kmatija

STORE Capital (NYSE:STOR) is set to be taken private, raising the question of whether the stock is worth holding until the close of that transaction, and which stocks can fill the void. While STOR remains a well-run company, it may not make sense to continue owning the stock given its relative premium to peers. I discuss three worthy candidates to replace STOR in a dividend portfolio with yields ranging from 7% to 10%. The rising interest rate environment has led to great volatility and high pessimism, but dividend investors likely welcome the high yield opportunities.

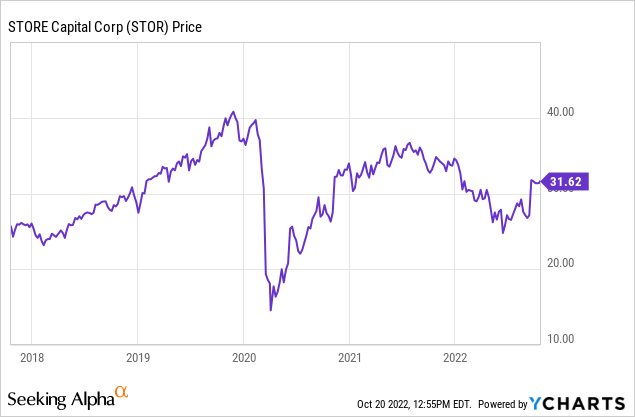

STOR Stock Price

STOR has seen its stock shoot close to the $32.25 per share takeout price.

I last covered STOR in May where I rated it a buy – STOR has since returned 15%. But is the stock still worth holding at current levels?

STOR Stock Key Metrics

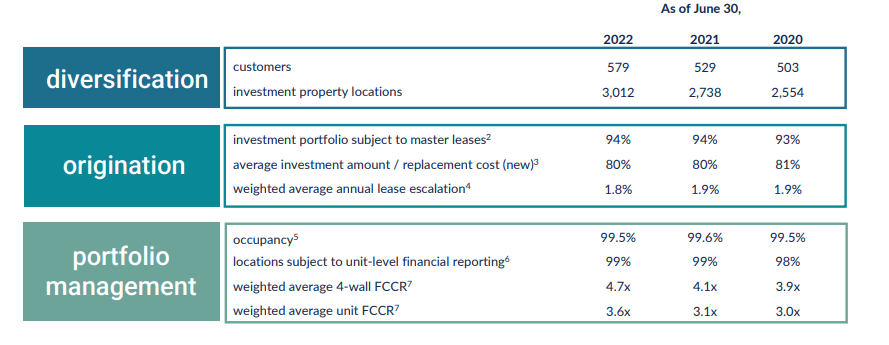

STOR ended the latest quarter with 3,012 investment property locations with 94% subject to master leases.

