gorodenkoff/iStock via Getty Images

A Quick Take On CGI

CGI (NYSE:GIB) reported its FQ4 2022 financial results on November 9, 2022, with revenue up 8% on an as-reported basis, beating revenue and EPS estimates.

The company provides IT technology and business consulting services worldwide.

Due to numerous headwinds, I’m on Hold for CGI over the near term, although the company will likely be well-positioned for further growth, assuming the economic slowdown or recession is short and shallow.

CGI Overview

CGI Inc. is an IT and business process services company, providing services to clients in various industries worldwide.

It provides IT management and business outsourcing, systems integration and consulting, software solutions, application development and maintenance, testing, portfolio management, digitization services, business consulting, and a range of business process services.

The firm’s clients are in various industries such as government, banking and capital market, health, utility, communication and media, oil and gas, retail, consumer and services, space, manufacturing, insurance, life sciences, retail and consumer service, and transportation and logistics.

The firm is headed by Chief Executive Officer George Schindler, who came to the firm in a senior role in CGI’s acquisition of American Management Systems. He led various teams throughout the company before being appointed CEO.

CGI’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was estimated at $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth in IT consulting are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

There is also expected growth in the number of industries adopting digital transformation strategies such as manufacturing, finance, and retail, as well as a growing demand for improved customer experience.

IT consulting firms can also leverage their expertise to help companies develop and maintain new or better business models, which are better suited to the digital world. Many organizations are turning to IT consulting firms to help them align their digital transformation strategies with their business objectives. This can help companies better leverage technology to improve customer engagement, boost collaboration, and reduce costs.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

The growth of IT consulting is expected to continue due to the evolving digital landscape, increased demand for improved customer experience, the need to develop and maintain new or better business models, and the accelerated demand for modernization due to the pandemic.

Major competitive or other industry participants include:

-

Globant (GLOB)

-

Thoughtworks (TWKS)

-

EPAM (EPAM)

-

Slalom

-

Accenture (ACN)

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions (CTSH)

-

Capgemini (OTCPK:CAPMF, OTCPK:CGEMY)

