coldsnowstorm

Co-produced with “Hidden Opportunities.”

The U.S. economy is slowing down. The Fed has hit the brakes hard with their quantitative tightening, and there is a clear downtrend in job openings, home sales, and manufacturing output. It is basic economics that changes made to parameters like interest rates have a delayed effect – it takes time to percolate through the financial system and slowly impacts inflation, business operations, and consumers. The Fed continues driving based on incomplete data, and the economy is on track to hit a recession next year. It is critical that you evaluate your requirements and your portfolio’s ability to provide for them.

What are your investment goals? While there can be several exceptions, they can broadly be categorized into

-

Education expenses for your loved ones, notably college

-

Major Purchases – a car, a house, a big vacation

-

Growing your wealth through your working years

-

Income in retirement

Fidelity Canada

The income Method is a style of investing where you transform your portfolio into a dividend machine. Dividends are misunderstood to be only a retiree’s investment strategy. In your 20s, you invest in crypto and high-growth stocks; in your mid-30s to 50s, you invest in slow growers and index funds; and closer to retirement, you invest in dividend payers, bonds, and other fixed-income assets, right?

You are quite wrong; I encourage you to think of dividends as passive income. Everyone can use them, and if designed correctly, they can snowball into a parallel paycheck. A regular chunk of cash predictably coming into your account can assist and support any of the goals above. They may not have the coolness of crypto, the swankiness of SPACs, or the niftiness of NFTs, but those dividends make my portfolio glow up in dark economies.

At HDO, we are strong proponents of fixed income during these uncertain times. Why fixed income during a rising rate environment, you may ask. The answer is simple; fixed income is quite underrated nowadays, and securities are trading at very cheap prices. We get to buy them at deep discounts and secure a very reliable stream of income for years to come. Two preferred picks with up to ~8.3% yields to get your income flowing.

Pick #1: RLJ-A, Yield 7.9%

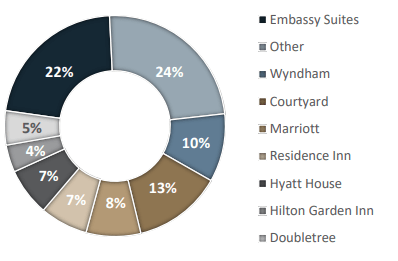

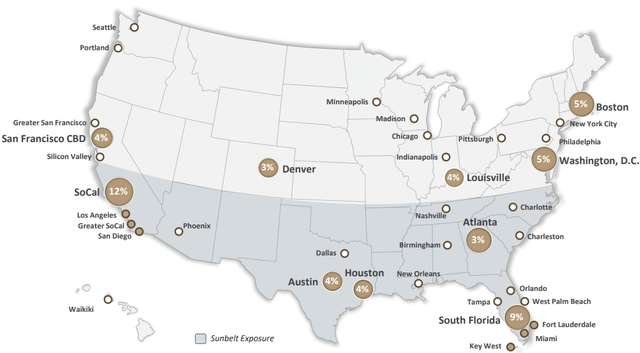

RLJ Lodging Trust (RLJ) is a hotel investment company that owns full-service hotels under well-recognized global brands such as Marriott (MAR), Hilton (HIL), Hyatt (H), and Wyndham (WH). The company maintains a portfolio of 96 hotels with ~21,200 rooms located in 23 states, with ~51% of its EBITDA generated from the sunbelt region. (Source: RLJ November Conference Presentation)

RLJ November Conference Presentation RLJ November 2022 Investor Presentation

Due to the global pandemic and its impact on the travel industry, 2019 performance is regularly used to compare performance vs. the pre-pandemic period. During Q3, RLJ reported Revenue Per Available Room (‘RevPAR’) to be 95% of 2019 levels. With sustained profitability and growing EBITDA, RLJ increased its common dividend by 400% in September. Additionally, the company has repurchased $57 million of stock YTD and has $193 million remaining in the authorized share repurchase plan. The raised dividend still puts RLJ’s yield below pre-COVID levels. Nevertheless, a rise in the common dividend is a sign of a healthy business with dependable operating cash flows.

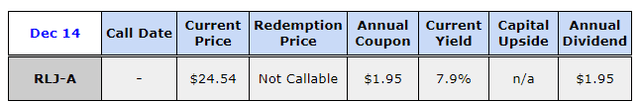

As income investors, we will focus on the $1.95 Series A Cumulative Convertible Preferred Shares (RLJ.PA). Notice how there is no mention of “redeemable.” RLJ-A cannot be called and has no par value.

