MF3d

Medical Properties Trust, Inc. (NYSE:MPW) is a high yielding real estate investment trust (“REIT”) whose share price has gotten pummeled in the current bear market as recession fears soar. In fact, year-to-date the REIT has lost more than half of its equity value.

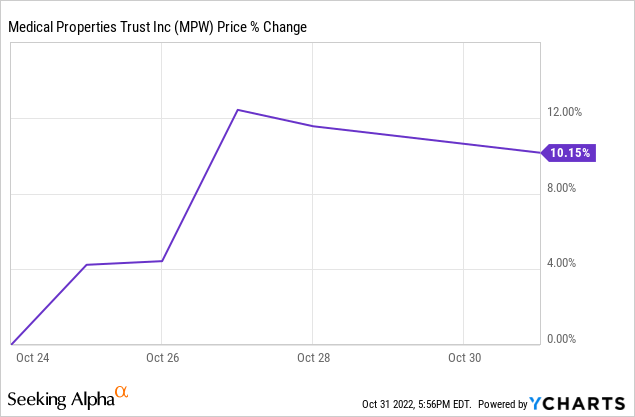

A month ago, we discussed that we have refrained from pulling the trigger on MPW shares despite them looking increasingly attractive during this epic 2022 sell-off. However, MPW recently reported its Q3 results, resulting in a bump in the share price:

In this article, we share our thoughts on the Q3 results and whether or not we think it is finally time to buy the shares.

Q3 Results

The biggest headline news from the quarter was that MPW’s continued solid performance prompted management to hike the lower end of its full year FFO per share guidance by two cents ($1.80-$1.82 per share instead of its previous range of $1.78-$1.82). On top of that, its normalized FFO per share increased by 2.3% year-over-year, which is pretty good considering that the REIT currently offers a 10% dividend yield and its stock price has gotten absolutely pummeled this year. Part of the reason for the growth in the FFO per share was due to lower interest expense, demonstrating prudent balance sheet management by the company.

That said, MPW’s year-over-year FFO per share growth is actually pretty remarkable given that MPW sold assets over the past year and used the proceeds largely to pay down debt instead of using them to buy back shares or grow the portfolio. Such moves typically reduce FFO per share, but MPW managed to grow enough through organic contractual rent bumps and other moves to still grow at a decent clip in spite of this headwind to FFO per share.

On top of that, the company expects between four and five percent rent growth in 2023 due to strong inflationary tailwinds to their CPI-linked rent bumps. Given the conservative structures of triple net lease real estate contracts, this is exceptional organic rent growth.

Perhaps the most positive development from the Q3 report was that its largest tenant – and the most popular target of MPW shorts – saw its financial condition improve. Steward’s operating costs, demand volumes, and reimbursement rates are all trending in the right direction, leading it to announce that it expects to generate considerable free cash flow moving forward. As a result, it should no longer be dependent on financial support from MPW or other lenders.

As management confirmed on the earnings call:

On a weighted average basis, Steward’s EBITDARM coverage in these markets has ranged from 2.7 times for the trailing 12 months ended June 30, 2022 to in excess of three times preliminarily for a stand-alone August. With these coverages Steward appears well able to continue paying MPT rent.

Based on these statements, while Steward is not necessarily out of the woods yet, they seem to be positioned to pay rent for the foreseeable future, which is ultimately what matters most for MPW. MPW also confirmed that Pipeline’s rent should continue to be paid on those hospitals that MPW owns, stating:

Earlier this month Pipeline announced that it has filed for a petition for reorganization relief under Chapter 11 protection. Many of the financial challenges for the Pipeline organization involved their hospitals in Chicago. As a reminder MPT does not own or lease those hospitals to Pipeline. We own Pipeline’s four Los Angeles hospitals. We remain confident in Pipeline as an operator, especially considering the value of our hospital properties that serve a vital need in their respective LA communities. We understand the decision to restructure as it will provide the flexibility and implement sustainable strategies for the corporation going forward.

We fully expect that our rents will continue to be paid and our hospitals will continue to serve their respective communities during the duration of the bankruptcy process.

Is It Time To Buy MPW Stock?

MPW is not recession proof as hospitals do suffer a little bit during economic downturns due to a decline in elective operations and increased incentive to search for cheaper alternatives to hospital care. This problem is compounded further by the fact that some of its operators such as Steward are struggling financially. If they are pushed into bankruptcy, MPW could be forced into renegotiating its lease terms, leading to a decline in cash flow or even in a worst case scenario, a decline in its occupancy. On top of that, MPW’s balance sheet is not investment grade as its credit rating from S&P is BB+ (Stable).

That said, management has fortified its balance sheet recently by selling some of its riskier properties at pretty good valuations and using proceeds to pay down debt. With a current ratio of 5.8x and EBITDA interest coverage of 3.96x, it is in excellent shape to meet its financial obligations.

Furthermore, management recently announced a substantial $500 million stock buyback program, which is over 7% of the current market capitalization. On top of that, management appears to be adopting an increasingly defensive posture in order to capitalize on the discounted stock price and improve the strength of its balance sheet, which we think is very prudent. As they stated on the earnings call:

For the foreseeable future, any additional acquisitions will require compelling economics, limited use of liquidity and strategic support of opportunities presented to us by our strong operator relationships. Other evident uses may include reduction of debt and repurchase of our very attractively priced common shares. But even without use of capital for new investments, our inflation-linked lease revenue should result in substantial internal and highly accretive rent growth, especially given recent global inflation.

Given that analysts continue to forecast low single digit (2.3%) annualized dividend per share growth through 2026 and AFFO per share is expected to only decline slightly over that span (a -0.2% CAGR through 2026), MPW does not look like it is about to fall off a cliff. Meanwhile, the stock remains heavily undervalued relative to its long-term averages:

|

Metric |

MPW |

|

Dividend Yield |

10.0% |

|

EV/EBITDA |

11.93x |

|

EV/EBITDA (5-Yr Avg) |

14.48x |

|

P/NAV |

0.62x |

|

P/NAV (5-Yr Avg) |

1.15x |

|

P/FFO |

6.41x |

|

P/FFO (5-Yr Avg) |

11.22x |

|

P/AFFO |

8.10x |

|

P/AFFO (5-Yr Avg) |

13.87x |

As a result, even with no growth and no multiple expansion, MPW is positioned to generate 10% annualized total returns moving forward from its dividend alone while likely also strengthening its balance sheet by using retained cash flow to pay down debt. However, unless interest rates continue to soar higher and remain in a higher range for an extended period of time, we expect MPW to see its multiples expand in the future. As a result, we think that MPW is very well-positioned to deliver high teens annualized total returns in the coming years even without much bottom line growth.

Investor Takeaway

While MPW is not a low risk stock and we do not think it is prudent to take on a large position unless you have a lot of risk tolerance, we do think MPW warrants a speculative Strong Buy rating right now. While we are unlikely to add it to our Core Portfolio at High Yield Investor in the near term given that there are other opportunities that we like more on a risk-adjusted basis, it could be a good fit for REIT-focused portfolios or more aggressive portfolios.

Be the first to comment