Scott Olson/Getty Images News

What’s The History Of Twitter?

You need to understand the history of Twitter in order to evaluate it as an investment, so don’t skip this part!

Contrary to popular belief, Twitter was not founded by Jack Dorsey.

Twitter Inc. (NYSE:TWTR) was born out of a podcasting company called Odeo in 2006, which in turn had been founded by Evan Williams and Noah Glass.

Shortly after Odeo was launched Apple launched its own podcasting service which presented a strategic dilemma for Williams and Glass. What to do?

In the event, what they did was to pivot. They bought into a pitch that one of their junior employees, Jack Dorsey, had made. The idea was to launch a group messaging service and this ultimately became Twitter.

So far, so good.

The Twitter idea was based around SMS text messaging. Bear in mind that this is before the iPhone existed and so predates smart phones generally. In those days, and of critical importance, SMS messages were limited to 140 characters and enabled one-to-one communication. In 2006 group communication wasn’t a thing and social networking was embryonic. So it is fair to say that the Twitter concept was well ahead of its time.

You may be thinking to yourself that today we have Facebook, Instagram, WhatsApp and other group messaging services, so Twitter has become marginalized and had squandered its opportunity to claim dominance in this space.

If so, you have missed a critical element in the Twitter investment thesis.

Facebook, Instagram, WhatsApp, LinkedIn and other social media platforms focus on the user interacting with his or her existing network of friends, family or work place acquaintances.

Twitter is different. It focuses on the user interacting with complete strangers based on common interests and, more importantly, intelligence and information sharing.

I cannot overstate the importance of this distinction.

My wife loves Facebook because it allows her to keep up with what Kim Kardashian had for breakfast or who Britney Spears is marrying this week. It allows her to look at the vacation photographs of her old school friends. In short, it is a quasi-voyeuristic means of wasting time. It is no more productive than watching reality TV shows. It is great for people with too much time on their hands. In terms of productivity, while some people promote their business interests on Facebook, for most people it is an unproductive means of spending time. One might argue that it serves as a distraction from spending time productively doing something else, and so it destroys productivity generally.

Twitter is different. It is the go to place for people wanting to share ideas and knowledge. Said differently, it is a tool that is used to create productive value. It is the electronic town-square where the intelligentsia congregate. It is the social media hub preferred by politicians, journalists, financiers, business people and other educated influential people.

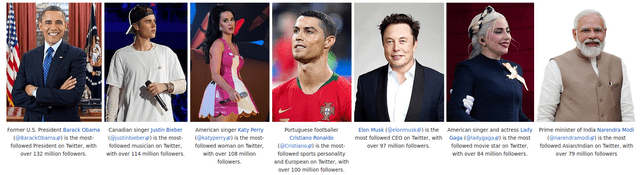

Until he was banned, Donald Trump used Twitter as his primary means of communication to drive public relations. Today it is still favoured by Barack Obama (who is at the head of the leader board with 132 million followers), President Biden, Elon Musk, Bill Gates and so many others. The Prime Minister of India, Narendra Modi is the most followed Asian person on Twitter. None of these people waste their day on Facebook or Instagram or TikTok.

If you are interested in sport and music, Twitter is the place that the stars tend to make big announcements. These include Justin Bieber, Katy Perry, Rihanna, Cristiano Ronaldo, Taylor Swift, Ariana Grande, Lady Gaga, Shakira, LeBron James to name but a few. All of these people have millions of followers on Twitter.

In short, news is being made on Twitter all of the time. Announcements are being made on Twitter. Valuable opinions are being shared on Twitter. Most of the activity on Twitter is productive activity.

On Twitter you will form a network of people with whom you are not acquainted and with whom you are highly unlikely to ever be acquainted, but with whom you have overlapping interests. It is a place to share thoughts and opinions, where one might seek information and knowledge amongst strangers. In this regard it is the electronic version of ancient Athens where people would gather to listen to the likes of Socrates and Plato, to challenge ideas and to debate.

Ancient Greeks Gathering To Share Ideas And Opinions (Painting by Louis Joseph Lebrun, circa 1867)

So, Twitter is not in competition with Facebook and other social media platforms because it offers something entirely different. It is, to a large extent, enjoying a monopoly in the niche in which it operates.

Interestingly, Twitter (market cap $28bn) is currently approximately 5% the size of Facebook (market cap $460bn), but in terms of societal relevance and importance it is arguably higher up the scale.

Facebook has 1.6 billion daily users, while Twitter has close to 250 million. That suggests a huge untapped TAM for Twitter to capture.

So, you may ask:

-

Why has Twitter’s share price stagnated since IPO while other social media platforms have sky-rocketed in value?

-

Is there still an opportunity to unlock explosive growth? If so, what is the investment thesis moving forward?

These are exactly the questions that you ought to be asking. This article presents the answers.

Why Is The Twitter Share Price Down?

The answer to this loaded question is that the share price may now be lower than it was at Twitter’s IPO in 2013, but the value of the company has increased significantly over the same period.

Following Twitter’s IPO in November of 2013, the first trade was a little over $45. Today, while I write this article, it trades for less than that ($38 to be precise). So in the eight and a half years since Twitter went public, its share price is down and early investors are very unhappy.

To put this in context, the last decade has seen the most lax monetary policy with an expansion in money supply and negative real term interest rates, all of which has acted as an accelerator for IT based intangible asset heavy companies to flourish.

Even after the huge correction of 2022, Facebook (META) is up 350% over the period from November 2013 to today (from $50 to $175), while Twitter is down 15% ($45 to $38). So what gives?

The problem was not so much with the business or indeed its subsequent performance, but with the share price. While Twitter is arguably under-priced today (more on this later), it was vastly over-priced in 2013. Investors back at the IPO had no chance of making any kind of reasonable return in the short to medium term because a decade of future growth was already baked into the share price. Said differently, the intrinsic value of the business needed the best part of ten years to catch up with the over-inflated market valuation.

I always remind myself that investing in a great company at the wrong price makes for a poor investment. This kept me away from Twitter over the last decade.

However, now it appears that the share price may be below intrinsic value and so for the first time I am now becoming interested in this investment opportunity.

What’s The Problem With Twitter?

Despite having a virtual monopoly in the space in which it operates, and having had a first mover advantage, the performance of the Twitter management team has been poor. This can be broken down into specific failings:

-

Big Egos In The Way of Good Business

Twitter has been a victim of over inflated egos for 15 years. When Dorsey suggested that Odeo pivot to an SMS messaging service in 2006 (see first part of this article), Williams and Glass bought into the idea and Jack was named CEO. After that, rather than working together, these over inflated egos were locked in conflict with each other. There have been books written about it. Dorsey was fired in 2008 and Evan Williams, the Odeo founder, took control. In 2009, Williams brought one of his friends, Dick Costolo, in to Twitter as COO. Believe it or not, Costolo landed at Twitter and sent his first Tweet which read: “First full day, Twitter COO tomorrow. Task number one, undermine CEO, consolidate power.” Initially it was taken as a joke but, truth is stranger than fiction, and in October 2010 Williams was fired by the venture capital firms backing the business and he is replaced by… you guessed it, Costolo. So Dick Costolo serves as the CEO until 2015. At that point, Costolo is pushed out and guess who comes back as CEO now?! Jack Dorsey. What a mess! By this point Dorsey was also acting CEO of his other listed company, Square (now called Block). It is fair to ask if anyone has the capacity to effectively manage two public tech companies. I would argue not. In any event, had there not been so much back-stabbing, and if Dorsey had been CEO from the beginning to see his vision through, then it may all have been very different. After all, many of the most successful tech companies were founder led: think Jeff Bezos, Mark Zuckerberg, Bill Gates, Steve Jobs. But the story doesn’t end there. There are more twists to this saga. By 2019 activist investors Elliot and Silver Lake were involved in the business. They recognised that Twitter had so much untapped potential and so they sought to unlock its true value. The changes that they introduced (more on this later) were very positive, but they culminated in Jack Dorsey resigning at the end of 2021 and leaving the company the very same day without serving any notice. Did he really leave voluntarily or was he pushed? Who cares? So, the good news is that the big egos have now all gone and the business is in the hands of shrewd capitalists which bodes well for the future.

-

Corporate Greed At The Expense of Shareholders

Stock Based Compensation has been abused at Twitter. In the period 2014 to 2019 (6 years), Twitter’s SBC totalled $3.1 billion which was 20.3% of its top line revenue and 170% of its reported EBITDA! Rather than the company being run for the benefit of its shareholders (the way that it is supposed to work), US tech companies, such as Twitter, are being run for the benefit of their over paid management teams who are syphoning off money in the form of SBC in order to enrich themselves at the expense of shareholders. Twitter did repurchase $245 million of common stock in 2020, but issued almost double that in stock based compensation so arguably the buy back was simply used to mask the SBC abuse. So while Twitter shareholders have seen a negative capital return since the 2013 IPO, Jack Dorsey has gone from being a humble employee on a regular wage to becoming a billionaire. I hear you objecting that he invented Twitter and so deserves a payback. Others may be objecting that he has made some of his wealth from his other company Square. Well, in response to the first objection, Dorsey’s net worth was $2.2bn on the day of the Twitter IPO and that was his payback for his invention. There was no need to treat the company as a cash cow for employees. In response to the second objection, Square was the product of his financial windfall from Twitter and so without one there would not be the other. In any event, Bloomberg’s Billionaires Index calculated Dorsey’s net worth in 2022 at $12.3bn and so between the IPO and today Dorsey has seen his wealth increase by 500% while his shareholders have watched the IPO share price of $45 drop to $38, a loss of 15%. Is that right? I’ll leave you to make up your own mind! My opinion, for what its worth, is that SBC is a wealth transfer from shareholders to senior management and ought to be the subject of very strict regulation because it amounts to market abuse.

-

Poor Corporate Culture

Twitter had low staff morale and high employee turnover. This made it difficult to hire or retain the best people.

-

Trolls

The platform was not well policed and was mired with people harassing and abusing each other. It actually began to lose users and had negative revenue growth in 2017 as a result.

-

Bad Tech Infrastructure

The tech stack was poorly designed which meant that development was dangerous. Essentially, the way that modern IT businesses operate is that they build modular components into a tech stack that combines to form the overall product. If one module is changed and encounters an issue, the rest of the stack is unaffected and the business can continue. However, at Twitter there was effectively a single module and so a small change could have destabilised the entire platform. Consequently, the safest course of action was simply to maintain the status quo and to make as few changes as possible. In fact, in almost a decade to 2020 there were really only two primary enhancements. The first was a doubling in the number of characters that make up a Tweet from 140 to 280; and second, the timeline changed from being chronological to being algorithmic which enabled it to feel a little more relevant for users. The look and feel was largely unchanged and an unevolved platform has hindered Twitter in its ability to grow and to better engage its user base.

Is Twitter A Failing Company?

Answering this loaded question, the answer is categorically “No”. In fact, the opposite is true. Twitter is a company going from strength to strength.

To his credit, when he returned in 2015, Dorsey recognised some of the key failings at the company and in the period 2017-2021 he focused on an organizational shake-up. There were four pillars of improvement at the heart of his plan:

-

Improving employee talent and morale

-

Increasing the focus of the team

-

Cleaning up abuse and harassment on the platform, and

-

Rebuilding the tech stack in a modular configuration and simultaneously adding new functionality (more on this later)

Dorsey’s efforts were rewarded and the health of the business began to improve. Revenue growth returned in 2018, and user growth accelerated in 2019.

Operating margins turned positive for the first time in the company’s history in 2017 which was a significant milestone.

Fast forward to today and top line revenue is up 7.9x on where it was at its IPO (CAGR 29%) and more than double where it was in 2017

Today Twitter is arguably a far better business than it has ever been in its lifetime, yet ironically it is available at the lowest share price!

However, don’t go and click that buy button on the screen just yet. An intelligent investor buys based on fundamentals not on price action. Just because it is trading lower now than it has in the past does not mean that it is a great investment.

The key reason for the under-performance of the share price was that the IPO price was way too rich. Twitter was trading at 52x sales back then. Utter madness and there is a lesson to be learned there. As I said earlier, my number one rule is that even a great company at the wrong price makes for a poor investment. At 52x sales, if the company was able to perform the impossible and convert all of its top line revenue into profit (implying zero costs, zero tax and zero financing costs) then the investor would only see a 1.9% earnings yield on investment. Not even close to the hurdle rate for an intelligent investor. Layer on costs, taxes and financing costs and the return promised by the company at IPO based on a silly valuation was negative. It should come as no surprise then that early investors have experienced a capital loss on investment over the past 10 years.

From its IPO to today, Twitter achieved top line growth of 688.5% (from $665m to $5.2bn). However, the total return seen by shareholders was -3.1% (yes that is negative). In other words, ten years worth of 29% compounded annual growth was already baked in to the IPO price. Said differently, investors at the IPO gave away 10 years worth of 29% compounded growth by over paying back then! Ouch!

Twitter is on target to generate $6bn of revenue this year and it has a $30bn enterprise value, so it is available at a far more reasonable 5x sales today, although against recent operating margins and profit margins it is still not necessarily a bargain. The big question is how far can the turnaround take it and how much margin expansion is achievable?

In order to answer that question, we need to understand the Twitter business model.

What is the Twitter Business Model?

There are two types of people on Twitter: the user and the creator. Creators put quality content onto the platform and so attract the users. It is something of a fly-wheel situation. Twitter provides creators with the tools that they need to attract their followers. More users means more reason for creators to produce content. This leads to more followers and it attracts more users, and so on. That is the Twitter moat. It has a fantastic network effect. The key creators have literally millions of Twitter followers which is a valuable thing. Followers are what creators crave because that results in influence, power and the opportunity to monetize the user base.

Barack Obama can send his thoughts and ideas to 132 million people with the click of a button. Why would he or any other creator give that up to use an alternative platform? They wouldn’t. Twitter has an entrenched position, a wide moat. It’s very difficult for a competitor to take that away from Twitter now.

Twitter Account Holders Leaderboard (Wikidedia)

Most users of the platform don’t pay to use it. That means that the users are not the customers but the commodity. Twitter monetizes them through advertising (circa 90% of revenue). The balancing 10% of the top line comes from Twitter reselling aggregated user data and by providing user tools on a SaaS basis at a reasonably high margin.

That’s it in a nutshell, that’s the business.

Who Runs Twitter?

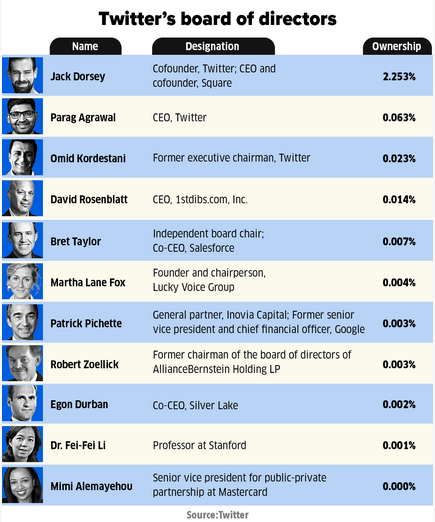

The board of directors is very strong and looks like this currently:

Twitter Board of Directors (Twitter)

Although Jack Dorsey is no longer the CEO, he is still on the board of directors.

Jack Dorsey’s sudden and unexpected resignation as CEO sent a shock wave through the market. Most CEOs give notice to leave and stay for an orderly handover to their successor. Bear in mind that Dorsey owns over 2.25% of Twitter and so it would be in his interest to remove all friction from the transition process. But that’s not what he does. Instead he says,”I’m done today, and the new CEO is Parag Agrawal.” That kind of behaviour does not inspire confidence and so the share price was hit.

