gorodenkoff

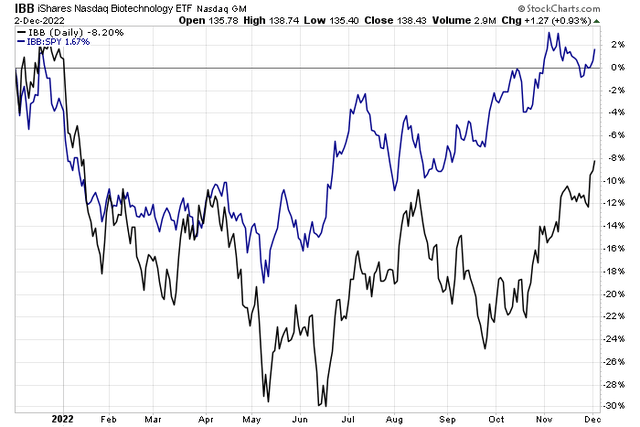

One of the major areas of relative strength in the last year has been Health Care. Biotech, specifically, shows big alpha over the last six months as the group has rallied in the face of generally higher interest rates and a dollar that had been on the rise.

Those macro factors have reversed recently with a bid to bonds and the greenback on the offer, but biotech just keeps working. I see upside potential in this speculative niche of the U.S. stock market.

Biotech Outperforming the Broad Market After A Dismal 1H22

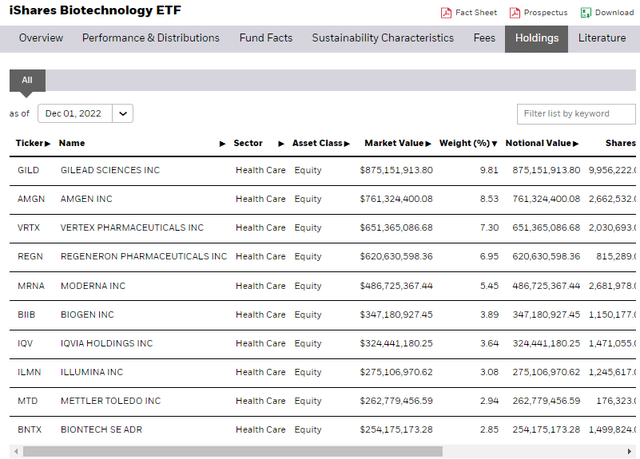

According to iShares, the Biotechnology ETF (NASDAQ:IBB) offers investors exposure to U.S. companies in the biotechnology industry. The fund is market cap-weighted and features a total of 364 equity positions. With an expense ratio of 0.44%, it is not the cheapest industry ETF around, but it’s not very expensive either.

Also consider that IBB’s median 30-day bid/ask spread is very tight at just two basis points. Moreover, investors can feel good about the large size of the biotech fund as it currently boasts nearly $9 billion in assets under management. IBB has a trailing 12-month yield of just 0.27% and pays distributions quarterly.

Digging into the portfolio, the biotech niche is often quite volatile – IBB’s 3-year standard deviation is above those of many sector funds at 21.2%, implying a daily expected move of about 1.5%. Interestingly, iShares marks the fund’s forward P/E ratio below that of the market at just 15.8.

Meanwhile, Morningstar assesses the fund with a two-star (negative) rating mainly due to the fund’s Process pillar, but I find that’s primarily because of the top 10 positions in IBB having such a high weight. Elevated turnover, per Morningstar, is another blemish to the fund. The ETF’s other pillars are strong, however.