2022 STOR Q2 Presentation

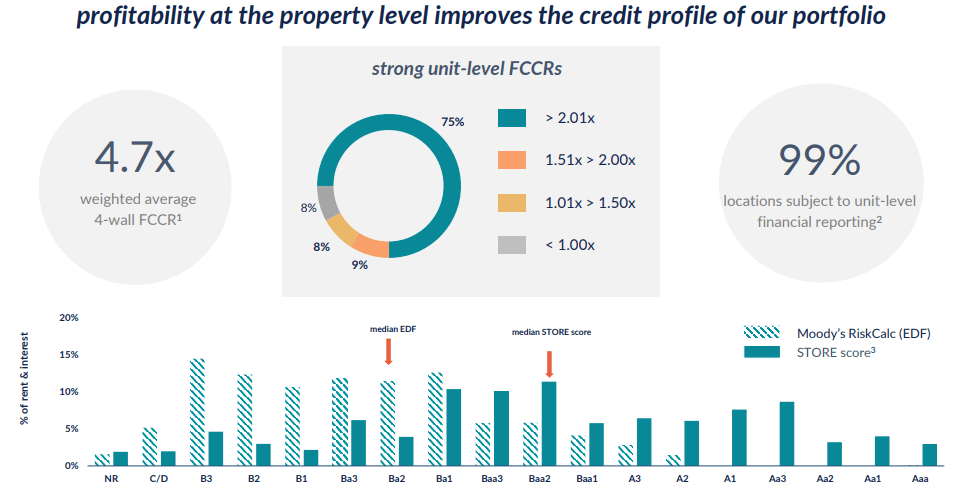

The credit quality has been improving in recent quarters as evidenced by the 4.7x weighted average 4-wall FCCR. That said, it’s worth noting that 8% of the portfolio has unit-level FCCR below 1x and another 8% between 1.01x and 1.5x. That may suggest some tenants are struggling to pay rent.

2022 STOR Q2 Presentation

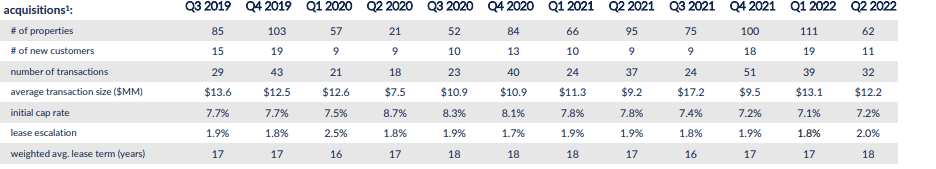

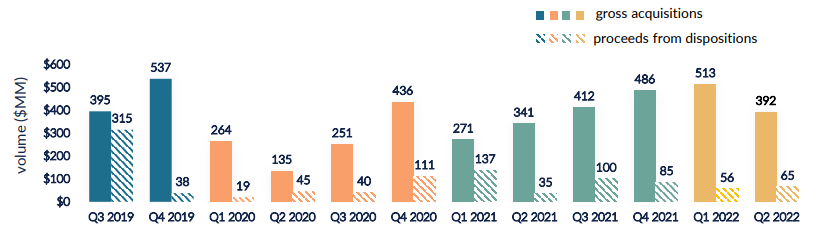

Like peers, STOR has been quite active on the acquisition front, investing $392 million in the quarter at a 7.2% cap rate. That cap rate has compressed from the 7.8%-8% range of the past, but the annual lease escalator remained strong at 2%. The cap rate compression is worthy note considering that one would have otherwise expected the opposite considering the rising interest rate environment.

2022 STOR Q2 Presentation

STOR did dispose of $65 million of properties in the quarter, making up 17% of acquisitions. That percentage has been high over the past two years. I view a lower disposition percentage of acquisition to be an indication of stronger credit underwriting as a good chunk of dispositions typically tend to be nonperforming assets.

2022 STOR Q2 Presentation

STOR grew AFFO per share by16% to $0.58 and increased its full-year guidance from $2.23 to up to $2.27.

The company ended the quarter with a leverage ratio of 5.7x debt to EBITDA, rather full though perhaps suggesting some debt capacity.

What To Buy Instead

The stock is trading with only 2% upside to the acquisition price – the company is not allowed to pay dividends until then. With the transaction expected to close in the first quarter of next year, that represents an annualized return of around 4% to 5%. The stock is currently trading at 14x FFO and a 5.2% dividend yield. In my view, that potential upside is not high enough considering that many net lease peers trade at far more compelling valuations.

