Handling trash in a sustainable way Makiko Tanigawa

Many people in their 20s and 30s are finding it increasingly difficult to manage and invest their money. They find it challenging to weed through the headlines and to figure out what all the financial jargon means to their wallets, careers, first homes, and their future.

What makes the exercise harder for people in this age group, as compared with their counterparts from decades prior, is that most-depending on what country they were raised in-have never lived through long periods of inflation or recession.

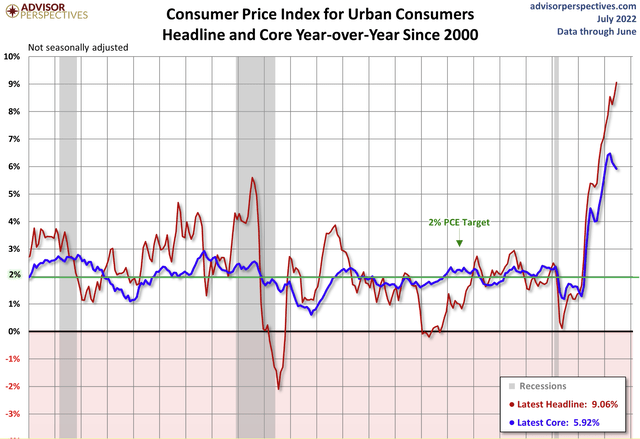

A sustained rise in the U.S. Consumer Price Index (CPI) represents inflation, defined as an increase in general price levels. The chart below displays the sharp increase in CPI for Urban Consumers as well as for the headline and core inflation.

CPI, Headline and Core Inflation (Advisor Perspectives)

Except for the global financial crisis of 2008-09, and a very brief COVID-related downturn in GDP, most young people in the U.S. have never experienced a long-term recession in their adulthood. Having lived through such periods makes a meaningful difference when managing money. And indeed inflation is only a recent phenomenon to many.

When asked what their biggest challenge is regarding finances and investing, many in their 20s and 30s point to a lack of guidance. They don’t know whom to ask or even the right questions. They don’t feel comfortable discussing money with their peers, finding it too sensitive a topic. Most conduct financial transactions through an app and hardly ever handle cash, making money something more ethereal than tangible.

Here are 10 steps to help young people manage their money followed by a stock tip for those ready to invest.

Calculate the sum of essential monthly expenses (housing, transportation, food, utilities, medical, dependents, pets, etc.). Subtract that from monthly income. From what remains, set aside a portion to invest and a portion for nonessential expenses (dining out, travel, culture, etc.). If the remainder is too small, consider lifestyle adjustments to reduce essential and non-essential expenses.

There are many financial services firms willing to steer people in the right direction. Seek out an advisor with whom there’s a good rapport, and if not, move to another representative or firm. Always ask about transaction and other fees as firms’ rates vary. Certain investments with lower fees such as ETFs (Exchange Traded Funds) and indexes, both which are baskets of investment in a specific sector or strategy.

- Question everything and everyone

No question is wrong when it involves one’s money. Don’t assume parents are experts just because they provided an allowance. Seek professional advice. Know the source and get a second opinion.

Emergencies can come about at any age and one needs to prepare for them. Emergencies can range from a job loss or rent hike to car repairs or health-related issues. Always keep a minimum in a savings account. A recommended amount for an emergency fund is 3-6 months of living expenses.

- More choices don’t make it easier

In addition to stocks and bonds, there are many other choices available in the markets, including alternative investments. For example, it’s common to read about cool meme stocks, Bitcoin (BTC-USD) and other cryptocurrencies, and NFTs (non-fungible tokens) and it’s tempting for many, it’s about FOMO, and wanting to get in on the action. Yet each has its unique set of risks and should be fully understood before investing.

- Understanding maximum risk

Maximum risk refers to the most amount of money one can lose from an investment. When purchasing a stock, the maximum risk is 100% of what was paid for it. As stocks can be risky, consider adding bonds and other fixed income strategies to a portfolio.

Try to keep credit card debt to a minimum (pay that off first) followed by other debt such as student loans. If a loan is needed, shop around for the best interest rates and terms. Interest rates can change frequently. If rates have been moving up or down, it’s more probable than not that they will continue to move in that same trajectory.

- Take advantage of pre- and post-tax payroll plans

Always try to take advantage of 401(k) plans (for-profit companies) or 403(b) plans (not-for-profit and government entities). It is advisable to put in the maximum one feels comfortable with. Ask the HR department or sponsor for help in allocating funds. Take advantage of flexible spending plans and pre-tax commuter benefits.

- Invest in what is understood

Perhaps researching investments isn’t all that exciting. If so, stick with sectors that are understandable or relatable. Some people are tech-geeks or retail junkies? Others are fashion-forward or sports fanatics. Learn about companies in known industries and decide which names look promising. Keep it simple. Love that ice cream brand? So do a lot of other people. Who makes it?

- Invest in what is meaningful

Don’t just look at what’s trending, but also what is meaningful. Why not try and profit while doing some good in the world? There are many stocks that have strong ties to ESG (environmental, social and governance) issues. Go to a company’s social media page and look for terms such as sustainability, renewable energy, diversity & inclusion, and impact. Consider crowdfunding campaigns with low minimum investment requirements.

Waste not, Want not: Waste Management, Inc.

