Mike Coppola

(Note: This was in the newsletter on December 14, 2022.)

Warner Bros. Discovery, Inc. (NASDAQ:WBD) is revising its impairment estimates for the fiscal year. This is something that should have been expected by the market. Large acquisitions frequently take time to go through to determine what is worth something and what is worthless. Any market reaction to a noncash impairment charge at this point is likely to be an overdone reaction to something unlikely to change the outcome, unless management so states the outcome has changed (“because”). What is “tiring” is repeated, focuses on noncash charges that do not change the outcome.

The big deal is that an impairment is a noncash charge. It directs the investor away from assets unlikely to either make any profit or make a sufficient profit. Instead, attention needs to focus on the remaining assets. Many times, management has an outcome in mind. That outcome is unlikely to change just because some peripheral assets are found to be worthless.

Note that the impairments are big numbers, in that they are in the billions. But compared to the total value of the acquisition, those charges do not appear to be large enough (or even close to it) to change the original strategy that led to the acquisition.

Unless the original profit picture changes, these write-offs are really not material to the original acquisition strategy or the outcome. All that is really happening is an attempt to make the “books” more accurately represent where the value is.

There may also be some minimal changes to the strategy as to how to “get there.” Shareholders have heard of cancellations, changes, and rearrangements now that management has had a chance to look at the assets. One thing that does appear to be fairly “set” going forward is the cash costs to “whip the acquisition into shape.” That has so far been unexpectedly good news because generally, it takes a while to find everything. That includes things that need to be fixed with money.

Improvements

Probably the undetected improvement for Warner Bros. Discovery that likely tells investors that things are better than the news is shown below:

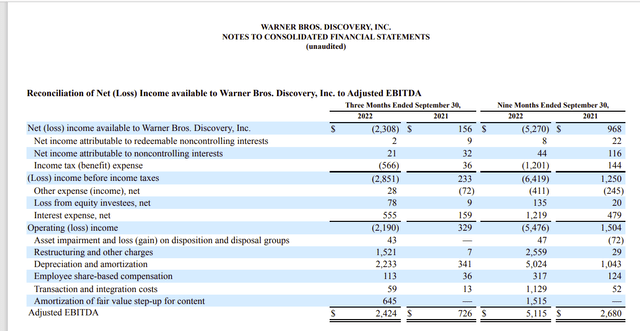

Warner Bros Discovery Third Quarter 2022, EBITDA Calculation (Warner Bros Discovery Third Quarter 2022, 10-Q)

The current quarter is post-merger and shows a material increase in EBITDA from the previous quarter pre-merger. That is good news, as the quarterly EBITDA rate is approaching an annual rate of $10 billion.

This is even though an annual rate of one-fifth the amount of debt is a bit much. The 10-Q already shows about $6 billion of debt repaid and another roughly $1.5 billion as current. That should mean that Warner Bros. Discovery, Inc. management intends to repay that as well in the next year or so. There have been some sales and will likely be more small sales. That could mean that debt repayments will remain at an unexpectedly high level compared to market worries.

But the key is that it only takes about $800 million more per quarter for management to reach the initial goal of debt being about 4 times annual EBITDA. While that in and of itself is a big number, compared to the size of the acquisition it should not be a big deal to get there. Management probably has an internal goal to do better than that (simply because most do).

The Federal Reserve

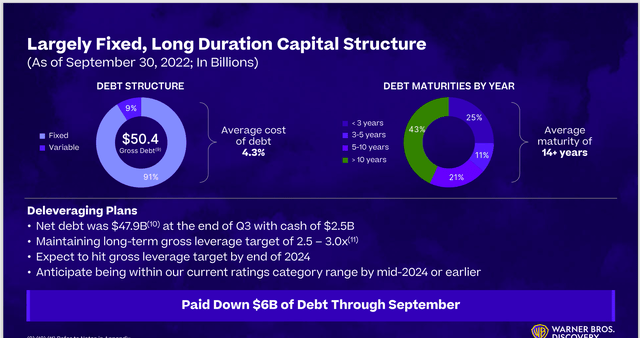

In the meantime, the Federal Reserve is providing unexpected help with rate hikes. Those hikes are particularly helpful for long-term debt.

Warner Bros Discovery Debt Structure (Warner Bros Discovery Third Quarter 2022, Earnings Conference Call Slides)

Warner Bros. Discovery, Inc. management has already carefully kept a strong cash position, just in case some cash is needed for unforeseen things until the cash flow is firmly established.

The initial merger expenses shown on the EBITDA calculation are going to decline over time. That will free up more cash generated by the business to be used for things like debt repayments. Without things like merger expenses and restructuring charges, the underlying company operating results will become more apparent to the market. Sometimes, like now, Mr. Market acts as though those charges never end.

