SHansche/iStock via Getty Images

ZIM Integrated Shipping Services (NYSE:ZIM) became a hot stock over the last year due to the large dividend from a booming seaborne transportation business. With the massive cut to financial targets in Q4’22, investors should expect a big dividend cut ahead. My investment thesis is somewhat Neutral on the stock with ZIM already dipping some 70% from the yearly high and the company having a solid balance sheet.

Back To Normal

The biggest frustration when reading the Q3’22 earnings report was the lack of details on the new normal financials. ZIM reported Q3 adjusted EBITDA of $1.93 billion with impressive net income of $1.17 billion, though both numbers were down YoY.

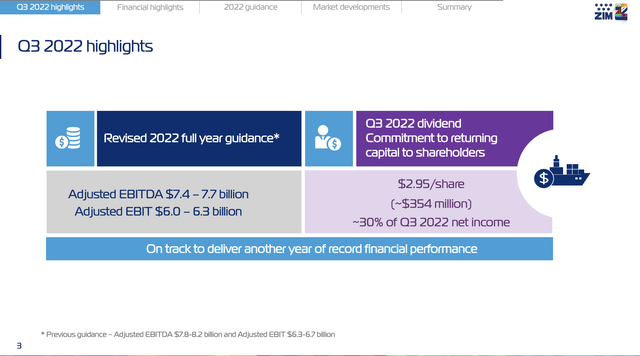

The global container shipping company guided to full-year 2022 numbers of adjusted EBITDA of $7.4 to $7.7 billion with adjusted EBIT of $6.0 to $6.3 billion. What the company didn’t actually provide is the specific details on the Q4 numbers.

Source: ZIM Q3’22 presentation

ZIM has generated a whopping $6.6 billion in adjusted EBITDA for the first 9M of 2022. The guidance suggests Q4’22 adjusted EBITDA dips to only $0.8 to $1.1 billion. In essence, the guidance is for an ~50% sequential dip in adjusted EBITDA.

The company was easily producing $2.0 billion in quarterly EBITDA and now the number has collapsed. Adjusted EBIT for Q4 will only reach $0.5 to $0.8 billion in a massive dip from the $1.6 billion in Q3’22.

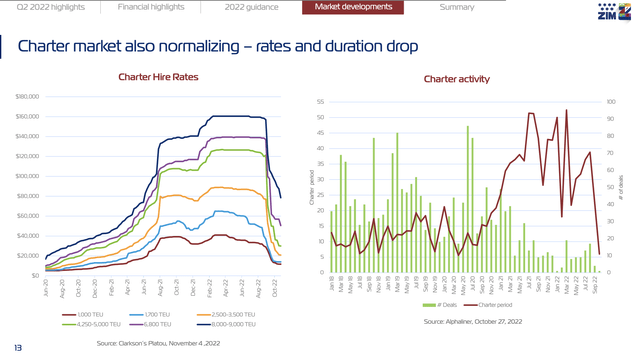

Global container charter rates are all collapsing to or below pre-covid levels. The amount of charter deals is below normal levels from pre-covid back in 2018/19.

Source: ZIM Q3’22 presentation

Back in 2019, ZIM produced whopping adjusted EBITDA of only $386 million with minimal adjusted EBIT of $149 million, but both numbers grew over 2018 levels. The container shipping index remains very dynamic and volatile and the current period appears quickly returning to the past levels.

Dividend Cuts Ahead

ZIM announced a Q3 dividend of $2.95 per share based on 30% of quarterly net income. The company will payout $354 million and the annualized dividend yield would be an impressive 43%, if only the dividend payout remained the same each quarter.

The guidance for a collapse in EBIT (operating income) will lead to another massive cut to the dividend for Q4. The Q1’22 and Q2’22 dividend payouts averaged $3.80 per share.

At the low end with operating income of only $450 million, ZIM would see the net income dip to only ~$300 million. Under such a scenario, a 30% dividend payout only amounts to $90 million in dividends and just a $0.75 dividend based on 120 million shares outstanding. Now, ZIM has a policy to pay the cumulative annual dividend at a rate of 30-50% of annual net income providing the possibility for a catchup payment for Q4.

Typical of markets with spiking profits, the normal path is towards overbuilding supply leading to a large supply/demand imbalance. On the Q3’22 earnings call, CFO Xavier Destriau highlighted this issue facing ZIM in the container market:

The supply/demand balance forecast shown here reflects lower demand growth assumptions for 2022 and 2023 in light of the worsening macroeconomic environment. With the order book to fleet ratio current at approximately 27%, of which 2.3 million TEUs are scheduled for delivery in 2023 and another 4.7 million TEUs scheduled for delivery. The following years supply growth is expected to be considerably greater versus demand growth than previously projected. The combination of weaker demand, falling freight risk and risk of oversupply creates a challenging business environment for container shipping.

Under such a scenario, the market has to wonder how many trips will remain profitable. Analysts tried to dig into whether the company was able facing unprofitable charter rates and if the adjusted EBITDA profit for Q4 was tilted towards October suggesting very limited profits in December.

Takeaway

The key investor takeaway is that ZIM is unlikely to pay anymore excessive dividends going forward. The container shipping company faces a very difficult 2023 where the excesses of the last couple of years turn into headwinds and huge negatives.

Investors interested in the stock should watch the story develop from the sidelines knowing the market excesses caused by covid disruptions are unlikely to return and the normalized numbers back form 2019 weren’t very impressive.

Be the first to comment