JHVEPhoto/iStock Editorial via Getty Images

Shopify (NYSE:SHOP) shareholders found out the hard way this week that stock splits aren’t much more than financial gimmicks. After several large cap tech companies successfully split shares in the last year, the e-commerce platform executed a large share split and the stock has continued on to recent lows. My investment thesis is more Neutral on Shopify until the retail shakeout ends, but the stock valuation is definitely more appealing here with the stock down over 80% from the highs.

Stock Split

Just about anyone with basic investment knowledge knows a stock split provides no economic benefit to shareholders. A stock split can cause further momentum higher in a bullish trending stock just as a reverse split can create more downside from a bearish trending stock. Either way, an investor still has the same ownership position in the company as before the stock split just more shares in this case.

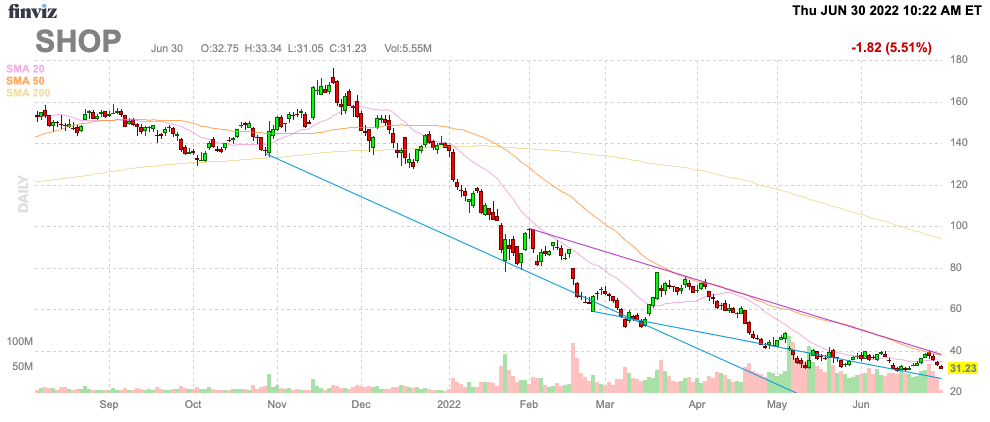

Shopify completed a 10-for-1 split on June 29. During the COVID e-commerce surge, the stock traded to a high of $1,763 where a split was probably warranted to make trading by retail investors and options more accessible. The stock though has collapsed prior to the split and now the company finds shares trading down at $31 and possibly heading into the $20s.

Source: FinViz

Considering stock price levels are considered a matter of strength, Shopify trading back down into the $20s doesn’t throw off the best vibes. If the stock was to head much lower, Shopify might regret such a large split that once appeared logical when a 10-for-1 split would’ve left the stock still trading above $100.

Not Done Growing

The e-commerce infrastructure platform providing retailers with the solutions to operate online still expects to report strong growth in the years ahead. The retail sector is struggling right now evidenced by the weak numbers from Bed, Bath and Beyond (BBBY), yet the market is extrapolating these results far into the future. A lot the current weakness is due to COVID pull forward making the comps difficult despite retailers still reporting solid numbers compared to 2019.

