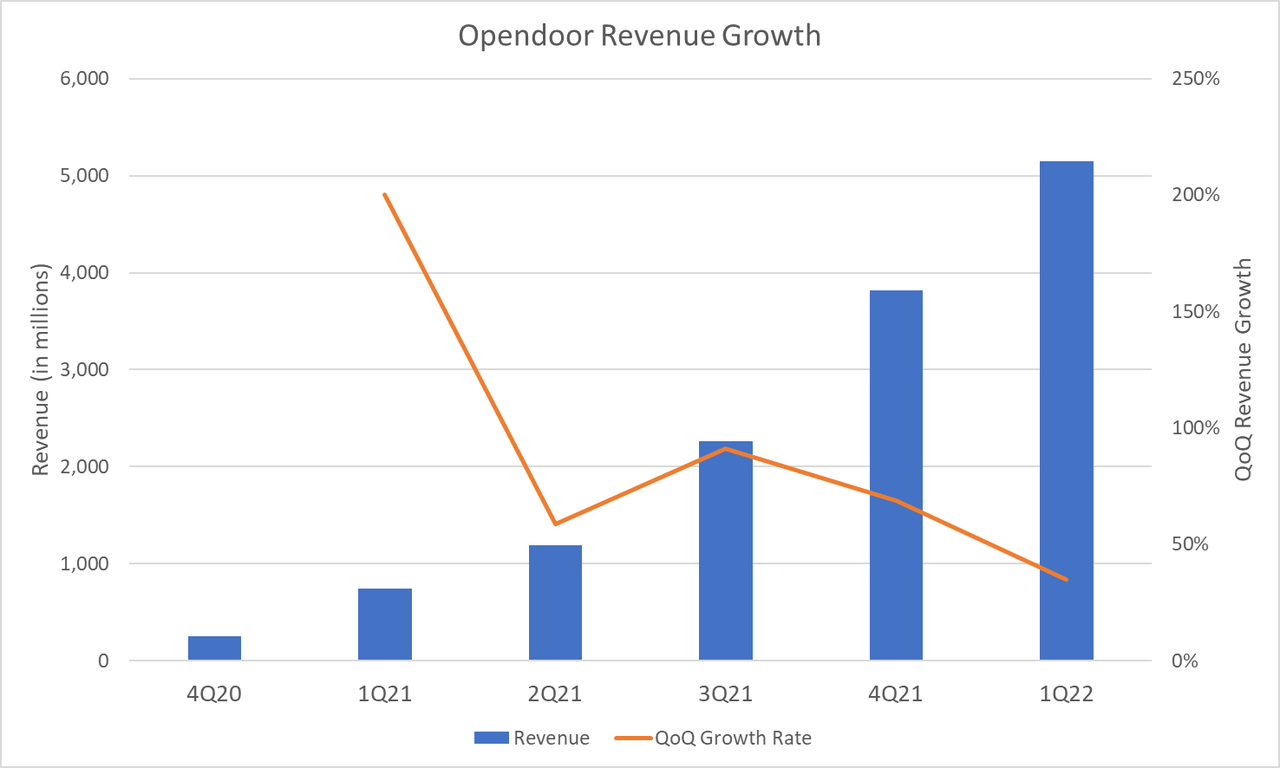

Most growth companies are happy with 30% annual growth. Anything over 50% is exceptional. Opendoor went public in December 2020. Here are Opendoor’s quarterly revenue and quarterly growth rates since then.