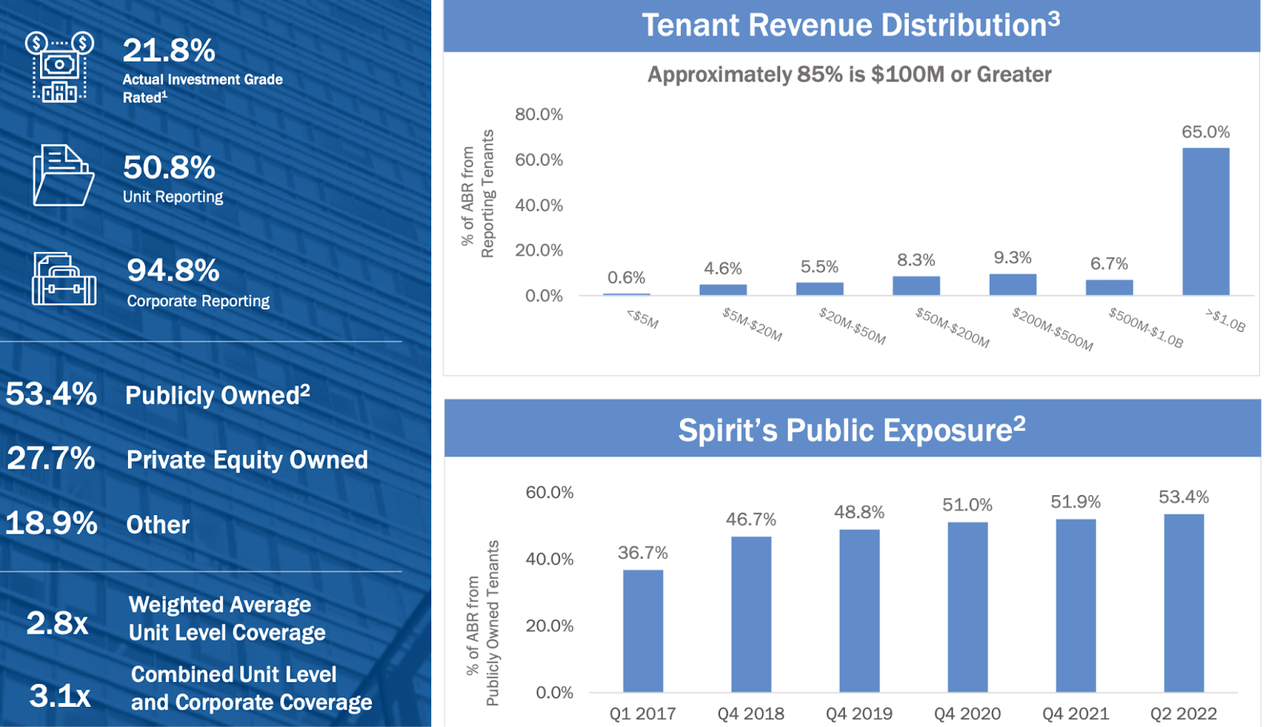

One candidate worthy of attention is Spirit Realty (SRC), a close peer. I covered SRC in September – the company has a comparable portfolio with solid investment grade exposure.

2022 SRC Q2 Presentation

Leverage stood at 5.5x debt to EBITDA, comparable with STOR, but the stock trades at only 9.6x FFO and a 7.6% dividend yield. If the STOR transaction were to fall apart, then I would not be surprised to see STOR and SRC trade at similar valuations.

If one is willing to look deeper in the net lease sector, cannabis REITs represent in my opinion the most compelling opportunity.