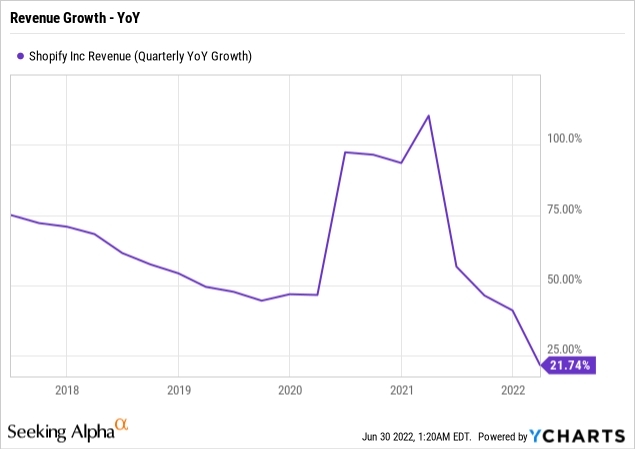

Shopify saw explosive growth during 2020 and early 2021 as retailers flocked to the platform looking for any solution to conduct sales online. With the company providing an alternative to selling goods on Amazon (AMZN), Shopify was in hot demand. The company saw the growth rate peak at 110% in Q1’21 making the recently reported quarterly results impressive to generate additional 22% sales growth on top of those growth rates. Shopify only reported Q1’19 revenues of $320 million and hit $1.2 billion in Q1’22 for 275% growth over the period.

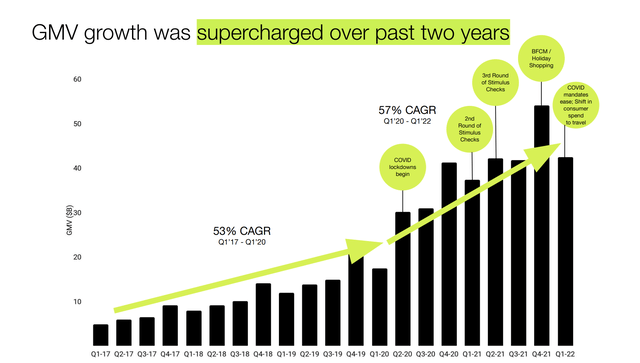

As the company discussed with investors, GMV growth was supercharged over the COVID shutdown period. Shopify reporting any growth in 2022 is actually very impressive.

Source: Shopify Q1’22 presentation

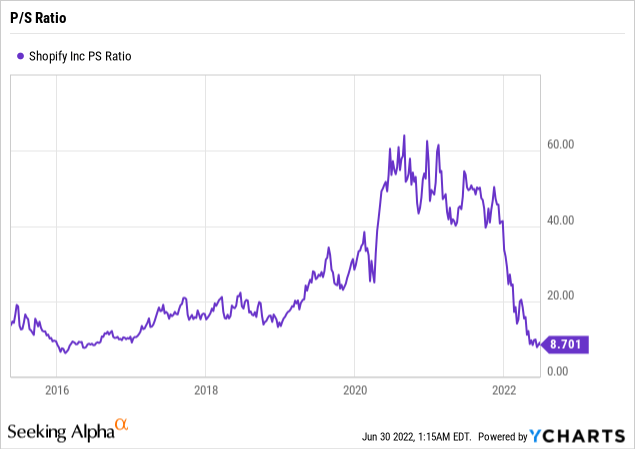

The market doesn’t really care due to either investors losing interest when growth stories struggle or algos running wild with decelerating growth. Either way, the stock now trades at the lowest trailing P/S ratio since Shopify went public at 8.7x sales. The stock valuation got carried away at the peak along with most tech stocks.

The stock trades at ~5x 2023 sales targets of $7.7 billion. With a cash balance of $7.25 billion with net cash of ~$6.34 billion, Shopify has an impressive balance sheet to fund future growth initiatives.

The Deliverr deal will require Shopify spend $1.7 billion in cash to pay for the deal to acquire the fulfillment technology provider. Prior to the Deliverr deal, the Shopify enterprise value is only 4x sales estimates providing one of the better prices to own the stock since going public while the prospects for growth remain strong. A lot of the analyst estimates have the company returning to 30% growth rates once the normalization period ends in 2023.

Shopify was profitable in Q1’22, though the company is scraping the bottom of profitability during the current period. The e-commerce platform has continued to invest in building out the platform despite the reduced growth rates. Regardless, Shopify has the cash balance and income to survive and thrive the current downturn in the retail sector.

Takeaway

The key investor takeaway is that the stock split gimmick definitely didn’t work for Shopify. The stock had no momentum heading into the split and the lack of economic value for shareholders just provided more shares to sell. As the stock bottoms out over the next quarter, investors should look into acquiring shares of the e-commerce platform leader at a far more reasonable valuation now.

Be the first to comment