AnthonyRosenberg

Thesis

Investors in retailers continued to be hammered into October as multitudinous headwinds hampered their CQ3 reporting season. In addition, a weaker consumer outlook and elevated inventories further compressed margins, weighing on their ability to execute during the holiday season.

Leading retailer V.F. Corporation (NYSE:VFC) was certainly not immune to these near-term challenges. Despite telegraphing a confident FY27 model (discussed in our previous article), the stock underperformed against the SPDR S&P 500 ETF (SPY), as VFC’s YTD total return collapsed to more than -60%.

As a result, the rapid collapse from VFC’s December highs saw it digest more than 10 years of gains at its recent October lows, likely sending even the most ardent investors fleeing to the hills to protect their gains/capital.

Our analysis indicates that VFC’s valuation is at its 10Y lows, with a dividend strategy well covered by its adjusted net earnings. Hence, we believe it doesn’t make sense for investors to throw in the towel now if you did not unload some exposure months ago.

Given the rapid selloff, the opportunity for a significant mean-reversion setup is looking increasingly likely, even though we have yet to glean a validated bullish reversal on VFC’s long-term chart.

However, we discuss why VFC long-term buyers would likely defend the current levels vigorously and hold it decisively to stanch further substantial selling downside.

Maintain Buy.

VFC: Revised Its FY23 Guidance Given Macro Headwinds

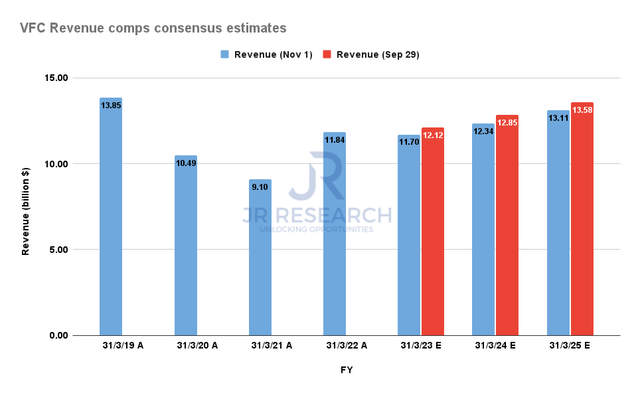

VFC Revenue comps consensus estimates (S&P Cap IQ)

VFC’s operating performance has continued to feel the impact of elevated inventory, impacting the sell-through momentum of its retailers/wholesalers. Also, macro headwinds impacting its value segment have led to weaker sales momentum, which could further impact its growth in FQ3.

Coupled with elevated inventory and a coming recession, management needed to reflect these challenges in its forward guidance. As a result, the consensus estimates (neutral) have also been revised through FY25 from their previous projections. Hence, Street analysts expect VFC’s growth recovery to be impacted markedly, as they also revised their estimates across the industry.

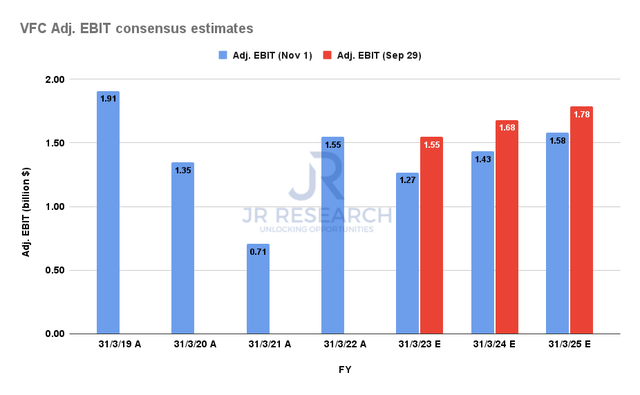

VFC Adjusted EBIT comps consensus estimates (S&P Cap IQ)

Accordingly, given its fixed costs leverage/deleverage, the company adjusted its operating profits guidance. VFC’s adjusted operating margins guidance has been revised to 11% (down from 12% previously). The consensus estimates lowered the bar further, seeing an adjusted EBIT margin of 10.8% in FY23.

In addition, its projections have also been revised through FY25, reflecting an increasingly pessimistic outlook of a structural recovery in the medium term.

