marchmeena29

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Income-seeking equity funds is a popular topic for coverage and comments on Seeking Alpha. When I started investing in the 1970s, mutual funds like the Fidelity Balanced Fund (FBALX), which blended equities with fixed income assets was about the only choice available for investors needing more income than dividends provided but didn’t want to give up the potential for capital gains.

In these days with 000s of funds to pick from, the variety is immense. One new choice is the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (QDPL), which I covered earlier this year. Since it launched in August’21, it has both outperformed the SPDR S&P 500 ETF (SPY), but also met its goal of 4X SPY’s income generation. It’s almost time to do a follow-up article on the QDPL ETF.

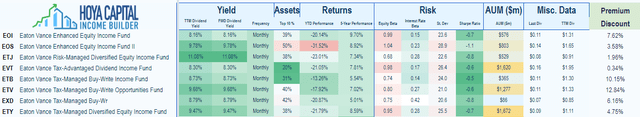

Here I chose to review the more common version of the equity/enhanced income strategy: holding stocks and writing calls on all or part of that portfolio. The Eaton Vance Enhanced Equity Income Fund (NYSE:EOI) is one of the many CEF’s Eaton Vance has in the equity/income arena. At the end, I will provide a complete listing of what they offer. After having compared EOI to its fellow Eaton Vance funds and some other popular enhanced-income ETFs, I would rate EOI a Buy compared to its competitors.

Eaton Vance Enhanced Equity Income Fund review

Seeking Alpha provides this description of the CEF:

The Fund will invest at least 80% of its total assets in common stocks. Normally, the Fund will invest in common stocks of large- and mid-capitalization issuers. The Fund expects to invest in at least 75 securities, seeking to reduce the exposure to individual stocks risks. The Fund will generally invest in common stocks on which exchange-traded call options are currently available. Under normal market conditions the Fund will seek to generate current earnings from option premiums by selling covered call options on a substantial portion of its portfolio securities. It will invest primarily in common stocks of U.S. issuers, although up to 10% of its total assets may be invested in securities of foreign issuers, including American Depositary Receipts, Global Depositary Receipts and European Depositary Receipts. The Fund will allow the sale of stock underlying a call option prior to purchasing back the call option on up to 5% of the Funds net assets, provided such sales occur no more than three days before the option buy back. Benchmark: S&P 500 TR USD. EOI started in 2004.

Source: SeekingAlpha

Eaton Vance provides this description of their CEF:

The Fund invests in a portfolio of primarily large- and midcap securities that the investment adviser believes have above-average growth and financial strength and writes call options on individual securities to generate current earnings from the option premium. The Fund pays monthly distributions to shareholders pursuant to a managed distribution plan (which I cover later).

Source: Eaton Vance

EOI has $575m in AUM and provides investors with a yield (Forward) of 8.35%. Eaton Vance charges 110bps in fees. Even it EOI is a CEF, it currently employs no leverage.

Holdings review

Having to pull data from multiple sites as none had everything I wanted to post can cause issues or confusion. Also, take dates with grain-of-salt if not Eaton Vance. Something to take note of.

morningstar.com EOI

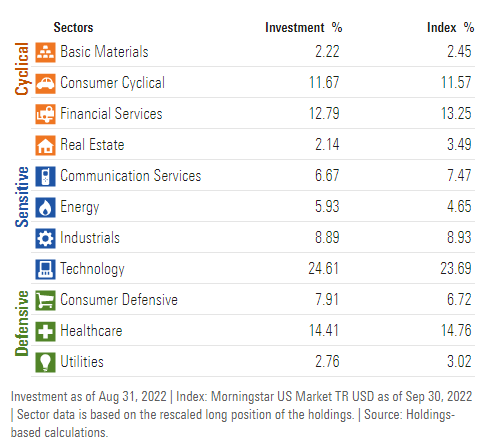

This results in the following weightings:

- Cyclical: 28.8%

- Sensitive: 46.1%

- Defensive: 25.1%

Based on my experience in trading options, the Cyclical and Sensitive holdings should generate more premiums per dollar than the Defensive stocks; though they should be the safest if the recession deepens.

morningstart.com (8/31/22); compiled by Author

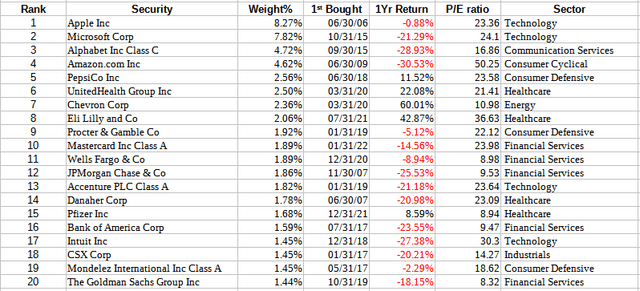

The Top 20, out of 67 equity positions, account for 55% of the portfolio.

