Rosendo Serrano Valera/iStock via Getty Images

A Quick Take On ShotSpotter

ShotSpotter (NASDAQ:SSTI) reported its Q3 2022 financial results on November 8, 2022, missing expected revenue and beating EPS estimates.

The company provides gunshot detection hardware and software to government entities and public and private infrastructure operators in the U.S. and overseas.

While the company has positive prospects from robust public coffers and a renewed interest in fighting growing crime conditions, I am cautious on its prospects going into an uncertain 2023 economic environment.

I’m on Hold for SSTI in the near term, although interested investors may wish to put the stock on a watch list for future consideration.

ShotSpotter Overview

Fremont, California-based ShotSpotter was founded in 1996 to provide law enforcement agencies with gunshot detection integrated hardware and software solutions.

The firm is headed by Chief Executive Officer Ralph Clark, who has been with the firm since 2010 and was previously CEO of GuardianEdge Technologies before its acquisition by Symantec.

The company’s primary offerings include:

-

Gunshot detection

-

Investigative tools

-

Patrol management

-

Forensic services

-

Highway security

-

Corporate security

-

Campus safety

The firm acquires customers through its direct sales and business development efforts as well as through partner referrals.

ShotSpotter’s Market And Competition

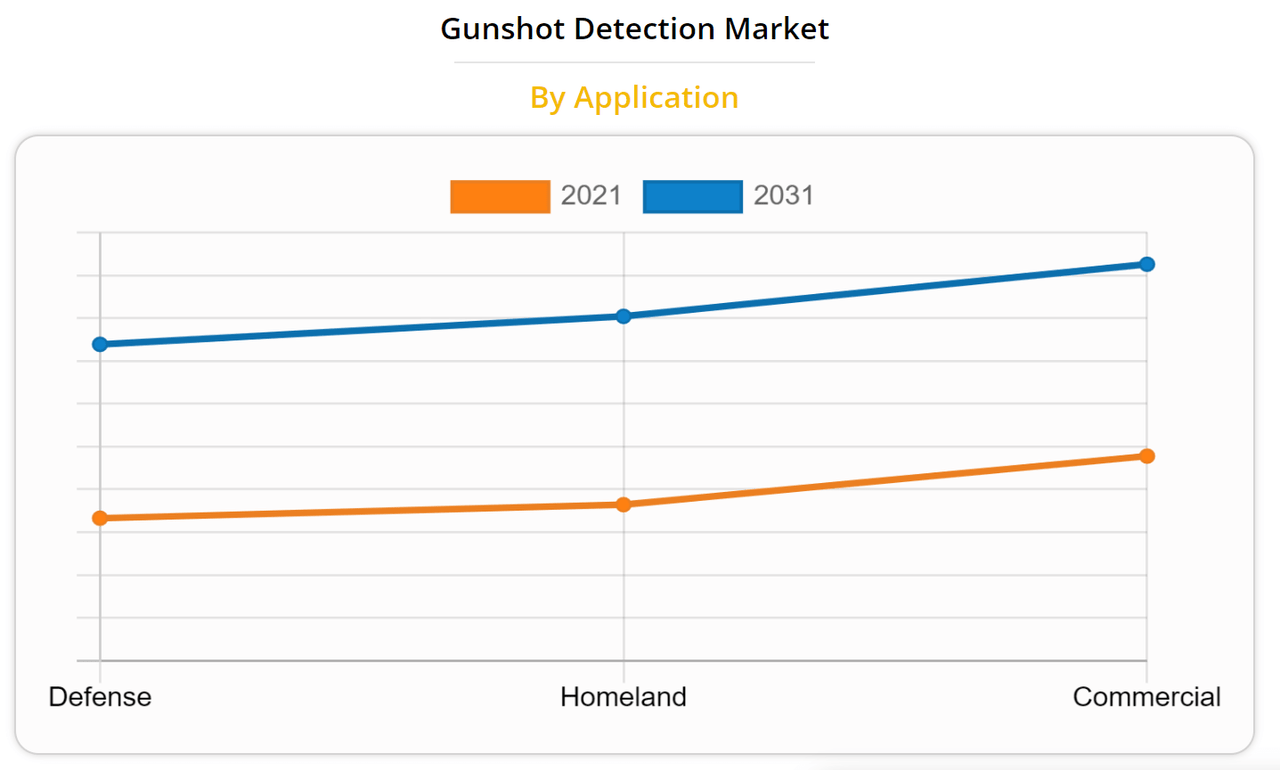

According to a 2022 market research report by Allied Market Research, the global market for gunshot detection systems was $580 million in 2021 and is forecast to reach $1.2 billion by 2031.

