Just_Super/iStock via Getty Images

Overview

In this series of articles, I am focusing on single Dividend Challenger stocks and determining whether they are solid long-term buy options for investors based on a number of criteria related to performance, financial strength, valuation, dividend strength, etc. In the first article of this series, I reviewed the Dividend Challenger stock ACCO Brands (ACCO) and determined it to be a hold for current shareholders and should be avoided for other long-term investors. That article can be found here.

Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

For this article, I will be reviewing the stock performance, financials, recent news, valuation, and dividend strength of Alamo Group (NYSE:ALG).

Alamo Group designs, manufactures, distributes, and vegetation and infrastructure maintenance equipment for governmental, industrial, and agricultural uses throughout the world. Equipment from Alamo Group ranges from zero-turn radius mowers and tractor attachments to snowplows, sewer cleaners, and hydro excavators. The company was founded in 1955 and is headquartered in Seguin, Texas.

Dividend

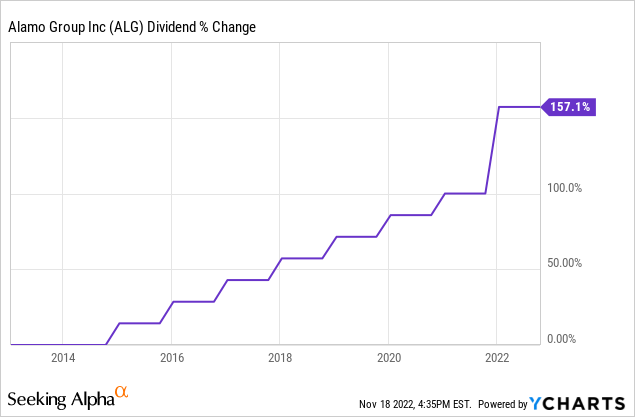

Alamo Group has been on the Dividend Challengers list for a while having 8 years of consecutive dividend growth. Looking at the chart below, you can see that Alamo Group’s dividend growth has been fairly consistent with a larger-than-expected jump (based on historical reference) for its last increase.

Alamo Group’s quarterly dividend payments of $0.07 in 2014 have increased to $0.18 in the last quarter of this year, with the company due to increase its dividend with its next quarterly payout.

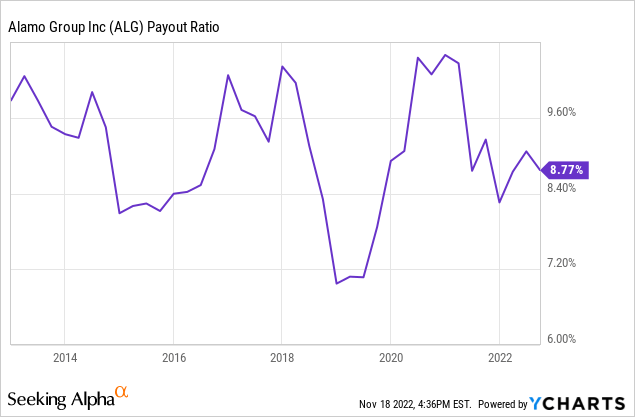

Looking at the chart below, you can see that Alamo Group’s payout ratio remains low and in line with its historical average. Based on payout ratio, Alamo Group should have no problem continuing its dividend growth moving forward.

The weakest aspect of Alamo Group’s dividend is its current yield of just 0.48%. Looking at its history, the yield has remained low never crossing 1% and seldom moving about 0.750%.

Financials

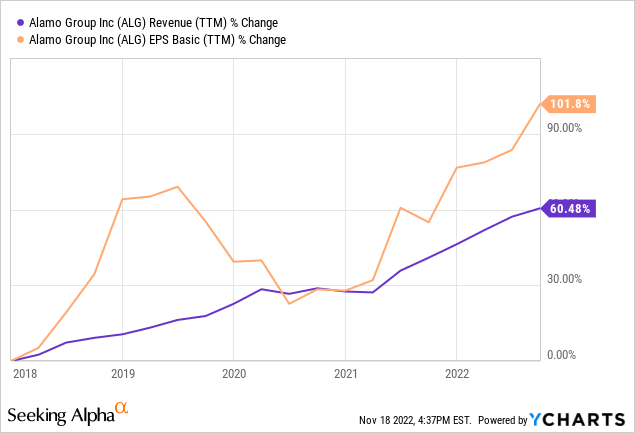

Alamo Group’s revenue growth has been fairly steady over the past five years. Looking at the chart below you can see that its earnings growth has seen some ups and downs during the same time period but overall has been largely positive.

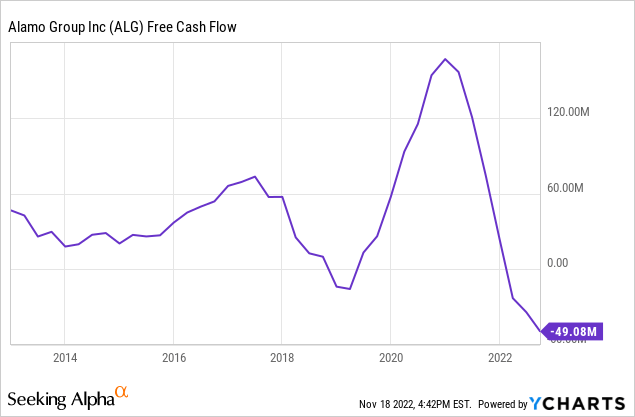

When looking at cash, you can see that Alamo Group’s free cash flow has also been up and down over the past several years and is currently at its lowest level in a decade. If this trend continues, this could apply pressure to both its payout ratio and future dividend growth.

Alamo Group’s long-term debt has decreased recently but remains at a higher-than-average level compared to its ten-year average. ALG missed both revenue and earnings estimates significantly in its last quarterly report. However, it wasn’t all bad news as income from operations was up 19.3% and the company’s backlog was up nearly 41% compared to the prior year.

Valuation and Performance

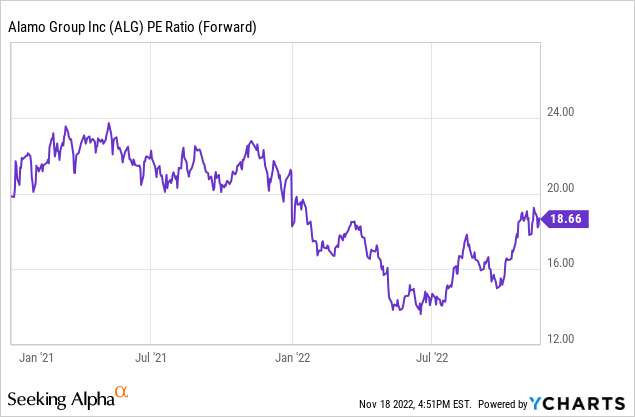

Alamo Group currently has a forward PE ratio of 18.66. Looking at the chart below, you can see that this is in line with its historical average.

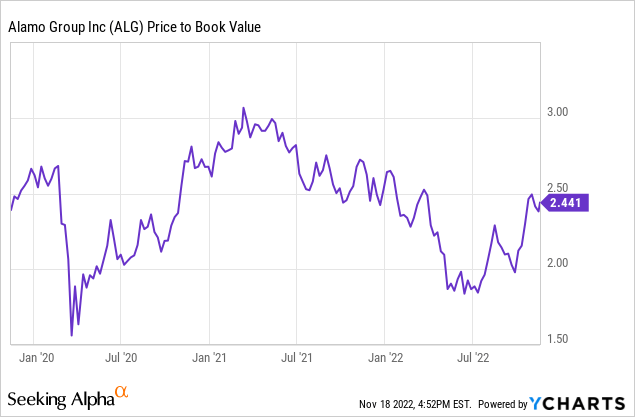

A similar trend can be seen when looking at ALG’s price-to-book value.

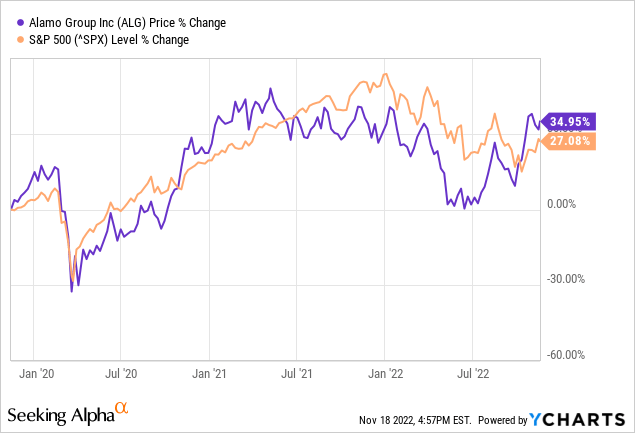

Based on its PE ratio and price-to-book value, Alamo Group appears to be reasonably priced, and looking at the chart below, you can see that ALG has performed fairly well over the past three years, gaining nearly 35% during this time period and slightly outperforming the S&P 500 during this time frame.

Peer Comparison

A few stocks within the same industry as Alamo Group include Proterra (PTRA), Nikola (NKLA), Wabash National (WNC), and Trinity Industries (TRN).

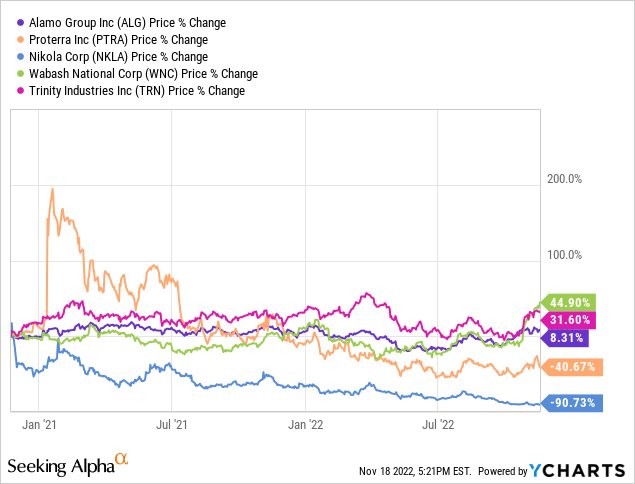

In terms of stock price, you can see in the chart below that Alamo Group is right in the middle in terms of performance with its competitors over the past three years.

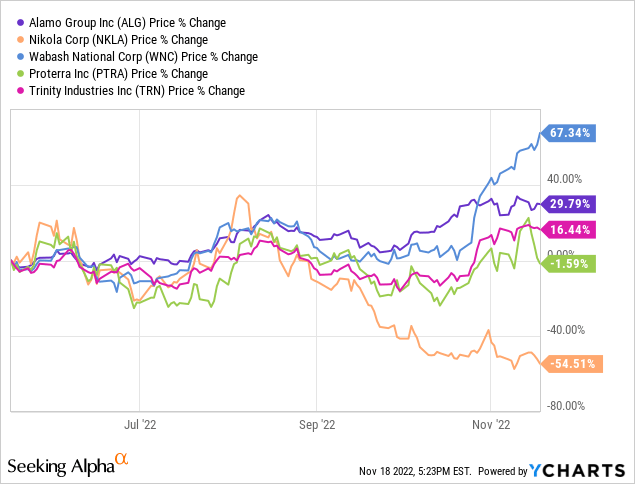

Alamo Group has performed better in the near term, coming in second compared to its competitors.

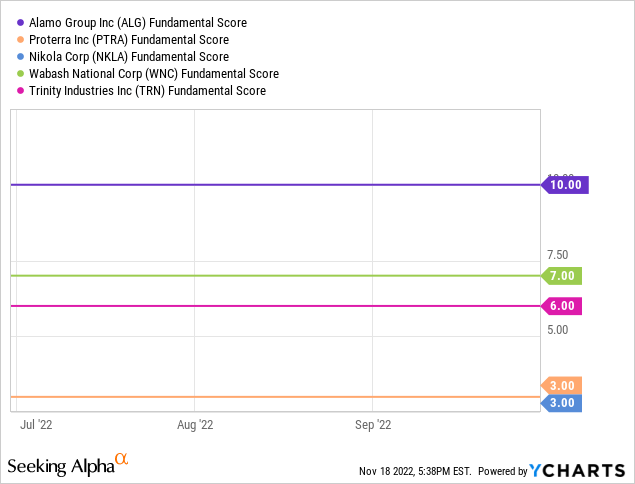

When looking at the fundamental scores of these stocks, you can see that Alamo Group stands at the top of the list with a score of 10.

Recent News

ALG’s Q3 results were announced earlier this month and as stated above it missed both earnings and revenue estimates. However, there were positive signs when reviewing the earnings call transcript.

- Consolidated net sales increased by 9% even as the company deals with continued supply chain and labor challenges

- While earnings missed expectations, net income per share did increase from $1.47 to $2.16 compared to the same period last year.

- Order bookings and backlog have increased significantly from last year

Management stated that they continue to focus on reducing inventory and debt levels.

Conclusion

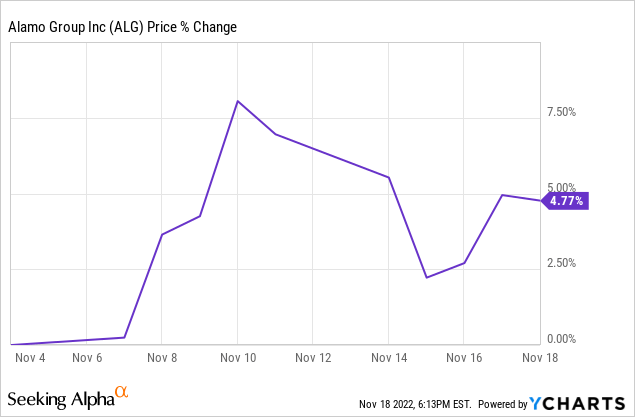

Alamo Group didn’t have a specifically strong third quarter, but even though it missed its estimates, it still has positive signs moving forward and investors seem to agree. While the stock did see a decline in price when earnings were reported on November 3rd. The stock is up nearly 5% since November 4th as seen by the chart below.

I think that Alamo Group’s diverse business operations along with an increase backlog and a trend of increased orders will help investors see positive returns moving forward. I think the stock is a solid buy for investors that don’t mind the low yield of its dividend. With increased revenue and a continued low payout ratio, I don’t believe there is any worry that Alamo Group won’t make the Dividend Contenders list soon enough.

I probably like Wabash National a little better due to its current valuation and its strong recent quarterly results, but I believe these two stocks are the best two long-term options out of the five stocks mentioned above.

As always, I suggest individual investors perform their own research before making any investment decisions.

Be the first to comment