marekuliasz/iStock Editorial via Getty Images

Whatever we say about Amazon (NASDAQ:AMZN), whether it’s about its valuation, margins, topline growth, competitive positioning, new business segments or its management, one thing is certainly true about the company – Amazon, alongside a few other companies, has become an icon of the past decade. A decade marked by significant technological advancements, peak globalization and cheap capital.

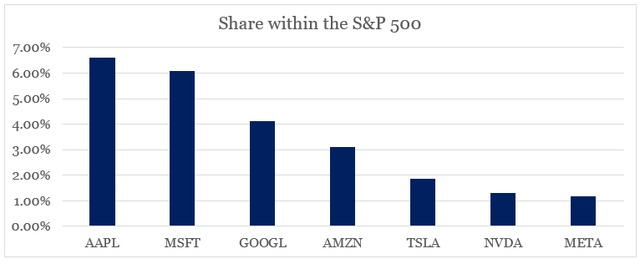

On one hand, it is hard to argue against each of the big tech names as their dominant positioning seems unrivaled, but on the other, concentration in only a handful of companies has reached extreme levels. As a result, only seven tech names within the S&P 500 top 10 companies by weighting (listed below), make up nearly a quarter of the index.

prepared by the author, using data from slickcharts.com

Although each of these companies deserves to be at the very top (perhaps with a few exceptions), their size relative to the rest of the S&P 500 is also a result of more than a decade of unconventional monetary policy and cheap capital. Additionally, as we all know, every 10 years or so the list of the top 10 largest public companies changes drastically. Therefore, it seems unlikely that all seven of the companies listed above will outperform the market over the next 10-year period and remain at the top.

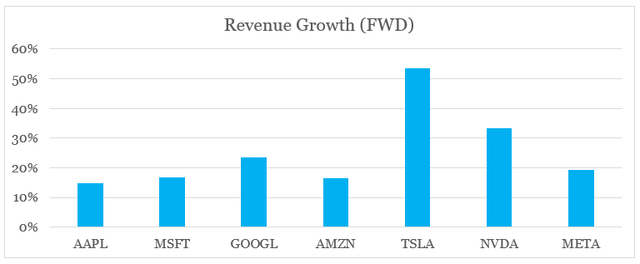

Having said that, we should also keep in mind that in spite of the enormous size of each of the big tech names, they are still expected to grow at incredibly high rates.

prepared by the author, using data from Seeking Alpha

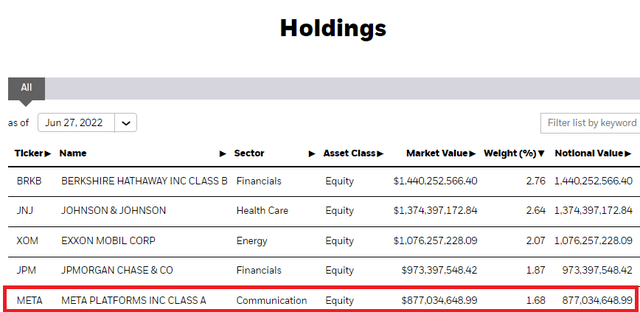

While these growth rates remain achievable in the short-run, they will be exceptionally hard to sustain over the medium-term. Moreover, the performance gap between the big tech names is also likely grow as some business models and management teams are better positioned to adapt to the future. Meta (META), for example, appears to be the first company that is headed out of the Top 10 list and has already become a large holding of the Russell 1000 Value ETF (IWD).

iShares Russell 1000 Value ETF (iShares)

Amazon on the other hand appears to be in a better spot to defend its trillion dollar market cap, however, there are significant risks as well.

Back in April of this year, I highlighted some of those risks and showed why investors should be wary of exciting narratives. More specifically, Amazon’s e-commerce business makes the company vastly different from its big tech peers.