As you know, market sentiment follows market narrative. The narrative follows the stock price. The stock price has been a disaster and so the backwards-looking narrative is negative, as is sentiment. Twitter needs to dig itself out of this hole but the actions of Mr Dorsey only made it worse.

The business is now being guided, at least in part, by activist investors Elliott Management Corp and Silver Lake. They are both heavily invested and were instrumental in the turn around of the business so far.

The company is trying to reinvent the narrative and at the end of 2021, Elliott issued the following statement:

Elliott Management statement on Twitter (CNBC)

Back to the change of CEO story, Mr Agrawal, previously the CTO at Twitter, was largely an unknown quantity to shareholders. So that didn’t help allay concerns of shareholders. However, I take comfort in the fact that a very competent board approved of the new CEO.

It is also worth pointing out that Bret Taylor was appointed chairman of Twitter at the same time. He is highly respected in Silicon Valley and he is co-CEO of the very successful Salesforce.

I’m not concerned about the departure of Dorsey. In the first instance, he needed guidance from activist investors to really begin the process of turning the business around. Second, he seems to have an enormous ego, which is not a good trait for a CEO. Third, he presided over what I describe as outrageous abuse of stock based compensation at the company. Fourth, he is CEO at Block (formerly Square), and there is no way one person can properly manage two public tech companies.

Mark Zuckerberg once described Twitter as “the clown car in the gold mine” because it had squandered such a wonderful gold plated opportunity in the past.

Now that the clowns are gone it has the best chance to achieve its true potential.

How Will Twitter Evolve?

In the future, in order to drive value, Twitter needs to focus on three core KPIs:

-

User acquisition (expand its user base)

-

Generate more user engagement

-

Drive more revenue per unit of engagement

I’ll explain how it is addressing this challenge.

The first iteration of Twitter, which didn’t change until recently, made it challenging to sign up, to sign in and to get going. Navigation wasn’t easy and finding people with common interests to connect with was challenging. This friction acted as an impediment to growth.

However, this is all changing.

-

Now users can use a Google ID or Apple ID to sign in quickly and easily.

-

Twitter uses algorithms to do all of the heavy lifting. For example, recently Twitter addressed this issue with a feature called Topics. In the past, if you wanted to learn more about your favourite football team then you needed to fish around Twitter to find people who were publishing information on your team. Today you simply click the Topic that you like, so the name of the football team, and the rest happens automatically. Not only that, but the platform now suggests Topics based on your activity. Far less friction which is great for user acquisition and engagement.

-

Once on the service, Twitter provides users with an incentive to come back more frequently and to spend more time on the platform. This means connecting users to the content that they love, content that they cannot find elsewhere. Referring back to the fly-wheel mentioned earlier, this means making it easy for creators to produce engaging content and Twitter is enhancing its suite of tools for creators.

This is all driving user engagement and increasing user numbers. This then needs to be monetized.

To increase revenue per engagement requires using machine learning to better understand what users are looking for and to deliver timely, targeted, quality adverts. Google is the master of this. Rather than just flashing up brand recognition adverts in a scatter-gun approach (like the pitch side adverts at the Super Bowl), instead they use a sniper rifle to target specific users and attempt to drive a purchase through a call to action, otherwise known as direct response advertising. This is higher margin advertising because the return on advertising spend (ROAS) is so much higher due to the targeting.

Targeted advertising is easier today with the Topics feature mentioned earlier because Twitter is now being told by users what they are most interested in. No need to second guess by reading between the lines which is what Facebook and Google do. So Twitter has a real advantage in that regard.

Twitter currently has approximately a 5% market share in advertising from large brands but has less than 0.5% of the advertising market from Small and Medium sized Enterprises ((SMEs)). The latter is where it needs to focus its attention. This goes back to the point made earlier about brand advertising versus transactional advertising linked to e-commerce.

None of this is difficult. It simply requires the focus of good management. SMEs need the tools provided by Twitter to design and deploy their own advertising campaigns and choose how to target them. Twitter can do the rest.

So far we have looked at enhancing the business as it is. But we can also layer on top of that commercial opportunities that have not been properly exploited.

Top of that list is subscriptions. Twitter has two different kinds of subscriptions:

-

Creator subscriptions enable charges to be levied by people creating valuable compelling content. So, you may be prepared to subscribe to the Twitter feed of The New York Times for example, or your favourite sports commentator. Most of this revenue goes to the creator and so this is less of a top-line boost for Twitter, but it does create a strong incentive for creators to fuel the fly-wheel by constantly producing great content in order to protect the subscription revenue. This indirectly benefits Twitter through greater user engagement.

-

Premium feature subscriptions. This is offering software as a service called Twitter Blue in the form of creator tools. It is interesting that if a creator is earning good money from his or her creator subscriptions then they will want to subscribe to Twitter premium tools. And so not only is Twitter taking a percentage of the creator subscription, but it is also, indirectly, taking another piece of it in the form of premium feature subscriptions. SaaS business has high operating leverage and so this is very high margin, recurring revenue, and largely untapped today. In this bucket we also need to consider Tweet Deck which was acquired by Twitter about a decade ago. It is effectively a power tool for people who spend their entire day on Twitter. Historically it has been offered as a value added free service, no idea why but perhaps it is because it has seen very little investment for over eight years. However, Twitter has revamped Tweet Deck and will be rolling it out on a fee paying subscription basis. So even more high margin business. All of this helps push average margins up (more on this later).

The next untapped opportunity is the ability to transact seamlessly inside the platform. This removes friction and creates more user engagement. It also feeds directly off the SME advertising push. E-commerce is a huge opportunity.

Finally, we need to look at all of this in terms of ARPU (average revenue per user) because Twitter has an opportunity to push this number significantly higher.

Facebook has a more diverse user base. Its users come from all walks of life and all demographics. By contrast, not everyone uses Twitter. Instead it appeals to a niche of the market. Twitter users are typically more affluent, higher income and higher educated people than Facebook users. Against that backdrop one would expect Twitter to generate a higher ARPU than Facebook, but it doesn’t. Facebook is generating more than three times the revenue per user.

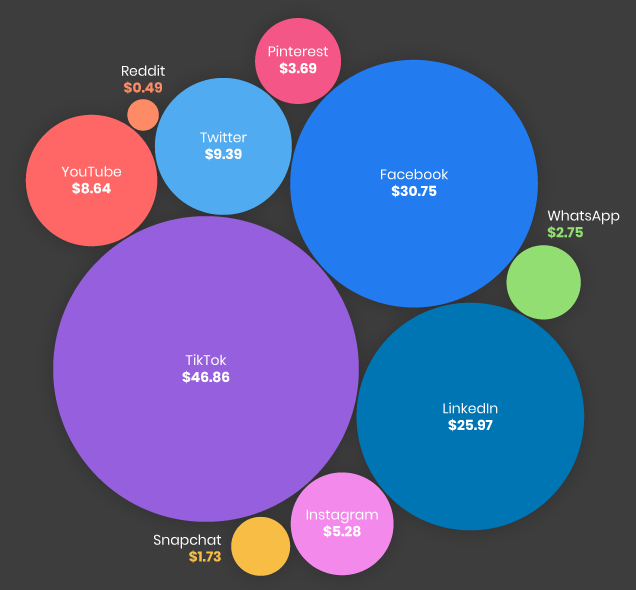

ARPU social media companies (PostBeyond.com)

So, think about this. If Twitter is only able to match Facebook in terms of ARPU in the future, then that means revenue growth of 300%. Given that Twitter has a more affluent user base and arguably more valuable content, there is no reason to think that it can’t exceed the Facebook ARPU.

Twitter has, finally, moved to an innovation phase. Over the last couple of years they have been playing with a raft of new services from e-commerce, recorded audio, live audio, subscription services sold by Twitter (not the creators) and professional profiles that are not dissimilar to LinkedIn. It has the user base to expand in all of these areas and from which it is able to increase its ARPU from non-advertising revenue.

So if we add the non-advertising revenue to the opportunity that Twitter has to increase its targeted advertising as discussed above, this starts to look super interesting.

Twitter is not only growing again but its growth is accelerating.

COVID-19 certainly provided a much needed boost for Twitter, but it is still growing users at a double digit rate.

It doesn’t take a genius to work out that if ARPU grows and user numbers grow then you benefit from a multiplicative effect.

Is Twitter A Good Investment?

First, it is important to know why Twitter has been a bad investment historically so that you are able to understand why it may be better in the future.

The first trade post IPO was at $45.10 and today the stock trades closer to $38.00, which is a total annual return of -2.12% (Twitter doesn’t pay dividends)

Let’s break out the fundamental reasons why investors have seen a such a poor return on their investment. Since IPO:

-

Revenue has grown 688.5% (this is where the good news ends for shareholders)

-

The share count has expanded by 27.9% (diluting shareholders)

-

Adjusted owner earnings margins have declined by 90.2% (not good for shareholder returns)

-

The over inflated IPO sales multiple has contracted by 89.4% (destroying shareholder value)

The cumulative effect of all of this (the mathematics is beyond the scope of this article but know this, it is a multiplicative function) means that on total return basis sales growth contributed 2.66% to total returns over the period while the dilution shaved 0.38% off that number, the declining margins shaved 2.27% off that number and the multiple contraction shaved 2.13% off that number.

2.66% – 0.38% – 2.27% – 2.13% = -2.12% CAGR from IPO to now (-17% Total Return from IPO until today)

This has seen the share price slide from $45 at IPO down to $37 and change today.

So, what does this mean for the future?

What’s The Fair Value of Twitter?

In 2018 and 2019, prior to its heavy growth investment today, EBITDA margins were over 20% but today they have been compressed to 10.4%. Now consider that Facebook has an EBITDA margin near 45% and you can imagine how much margin expansion is possible for Twitter. It should certainly be able to expand its margin to around 25% after the heavy investment in turning the business around is complete. So this is our first bull case assumption.

We know that Twitter targets to expand its user base aggressively, to increase its user engagement and to increase its ARPU – the latter two will see a benefit flowing both from the new users plus more engagement from existing users.

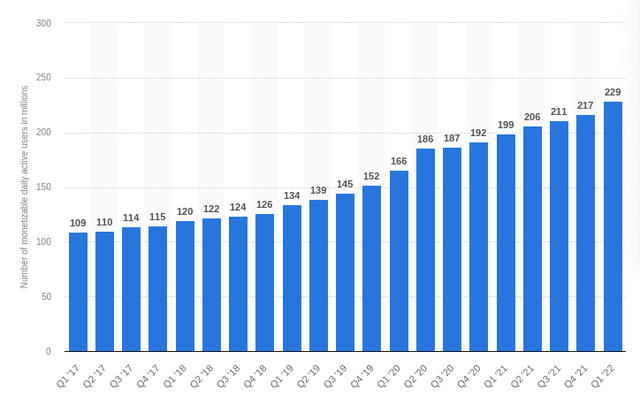

Targets set by Twitter at the beginning of 2021 were that by the end of 2023 it aims to have 315m daily active users (the number was 200m when the target was set so that’s an aggressive number), but it is moving in the right direction finding itself in the mid 200s today (see chart below).

