SolStock

When making a big purchase, consider the opportunity cost; what else could you do with that money? – Dave Ramsey

Introduction

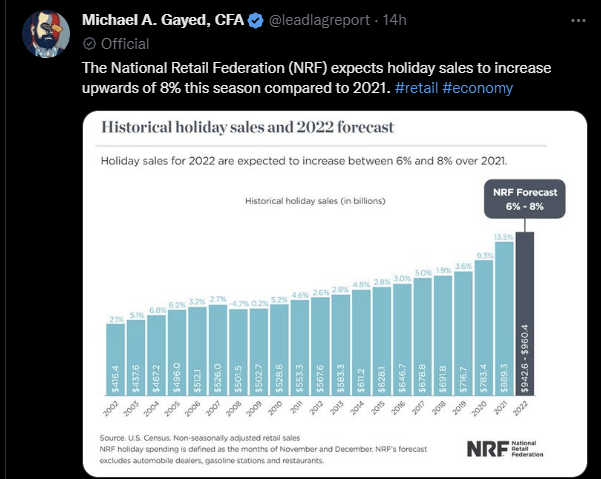

As we enter the holiday season, investors may be on the lookout for discretionary names that could receive interest from the festive cheer. As noted in a tweet on the timeline of The Lead-Lag Report, the National Retail Federation believes that holiday sales growth this year will fall short of the double-digit growth seen last year. However, considering the high base effect, a 7% annual growth isn’t the worst forecast around.

Twitter

Today I’ll be reviewing the prospects of one of the stocks from the discretionary sector.

Company Profile

Flexsteel Industries (NASDAQ:FLXS) is involved in the manufacturing, importing, and marketing of furniture products in the US residential market. These products are distributed via both direct sales channels as well as e-commerce. Note that this company previously did have some exposure to the commercial office segment and the hospitality segment, but it decided to exit from these markets in 2020 and 2021. The company’s manufacturing facilities are located in Dublin, Georgia, and Mexico.

Should You Get Involved with FLXS?

There are both good and bad reasons to pursue a business of this sort, and I’ll start with some of the less-appealing facets.

There’s this flawed theory doing the rounds that the retail sector is coping just fine, and this is based on recent Black Friday sales. Reportedly online sales were up 2% and that is supposed to be perfectly acceptable. But you bring the 8% inflation levels into the equation, and you actually have no growth in real terms. I’m not sure that’s a thesis worth parading.

Ultimately you have to consider that Flexsteel’s furniture products are inherently deferrable purchases, and that’s something that will take on even more weight in the face of a housing downturn.

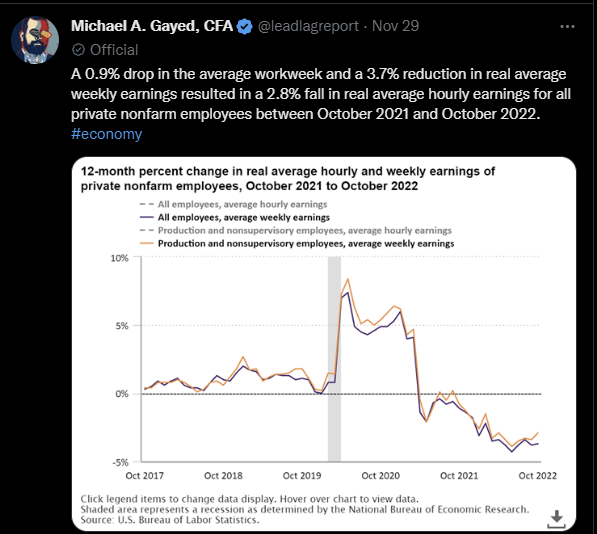

Besides, as pointed out in The Lead-Lag Report, over the past year, private nonfarm weekly wages have actually declined by ~4% YoY, so there’s very little incentive to indulge in these sorts of purchases when your purchasing power has been taken to the cleaners.

Twitter

Conversely, as noted in the Leaders-Laggers section of my subscription research, dividend plays could receive additional interest if the long-term recession narrative begins to gather pace, and for a micro-cap stock, FLXS’s dividend credentials are indeed quite impressive.

In an industry where the median years of dividend payments have only been around 3 years, FLXS more than stands out, as it has been rewarding its shareholders with dividends for over three decades now (32 years to be more specific)!