This represents a forecast CAGR of 7.9% from 2022 to 2031.

The main drivers for this expected growth are a rise in urban crime and a surge in adoption by law enforcement agencies tasked with ‘doing more with less’.

Also, the gunshot detection market by application growth is shown in the chart below:

Gunshot Detection Market By Sector (Allied Market Research)

Major competitive or other industry participants include:

-

3XLogic

-

Alarm Systems

-

AmberBox

-

Databuoy

-

Qinetiq Group

-

Raytheon Technologies

-

Safe Zone

-

Shooter Detection Systems

-

V5 Systems

-

Tracer Technology Systems

ShotSpotter’s Recent Financial Performance

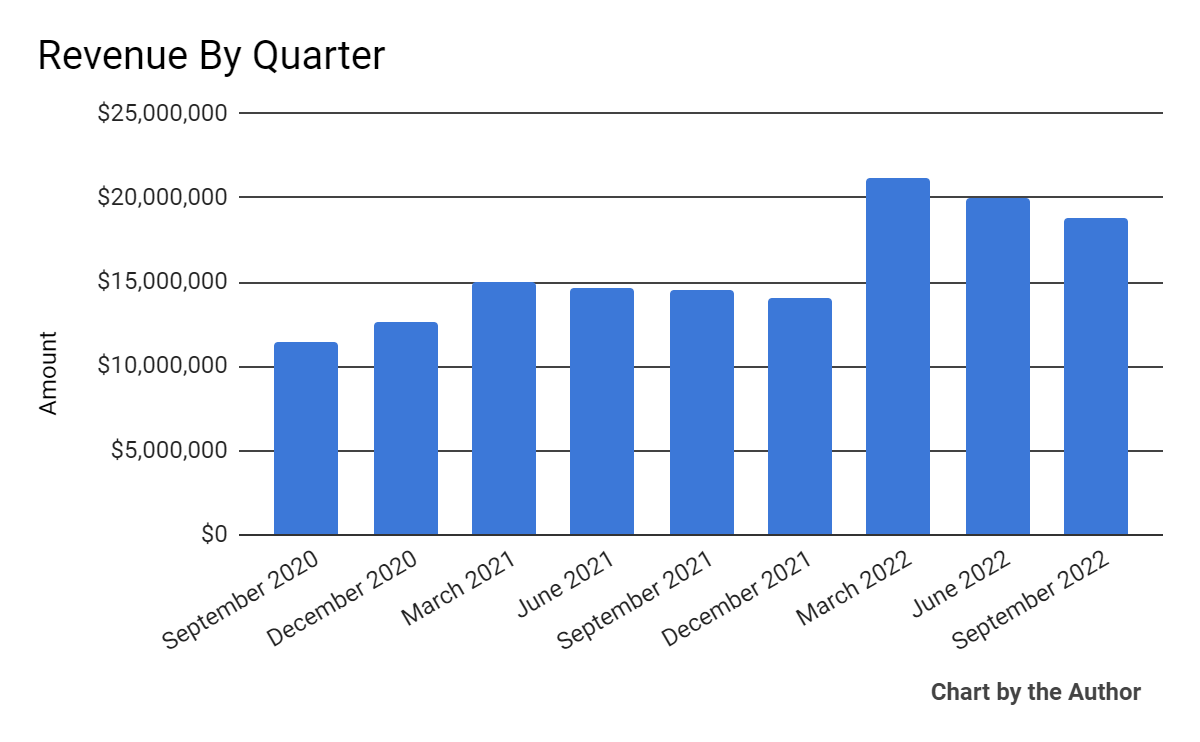

Total revenue by quarter has risen per the following trajectory:

