jetcityimage

The recent market rebound has a lot of people wondering if maybe the market is back in full swing, but there are also many who worry about where things will go as we continue with rate hikes and tackle inflation with unemployment. For those wanting to sit the market out, the iShares Floating Rate Bond ETF (BATS:FLOT) might be an ideal pick. Its maturity profile lends itself to the typical length of a bear market, and floating rates mean little interest rate risk. Moreover, the bonds are highly rated. You pay a small fee, but lower than other ETFs, and it’s cheaper than buying bonds through your brokerage if they are even available. Transaction costs are higher on the bond market as it functions more bespoke with larger tickets and through a network of broker-dealers, and it’s best left to institutional players, especially for the horizons we’re thinking about. FLOT gives you a lot of what you need to imitate that sort of exposure on the equity markets.

FLOT Breakdown

FLOT has pretty low fees at only 0.15%. An iShares ETF will typically require a 0.5% fee even when very passive, and this is important because the yield here is precious, and you’d prefer it not to be eaten away.

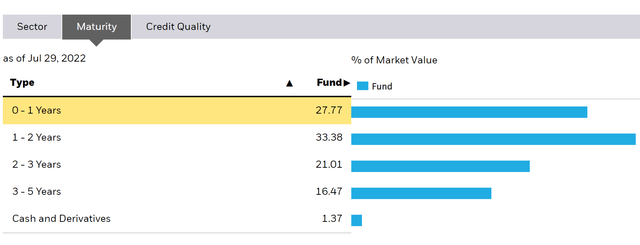

On a maturity basis, the bonds are mostly between 0-3 years, so relatively short term. Therefore, with this being for waiting out the recession, some of the portfolios will roll over into higher base rates. But ultimately, maturity risks are neutralised by the fact that it’s a floating rate portfolio. In fact, floating rate means most of the issues that you’d worry about with bonds are not considerations.

Maturity Profile (iShares.com)

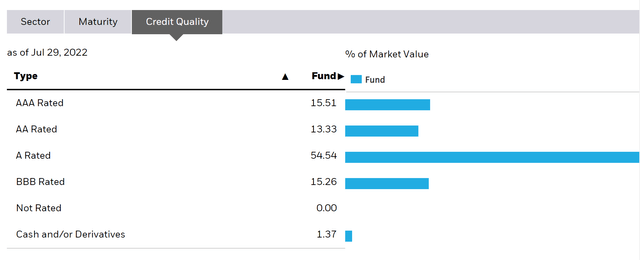

The only thing that investors might be concerned about is credit risks. These bonds are primarily from banking exposures like Goldman Sachs (GS). The bonds are all investment grade rated, mostly above A rated. Of course, ratings aren’t helpful when things dramatically change. The current market environment is still not without worry, as unemployment will go up with further rate hikes. In fact, even with the current hikes, unemployment might grow just on the basis of unemployment spiraling. Nonetheless, there is scope for further issues. However, contagion risks through banking should be fairly limited, and the capital base of most banks has improved massively since 2008, as have their systems. Moreover, banks are benefiting in the current environment in their retail businesses and their corporate businesses are also generally strong or resilient enough, so overall credit risk should be fairly limited.

Conclusions

FLOT is very stable. It is designed to essentially not move at all. The capital risks here are extremely low, and it offers a dividend at 1.84% net of fees, just as a bond might. To park money from your stock account into something that isn’t just straight cash, FLOT appears to be an appropriate option.

We might have a bad recession, and it could be a good idea to move your money into basically cash equivalent instruments, but it’s likely to be a rather garden-variety one and nothing potentially cataclysmic like 2008. While COVID-19 has created some serious and real economic problems, they shouldn’t be existential, and at worst the market will enter into an environment where equity returns are still positive, but much more muted as we work through the value destruction from economic disintegration: a relatively known quantity that shouldn’t invite the sort of volatility we’ve so far seen absent new geopolitical developments.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment