Davi Correa/iStock Editorial via Getty Images

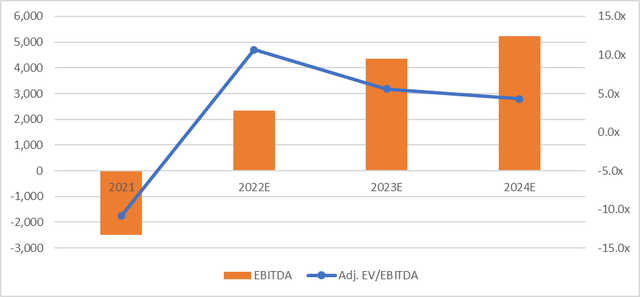

GOL Linhas Aereas Inteligentes SA (NYSE:GOL) continues on its post-COVID recovery path, with Q3 EBITDA and cash generation improving significantly YoY and the updated guidance still calling for positive EBITDA generation this year. While profitability missed consensus estimates this time around, the increasingly rational industry dynamic is a key positive, allowing airlines to pass through higher costs into tariffs. Any cutbacks in capacity could weigh on the near-term financial results, though the positive outlook for unit revenue management, fleet transformation, and hedging strategies should provide some offset. Jet fuel prices also look to have peaked and should moderate over time, further enhancing airlines’ pricing power in the mid to long term. As GOL recovers profitability towards pre-COVID levels, the stock offers significant re-rating potential from the current ~4x FY24 EBITDA valuation.

JP Research

Silver Linings from GOL’s Quarter

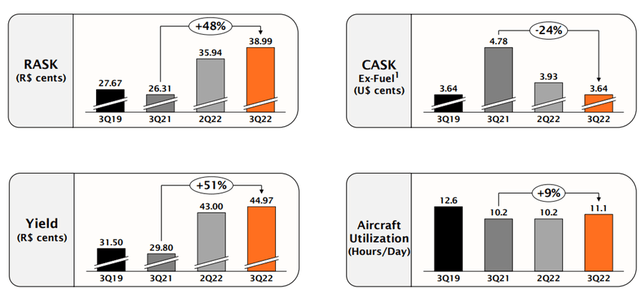

GOL’s R$4.0bn in net revenues for Q3 more than doubled its prior year’s results as a healthy pricing and demand environment in the Brazilian airline industry prevailed. The yield performance was particularly strong at R$0.45, while RASK (i.e., the unit revenue of ‘revenue per available seat kilometer’) came in +48% YoY at R$0.39. By comparison, the airline’s CASK (‘cost per available seat kilometer’) ended the quarter at R$0.386. As a result, GOL’s reported EBIT was positive at R$40.7m, or a 1.0% EBIT margin, even if it fell just short of consensus estimates. On an adjusted basis (excluding non-recurring expenses), EBIT would have been closer to R$R$262m, implying an adj. margin of 6.5%.

GOL Linhas Aereas Inteligentes SA

While bears will point to the net loss for this quarter, the influence of non-cash items such as depreciation and monetary variations was also greater than expected, clouding the underlying earnings power. Importantly, GOL still saw positive free cash flow generation at R$94m for the quarter, along with cash flow from operations of R$465m. The yield improvement and the strong cash generation validate the case for a more rational competitive environment for Brazilian airlines, in my view. Having seen industry players outline plans to adjust capacity and prices recently, the initial results are already flowing through to the P&L. Continued industry discipline and a more consolidated industry post-COVID bode well for GOL’s earnings growth outlook.