Author

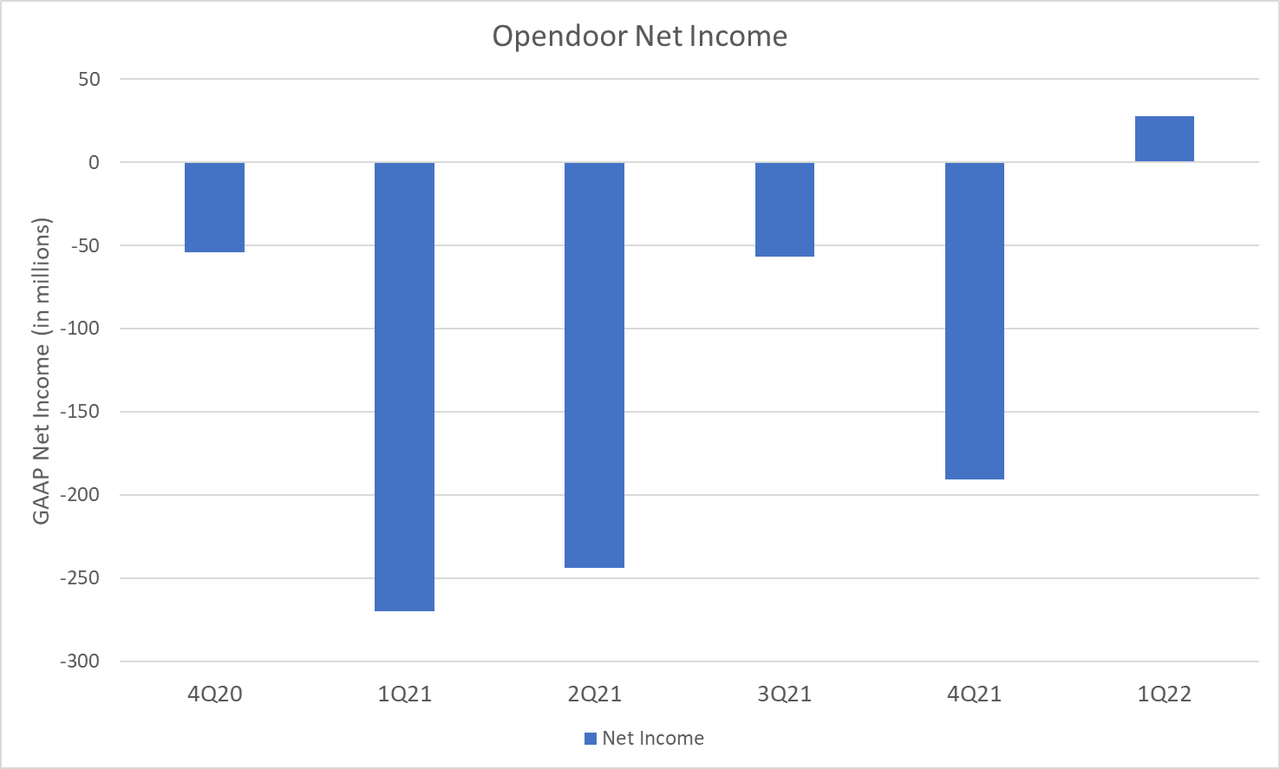

Opendoor has quarterly growth rates that growth companies would be proud of as annual growth rates. And they are not just going all out for top line growth at all costs. While not quite as linear as the revenue growth, the bottom line improvements have been equally impressive, culminating with surprising Wall Street with their first GAAP profitable quarter in 1Q22.

Author

Despite the improving business fundamentals, the stock has been decimated. This is a company with exponential growth, a massive TAM where they’ve only scratched the surface, and a strong balance sheet. Not only that, but they have no true competition since Offerpad (OPAD) is so conservative and Zillow (Z) failed and left the iBuying arena with their tail between their legs. There are massive technological barriers to entry and even bigger financial barriers. The cost of entry is very high and margins are thin and require scale to achieve. This is at worst a limited oligopoly with Opendoor already cornering the lion’s share of the market and at best an enduring monopoly. Despite their excellent track record and continued results that surpass analysts’ highest estimates, they are being priced as if bankruptcy was imminent. The stock is currently trading at a trailing twelve month price to sales ratio of 0.27 and a price to book value of 1.45. In fact, their revenue from just the first quarter of this year was 1.5x their current market cap.

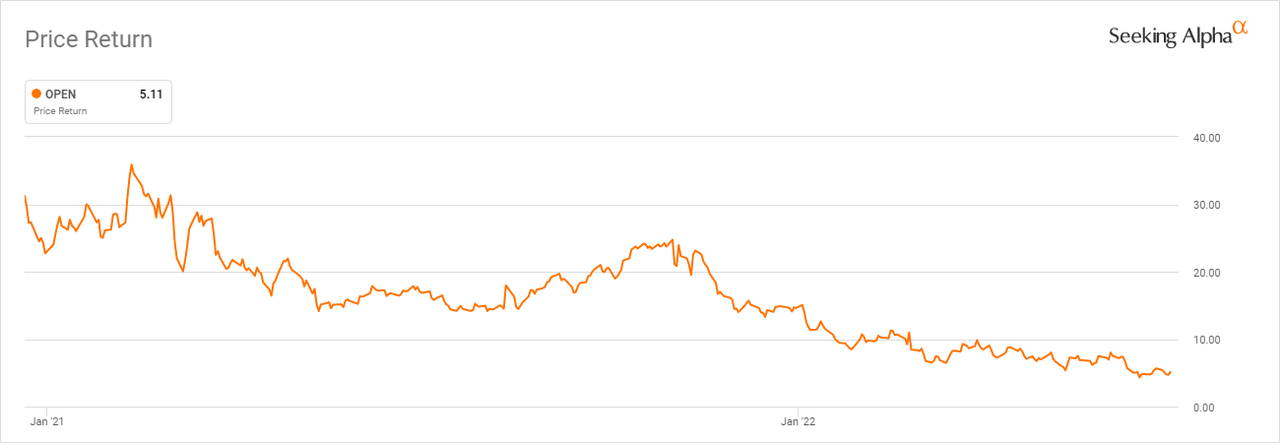

Seeking Alpha

The Great Misunderstanding

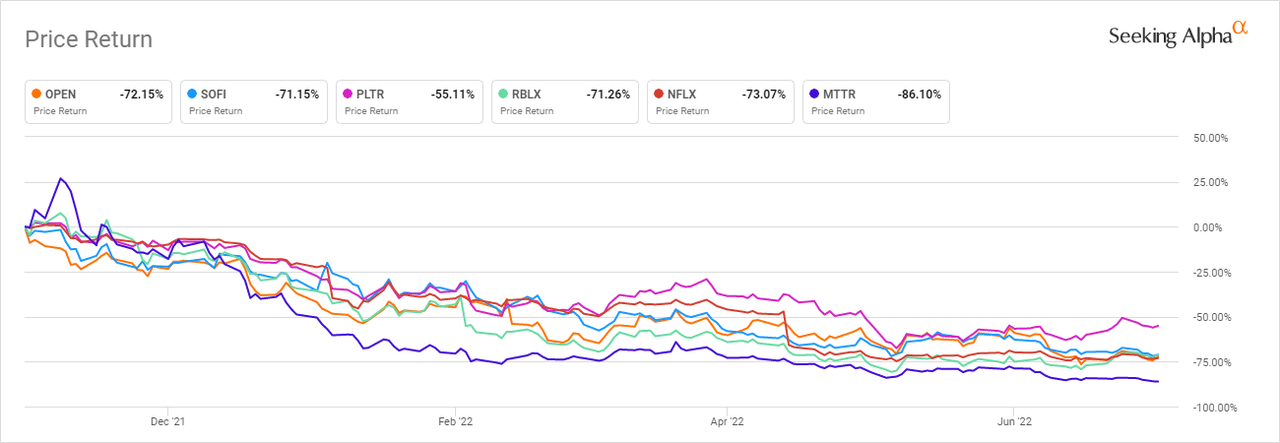

So why is the market so bearish on the company? First of all, it’s important to acknowledge that the vast majority of the drawdown in the stock price since November is driven by the macro environment. Valuations have compressed as the times of high liquidity and historically low rates are coming to an end. It doesn’t matter what type of company you are, if you were a high growth story, you’ve been slaughtered. Here is a smattering of well-known growth stocks across a host of different sectors since Nov 22, 2021, the day the Nasdaq hit its all-time high. Included are SoFi (SOFI) from fintech, Palantir (PLTR) from big data analysis, Roblox (RBLX) from gaming, Netflix (NFLX) from streaming, and Matterport (MTTR) from 3D digitization. As you can see, all of them have been completely obliterated and are down significantly more than the S&P 500 or Nasdaq indexes.