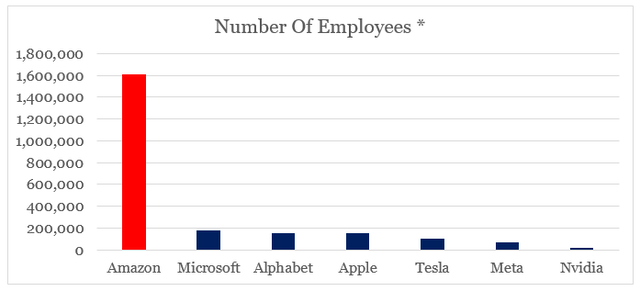

Prepared by the author, using data from various sources

* based on the latest available information as of April of 2022

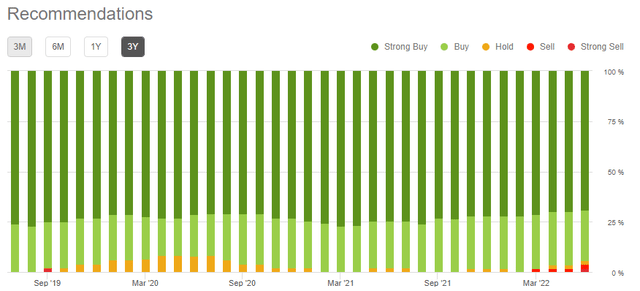

Contrary to these risks, however, Amazon continues to solidify its competitive positioning not only in e-commerce, but in cloud infrastructure, advertising, streaming and distribution & logistics. All that makes it extremely hard to consider anything but a highly optimistic investment thesis, which in turn has made AMZN a very one-sided trade.

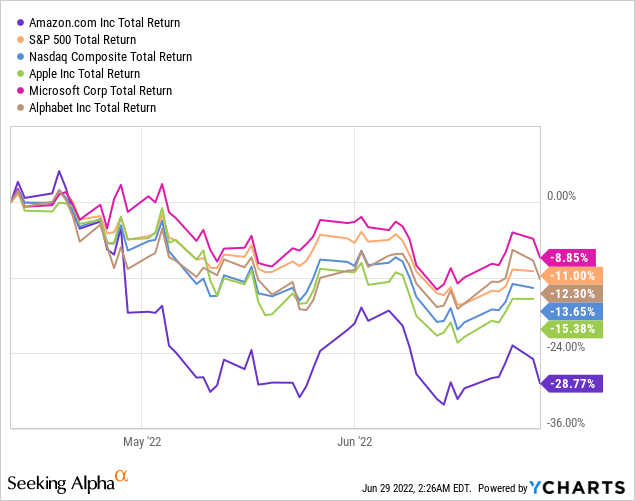

In the meantime, the company has lost nearly 30% of its value in just a few months since I first covered the company in April.

All that clearly illustrates the need for objective analysis of the company’s potential risks and opportunities and avoid becoming victim of the halo effect of the company’s recent success. That is why, down below I will first cover my optimistic view of the company by abstaining from any of the pending risks affecting the company. After that, I will expand on my bearish thesis, where both idiosyncratic and systematic risks will be evaluated. Finally, I will reconcile the two views in the context of Amazon’s valuation.

What Is Amazon’s Bullish View?

The bullish view of Amazon usually gravitates around one of the following:

- High topline growth rate and leading positioning in e-commerce

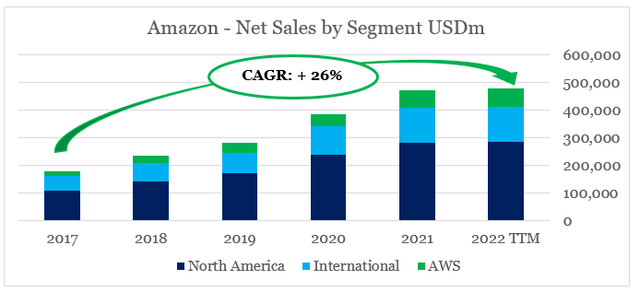

prepared by the author, using data from SEC Filings

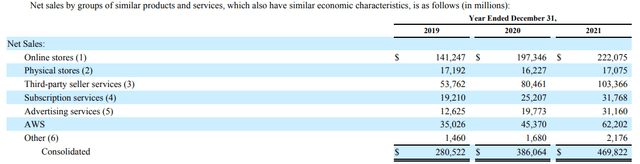

Amazon achieved a compounded annual growth rate of around 26% since 2017 and the company is still expected to grow sales at a rate of 16.5%.