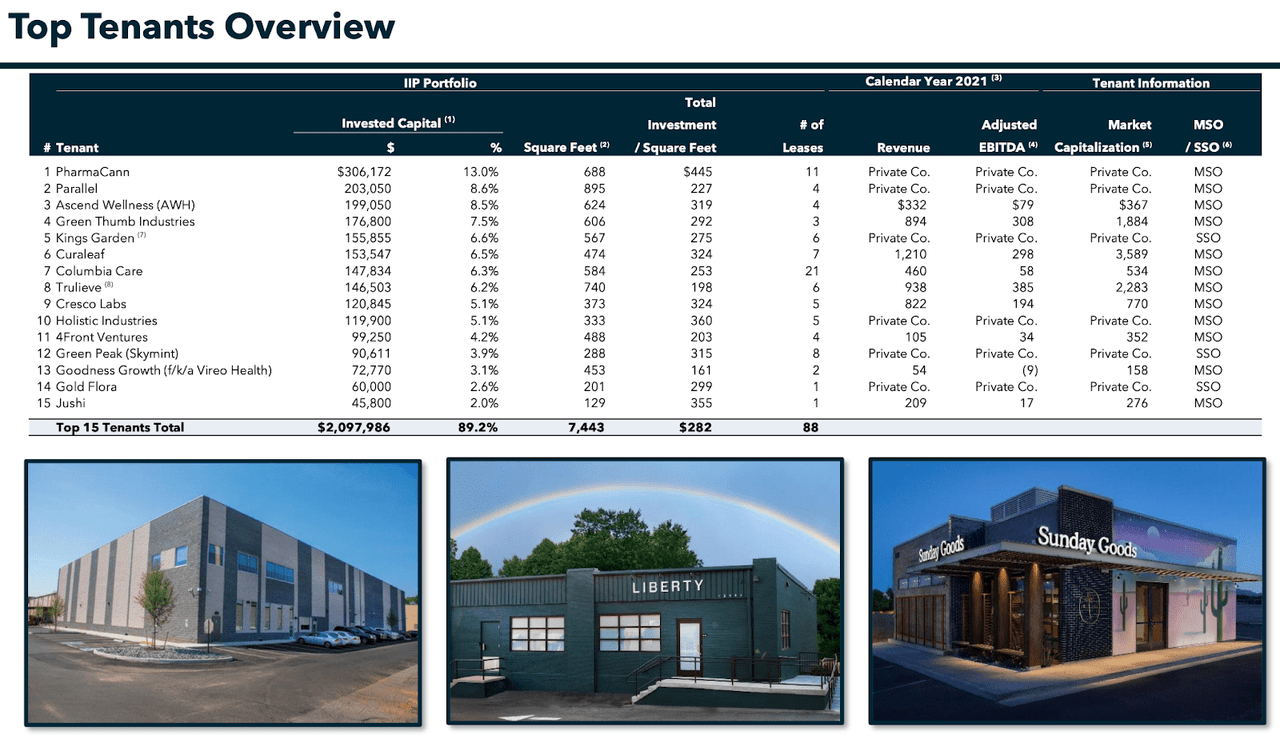

The most well known operator is Innovative Industrial Properties (IIPR), which is the largest publicly traded cannabis REIT. I last covered IIPR in August. As a landlord of cannabis real estate, IIPR primarily owns cultivation facilities (where tenants grow cannabis) leased to licensed operators in states that have legalized the plant for either medical or recreational use.

2022 IIPRQ2 Presentation

If you are unfamiliar with cannabis REITs, there’s a couple of things to know. First, cannabis can be considered to be a hyper-growth sector – largely because the plant has and remains federally illegal, but is rapidly being legalized at the state level. Consumers are embracing the plant for its recreational and medical applications. Yours truly has found the plant to be a life saver for occasional anxiety and insomnia.

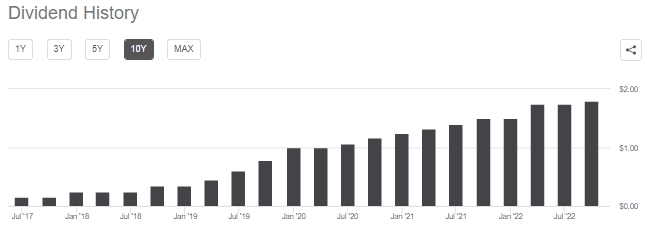

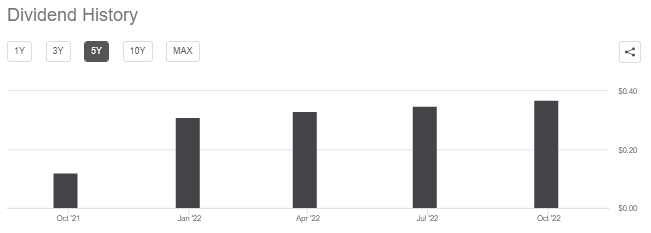

Second, because cannabis is federally illegal, it is very lucrative to be a landlord. IIPR is able to charge elevated cap rates at around 13% with annual lease escalators around 3%. In comparison, traditional NNN REITs like STOR and Realty Income (O) get cap rates around 6% to 7.5% with escalators in the 1% to 2% range. Those improved fundamentals have paid off, as dividends have increased by more than 10x since 2017.