What makes things even more alluring is the fact that the forward dividend yield of over 4% is currently at its highest point in over a year, and is also well above the stock’s long-term average of 3.18%!

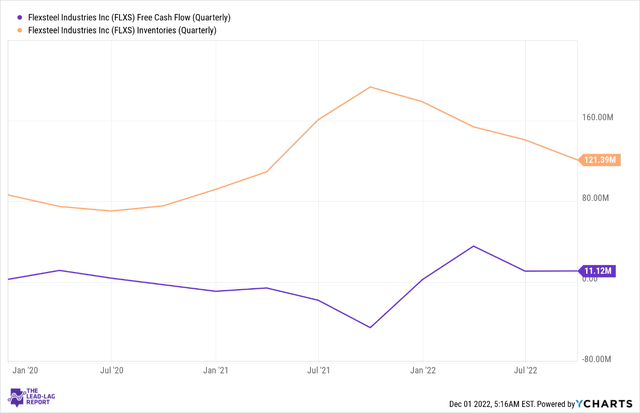

Previously, FLXS could be accused of not generating ample free cash flow to cover its dividends; just for some context, over the last 5 years, the FCF generated per quarter used to come in at -$0.93m. However, over the last 4 quarters, it has been positive (In the Sep quarter it came in at $11m), and this trend could will continue.

Why so? Well, much of this is being driven by inventory reductions which are already down by $75m from its peak (in the Sep quarter this was down by nearly $20m) and management confirmed that this will likely continue to be wound down for a few more months.

Sadly, while these inventory reductions may be good for cash generation, the company is not really generating ample value for the products being sold (translating to weak gross margins) as they are being disposed off under heightened promotions and discounting. In fact, whatever limited cost savings FLXS has been generating (by way of reduced SG&A, lower compensation, and lower ancillary expenses) are all being directed to consumers by way of lower prices. For a stock that belongs to the growth sector, that is not the ideal scenario, as you want to see some form of pricing strength, or at least stable prices. Nonetheless, as discussed with John Roque in a Lead-Lag Live chat, we’re fast pivoting away from an inflationary narrative, and this growing deflationary cloud is likely to damage the consumer side of the economy in a big way.

Conclusion

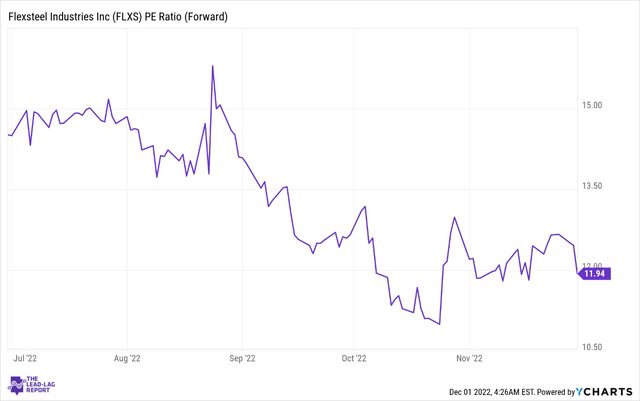

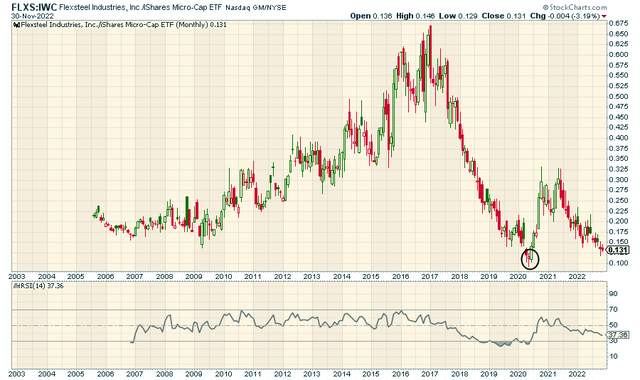

From a valuation angle, FLXS appears to offer decent value at current levels. The stock currently trades at less than 12x, a 10% discount over its long-term average of 13.3x.

When you juxtapose FLXS against its micro-cap peers, we can see that the ratio looks quite stretched to the downside and is not too far away from record lows seen during the pandemic era. As we get closer to that zone, you could see some buying interest germinate for FLXS.

Besides, as noted in the global section of The Lead-Lag Report, companies exposed to the housing market such as FLXS could benefit from a short-term FOMO trade given the recent fall in mortgage rates.

Be the first to comment