jetcityimage

Every year, Amazon (NASDAQ:AMZN) invests heavily in Amazon Prime Video to capitalize on the secular growth trends benefitting the video streaming industry, as well as to enhance the appeal of its flagship subscription service, Amazon Prime. Across the industry, competing streaming providers have also been incrementally investing in content and adjusting their business models to improve their resiliency. Amazon Prime Video not only benefits from being part of a platform-wide network effect, but also offers opportunities to further enhance the network effect.

Integration with other Prime benefits

Amazon offers Prime Video through two different subscription options, either through a Prime Video subscription for $8.99/month, or through a bundled Amazon Prime subscription for $14.99/month, combining the streaming service with various other platform-wide benefits, chiefly its fast & free delivery services. It is worthwhile noting that Amazon does not offer a separate subscription service for shopping benefits on their own. Therefore, consumers that want to take advantage of Amazon’s speedy and cost-effective delivery services (along with other shopping benefits) have to subscribe to the all-inclusive subscription service for $14.99/month. This serves as a key strategy Amazon uses to encourage content consumption on Amazon Prime Video by bundling it with attractive shopping and delivery perks.

Amazon raised the Amazon Prime subscription fee for new subscribers in February 2022, and for existing subscribers in March, from $12.99/month to $14.99/ month. Despite the price hike (and economic re-openings post-pandemic), CFO Brian Olsavsky proclaimed on the Q1 2022 earnings call; “we continue to see consistently high member renewal rates. We also added millions more new Prime members during the quarter”. Furthermore, while executives did not offer insight into Prime subscriber gains/losses during the second quarter of the year, Olsavsky did state on the Q2 earnings call; “on the Prime fee increase earlier in the year, we’re happy with the results we’re seeing in the Prime program. Prime membership and retention is still strong”. For context, Netflix (NFLX) had reported subscriber losses over the first two quarters of the year, following its own price hike in January to $9.99/month (Basic plan without ads). The relative resiliency in Amazon’s overall Prime subscribers is indicative of the stickiness of its service thanks to its ability to bundle multiple services together.

That being said, while executives have been proclaiming Prime membership resiliency on earnings calls, it is not necessarily recession-proof. According to an Ofcom study, 590,000 UK households (around 5% of total UK subscribers) cancelled their subscriptions in the second quarter of 2022 amid the cost-of-living crisis taking hold in the country. Though it is worth pointing out that “almost three quarters of customers said they anticipated they would resubscribe” at some point in the future.

Nevertheless, Amazon’s strategy of integrating Prime Video with other services and shopping perks makes the streaming service stickier than most competitors’ services. The e-commerce giant has been spending billions over the last decade on augmenting the services provided as part of Prime memberships to continuously enhance the stickiness of the platform. The impending recession will be the first real test of how successfully the company has been able to deeply imbed Prime services into consumers’ everyday lives.

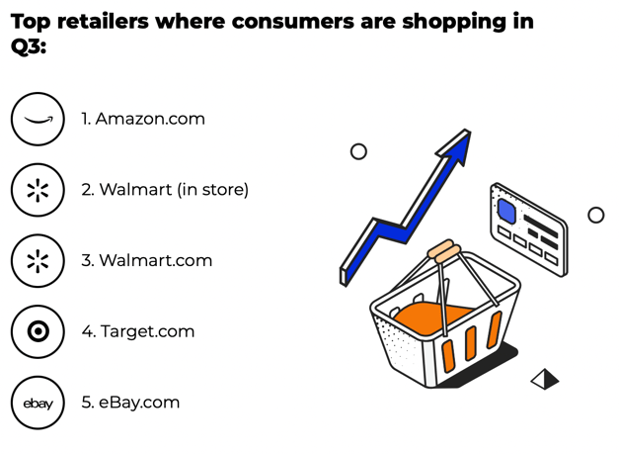

It goes without saying that recessions induce consumers to seek cost-saving opportunities and increasingly pursue discounts and special offers when making purchases. Amazon is well-known for its rigorously competitive pricing strategies (particularly for its Amazon-branded products) as part of its resolute focus on optimizing customer satisfaction, which could indeed enhance its resiliency against recessions as consumers keep returning to Amazon to find low-cost goods. In fact, according to a JungleScout study, Amazon was the most popular shopping destination in the US relative to other key retailers in Q3 2022.