Seeking Alpha

IIPR also has far less leverage than conventional NNN REITs, with debt to EBITDA at only 1x. IIPR recently traded hands at 12x FFO and a 7.7% dividend yield.

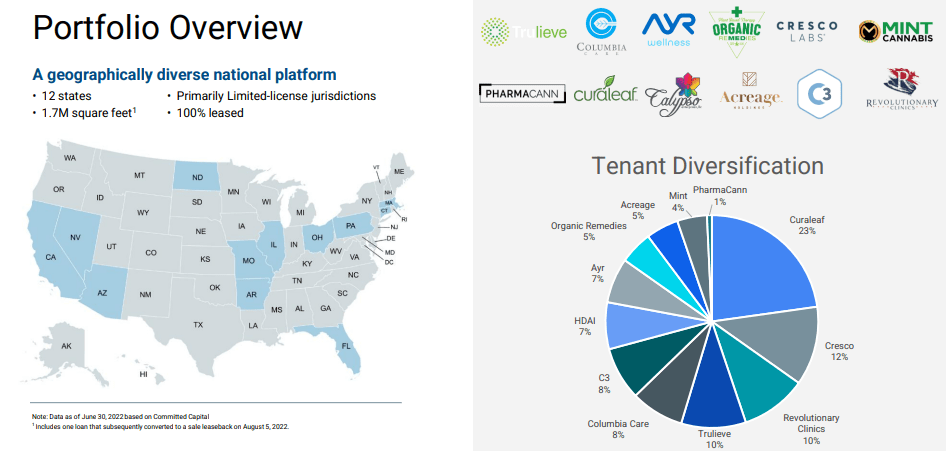

IIPR is by far the most well known cannabis REIT, but there’s another pick worth mentioning. NewLake Capital (OTCQX:NLCP) is just like IIPR in that it is an internally managed landlord of cannabis real estate, but it is far smaller at just $330 million in market cap and is listed Over the Counter (‘OTC’).

I consider NLCP as having a higher quality portfolio than IIPR due to its focus on limited license states. Some states limit the number of licensed operators, which helps improve profit margins.

NewLake Capital September Presentation

NLCP has increased its dividend rapidly since coming public last year.

Seeking Alpha

NLCP has minimal debt and $90 million of available liquidity from its 5.65% debt facility. The stock trades at a relative discount to IIPR, at 10x FFO and a 9.8% dividend yield. That lower valuation is likely due to its OTC listing and size – institutional capital might not be so interested in the name. Yet I expect NLCP to trade similarly as IIPR largely because there will always be the possibility that IIPR tries to acquire the company.

IIPR and NLCP trade at deeply discounted valuations, yet can continue to grow rapidly. The rising interest rate environment has likely led to cap rates expanding further – this is a case where rising interest rates are beneficial to these REITs because of their minimal debt. Moreover, the 3% annual lease escalators should allow for solid growth even without external acquisitions.

Key risks to cannabis REITs include worsening financial positions for the tenants. Because cannabis is federally illegal, US cannabis operators pay high interest expenses and unusually high corporate tax rates. They also have to compete with illicit operators which can compete with a lower cost structure. Yet I am bullish on the future of the US cannabis industry as more states come online for adult-use sales. I also expect cannabis use to increase as the negative stigma wears off – increased demand should help to stabilize prices. I can see these cannabis REITs eventually trading up to dividend yields in the 3% to 4% range – more in-line with industrial REITs. That suggests 100% to 200% upside from multiple expansion alone.

Bottomline

The takeout of STOR should have validated the value of net lease real estate, but that has not prevented valuations to remain depressed for many peers. SRC offers a closely comparable portfolio trading at a 7.6% yield, while NLCP offers a double-digit yield with faster growth. Long term dividend investors may find the current environment to be one filled with buying opportunities – as long as one is willing to accept some volatility in the near term.

Be the first to comment