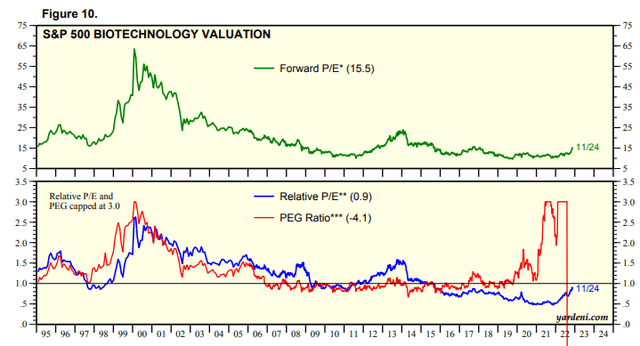

S&P 500 Biotech Industry Historical Valuations: Currently Somewhat Modest

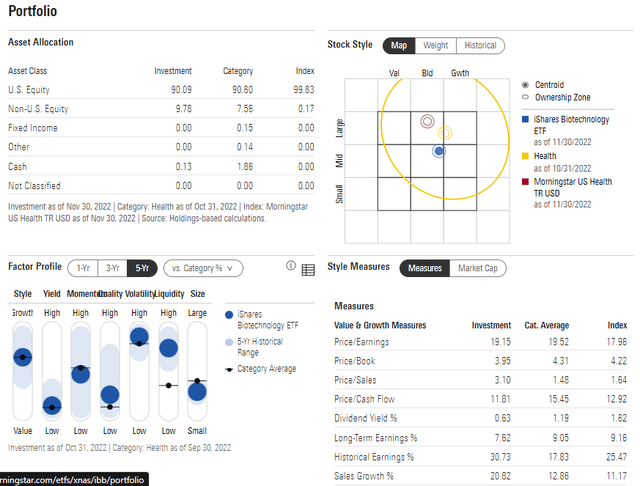

IBB’s portfolio falls in the mid-cap blend zone of the Morningstar style box despite it being cap-weighted. The equal-weight SPDR Biotech Fund (XBI) has a smaller average market cap, by contrast. While iShares shows a low earnings multiple on IBB, the fund’s price-to-sales ratio is on the high side, above 3, while its price-to-cash flow multiple is elevated near 12.

Overall, the valuation looks fine given high historical and expected sales growth. Moreover, only three of the fund’s largest 10 positions have forward P/Es above 21. Most of the top 10 are well-known Health Care sector stocks, so investors can take some assurance that small caps do not dominate the fund.

IBB: Mid-Cap Blend On the Style Box, High Volatility

IBB’s Top 10 Holdings: Mainly Large-Caps With Reasonable P/Es

The Technical Take

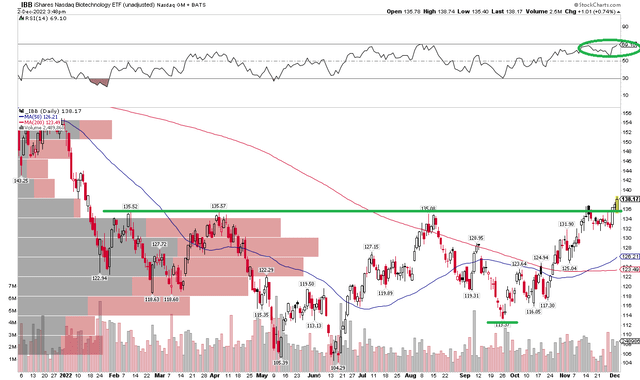

With a valuation below its long-term average, I see more bullish potential in IBB’s chart. Notice how shares closed the week at fresh highs dating back to January of this year. Also catching my eye is confirmation of a fresh rebound high in IBB’s RSI at the top of the chart. Finally, there’s ample volume of shares traded in the $120 to $135 range that should be supportive on any sustained pullback. What you do not see, though, is much in the way of overhead supply in the last year until you get near $150 if you zoom out to 2020.

There is also a bullish cup and handle pattern that is now breaking to the upside. The target – using the cup low to the recent range highs – implies a bullish measured move price objective to $158 which is the high from one year ago. Being long here with a stop under $120 appears as a favorable risk/reward to me.

IBB: Shares Breaking Out On Strong Momentum; Eyeing $158

The Bottom Line

Long-term investors should like biotech’s historically reasonable valuation while technical traders and those with a short-term horizon must like the bullish price breakout in the last few days. I like IBB here as it continues to exhibit relative strength.

Be the first to comment