This makes it an almost perpetual cash machine and gives it nearly an unlimited price upside potential like equities. Investors must note that RLJ-A isn’t redeemable but is convertible into 0.2806 common shares at the initial conversion price of $89.09 per common share. However, the company cannot force this conversion unless their common shares are trading at 130% of the conversion price for 20 of any 30 consecutive trading days. So for RLJ-A to be forced to convert, the common units must trade at or above $115.82 – a whopping 860% increase from current levels.

If that happens, RLJ-A shareholders will receive a value at or above $32.50/share, a +32% upside from current levels. An unlikely event, but if we have to part with our cash machine, we can live with that result!

RLJ-A’s annual $1.95 coupon represents an 7.9% yield at current prices. The company spends ~$25 million annually towards preferred dividends and ~$72 million YTD towards interest expense. These are adequately covered by RLJ’s YTD net cash from operating activities ($203 million). At the end of Q3, the company had $488 million in cash and cash equivalents which covers the preferred dividends for 20 years!

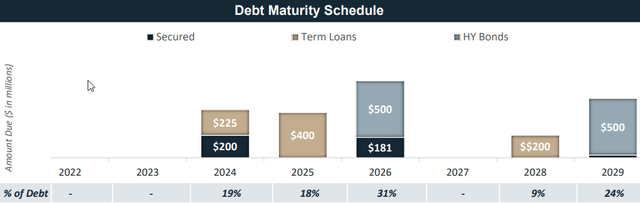

At the end of Q3, RLJ removed its debt covenant restrictions and lowered its borrowing cost by ~40 bps which translates to a cool $9 million in annual interest savings. The company has no debt due until 2024, and ~99% of debt is fixed or hedged to shield them from these rising interest rates.

RLJ November 2022 Investor Presentation

RLJ November 2022 Investor Presentation

RLJ-A presents a perpetual high-yield opportunity from a company with a growing common dividend and large share buybacks. Since RLJ-A is cumulative, a growing common dividend offers adequate protection for your income stream. Additionally, the company is in a comfortable position to meet its interest and preferred dividend payments, and we can sit back and collect 7.9% for years to come.

Pick #2: SPNT-B, Yield 8.3%

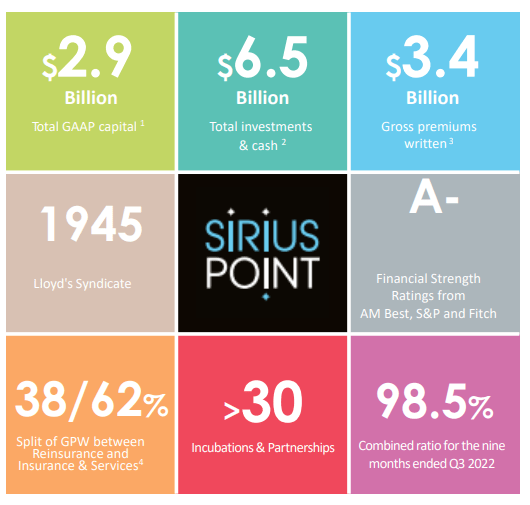

SiriusPoint Ltd. (SPNT) is a global insurer and reinsurer with $2.9 billion in total capital. The Bermuda-based firm underwrites a worldwide portfolio of business and provides solutions to clients and brokers in ~150 countries. SPNT was formed last year from the merger of Triple Point and Sirius Group and is undergoing serious transformations to achieve sustained profitability, including a revamp of key management positions. (Source: November 2022 Investor Presentation)

SiriusPoint November 2022 Investor Presentation

In September, the company named Scott Egan as the CEO and recently appointed Steve Yendall as the CFO. Additionally, during Q3, the company announced that it would close its offices in Miami, Hamburg, and Singapore and reduce its footprint in Liege, Belgium, and Toronto to restructure its underwriting platform. SPNT reported an underwriting loss of $88 million and a combined ratio of 114.5% in Q3 (98.5% YTD). While this looks bad, it is a material YoY improvement ($245 million loss and a combined ratio of 150.2%). Out of the $115 million of catastrophe losses, Hurricane Ian accounts for $80 million.

While reinsurance continues to weigh down overall results, the insurance segment reported a 33% YoY growth in core gross premiums written. This reflects the shifting of SPNT’s business mix from reinsurance to insurance to reduce earnings volatility and improve underwriting profitability.