Return since November of Selected Growth Stocks (Seeking Alpha)

The other big reason for the drawdown is that the market is forward looking. And here is what the market seems to see when they look at Opendoor’s future…

It’s true that the real estate market is softening. Inventories are still near historic lows and supply is still constrained, but a number of indicators are starting to turn. Listing price drops are increasing, and the rapid ascent of mortgage rates has really hurt affordability.

Spread – Opendoor’s Secret Weapon

However, what most people don’t understand is that Opendoor has a secret weapon that they are already using to continue their growth and profitability trajectory through this rough patch in the housing market. They have a lever they can easily adjust to stay ahead of the curve and maintain margins. It helps to guard against a softening market, decreasing house prices, increasing rates, and anything else the market chooses to throw at them. That weapon is their spread.

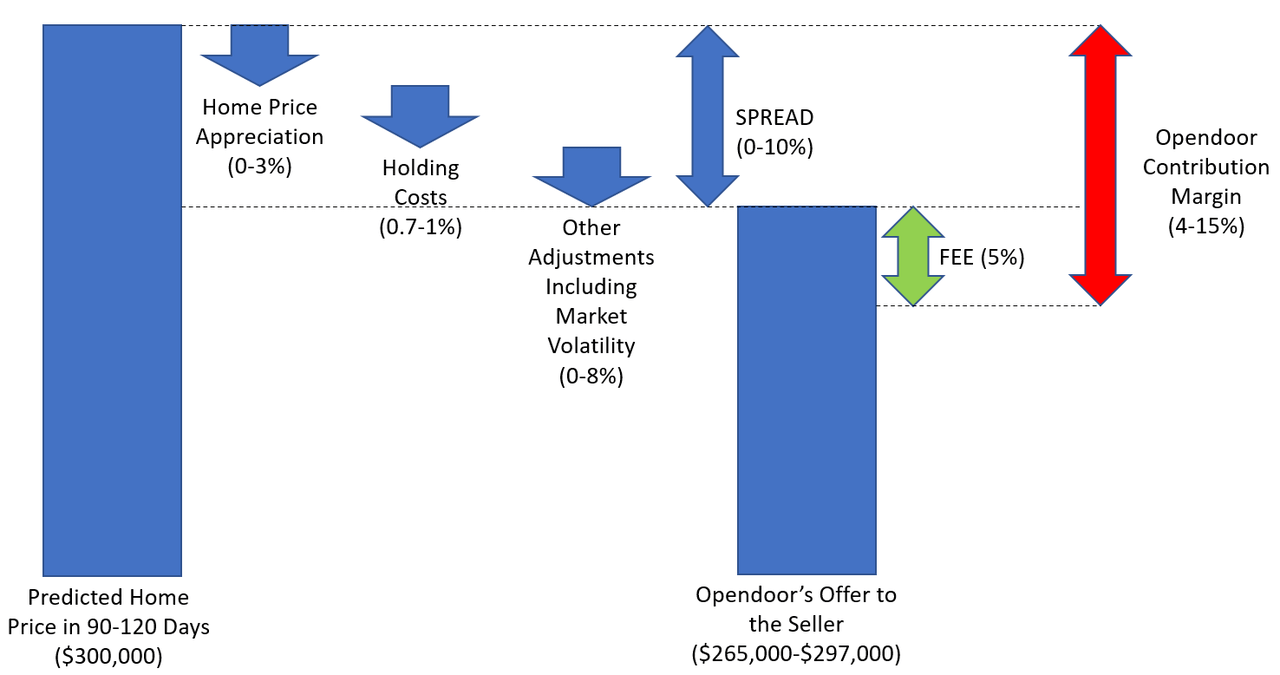

To understand spread, you need to think of the transaction from Opendoor’s perspective. Opendoor’s algorithm is predictive. Opendoor doesn’t only care what your house is worth right now, they also care deeply about what your house will be worth in 90-120 days when they sell it. If things in the macro environment are murky, or mortgage rates are increasing with unprecedented speed or the economy seems destined for a recession, Opendoor doesn’t want to be left holding onto assets that they overpaid for as housing prices slump.