Every time the Federal Reserve hikes interest rates, the long-term debt gets cheaper. There is every chance that Warner Bros. Discovery, Inc. will use at least some cash flow to repurchase debt at a discount while interest rates remain high. The more pessimistic an investor is about interest rates, the longer the discount bonanza lasts (in the eyes of that investor) for this company to repurchase debt at a discount. This management has a lot of long-term debt to choose from when it comes to repurchasing that debt at a discount.

Eyes On Cash

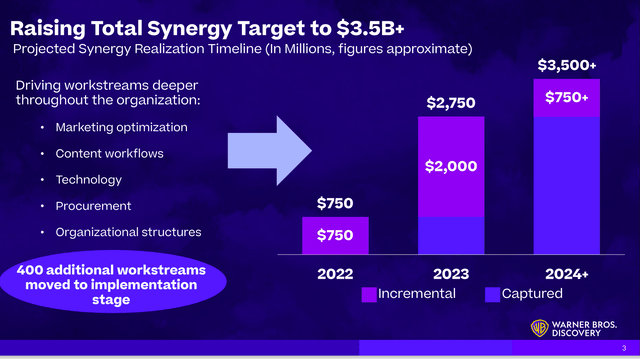

This is one time when management promises synergies that those promised benefits will flow through to cash flow. Management does give a percentage which looks reasonable. But the key is to keep focused on that increasing cash flow from those promised synergies.

Warner Bros Discovery Increase In Promised Merger Synergies (Warner Bros Discovery Third Quarter 2022, Investor Presentation)

That means that EBTIDA should head upwards throughout the fiscal year next year. Now maybe it will not be a straight line because the future sometimes dumps unexpected challenges into the plans. But investors should be able to see the way to a considerably higher EBITDA and Free Cash Flow in fiscal year 2024 as a result of the work being done now and next year.

This is actually more important to investors than is the impairment announcement because this will change cash flow generated for the better. More cash flow means that more debt can be repurchased at a discount. Lower leverage eventually enables dividends.

The key risk, of course, is “cutting your nose off to spite your face,” which means management looking good in the short-term while really hurting the long term. The worst possibility would be to hurt both the short term and the long term. But Warner Bros. Discovery, Inc. management appears to have enough checks and balances in place to do a “course adjustment” should that prove to be needed.

The Future

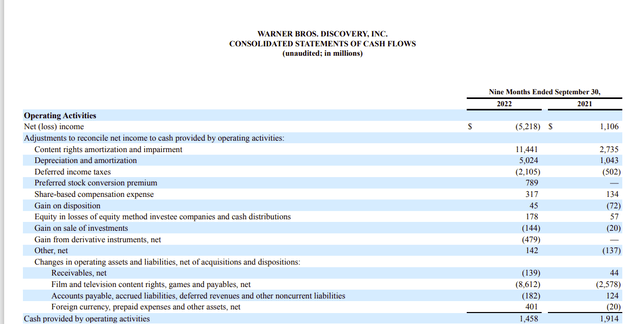

The WBD cash flow statement points to sources of cash that will be available in the next fiscal year. This appears to back up the progress being made, as shown in the EBITDA calculation.

Warner Bros Discovery Third Quarter 2022, Cash Flow Provided By Operating Activities Statement (Warner Bros Discovery Third Quarter 2022, 10-Q)

The account((s)) that changed by far the most is the “Film and television content rights, games and payables, net.” That negative $8.612 billion account((s)) balance change is unlikely to recur in the next fiscal year. Adding that to the cash flow would show a potential cash flow next year of $10 billion at the nine-month period. Remember, this is very rough estimating. (Note that the amortization or depreciation from those accounts will most certainly rise on the income statement.)

Things will happen and account balances will change. But the previous fiscal year account balance changes appear to be far more likely than the current account balance changes, even though the company is now much larger.

This is the short-term cash changes. Longer-term benefits that would involve earnings growth and still more cash flow would involve the better use of movies along with a big improvement in direct-to-consumer. So, there are a lot of solid possibilities here.

But the key is to not get all upset about non-cash adjustments. Instead, focus on the fact that management has actually “found more cash flow” since the merger. This whole thing still has to be executed properly. But it appears that management is off to a good start.

Warner Bros. Discovery, Inc. management would usually get involved with something like this to triple the value over about 5 years. This is a rough estimate that implies a stock price of about $50 at the end of the five-year period if management is successful. From the current price, management could miss that rough goal and the return would still be decent. But generally a good return is demanded to overcome the risk of the high financial leverage and of course the risk of failure. Now let us see what happens.

Acquisitions are also done to acquire a necessary product or service that enables continued competition. But that does not appear to be the case here with Warner Bros. Discovery, Inc.

Be the first to comment