Marcus Lindstrom

Overview

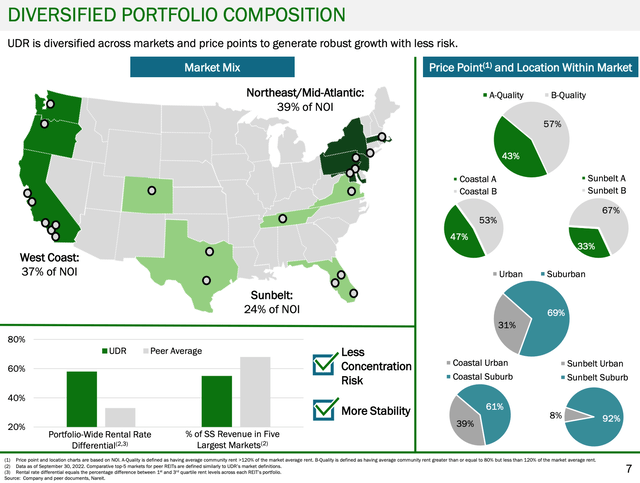

UDR (NYSE:UDR) is unique amongst large cap apartment REITs in that it is geographically diversified with significant exposure to both coastal markets like California & New York but also significant sunbelt exposure. Recently both Equity Residential (EQR) and AvalonBay (AVB) have decided to mimic this approach and have begun to diversify away from coastal markets but investments outside the coast represent only about 5% of total assets currently.

While coastal markets suffer from lower population growth, more government restrictions (i.e., rent control), they benefit from limited supply growth. It is notoriously difficult to add new supply in CA and NY – I discuss this in my piece on the Essex Property Trust (ESS). Further, CA and MA benefit from low and stable property taxes (property taxes are the largest operating expense for apartment REITs).

Overview (Investor Presentation)

By contrast Sunbelt markets benefit from a business friendly environment which has led to superior long-term population growth. The offset in these markets is the prevalence of new supply where there is less NIMBY-ism, more available land, and lower construction costs.

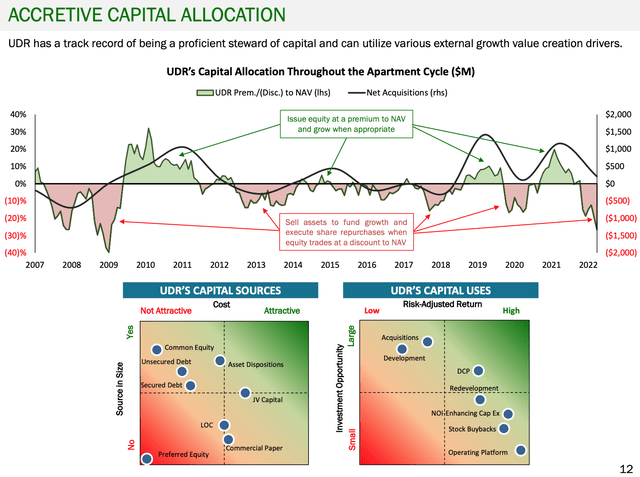

UDR has a long-term track record of success, through operational excellence. The company has consistently produced industry leading occupancy & same store revenue growth while keeping a tight lid on costs which have led to 10 year same-store NOI CAGR of just over 5% which is 50 bps higher than peers. Of equal importance is UDR’s logical approach to capital allocation. As shown below, the company has grown opportunistically when shares trade at or above NAV.

Capital Allocation & NAV (Investor Presentation)

To elaborate a bit on optimal REIT capital allocation (for those who may be newer to REIT investing and associated reflexivity), when shares are above NAV UDR has a low cost of capital (i.e., trades at a low implied cap rate or yield on assets) making it value accretive to issue shares and use the proceeds generated to purchase or develop assets which have higher yields. In doing so, the company is able to grow NAV/share.

Conversely, when shares trade at a discount to NAV, the best/easiest way to build value for shareholders is to sell assets (lower yield than the yield implied in its own share price) and use the proceeds to retire debt/repurchase shares. While earlier this year UDR issued shares to buy assets (at a price of $58/share), today with shares at $40, the company is selling assets and buying back shares. This type of flexibility builds NAV/share – while there can be dislocation in the short term, over the long term, apartment REIT share prices track NAV.

Current Conditions

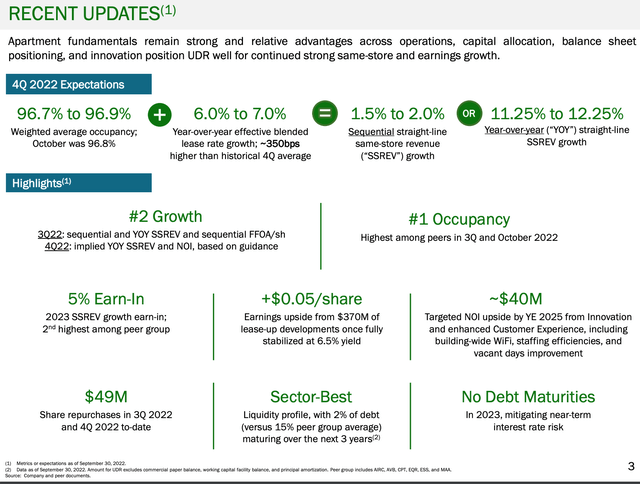

As shown below, UDR’s business is very strong with nearly 97% occupancy and continued rent growth which has translated to high same store NOI growth (+14% year over year).

