poba

Investment Summary

Dr. Reddy’s Laboratories (NYSE:RDY) had large revenue growth in 2021 due to sales of its Sputnik COVID vaccine product offering. Over a million doses were administered in India. Now, after cancellations as well as a drop in demand for the vaccine internationally, RDY needs to refocus on new generics in order to keep pace with revenue targets. Shareholders should be excited but also wary of the success of these new generic launches and acquisitions.

Company Recent Financial News

RDY’s involvement in the Sputnik COVID-19 vaccine in 2021 has boosted EPS, but now, RDY is trying to replace that revenue this year with it’s other product segments. Recent profits shows a mixed offering. Gross profit margins rose to 59% in the latest quarter, compared with 53% from last year. Sales in the company’s key North American market increased 48% this past quarter. 12% growth in consolidated net profit was reported in Q2 2022 compared to 2021, and revenues improved by 9%.

Drilling down, their Global Generics business posted revenue that is +18%. Pharmaceutical Services and Active Ingredients revenue was however down 23%, and ‘Others’ revenue was down 63%. In the Global Generics segment, North America recorded revenue growth of 48%. The emerging Markets division saw a decrease of 6% since last year. Profit before tax was up 27% in Q2 from last year as well.

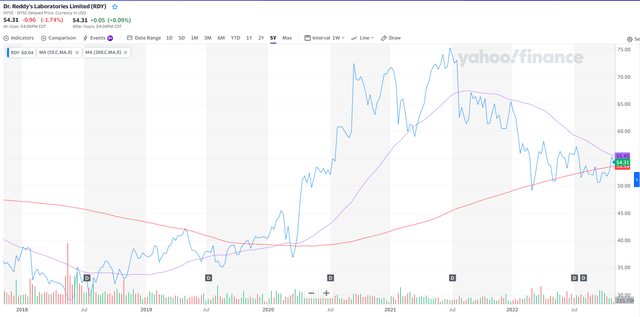

Long Term Share Price Performance

Based on the 5 year stock performance, RDY has generated a YTD gain of 55.27%. By benchmarking this performance against the S&P500, it has performed only slightly better than the S&P500, which has only generated a YTD gain of 50.39%.

RDY Moving Averages, 50 vs 200 (Yahoo! Finance)

RDY stock price has dropped below MA50 on 26, June 2021 and has stayed below it ever since. However, it is looking to cross the MA50 line if there is further upside to the price. Historically when the price drops below the MA200 line, there is a strong rebound shortly. When the stock price first drops below MA200 in February of 2022, there was still a rebound rally although it was not at the levels of 2020. This was partially due to negative macroeconomic headwinds, recession fears, rising interest rates and supply chain disruption. Currently, the stock price is nearing the MA200 line and if there is any retracement, it could be an opportunity to start a position once it dips below the MA200 line.

Currently, RDY is trading at a forward P/E of 20+ which is slightly higher than the average forward PE of the healthcare industry of 15.1. However, this is warranted as the company has been paying a consistent dividend with a payout ratio of at least 15%. The company has also been growing their EPS consistently and even with the recent poor outlook of 2021 and 2022, their EPS and revenue did not miss outside of normal estimates. Hence, this would warrant a higher forward P/E ratio compared to the average healthcare industry.

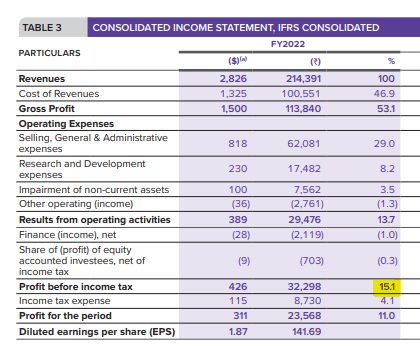

Financial Insights

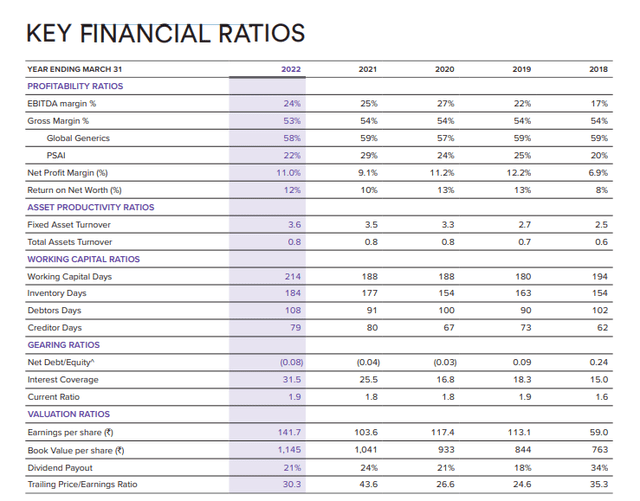

The EBITDA and profit margin has increased from 2018 while gross margin has maintained around the same for the past 5 years. This is a mixed sign as it shows the resilience of management and their ability to maintain cost, given the current supply chain and inflation headwinds that most company are facing, but also possible headwinds and a reliance on new products replacing older ones. Asset productivity has increased over the past 5 years, which shows that management is efficiently using their assets to generate return. Current ratio has increased which shows that there is sufficient liquidity in the balance sheet for management to repay all of their current liabilities if they choose to do so. Interest coverage ratio has also increased which means that management has reduced their debt leverage.