Most people think that the Opendoor algorithm spits out a value of the home right now and that’s what Opendoor offers, taking a 5% fee and that’s what drives their margins. Then if housing prices go up between then and when the house gets sold, margins get bigger. If housing prices go down, then margins shrink. If the algorithm ends up being wrong and guessing high, they lose even more money. That’s not how it works. Carrie Wheeler, Opendoor’s CFO explained how they arrive at their spread during the Q1 earnings call:

Housing dynamics are a key input to our business, and we’ve custom-built our pricing and operational systems to give us a deep understanding of the underlying drivers and to be able to dynamically adjust to changing conditions. That’s reflected in our offers. And those account for the level of certainty in our home acquisition pricing, inclusive of forecasted HPA.

I created this graphic to help visualize spread as explained above. Note that the dollar amounts and percentages are just illustrations as each individual house is unique.

Visual representation of Opendoor’s spread (Author)

Opendoor knows what your house is worth now, but they also predict what the sale price will be in 3 months when it gets sold. Additionally, they know their holding costs, and the algorithm takes into account market volatility and home price appreciation (HPA). They adjust the offer they make based on these and several other factors. When the market is especially choppy, they build that uncertainty into the model to make sure to maintain contribution margin even if there is a downturn. In other words, the AI crystal ball doesn’t just spit out a number, it incorporates an uncertainty factor as well. If the uncertainty is high, they’ll adjust the offer downward to make sure they aren’t going to be left with an asset that is worth less than they paid for it. In fact, they’ve been doing that for the last 9 months or so. Again, according to Carrie Wheeler, “we have been increasing our spread since late last fall in light of what we foresee to be increasing market volatility.”

But Don’t Lower Offers Lead to Lower Volumes Bought and Sold?

Logic would say that if you start offering less to sellers then less sellers would take the offer. If everything else were equal, that would be true. But the thing about the real estate market is that all else is not equal, and so far their conversion rates have remained robust. Sellers are just as aware that cooling and possible home price depreciation are on the horizon and so they seem to be just as willing to accept Opendoor offers now as they were previously. Also, the ease of the experience makes it very enticing to sellers.

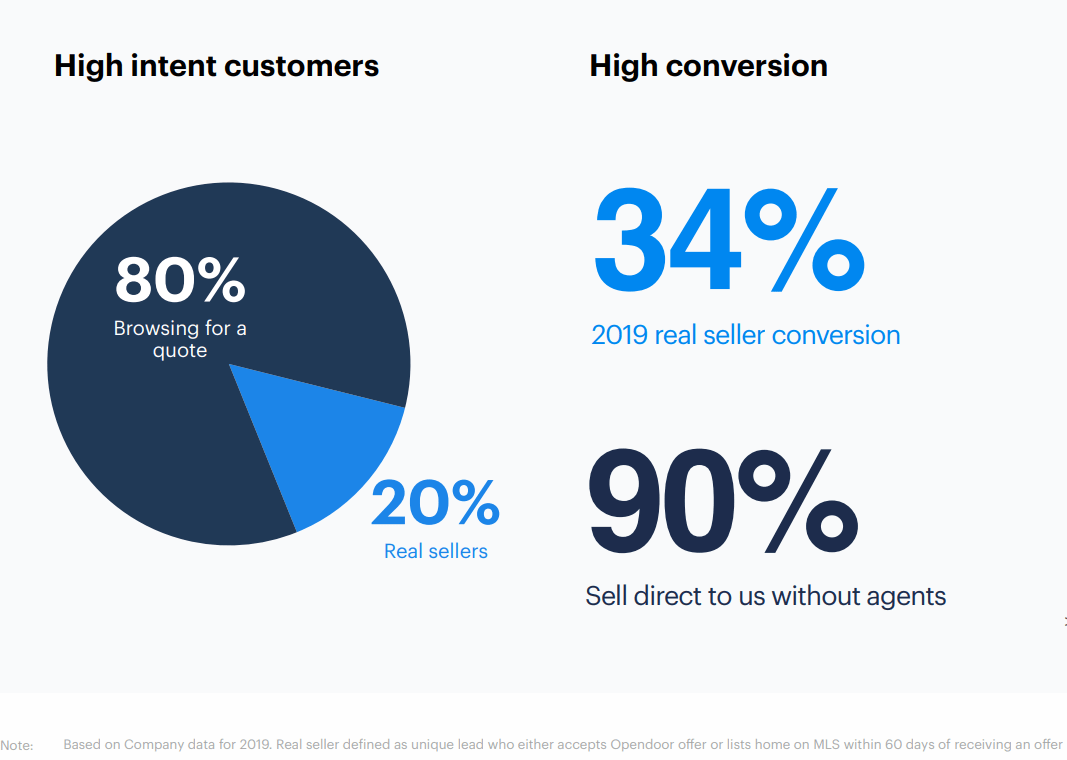

Lots of people go to Opendoor just to get quotes to see approximately what their home is worth, similar to how people like to check up on their Zestimate on Zillow. Those people shouldn’t contribute to conversion rate, since they are looking for information, and not necessarily looking to sell. To define a conversion rate, Opendoor uses the number of “real sellers” who end up accepting an Opendoor offer. A “real seller” is defined as someone who gets a quote from Opendoor and then either sells to Opendoor or lists their house on the market within 60 days of receiving an Opendoor offer. While that may not be a perfect definition, it is a consistent one that they can use to measure how many people accept their offers. If Opendoor has pricing power and if the service they offer is valuable to sellers, then conversion rate can stay high as they increase spread. If you see a drop in conversion rate, demand from sellers is very price sensitive, and they won’t be able to increase spread without losing volume.

There are four data points that show conversion over time. The first is from the Analyst Presentation that was given in November 2020, just prior to going public via reverse merger. One of the slides, seen here, shows that 2019 conversion rate was 34%.

Opendoor

The second data point comes from their Q3 2021 earnings call, where CEO Eric Wu stated that “Again, conversion is north of 35%.” The third is from the Q4 2021 Shareholder Letter, where they stated that they had “Real seller conversion of over 35% along with record offers” for the year of 2021. The final data point is from their most recent Q1 2022 earnings call where CFO Carrie Wheeler stated:

I mean what we have been doing since last fall is we have been increasing our spreads. But that hasn’t inhibited either a conversion or a pace of acquisition growth. And we expect to continue to grow acquisition volumes. They’ll be up in Q2. And so long that we can meet our margin targets, we will continue to grow our acquisition volumes. I think that’s a really important takeaway with increasing spreads and at the same time we’ve not seen a real market impact to conversion and we’ve been growing acquisition volumes. [This backs up the previous] comment that in this environment, our value prop should only increase in times of greater volatility.

At this point, they have been increasing spreads for about 9 months and they have not seen conversion decrease or decreased their pace of acquisition of homes. In the introductory statement on that same earnings call, they reiterated that “we’ve been able to maintain real seller conversion at over 35%”. The data we have is 34% for 2019 and greater than 35% for 3Q21, fiscal 2021, and 1Q22. The data supports the argument that their value proposition to sellers is so great that they have been able to maintain conversion and increase their pace of home purchasing even while increasing their spread and making more profit on each individual home.