Guidance Revisions Point to More Industry Discipline

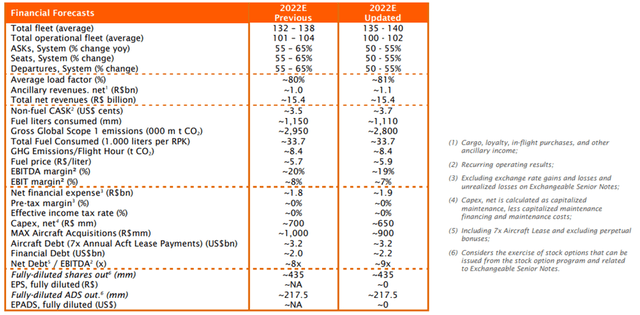

GOL revised downward some of its guidance assumptions for the full year, most notably its capacity outlook, which now stands at a +50-55% YoY increase in ASK (down from the previous guidance of 55-65%). This still implies a load factor of 81%, with the mid-point of the guidance range also implying a Q4 RASK >40% above pre-COVID levels. While cutting capacity might not seem accretive at first glance, it should help recover profitability and better aligns supply with demand. More broadly, GOL’s decision is in line with its industry peers, reinforcing the case for a more rational industry heading into potential macro challenges ahead.

GOL Linhas Aereas Inteligentes SA

Meanwhile, revenue is guided to be R$15.4bn for the year (unchanged from the previous guidance). The upward revision to the fuel price assumption (R$5.9/liter) also means the adj EBIT margin is now set to end the year at 7.0% (excluding non-recurring maintenance expenses). There could be upside to these numbers, though, with management noting promising booking numbers for Q4 ahead of a continued recovery in corporate travel as well as a healthy pricing environment. 2023 should also see tailwinds from a sequential capacity increase, which should offset any unforeseen FX or oil price fluctuations ahead.

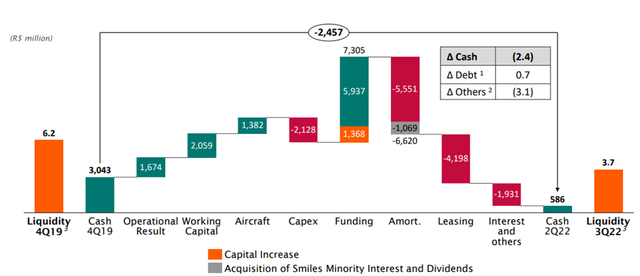

Elevated Debt but Funding Risks Manageable for Now

As of Q3, GOL had R$25.5bn of gross debt on its balance sheet against a R$3.7bn liquidity position (comprising mainly cash and receivables). Also concerning is that a sizeable portion of the debt is USD-denominated and, thus, exposed to FX fluctuations. That said, there are levers available to management on the liability management front. These include negotiations with leasing companies on the B-737 MAXs (existing and newer contracts) and leveraging its unencumbered ‘Smiles’ loyalty program asset.

GOL Linhas Aereas Inteligentes SA

As for its fleet, GOL ended the September quarter with 145 aircraft and 92 firm orders for Boeing 737-MAX aircraft. Assuming all goes according to plan, GOL should end the year with 44 B-737 MAX aircraft (up from 37), with a relatively long leasing contract profile of 10-12 years. While the leverage levels are high, investing in MAX aircraft could pay off in the long run, given they generate 15% savings in fuel consumption and have lower maintenance costs. Beyond this year, the plan is for the return of up to 25 operational aircraft by 2023 while maintaining the flexibility to adjust the volume of returns as required.

On Track for a Post-COVID Recovery

Following a difficult 2020/2021 amid COVID-related headwinds, GOL’s improved revenue and cash generation bode well for the mid to long-term recovery. While earnings fell short of Street estimates this time around, guidance is still pointing to a positive full-year EBITDA generation along with more free cash generation. Plus, the industry is turning more rational on capacity, paving the way for higher cost pass-through into tariffs. The only caveat here is the FX volatility, which could impact GOL’s funding, given its USD-denominated debt exposure, as well as overall profitability via fuel costs. Yet, the ~4x FY24 EV/EBITDA valuation offers a wide margin of safety for investors willing to look through the short-term challenges in anticipation of a continued post-COVID recovery over the coming years.

Be the first to comment