Current Conditions (UDR Investor Presentation)

Importantly, the strong rental growth achieved by UDR throughout 2022 will not have a full year impact on NOI until 2023. Because rents have increased continually during 2022 (but only had a partial year impact on the 2022 income statement), UDR has a 5% earn-in heading into 2023. This means that UDR’s revenue is expected to be 5% higher in 2023 as even if market rent growth is zero.

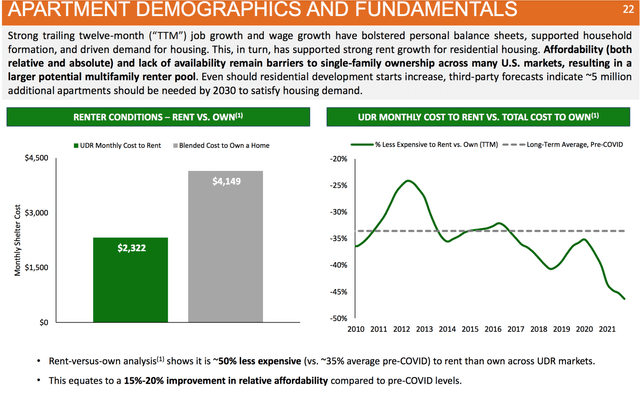

Further, there is solid underpinning of rental demand given the relative affordability of apartments versus home ownership. Higher mortgage rates reduce the ability of renters to become homeowners as ownership costs have increased dramatically relative to renting as shown below. UDR notes that move-outs to buy homes are nearing multidecade lows.

Cost of Renting vs. Owning (UDR Investor Presentation)

Addressing Investor concerns

While investors are concerned about a deteriorating macro picture and looming supply, there are some important offsets including:

1/ As mentioned above, UDR is entering 2023 in a position of strength with occupancy north of 96% and an earn-in of 5%. Even in a recessionary scenario, UDR will experience rent and NOI growth in 2023.

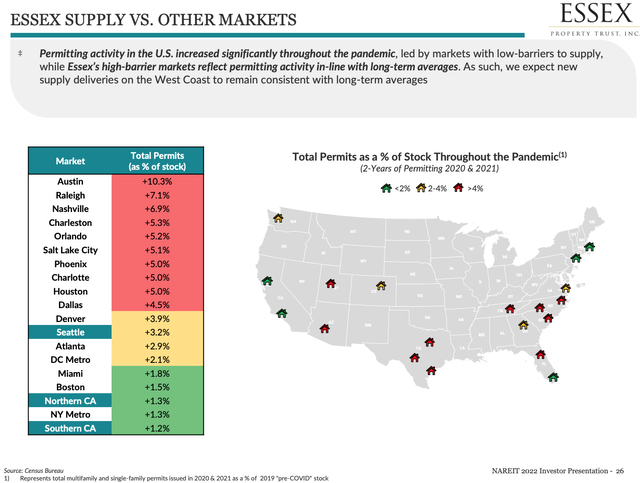

2/ With regard to supply concerns, the bulk of UDR’s portfolio (~75%) is in coastal markets which, as shown below, will see relatively insignificant levels of supply growth in 2023/24.

Supply growth by Market (Essex Property Trust Investor Presentation)

Further, 57% of UDR’s apartment assets are Class B. Class B properties tend to be more resilient to both economic conditions and new supply than Class A (which are newer and more expensive). Class B properties are 15-30 years old and priced at a 15-25% discount to A units (and 30+% to brand new units) of comparable size. Class B & C is not subject to competition from new construction as development is ALWAYS focused on Luxury/Class A (Class B would never pencil out and new Class B is NEVER BUILT).

3/ As for higher interest rates, like the other apartment REITs, UDR has a very strong balance sheet (loan-to-value less than 30%) and has mainly long-term, fixed rate debt which means that interest rate increases will have very limited impact on FFO/share.

Valuation & Conclusion

As we sit today, UDR trades at an implied 5.7% cap rate and 16.6x FFO which are at the low end of its 10-year average. Historically, UDR has traded at 14-28x FFO (and an implied cap rate of 3.8-6%).

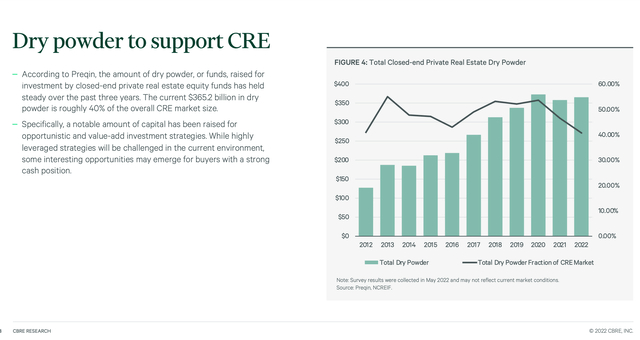

Ultimately, I assume that valuations will revert back toward the higher end of their historical range. The logic underpinning this assumption is the significant amount of private capital chasing apartment assets (as shown below). Further, inflation has driven up the replacement cost of apartment assets making the REITs increasingly attractive on a per-door basis (which represents an estimated 20-25% discount to replacement cost).

RE Private Equity Dry Powder [CBRE]

Note the significant increase in private capital allocated for real estate investment over the past 10 years. Eventually, this capital will have to be invested to allow the private equity sponsors to earn fees. Given the turmoil in office and retail, many private equity firms are increasingly focused on apartment assets.

Assuming a 4.5% cap rate, I get a fair value of $53 per share for UDR suggesting 33% upside which I consider to be very attractive given the low-risk profile and high quality of both the assets.

Be the first to comment