SiriusPoint‘s Series B Resettable Fixed Rate Preference Shares (SPNT.PB) present a deeply discounted and high-yield opportunity for income investors. SPNT-B was structured at the time of the Third Point – Sirius Group merger and was designed to be very attractive for shareholders and was not intended to raise capital from the public markets. As such, SPNT-B enjoys an above-average 8% coupon with a lucrative reset-rate structure post-redemption date that provides an excellent defense against inflation. SPNT-B is a cumulative preferred security, a rare characteristic in the financial services industry, providing additional income protections to shareholders.

SPNT-B preferred dividends cost SPNT $16 million annually, and the firm pays ~$38 million towards interest expenses. At the end of Q3, SPNT reported $650 million in cash and cash equivalents, giving significant flexibility to meet their debt interest and preferred dividend obligations. Fitch and S&P give SPNT an investment-grade credit rating and an A- financial strength rating.

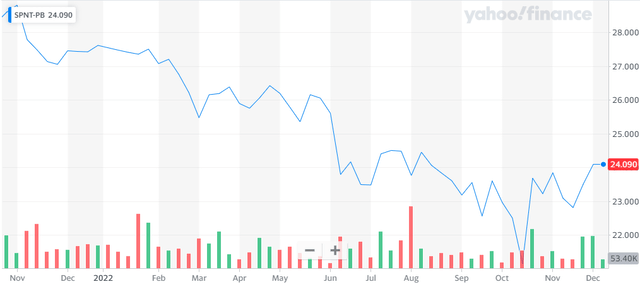

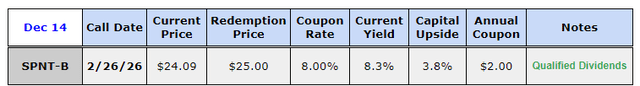

Due to uncertainties associated with SPNT-B’s management, restructuring, and path to profitability, the preferreds have sold off in recent months. Current prices provide an attractive 8.3% qualified yield and ~4% upside to par value.

Yahoo Finance Author’s calculations

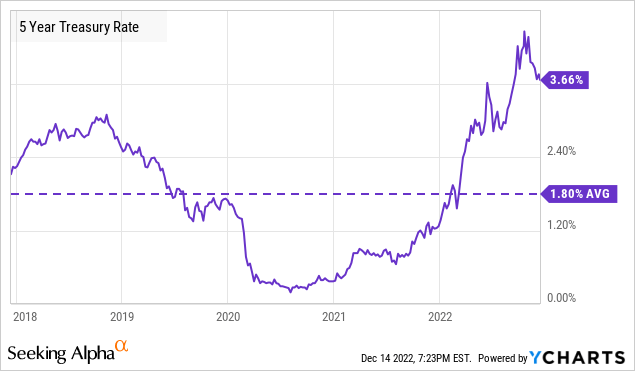

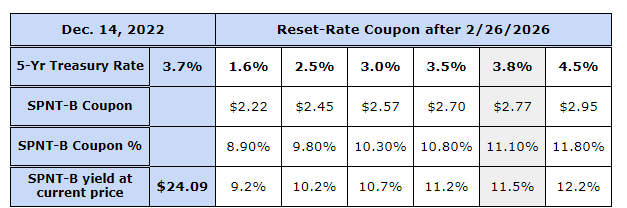

SPNT-B is a reset rate preferred. Its coupon post-redemption date (Feb 26, 2026) will be 7.298% + 5-yr Treasury Yield at the time, and this coupon will reset every five years. The average 5-year Treasury yield over the past ten years is 1.8%.

Even that rate will make SPNT-B’s yield post-call date significantly greater than today’s.

Author’s calculations

SPNT-B is rated BB+, differentiating it from peer-preferred securities, which are generally unrated. As income investors, we will let the investment-grade SPNT restructure its business and move toward sustainable profitability. We will patiently buy and hold its preferred and collect a well-protected and qualified 8.3% yield. Its reset rate setup positions us for even higher yields in three years, making SPNT-B a solid long-term inflation fighter.

Conclusion

The stock market is an emotional rollercoaster where the capital upside of your favorite securities depends on many unmeasurable factors. The mindset of the investment community (retail and institutional investors), upcoming events from the geopolitical spheres, the weather forecast, the mindset of the Federal Reserve board of governors – quite an endless list. I can’t crunch all these unquantifiable variables and don’t want to play a wild guessing game with my hard-earned capital. My landlord will not waive my rent because we are in a bear market. There are expenses to tackle in all markets, and I want to position my portfolio to help pay my bills.

Your monthly utility bills, car or mortgage payments, or income in retirement, dividends can provide for them. The earlier you begin investing, the more time you have to grow a high-quality income stream. Keep building your dividend portfolio so you never run out of money in your requirement; we have two picks with up to 8.3% yields to get you started.

Be the first to comment