-

Company in-house development efforts

CGI’s Recent Financial Performance

-

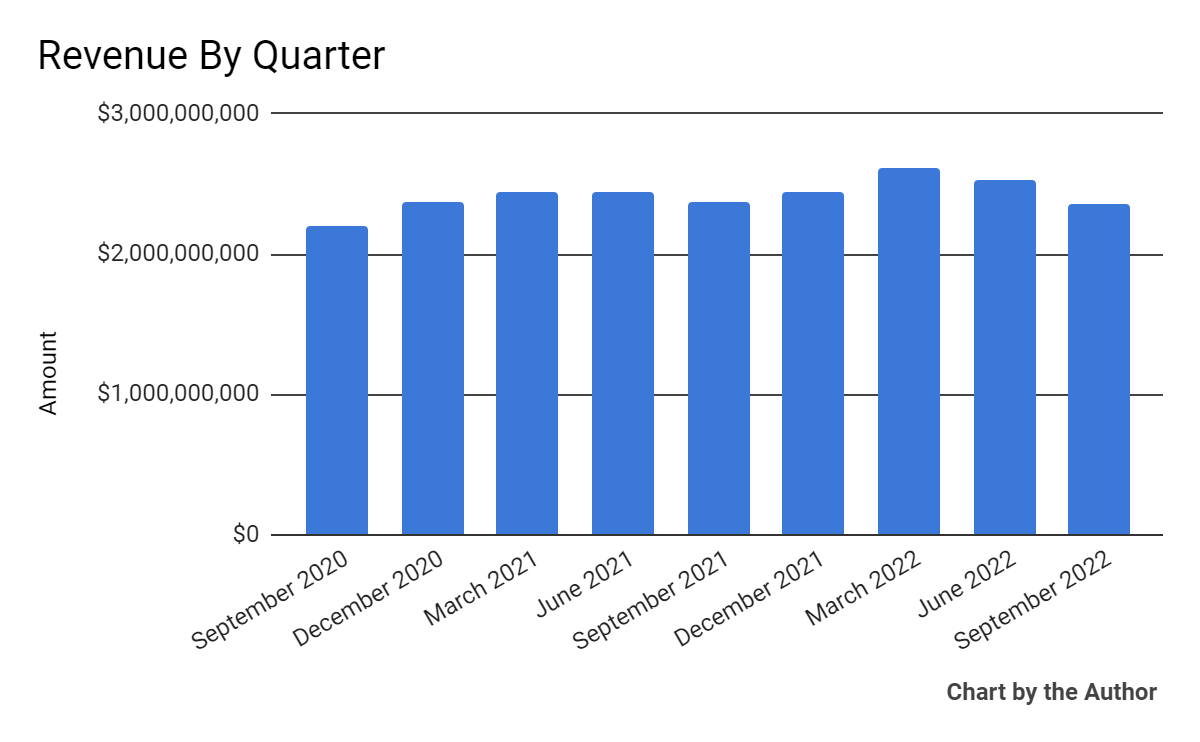

Total revenue by quarter has plateaued in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

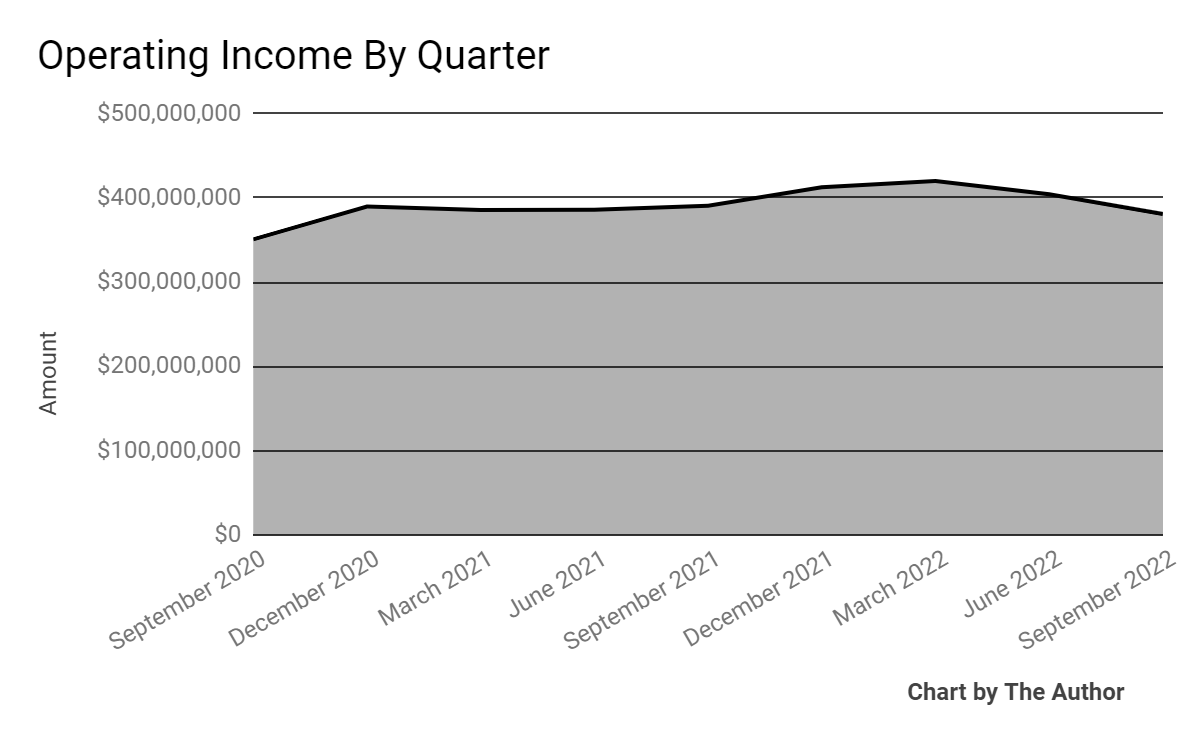

Operating income by quarter has also reached a flat line in recent reporting periods:

9 Quarter Operating Income (Seeking Alpha)

-

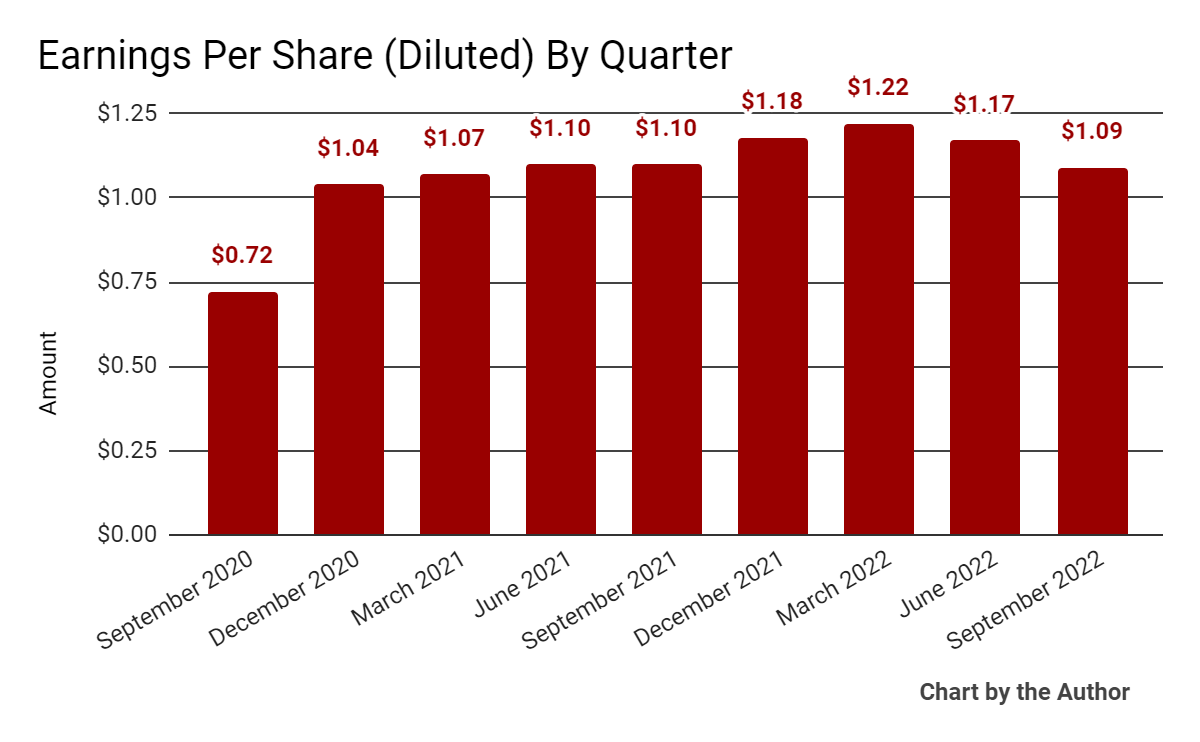

Earnings per share (Diluted) have similarly peaked in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

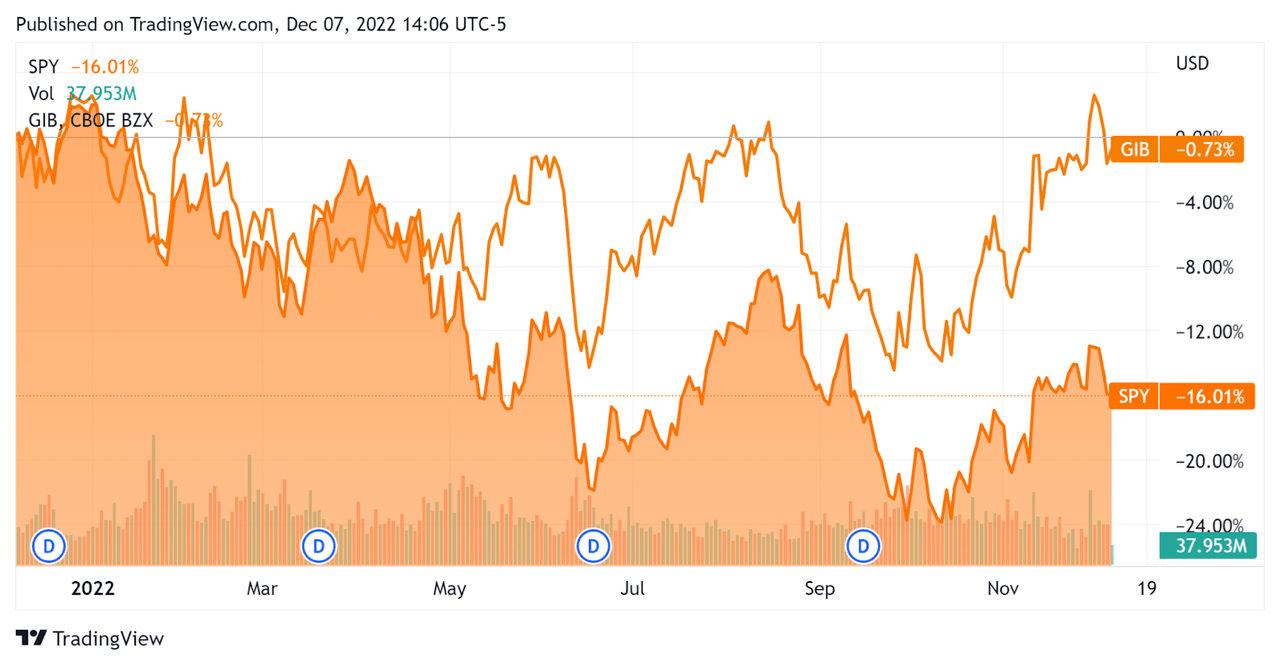

In the past 12 months, GIB’s stock price has fallen -0.8% vs. the U.S. S&P 500 index’s drop of around 16%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For CGI

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.4 |

|

Enterprise Value / EBITDA |

13.7 |

|

Revenue Growth Rate |

6.1% |

|

Net Income Margin |

11.4% |

|

GAAP EBITDA % |

17.7% |

|

Market Capitalization |

$20,427,278,300 |

|

Enterprise Value |

$22,628,495,400 |

|

Operating Cash Flow |

$1,350,312,830 |

|

Earnings Per Share (Fully Diluted) |

$4.66 |

(Source – Seeking Alpha)

