blackdovfx/E+ via Getty Images

Published on the Value Lab 3/7/22

DXC Technology (NYSE:DXC) is a tech consulting company that, like its peers, is struggling in some structural respects. The company is focusing on a transformation initiative designed to improve performance. While the initiatives are bearing fruit, we feel that the benefits are going to go no further than coming from the cost side. While some segments are seeing organic growth at attractive rates, structural issues and the incoming recession make this turnaround story poorly timed. We think it is better to be exposed elsewhere in markets.

Q4 2022 Update

DXC does a combination of tech consulting activities that constitute operations in two segments, the GBS segment, named the same as IBM’s (IBM) global business solutions, and the GIS segment, also with an identical name to Big Blue’s segment and containing the infrastructure and cloud businesses. Indeed, these core activities resemble somewhat the IBM’s businesses minus the high quality Red Hat exposure. Indeed, the consulting services for IBM, previously also named GBS, runs at similar margins.

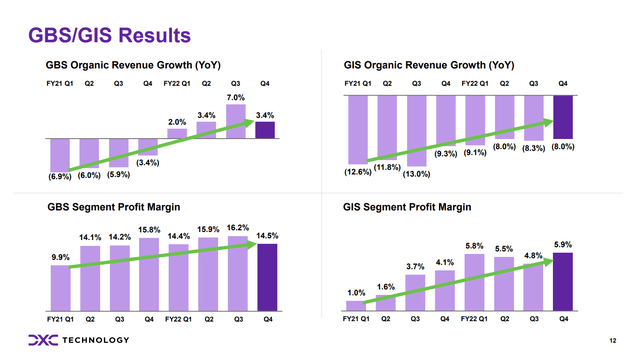

The situation with DXC is that poorly priced contracts in GIS are dragging on margins, but as were general issues in the company’s cost structure. Moreover, the company felt that opportunities were being missed to cross-sell products between the divisions.

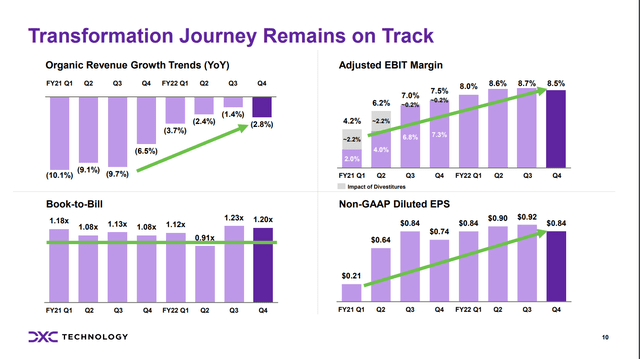

Revenue and Profit Evolutions (Q4 2022 Pres)

Cost cutting initiatives have been repairing margins quite meaningfully, moreover the tide of decline has been stemmed by cross-selling efforts as well as incremental work in fixing poorly performing contracts that were running too far below market value. Unfortunately, base effects are not enough to explain the revenue situation for GIS, which has been underperforming for years and giving up the share of the mix to the consulting business, although modern workplace is a function that is adding some meaningful base-affected drag to revenue growth, accounting for about 30% of that segment’s revenue. However, while a drag, backlog still built in that segment, and while the contracts are complicated and difficult to liquidate, they will eventually, so the GIS segment is capable of building business, albeit with a hampered turnover.

Segment Evolution (Q4 2022 Pres)

The consulting side has been performing impressively, with growth against strong comps and the growth focused on analytics and engineering applications, which is reassuring. Pre-emptive maintenance and analytics work with manufacturing clients has been a source for organic revenue growth in that segment, and it leads the growth in the GBS segment accounting for about 33% of that segment’s revenue, and about 15% of the company’s overall revenue. This offset declines in modern workplace derived from base effects and strong 2021 comps.

Outlook

The outlook is reasonable from a margin side, where they expect margins to stay on at about 8.5%. Revenue growth was not provided where there still isn’t much clarity on the revenue development at this point.

While the decelerating declines is nice, we can see that the majority of the improvements YoY have come from almost a doubling of the margin, deriving from the cost side. We think that there are structural issues that a tech consulting company like DXC face that make it difficult to take the next step into repairing the growth situation. One of the reasons why GIS is underperforming is also to do with some structural issues in how a consulting company like DXC does business. Consulting services may be bringing in the bread because services from GIS are being packaged together in a comprehensive client offering at discounted prices. While this is a valid approach to maximize the amount of LTV that you get from a lead, it also means that you get a discounting effect on whatever part of the business will become a cost-center for the client, i.e., the more commodified stuff. This was the logic of the Kyndryl (KD) spin-off by IBM, which contained poorly performing technology services that could do better without being packaged by IBM.

Conclusions

The cost side improvements are welcome, and the base-effects on modern workplace are temporary, but structural issues should see GIS being a pretty unexciting area for the indefinite future. While there are engineering teams in the GBS segment that are doing a good job and producing impressive results in analytics, this can at best offset issues in other segments, producing maybe a small overall revenue growth under normal circumstances. The issue is that we are entering a recession, and investment cycles have been at all time highs. With CAPEXing becoming a more disciplined area for clients, the direction for the company is not the best, as is the case for most of the economy. With a stock price that has been steadily creeping up, we think that there is downside already on the basis of trend analysis. More importantly, the difference between the IBM multiple and the DXC multiple isn’t so big. IBM is actually growing finally, and the company has more solid cash flows with a more powerful recurring revenue base and some more interesting and mix-relevant engineering platforms to drive organic growth including Red Hat. It also pays a dividend which DXC does not. With the DXC multiple at 8.5x and the IBM multiple at 10x we think the head-start on returns in a depression environment provided by the IBM dividend is important, and that their more solid customer base and technology platforms also deserve a premium. With selectivity in the markets being key due to the macro environment, and with the fact that there isn’t a strong relative case for DXC, we think it’s a pass.

Be the first to comment