EPS has increased steadily for the past 5 years, and overall, the company has shown some improvement in the past 5 years. Assuming a market risk premium to be 5.60%, the equity beta of RDY is 0.22. CAPM = 4.01% + (5.60% x 0.22) = 5.24%. Based on their annual report, the interest expense is $644m and the total debt borrowings is $21,711m. Cost of debt was 2.97%, and the equity financing ratio (E/V) was 0.75. The debt financing ratio (D/V) was 0.25.

RDY Income Statement, Consolidated (SEC Filing)

Dividend payout ratio has been 15%-25%, which is the average dividend payout ratio in the past 5 years. Although it has never reached a bottom of 15%, the outlook of the current macro economy is questionable, and it would be more prudent to forecast a lower dividend payout ratio in the worst case scenario.

RDY cash on hand for 2022 was $0.61B.

Revenue Insights and Near Term Price Takeaway

RDY continues its push into the generics market in both its acquisitions as well as its licensing deals and new product launches. Most recently, RDY’s first-to-launch generic versions of extended release antihistamines as well as sorafenib for the treatment of kidney and liver cancers has shown that RDY is pushing towards a broad lineup of generics. It has also increased it’s pace of acquisitions and licenses, with Biorphen and related hypotension drugs as well as Lumify white labels for the treatment of eye redness. Off-loading it’s non-generic portfolio continues, with I/ONTAK/e7777 coming to mind, an oncology drug focusing on CTCL and potentially PTCL that was a reformulation of a previously approved drug.

Fexofenadine HCI and Pseuudoephedrine HCI extended release antihistamines are a generic drug replacement for Allegra-D 24 hr, which had U.S. retail sales of approximately $45 million as of May 2022. Sorafenib tablets are a generic replacement for Nexavar, which had over $750 million in sales in 2020. Cysteine hydrochloride injections are generics for Biorphen and Rezipres injections, with a total addressable market of $174 million in 2022. Brimonidine Tartrate ophthalmic solution, a generic to replace Lumify OTC eyedrops, has a total addressable market of $130 million in 2022. I/ONTAK/e7777 represents a total of $100+ million in one time payments once approved, with revenue share afterwards of an immediately addressable market of $330 million +/-.

All told, with several acquisitions and new generic drugs coming online, RDY is hoping to capture part of $634 million in addressable markets as well as part of ~$800 million in ongoing sales from current brand name drug sales from the above generic launches. These represent the largest product launches that aren’t hampered by legal action or FDA approval delays, and whose sales should help boost sales across segments to help meet the Sputnik vaccine shortfalls. Incorporating relatively conservative estimates of these sales of 10-20% in the near term as well as applying a margin of safety of 10%, the fair value of RDY would be around $49-$51 per share, in comparison to the current stock price of ~$54. Hence, RDY seems to be slightly overvalued at the moment. To fully capture income from these new generics, RDY needs at least 3-4 quarters to ramp up. Therefore, a higher than $54 share price is justified after sales are reflected of these new generics, assuming RDY is able to capture 40%+ of their addressable market and sales targets.

Potential Outside Factors and Downside Risks

Fluctuation of Commodity Price

Raw materials that are purchased in developing / making the drugs can fluctuate immensely. The 2022 commodity pricing cycle has shown huge swings compared to pre-COVID years. With the recent Ukraine-Russia war and recession risks, material prices have increased quite significantly since 2021. This would affect the gross margin and bottom line net income.

Higher interest rates impacting dividend yield attractiveness

RDY, like many stocks offering dividends, will see some negative outflows due to higher interest rates being offered across the globe. Although some Fed bank presidents have indicated smaller interest rate hikes in 2023, the consensus of the marketplace has been that 5% and higher will be the new benchmark for the Fed chair going forward unless major inflation indicators show a downward trend.

Recalls and negative public relations

RDY seems to be more prone to recalls and negative press compared to its US and European equivalents. Their 2019 and 2020 recalls of Ranitidine, Nitrofurantoin, and Aripiprazole products due to contamination and manufacturing issues seems to point towards shortfalls in monitoring. Although manufacturing issues can be quite common in major pharmaceutical companies, public scrutiny of these recent recalls may impact adoption of their new generic product launches for the near term in the US and EU markets.

Conclusion

Although RDY has shown a strong push towards marketing and launching their generics lines of product offerings, it is still yet to be seen if they can recapture the lost revenue from their Sputnik COVID vaccine offering, and subsequently, it’s current share price of ~$54 seems to be in line with expectations. New revenue streams are not seasoned enough to show true income potential, so RDY remains a wait and see as well as a long term hold.

Be the first to comment