JungleScout Consumer Trends Report Q3 2022

Furthermore, Prime memberships also entail grocery shopping benefits, including free same-day delivery for orders over $35, and 20% discounts on essential items at Amazon Fresh stores. These essential, cost-effective services make the Prime subscription service stickier, especially as they become deeply imbedded into consumers’ routine lives, making Prime harder to walk away from.

As a result, Amazon Prime Video benefits from being bundled with other sticky services that induce high member renewal rates, thereby encouraging more content consumption on Prime Video than other streaming services. Video-streaming subscription models generally are susceptible to fluctuating demand as the absence of switching costs enables “users to pick and reject subscriptions depending on changes in programs, needs, or circumstances”. That being said, Amazon Prime Video subscription should prove less cyclical than other single-service video-streaming platforms like Netflix, which are more susceptible to consumers switching between platforms driven by periodical content consumption trends based on new launches of shows and movies.

Cross-selling strategies

Last year, Amazon won the bid to exclusively stream NFL Thursday Night Football games for 11 years. On the Q3 2022 earnings call, CFO Olsavsky proclaimed:

NFL Thursday Night Football also premiered in September, averaging more than 15 million viewers during its first broadcast, and driving the three biggest hours of US Prime sign-ups in the history of Amazon.

Amazon’s new streaming rights have not only induced increased Prime subscriptions and engagement with Prime Video, but also opened the doors for new cross-selling strategies. Moreover, Amazon is offering Prime subscribers exclusive offers on NFL team merchandise, as well as on its own line of home entertainment devices, including Echo Studio and Echo smart speakers. This serves as a wise strategy to encourage Prime Video subscribers to upgrade to the multi-service Prime membership for $14.99/month to boost subscription revenue. Furthermore, the strategy also enables Amazon to embed its own line of products into the NFL viewing experience, thereby advancing hardware sales revenue by inducing an Amazon-powered ecosystem around NFL streaming.

While current cross-selling strategies are primarily focused on Amazon’s own line of products, exclusive streaming rights could also create opportunities to cross-sell third-party sellers’ items. Offering third-party merchants the ability to cross-sell relevant products with popular, exclusive streaming content would enhance the appeal of selling on the Amazon marketplace, and more specifically joining the Prime network. It would allow Amazon to better compete against rivals like Shopify (SHOP) in terms of winning business from digital merchants. More third-party sellers on the Amazon platform would translate to a wider range of products available, conducive to attracting more consumers to Amazon and becoming Prime members, thereby re-enforcing the network effect.

Amazon could also replicate this strategy abroad to spur market penetration efforts and boost international revenue growth. It is worth noting that Amazon had bid for the five-year streaming rights of the Indian Premier League alongside competitors Netflix, Disney and Facebook, but pulled out in June 2022. Nonetheless, securing exclusive streaming rights is likely to be a key growth strategy for the e-commerce platform going forward.

Off-site data sources could enhance content investment decisions

Aside from Prime Video, Amazon also owns video content database IMDb and the ad-supported video-streaming service FreeVee. IMDb offers information on a wide range of digital video content, including those of competitor streaming services like Netflix and Disney. IMDb averages over 500 million monthly site visitors, and grants Amazon insights into which pieces of content are trending and what sort of information people are most interested to know about, in addition to the publicly-available audience ratings for various movies and shows across the video-streaming industry. This makes IMDB a valuable data source to better inform content investment decisions in Amazon’s in-house production unit, and augments the chances of delivering hit content for subscribers. Content consumption trends data from its Advertising-Based Video on Demand (AVOD) service, FreeVee, could further enhance Amazon’s ability to deliver captivating content that would augment the appeal of its Subscription Video On Demand (SVOD) service, Amazon Prime Video.

Therefore, Amazon’s offsite data sources offer competitive advantages over other streaming service providers to deliver alluring content that augments the value of Prime membership.

Summary

The ability to bundle Amazon Prime Video with other Prime benefits offers a distinctive competitive advantage, making it stickier than other streaming services. Amazon’s exclusive NFL streaming rights and pursuit of other similar deals opens doors for lucrative cross-selling opportunities to drive revenue growth and re-enforce the network effect. Offsite data sources like IMDb and FreeVee should enhance Amazon’s ability to deliver hit content and augment the value proposition of Prime membership. Amazon’s judicious strategies and competitive advantages position the firm well to continue driving subscription revenue growth going forward.

That being said, Amazon is a large tech giant with multiple business divisions and revenue sources. Any buying and selling decisions should take into consideration performances of all business divisions together. As this article solely focuses on the Prime Video segment, a neutral ‘hold’ rating will be assigned to the stock.

Be the first to comment