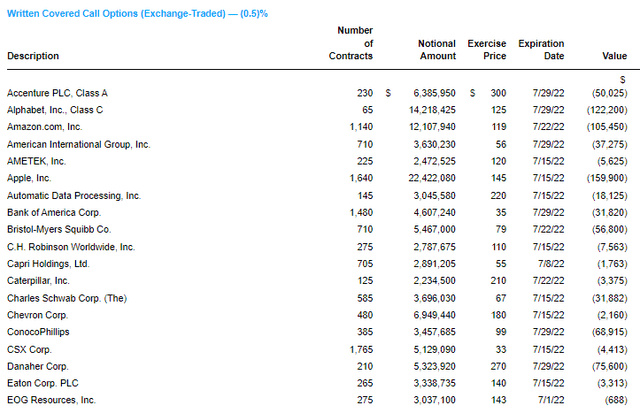

EOI only reports their option holdings quarter, so the last available is from June’22. An updated listing should be available soon.

actionsxchangerepository.fidelity.com

As of the end of June, the option statistics were:

- % of Stock Portfolio covered: 46%

- Average Days to Expiration: 20 Days

- % Out of the Money: 10.31%

Compared to March’22, while the percent covered was little changed, the days to expiration was longer (24) and the OTM percent was only 6.4%.

Distribution review

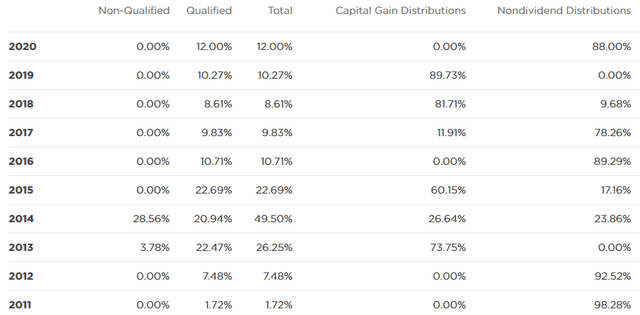

After a series of cuts following the GFC, EOI has increased the payment twice in recent years. Eaton Vance provides this payout breakdown, though the last two years were not posted.

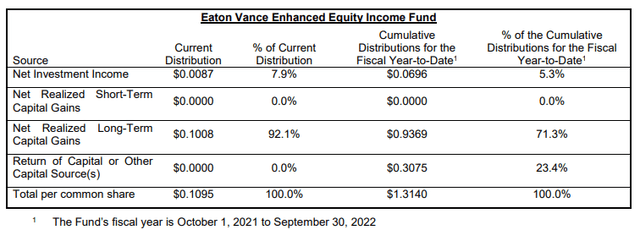

In 2021, most of the payouts were from capital gains; about 3% from what is considered ROC. I found a 2022 19-a form for EOI:

This note from the Prospectus helps define the Managed Distribution Plan EOI follows:

The Fund may distribute more than its net investment income and net realized capital gains and, therefore, a distribution may include a return of capital. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” In addition, a return of capital is treated as a nondividend distribution for tax purposes, is not subject to current tax and reduces a shareholder’s tax cost basis in fund shares.

Source: Eaton Vance

In their ROC Demystified PDF, this is one statement I thought worth posting:

The best measure of whether a fund has earned its distributions is the change in its NAV net of distributions. Regardless of how distributions are characterized, if a fund’s NAV increases, the fund earned its distribution. If not, the fund did not earn its distribution – the economic concept of return of principal.