Twitter daily active users (Statistica)

The revenue target for the end of 2023 was set at $7.5bn. It was $3.7bn at the end of 2020 when the target was set and $5.1bn a year later at the end of 2021, so it appears on track to achieve this.

Twitter may actually exceed its target numbers. So, let’s say that by the end of 2023 it achieves its 315m users. Twitters annual ARPU is approximately $25 in North America, but if we assume a 10% uplift to $27.50 (which is easily achievable given that Facebook achieves $62 ARPU in North America) then that gets us to $8.7bn top line revenue well ahead of target.

Alternatively, at an ARPU of $27.50 if Twitter hits its $7.5bn target then it only needs to increase its daily active users to 273m rather than the 315m.

Either way, let us use the $7.5bn top line number as our second assumption.

It seems appropriate at this juncture to quickly deal with the noise created by Elon Musk in relation to fake accounts and bots being active on Twitter. I am discounting that noise because it washes out in my numbers. Allow me to explain. If the actual number of active daily real users is lower than our assumptions then the ARPU per real user must be higher because our ARPU numbers are based on the number of users (the two are inextricably linked). We are assuming a 10% increase on ARPU and so it doesn’t matter what the starting point really is, a 10% uplift is a 10% uplift. The result is the same.

The final assumption is the multiple. Twitter currently trades on a difficult to justify 5x sales multiple. Even if it achieves a very ambitious profit margin of 25%, then that means an earnings yield for the investor of only 5%. Inflation is pushing risk free rates higher and so earnings yields will need to move the same way. This would suggest a multiple contraction rather than an expansion in coming years.

Although Twitter is nowhere close to a 25% margin today, bear in mind that it is a business that invests heavily on in-house development of intangible assets. These are off balance sheet assets due to international accounting standards which means that they are expensed immediately rather than being amortized over time. Expensed investment steepens the shareholder return curve. It depresses the front end but boosts the back end. This is because investments that are all paid for today will yield benefits for years to come and so there is a mismatch between the accounting treatment of revenues and of costs. In other words, after the investments have been made, operating leverage should kick-in.

So let’s stick to a very ambitious 25% forward profit margin. This is our final assumption.

Today the Enterprise Value of Twitter is $30bn, so if it hits its $7.5bn top line target by the end of 2023 and the sales multiple contracts to 3x (in line with its peers and producing an 8% earnings yield against an assumed profit margin of 25%), you arrive at an enterprise value closer to $22.5bn.

Looking at it slightly differently, $7.5bn top line and a 25% profit margin (very optimistic) gives $1.875bn earnings. Apply an earnings multiple of perhaps 12x (which implies an earnings yield of 8.5%) and we come out at $22.5bn market cap.

Why would you pay $30bn for this business today when it is likely to be worth only $22.5bn in two years time (implying a valuation today of $19bn on an NPV basis at a discount rate of 8.5%).

And all of this assumes that Twitter hits its very ambitious targets.

In February this year Twitter announced a $4bn share buyback program but stock repurchases are only accretive to shareholder value if the price being paid for the shares is less than its intrinsic value (the accretion is the positive differential). Share buy backs at over inflated prices destroy shareholder value and are often only used to mask excessive SBC. (This is a fascinating area of corporate finance which too few investors understand. The detail is beyond the scope of this article but I dedicate a chapter of my book to this topic if anyone is interested in learning more.)

In any event, we seem to have established that the market valuation of Twitter is beyond its intrinsic value and so the $4bn stock buy back announcement at these over inflated levels is in fact bad news for investors.

How does Twitter compare to Peers Including Facebook?

We have already looked at the differences in the business models from a qualitative perspective, but it is also useful to compare financial fundamentals on a peer-to-peer basis. I’ve brought Snapchat (SNAP) and Pinterest (PINS) in to the mix for comparative purposes.

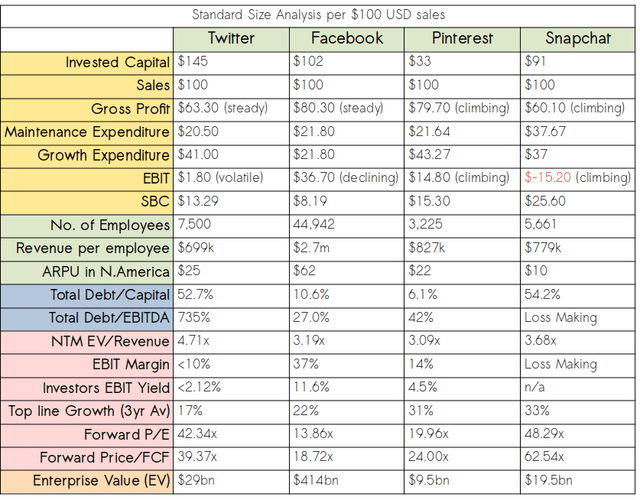

Twitter Facebook Pinterest Snapchat Compared (Author’s Analysis)

Allow me to talk you through this table.