Finally, should someone in this age bracket have saved enough to start investing in the market, consider Waste Management, Inc. (NYSE:WM). The company, through its subsidiaries, provides collection, recycling and disposal services to millions of residential, commercial, industrial and municipal customers throughout the U.S. and Canada. It owns and operates landfills and waste collection vehicles across North America and has sizable contracts with local governments.

Here are some reasons why Waste Management is a good investment for beginner investors:

- While WM’s stock is not cheap, currently trading around $155 per share, one can dip into the market with just a few shares. After all, it’s not like buying AutoZone (AZO) at $2,138, and it’s even less than Meta Platforms, Inc. (META) at $183/sh.

- Waste Management classifies as a Large Cap stock in the Industrials sector, valued at $63.42 billion as of July 21, 2022. Large-cap companies are typically a safer investment, especially during a downturn in the business cycle, as they are much more likely to weather changes without significant harm.

- Sure, trendy stocks can appreciate quickly, but they’re called trendy for a reason – they come in and out of fashion. Stick with a stock that will be around for the long term. After all, even though studies show that younger people value experiences over possessions, they still develop trash like everyone else, and in all business cycles – even during recessions.

- New technologies are also fun investments. Just learning about what the technology may accomplish and how it came about can be fascinating. But will it work? Perhaps it’s still in beta testing and has not been proven. It’s safer to stick with something that’s tried and true. WM origins stem from 1968. By 1982 Waste Management had become the world’s largest waste disposal company, with more than $1 billion in sales. Thus, it’s not going away anytime soon.

- With its large customer turnover, Waste Management has a relatively predictable revenue stream.

- Younger generations tend to be environmentally focused, so why not put money where one’s mouth is. Recycling and waste management play an important role in the fight against climate change. Solid waste directly contributes to greenhouse gas emissions through the generation of methane from the anaerobic decay of waste in landfills and the emission of nitrous oxide from solid waste combustion facilities. WM is part of the carbon footprint management market, announcing on April 28th, its plan to invest $825 million in its renewable energy footprint from 2022-2025 by expanding its renewable natural gas infrastructure. WM’s network of RNG plants, landfill gas-to-electricity plants and other beneficial projects are estimated to provide enough renewable energy to supply the equivalent of one million homes across North America and help WM fuel its entire natural gas fleet with RNG by 2026.

- In Q1, Waste Management’s earnings per share ($1.29) beat expectations by $0.15.

- Its EPS (TTM) is $4.54 compared with an industry average of $3.99, while its P/E (TTM) is 32.88 vs. the industry’s 40.89. Its P/E on a 5-year average basis is 27.50 vs. the industry at 38.5, indicating it is considered a better value than its peers.

- In May, WM announced the declaration of a quarterly cash dividend of $0.65 per share. That equates to $2.60 per share of dividend income or at 1.7021%. In fact, WM has consistently increased its dividends over the years. In Q1 2022, the dividend was $0.5450, making its 5-year annualized dividend growth rate 8.87%.

- According to S&P Global Market Intelligence, as of 07/21/2022 it is a high-quality stock, ranking 94 out of 100.

- Like any investment, one should do a bit of research and, if possible, due diligence. Due to the vast network of service facilities and drop-off locations across the US and Canada, it’s fairly easy to find one, stop in and ask a lot of questions.

Risks

No investment comes risk-free. Some points to consider are that from a risk perspective, StarMine from Refinitiv gives the stock an equity summary score of 6.2 which is neutral. This number is an average from analysts from a group of investment firms. When looking at its competitors in the Commercial Services and Supplies space, nevertheless, only Republic Services Inc. (RSG) ranks better at 6.6. It is the second largest provider of waste disposal in the United States, behind WM. Others in the sector rank much lower, with Casella Waste Systems Inc. (CWST) at 1.5, Clean Harbors Inc. (CLH) ranking at 3.0 and Stericycle, Inc. (SRCL) at 1.7.

Furthermore, WM has significant debt with long-term debt-to-equity ratio of 179%. Nevertheless, throughout history, the company has responsively paid off its debt and has demonstrated the ability to convert EBIT to free cash flow.

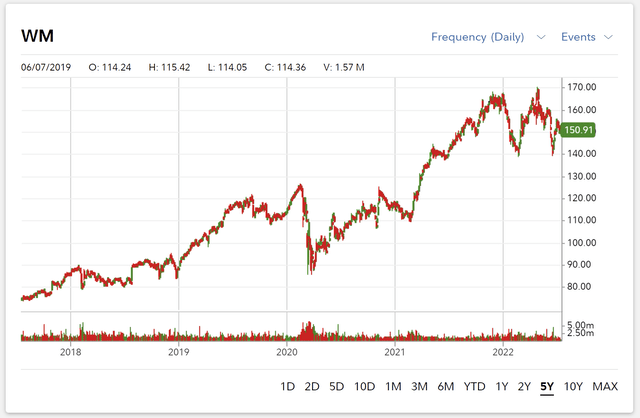

Five-Year Stock Price (Fidelity Investments)

The chart above shows that the stock has fared well over the last 5 years, while, like most stocks, subject to the macro environment affecting the overall markets. Note that the company will release second quarter 2022 financial results before the opening of the market on Wednesday, July 27, 2022. Following the release, WM will host its investor conference call at 10 a.m. ET.

The bottom line, follow the above 10 steps and be well-positioned for investing in Waste Management and other financial instruments.

Be the first to comment