9 Quarter Total Revenue (Seeking Alpha)

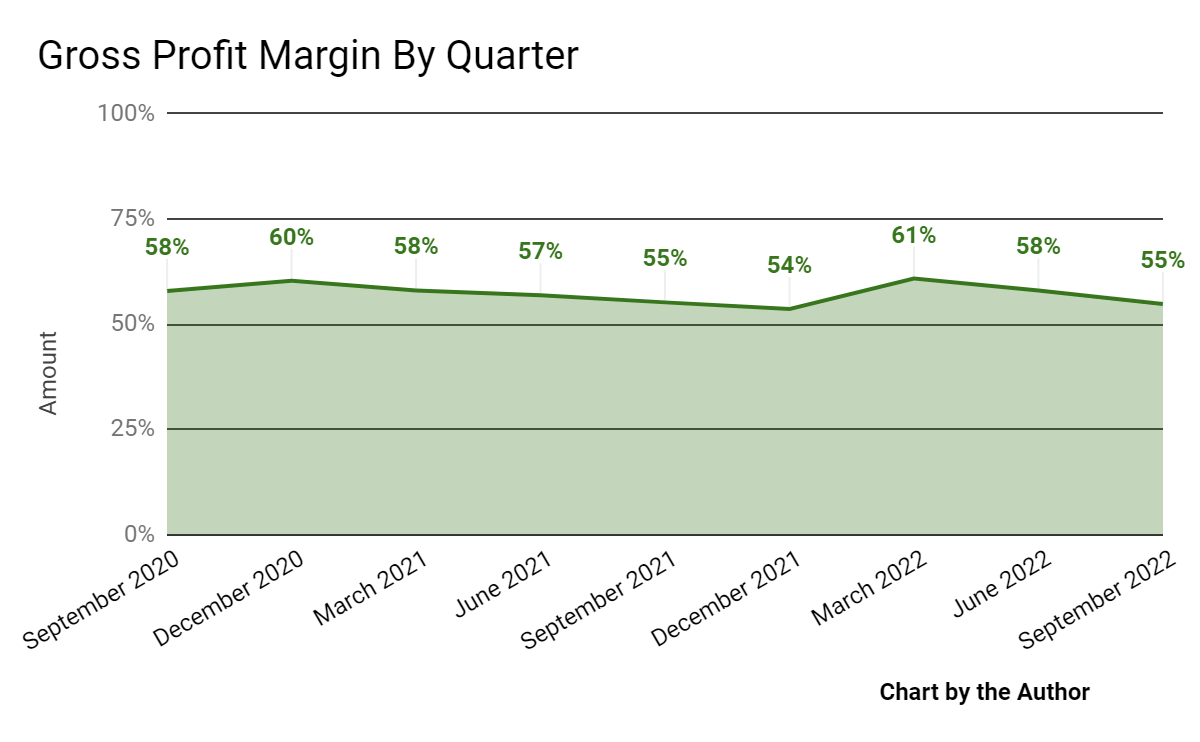

Gross profit margin by quarter has remained within a relatively tight range:

9 Quarter Gross Profit Margin (Seeking Alpha)

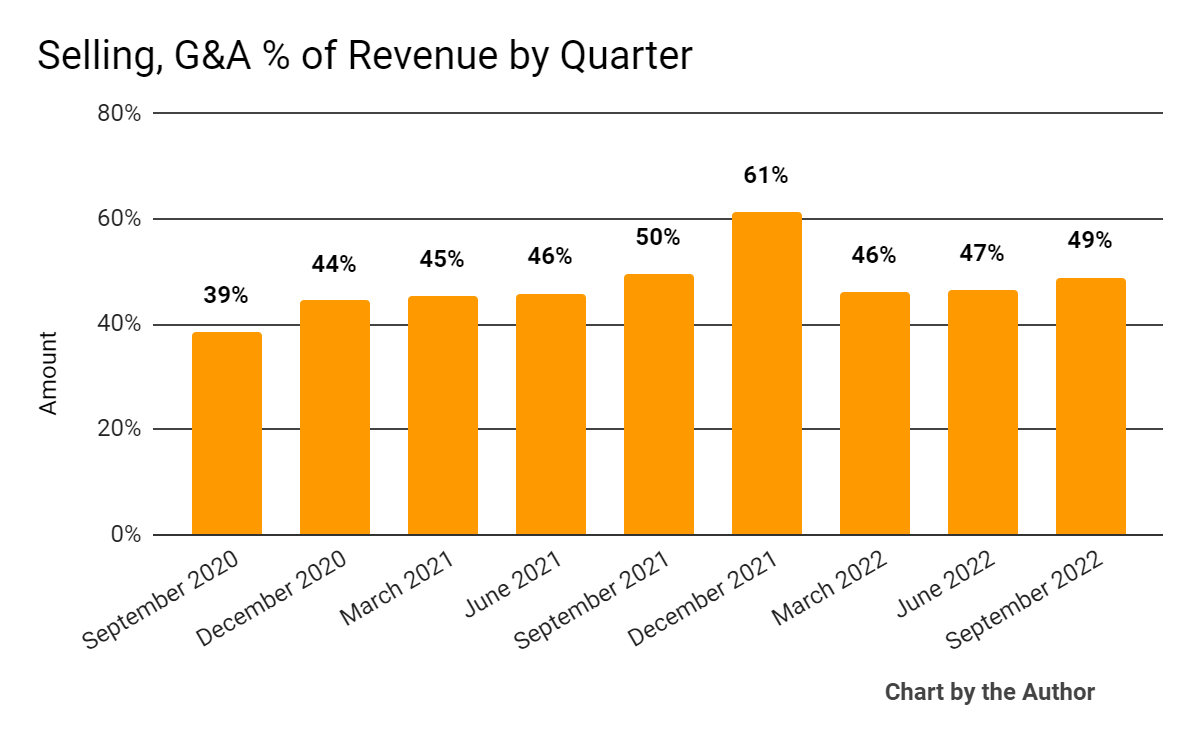

Selling, G&A expenses as a percentage of total revenue by quarter have produced the following results:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

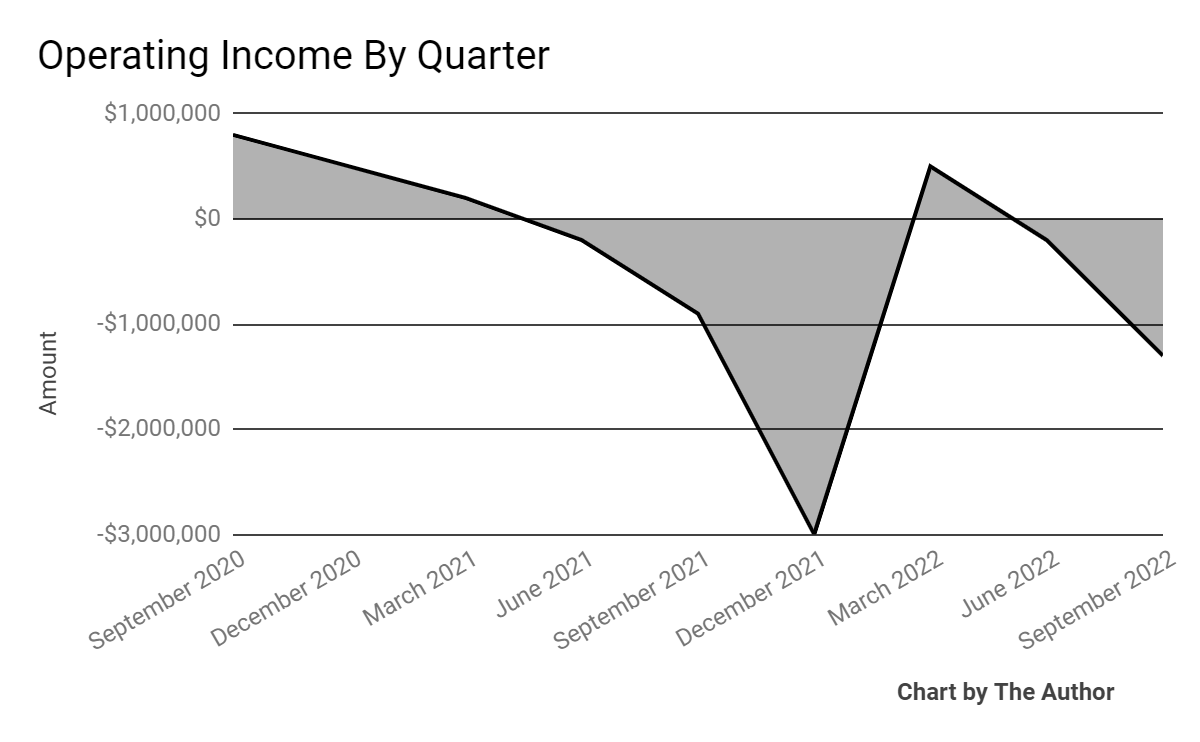

Operating income by quarter has been quite uneven:

9 Quarter Operating Income (Seeking Alpha)

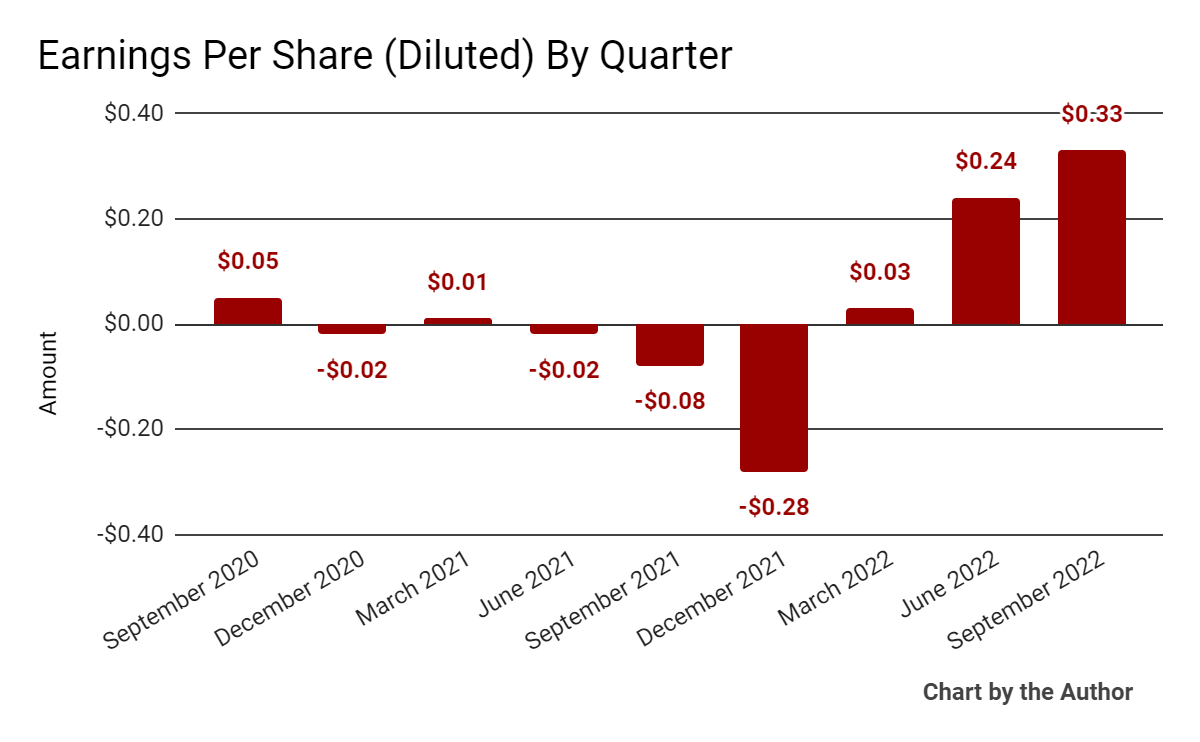

Earnings per share (Diluted) have risen markedly in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