The top part in yellow is the standard sized analysis. Very useful for comparing businesses operating on a different scale.

Essentially, we are looking at inputs and outputs on the basis of each $100 worth of sales.

Twitter is the most capital intensive company and, by my calculations, needs $145 worth of capital to generate $100 of sales. Snapchat and Facebook are at similar levels closer to $100 of capital per $100 of sales. Pinterest is the winner here and is very capital light requiring only $33 of capital to generate the same $100 of sales.

From that $100 of revenue, both Facebook and Pinterest generate a similar level of around $80 of gross profit. Snapchat and Twitter trail behind as they only convert around $60 of sales into gross revenue.

Now we have allocation of capital to consider.

I have split these out into Maintenance Capital and Growth Capital. Both Twitter and Pinterest appear to be investing heavily in growth and so I have assumed a ratio of 1:2. Looking at the financial reports of Facebook and Snapchat it appears that they have a more even split and so I have used a 1:1 ratio. None of this is particularly material to this high level analysis, but I wanted to explain the presentation.

Either way, the deduction of Maintenance Capital and Growth Capital from Gross Profit gives us the EBIT number.

Facebook is the clear leader here having generated nearly $37 of EBIT from every $100 of sales. Pinterest comes second, but doesn’t even achieve half of the Facebook EBIT number at about the $15 level.

It is worth pointing out here that although Pinterest only achieved $15 of EBIT, it did it with $33 of invested capital. Facebook generated a far better $37 of EBIT, but it needed $102 of invested capital to achieve it. Turning this on its head, for every $102 of invested capital at Pinterest it will generate $45 of EBIT. From this perspective, Pinterest is arguably the better business (whether you prefer Pinterest or Facebook as an investment at this stage is down to personal preference but whichever way you go, both of these businesses look far more attractive than either Twitter or Snapchat).

Twitter is investing heavily and so its EBIT number is barely positive now, but this will change as soon as the turnaround investment is complete and I would expect it to be up in the $15 to $25 range at that point. Snapchat is still a loss making business and so its EBIT number is horribly negative.

The next line item on my table is SBC. As you can see, for every $100 of sales revenue generated Facebook pays out $8 of SBC, Twitter $13, Pinterest $15 and Snapchat $26. Know this, for Snapchat, if 26% of top line revenue goes out the door into the pockets of employees its very difficult for shareholders to ever generate a good return (perhaps this is one of the reasons that Snapchat is still loss making). In relation to the other three companies, SBC was originally used by tech start-ups as a means of paying employees prior to the point of break even when cash flow was dangerously tight but future prospects were bright. In these circumstances SBC makes some sense. But for a company like Facebook with very strong positive cash flows, it can afford to pay its people with cash and SBC is entirely unnecessary. It misaligns the interests of shareholders and employees because it amounts to a wealth transfer from the former to the latter. Award staff with performance bonuses instead – that aligns interests. SBC is today one of the most abused aspects of corporate finance and it is something I dislike immensely. It is a huge red flag for me when investing (that’s another chapter in my book if you are interested!)

Next we have performance metrics. Facebook smashes this one out of the park. It generates 3x more revenue per employee than any of the other businesses in our comparison. It also generates more than double the ARPU of Twitter and Pinterest. Snapchat is left in the dust by all three on this measure.

In terms of financial health, both Pinterest and Facebook utilize very low levels of debt in their business while both Twitter and Snapchat use approximately 50% debt. On a debt to EBITDA basis Facebook is in the best health but Pinterest is not far behind.

Now we are down in the pink section. We have already established that both Facebook and Pinterest look like the better companies from an investment perspective. Now look at the sales multiple that they trade on. Both similar at 3.1x enterprise value. Twitter by comparison is trading at nearly 5x EV. That makes no sense and confirms what I said earlier in my valuation when I suggested that a 30% to 40% multiple contraction is most likely for Twitter.

Facebook is the only company of this group that looks to have a fair valuation. Against an EBIT margin of 37% it offers investors an EBIT yield of 11.6%. None of the others meet the hurdle rate for an intelligent investor.

In terms of top line growth, all are strong but based on an average of the past few years, Pinterest and Snapchat have been the strongest. Twitter is accelerating its growth due to its heavy investment. But it is worth bearing in mind that the bigger a company becomes, the more difficult it is to sustain strong growth. Facebook is by far the biggest company in the group and by a significant order of magnitude. Against this backdrop, 22% top line growth is nothing short of incredible.

Finally, I’ve included the forward earnings multiple and free cash flow multiple for the sake of completeness. The issue here is that heavy investment by Twitter and Pinterest depresses short term earnings as mentioned earlier, so these are not really very useful comparative indicators on this occasion. However, it is worthy of note that Facebook looks very reasonably priced on these metrics.

Will Elon Musk Buy Twitter?

Should we be concerned about the noise that Musk is making about Twitter and fake accounts? I would say no. My theory goes like this. Musk is often reported to be the richest man in the world. But it is not cash wealth, it is paper wealth. Most of it is tied up in Tesla stock. Musk has publicly stated several times that he believes the stock to be over priced in the market. He actually expressed these opinions on Twitter!

Elon Musk Tesla Stock Price Too High (CNBC)

So what do you do if your wealth is tied up in over inflated stock?