Spread is a Lever to Balance Margins and Volumes

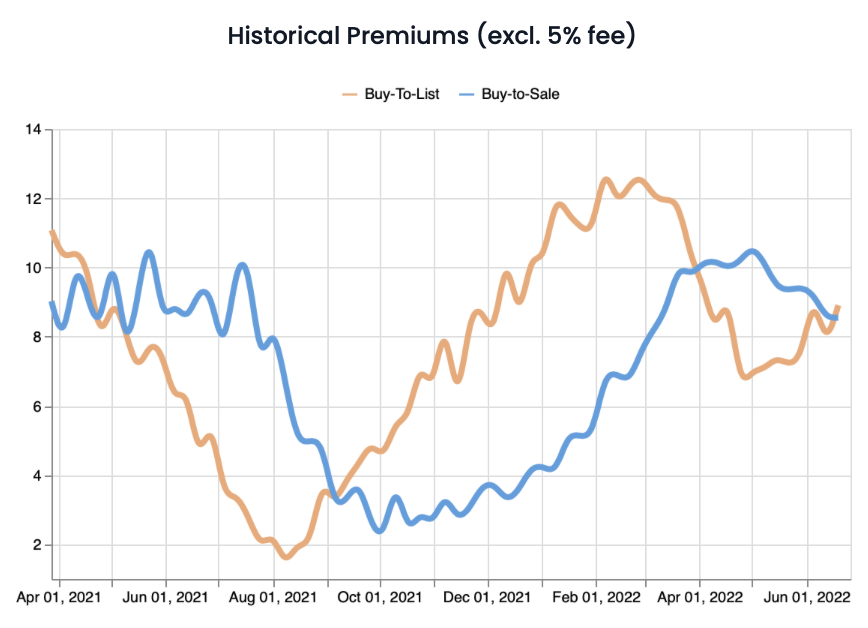

The ability to adjust their spread according to market conditions grants Opendoor flexibility to operate in any environment. It also safeguards profitability in times when the market would otherwise be slowing down. The data back this up. Here is a graph, courtesy of datadoor.io (an incredible tool for data surrounding Opendoor’s operations) of the Buy-to-List spread and Buy-to-Sale spread for the last 15 months. Buy-To-List means the difference between the price Opendoor paid for a property and the price they listed it for. Buy-To-Sale is the difference between the price Opendoor paid for the property and the price they eventually sold it for. Buy-To-List logically leads Buy-To-Sale because it takes time between when you list it and when you close the sale.

Datadoor.io

The first thing that jumps out to me is that this data matches up fairly well with statements made by management and the other data above seen. It is obvious that they started the process of increasing their spread last fall just as they reiterated multiple times. Additionally, when compared with the QoQ revenue numbers above, the correlation seems to hold that they can reduce spread to increase volume. They decreased spread through 2021 to increase volume and scale quickly and now they are increasing spread to compensate for market volatility, sacrificing some volume to make it happen.

In other words, spread is doing exactly what it was meant to do. It is safeguarding the company in a time of uncertainty and makes it so their business can operate sustainably in any macro real estate environment. The algorithm has proven to be robust, the business continues to grow at an astonishing pace, and their ability to control their spread is completely misunderstood by the market. I am legitimately excited to see how they navigate the coming housing market because I am confident they will do so with flying colors and emerge as a stronger company on the other side.

As a quick aside, you will also notice that 2Q22 (April, May and June) has the highest spread of anything in the past twelve months. Additionally, BTL just crossed over BTS gain at the end of June, signaling that the third quarter might have even higher spreads. That’s very bullish for their next few earnings.

Conclusion

Opendoor’s business model is fundamentally misunderstood. They hold all the cards in every real estate transaction, and their product is so much easier than the alternative of selling a home in the conventional way that they also have pricing power. It is such a good experience that people who sell to Opendoor have a significantly better experience as measured by their NPS above 80. Even in a rocky real estate environment they can and will maintain their contribution margin because they control their spread. This doesn’t even take into account the rest of their higher-margin products and ancillary services that they are ramping up, including Opendoor Complete (selling and buying and closing in one seamless transaction), Opendoor Max (your Dashboard into your homes’ value), Opendoor Exclusives (homes sold directly to buyers at a no-haggle price before being publicly listed), Opendoor-Backed Offers (making your offer to buy a home an all-cash offer, giving you a leg up on the competition when submitting an offer), title and escrow services, and a host of other services that will add to the top and bottom line. Opendoor is priced for bankruptcy, but they are primed for robust, sustainable, and profitable growth and I consider them a strong buy.

Be the first to comment