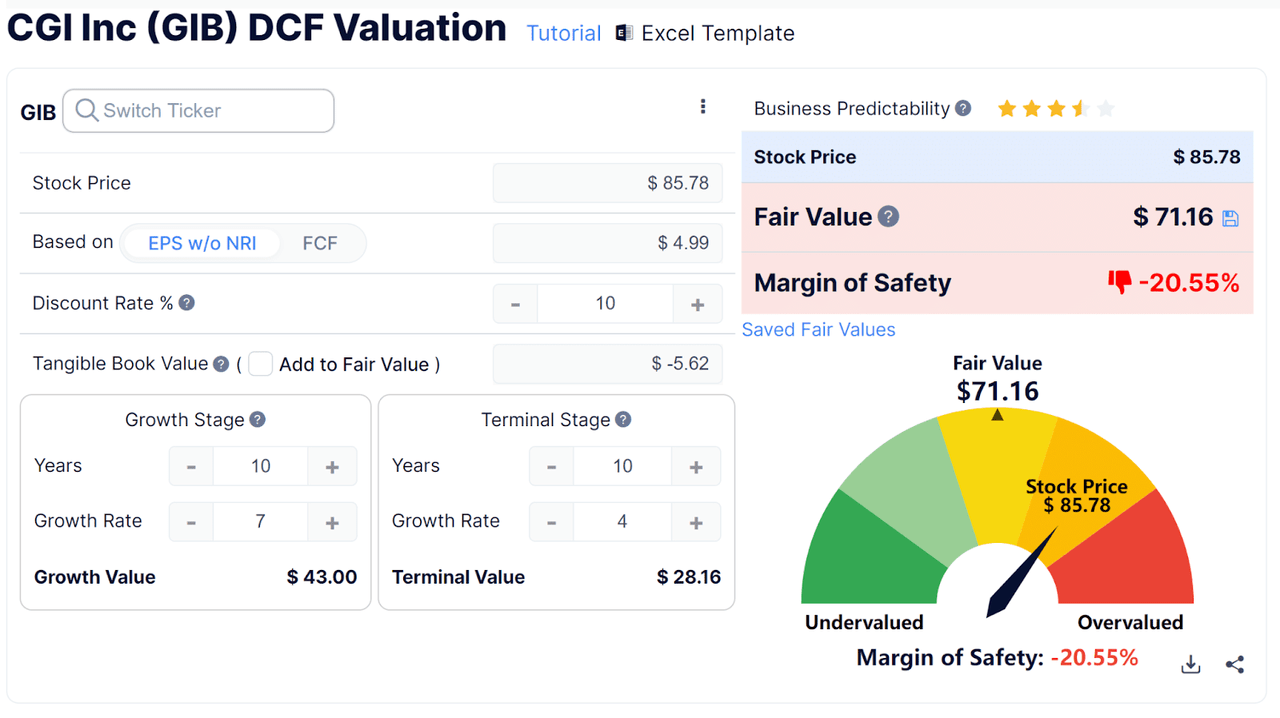

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

CGI Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $71.16 versus the current price of $85.78, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On CGI

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted the closing of five new mergers, adding over 5,000 consultants. As clients prioritize cost savings to fund and accelerate their digitization investments, CGI is continuing to identify and assess new M&A opportunities.

There is an increasingly positive M&A environment for CGI due to valuations coming down, the strength of the Canadian dollar, and its balance sheet. This, combined with a robust pipeline of potential mergers, suggests that there is potential for attractive and actionable merger opportunities. CGI will remain disciplined in its approach to ensure that investments are beneficial and they maintain the necessary cultural fit.

The company has seen an increase in demand for strategic IT consulting services and overall systems integration and consulting bookings increased by over $1 billion in fiscal 2022. This indicates that clients are looking for more holistic approaches to technology and are investing in digital transformation initiatives which require business model transformation, customer experience design, and cloud advisory services.

CGI’s pipeline of opportunities for these services is up on a year-over-year basis, with an increased interest in managed services and IP demand being up by nearly 40% and 25%, respectively.

As to its financial results, total revenue rose 8% year-over-year on an as-reported basis but was up 13.9% on a constant currency basis, so the company faced significant foreign exchange headwinds from a strong US dollar environment against the Canadian dollar and others.

Operating income was down 1.4% year-over-year, while earnings per share (USD) dropped by a penny.

For the balance sheet, the firm ended the quarter with cash, equivalents, and short-term investments of $704.2 million and $2.37 billion in total debt.

Over the trailing twelve months, free cash flow was $1.24 billion, of which capital expenditures accounted for a use of $113.0 million of cash.

Looking ahead, it appears leadership will be looking to snap up companies via M&A in what is likely a more favorable market for valuations.

Also, with a strong dollar expected into 2023, its foreign exchange headwinds may not subside.

So, we may not see particularly great results over the coming quarters due to these factors, as well as general macroeconomic pressures slowing down customer decision-making and reducing spending.

As a result, I’m on Hold for CGI over the near term, although the company will likely be well-positioned for further growth, assuming the economic slowdown or recession is short and shallow.

Be the first to comment