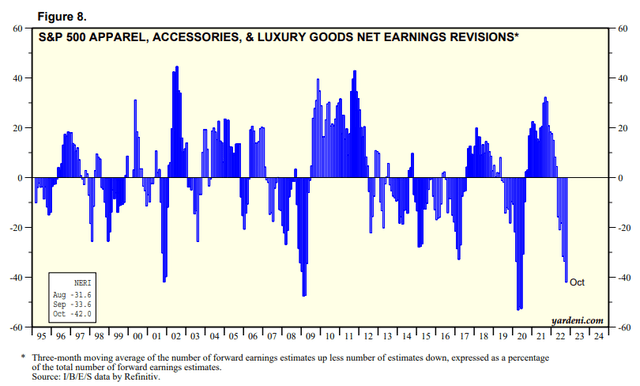

S&P 500 Apparel, Accessories & Luxury Goods net earnings revisions (Yardeni Research, Refinitiv)

Our analysis indicates that Street analysts have turned so pessimistic that the extent of their net earnings revisions for VFC and its industry peers through October reached levels seen at the bottom of the previous downcycles.

As such, unless things take another significant tumble from the current levels, investors could likely be looking at VFC’s long-term bottom at the current levels.

VFC communicated two critical factors that undergird the assumptions in its outlook. It highlighted:

No additional significant COVID-19-related lockdowns in any key commercial or production regions. No significant worsening in global inflation rates and consumer sentiment – VFC

We postulate that the company’s guidance had likely assumed the worst of the COVID lockdowns in China. While Chinese President Xi Jinping’s third term has likely put any idea of near-term easing of zero-COVID restrictions to rest, they are not likely to get worse than anticipated.

Notwithstanding, consumer sentiments could weaken further as a global recession takes shape. We believe Street analysts have revised their projections markedly through FY25, seeing structural impacts to the medium-term recovery in VFC and its peers.

In other words, we believe the market had already anticipated these headwinds, and the Street has already factored them in, given the pessimism observed in the extent of their net earnings revisions.

Is VFC Stock A Buy, Sell, Or Hold?

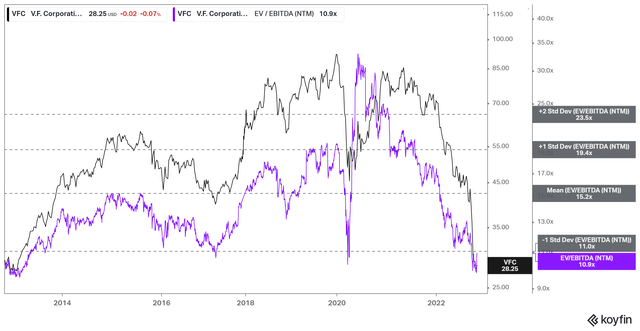

VFC NTM EBITDA multiples valuation trend (koyfin)

VFC last traded at an NTM EBITDA multiple of 10.9x, well below its 10Y mean of 15.2x and in line with its 10Y lows. So, VFC seems undervalued relative to its historical averages.

Its NTM dividend yield of 7.41% is at the highest levels we have seen over the past ten years. Management juiced it further by raising its quarterly dividend to $0.51 recently, accentuating its confidence in its earnings sustainability.

Hence, VFC’s valuation suggests it could be near (or already at) peak pessimism, as the market forced weak holders to capitulate.

But what does the price action say?

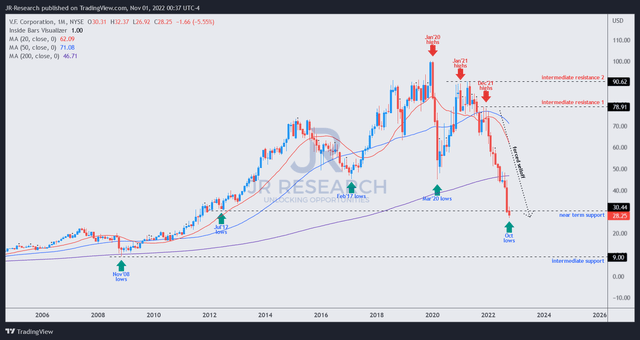

VFC price chart (monthly) (TradingView)

There’s no question that VFC needs to hold its near-term support, in line with the lows last seen in July 2012, going back more than 10 years. Yes, the selloff from its December highs took out more than 10 years of price gains in just ten months.

But, such a rapid capitulation move is emblematic of the selloff seen in March 2020 as the market also forced holders to flee. What we are short of at the current levels is a validated bullish reversal (which could take a few months to form).

Furthermore, we gleaned that the current levels are critical for long-term buyers to hold, as the “no man’s land” toward its intermediate support (2008 financial crisis lows) is the next critical support zone.

Coupled with well-battered valuations, highly pessimistic earnings revisions, and a Fed Fund rate (FFR) that could potentially peak in Q1/early Q2’23, the setup for a significant mean-reversion move looks favorable.

Maintain Buy. However, we urge investors to expect further near-term downside volatility as the market could attempt to force more holders to give up.

Be the first to comment