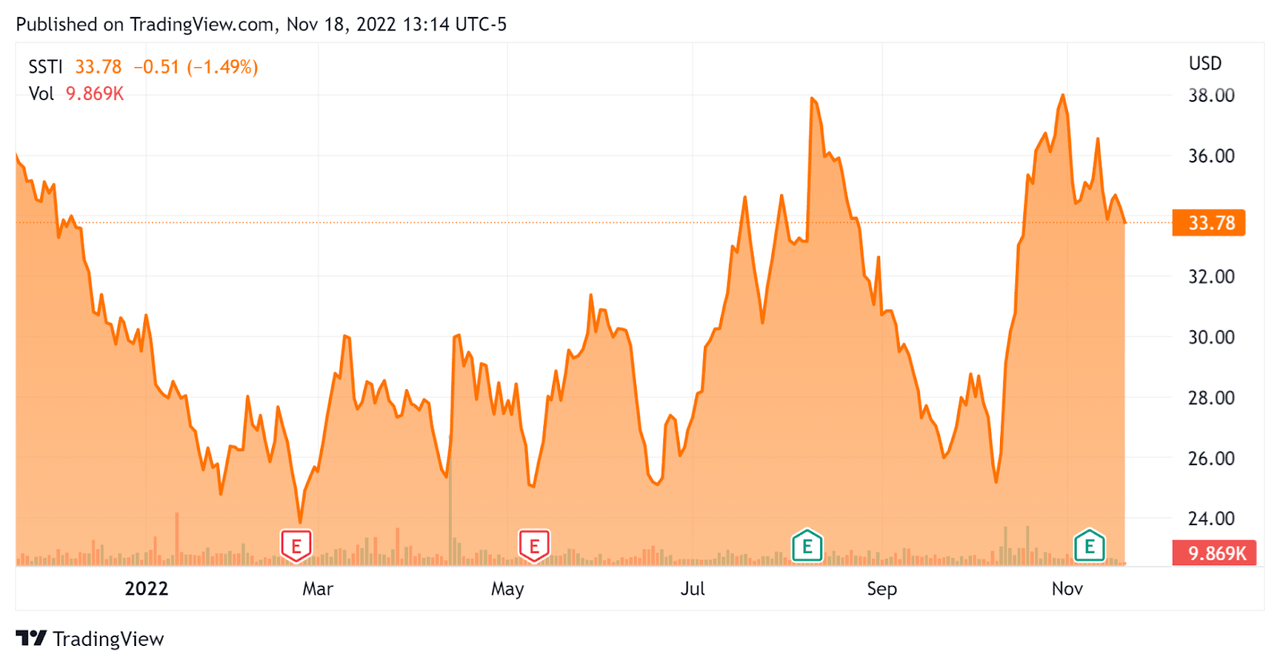

In the past 12 months, SSTI’s stock price has fallen 6.5% vs. the U.S. S&P 500 index’ drop of around 16%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For ShotSpotter

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.6 |

|

Enterprise Value / EBITDA |

108.7 |

|

Revenue Growth Rate |

30.2% |

|

Net Income Margin |

5.6% |

|

GAAP EBITDA % |

5.2% |

|

Market Capitalization |

$422,960,000 |

|

Enterprise Value |

$416,390,000 |

|

Operating Cash Flow |

$14,520,000 |

|

Earnings Per Share (Fully Diluted) |

$0.32 |

(Source – Seeking Alpha)

Commentary On ShotSpotter

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted going live with seven new customers and expansions of six customer installations.

Management also noted its customer funding environment as a positive, with a large percentage of police budgets spending more in 2022 than in 2019.

The company is also continuing to work on an 8-figure deal size with an undisclosed customer which it expects to be a ‘bellwether account that will accelerate the adoption and consideration of other corrections prospects’ in its pipeline.

As to its financial results, total revenue rose 29% year-over-year and adjusted EBITDA grew by 37%, to $3.1 million.

The company published a forecast of ‘less than 1% GAAP revenue attrition’ for its core respond business, the third year in a row of this retention metric.

Gross profit margin was 55%, flat year-over-year, while operating expenses were down year-over-year due to a non-cash adjustment for reduced contingent consideration associated with its Forensic Logic acquisition.

Earnings per share rose to a nine-quarter high of $0.33, due in part to the Forensic Logic adjustment.

The Board has approved a new stock repurchase program for up to $25 million when appropriate.

For the balance sheet, the company ended the quarter with $10.2 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash flow was only $3.3 million, with $11.2 million in capital expenditures weighing on the result.

Looking ahead, management expects 2023 revenue to grow 17% over 2022’s results.

Regarding valuation, the market is valuing SSTI at an EV/Revenue multiple of 5.6x and an EV/EBITDA multiple of 108.7x.

The primary risk to the company’s outlook is the potential for reduced spending by customers and prospects as the overall economy goes into recession and funding experiences downward pressure over time.

An upside catalyst could be a pause in interest rate hikes as the U.S. proceeds further into a slowdown or recession. This development might result in a higher valuation multiple for growth companies such as SSTI.

While the company has positive prospects from robust public coffers and a renewed interest in fighting growing crime conditions, I’m cautious on its prospects going into an uncertain 2023 economic environment.

I’m on Hold for SSTI in the near term, although interested investors may wish to put the stock on a watch list for future consideration.

Be the first to comment