Source: Eaton Vance

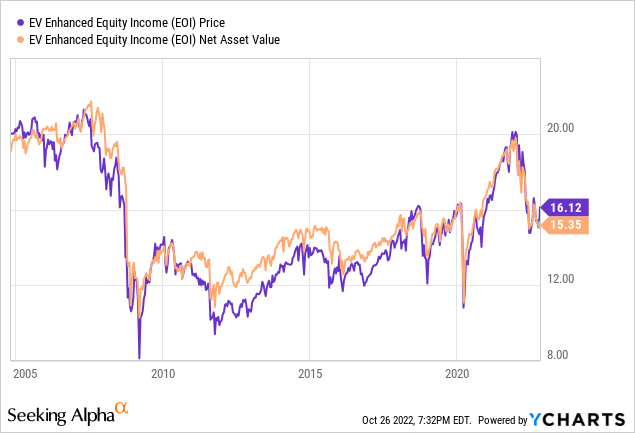

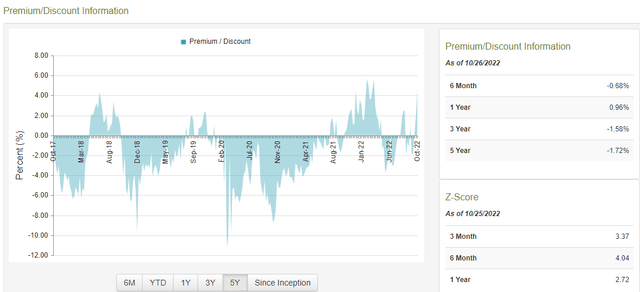

Price and NAV review

As was shown above, the current price is down close to 20% since inception; same for the NAV. This is not the best result based on Eaton Vance’s own comments about ROC payouts and changes in NAV. A recent surge in price has moved EOI from a recent 2.5% discount to a 7.6% premium as of this writing, which appears to be record high. The extreme Z-scores confirm this is not normal.

Portfolio strategy

While I do not own any of the Eaton Vance enhanced CEFs, I do have some exposure to the concept with my holdings in the JPMorgan Equity Premium Income ETF (JEPI), well covered fund on Seeking Alpha, including by me.

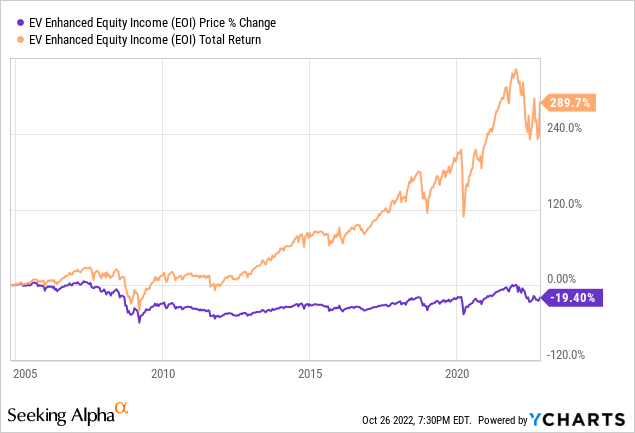

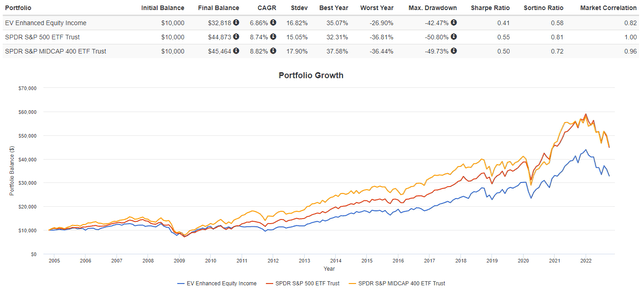

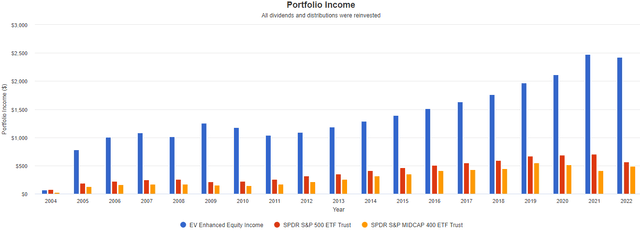

As mentioned above, my observation is few income enhanced funds manage to achieve a similar return as funds investing in the same stocks but without the option strategy attached. The next chart shows that to be the case with EOI.

But dates matter, and EOI has closed the gap over the last 5- and 10-yr periods, actually outperforming the SPDR S&P MidCap 400 ETF (MDY). Income wise, there is no contest, as one would expect.

Eaton Vance is a major player in the enhanced income-equity arena, having eight CEFs to choose from.

EOI has been the top performer over the last five years so Eaton Vance fans should definitely consider it (after the premium comes down), especially if they own a similar fund where they can claim a tax loss and reinvest those proceeds into EOI.

Be the first to comment