-

He can’t sell the stock on the market because that would cause panic and the share price would collapse.

-

He can’t sell the entire company because no other business would pay such a nonsensical price (Tesla is priced on the market at more than every other auto manufacturer combined and only accounts for 1% of cars manufactured and it has awful profit margins compared to the likes of Toyota, the market leader).

So what would you do?

The answer is simple. You use your over inflated currency (Tesla stock) to buy another asset, in this case Twitter. Musk fans can’t see what is happening and laud him but this is undoubtedly part of an exit strategy for him to cash in some of his chips.

So Musk would take Twitter private see through the Twitter turnaround and exit after a few years via another IPO. So he extracts $44bn of value from his Tesla stock without causing the share price to collapse. He then exits in a few years with a large cash payout. If the Twitter value increases then that’s a bonus for him. If not, I don’t think he cares. This is just a special purpose vehicle for converting paper wealth into cash. Genius.

So why is Musk now making so much noise after having his bid accepted? Well, the value of Tesla stock has collapsed between the acceptance of his Twitter bid and now and so the plan has hit a bump in the road. If he completes the deal now, it won’t be worth as much to him as it was a couple of months ago because his over inflated currency is a little less over inflated. So, my theory is that Musk is playing for time in the hope that the Tesla share price recovers. Just my theory. You may have a different one.

Either way it doesn’t impact my assessment of the Twitter investment opportunity.

Conclusion

I conclude this article with my thoughts on whether Twitter is a good investment. On the basis of the case that I have set out above, I would say that there are far better places to put my money right now. I have demonstrated that Facebook, at its current valuation, is one of them.

Is there any other evidence in support of my conclusion? I believe so and here’s why:

-

On April 2022 Elon Musk acquired 9.2% of Twitter for approximately $42.67 per share. He then followed up with a bid for the remainder of the company at $54.00 per share. Does this mean that Twitter is worth $54? I would argue not. I have explained why I believe Musk is interested in acquiring Twitter. There is an ulterior motive. I believe that his bid is way higher than the intrinsic value of the business.

-

When someone bids for a public company it usually acts as a catalyst for others to evaluate the opportunity and, more often than not, other bids come in at higher prices and the first bidder is forced to improve. That hasn’t happened with Musk and Twitter. Why? I would suggest that others have looked at it and concluded that Musk is over paying and that they could not improve on his bid.

-

The most sensible fit would be for Facebook to buy Twitter. It could leverage its existing infrastructure to extract more value from Twitter than anyone else. But it has expressed no interest. Such a deal would attract the attention of the competition authorities and may be blocked, but it is worth a try. Twitter is very complimentary to the Facebook, Instagram and WhatsApp business franchise. This hasn’t happened either.

-

In the past, both Disney and Salesforce have looked to acquire Twitter but after conducting due diligence they have walked away. It wasn’t the business that put them off. It can only be the market valuation being well above intrinsic value.

-

After Musk made his bid for Twitter it was very quickly accepted by the Twitter board of directors (a very competent group of people). Why? They didn’t attempt to negotiate, they just accepted. Generally that doesn’t happen unless the vendor believes that the price being offered is too good to be true. This view is cemented by the fact that Musk has been making lots of noise about fake accounts and threatening to walk away, but the board of Twitter is holding him firmly to the terms of the deal.

-

If the new CEO believed that there was a great deal of value to be unlocked in the short term then he would want to preside over that transition. Not only would it be lucrative for him, but he would earn the kudos of being the man who made Twitter great again. But he has chosen to accept Musk’s offer instead. This is a compelling argument to suggest that there is no short term upside in Twitter right now.

Alternatively, in order to add balance to this last point I shall put out an alternative theory. In 2011 Agrawal was completing his doctoral studies in computer science at Stanford University. After that he was a salaried employee, one of 7,000 at Twitter. Suddenly, Mr Agrawal finds himself in the top job as CEO at the age of 38. He is earning $12.5m per year in that post and if a takeover happens during his tenure he would be awarded a $60m bonus. If you were Mr Agrawal, would you be tempted to approve the takeover approach regardless of Twitter’s prospects?

I am certainly not prepared to invest in Twitter at current prices. If the Musk takeover happens then shareholders achieve $54 which is a nice uplift on the present $38 price, but the fact that the gap in prices is so wide suggests to me that the market believes that the most probable outcome is that the deal fails.

Personally, I would become interested after a multiple contraction to bring the share price down in to the $20 to $25 range. That would be closer to intrinsic value and may introduce some kind of margin of safety. At the current $38 price I believe that there is as much chance of the stock dropping $16 as there is of it climbing by the same amount to Musk’s bid price. In fact, so many people have bought the stock blindly seeking to capitalise on the takeover arbitrage, that a move to the downside is likely to trigger stop losses and push the stock sharply lower.

I think it highly unlikely that the stock will hold at current levels of $38. It will either jump higher if Musk seals the deal or drop violently if the deal collapses. Perhaps the best trade is a long Twitter straddle position!

Alternatively, perhaps a long/short position: long META, short TWTR may be worth considering. This is more risky because of the uncertainty around the outcome of the Musk buyout of Twitter.

I believe that there will be a good opportunity to invest long in Twitter. I simply don’t believe that now is the time.

I hope that this article has provided you with the information to make up your own mind. It is not to be construed as investment advice, just the humble opinions of the author. Please seek professional investment advice before investing.

Be the first to comment