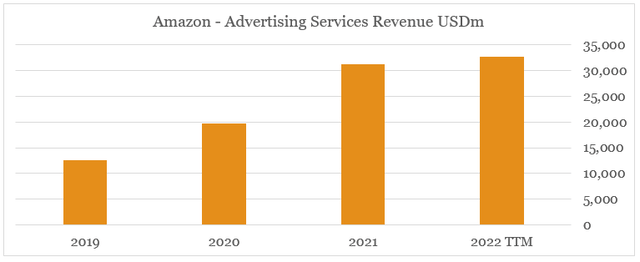

Seeking Alpha

More importantly, however, AMZN managed to capitalize on recent trends in e-commerce through its dominant positioning. Similarly to Google for online searches, Amazon has become almost synonymous with online shopping in key markets across North America and Europe. In addition to all that, high investments in shipping centers and logistics kept customer loyalty and satisfaction high.

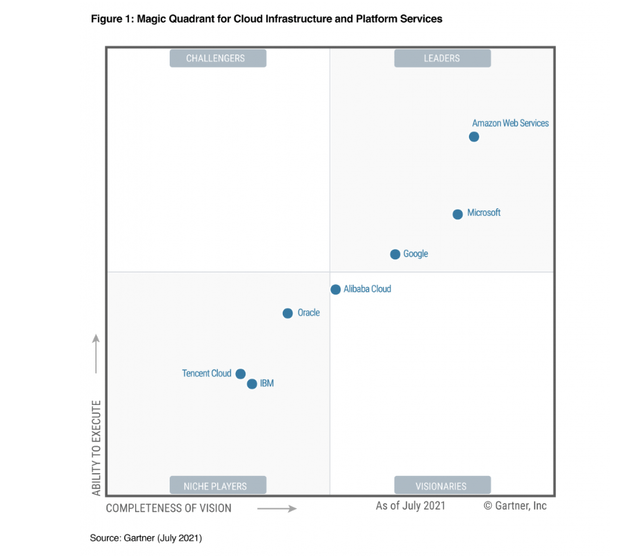

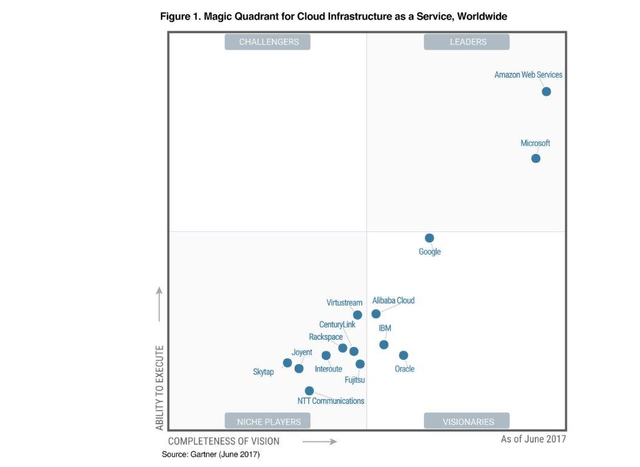

Due to its first-mover advantage and ability to sustain high capital investments, AWS still has a firm grip on the cloud infrastructure market. Even behemoths, such as Microsoft (MSFT) and Alphabet (GOOGL) are still catching up to Amazon.

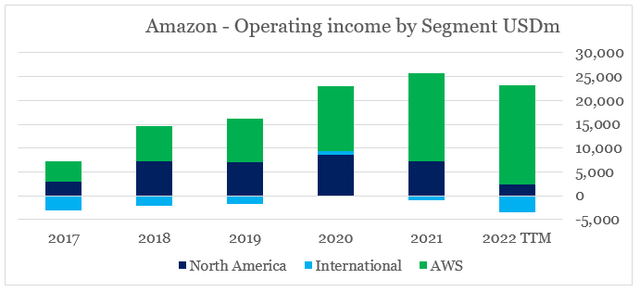

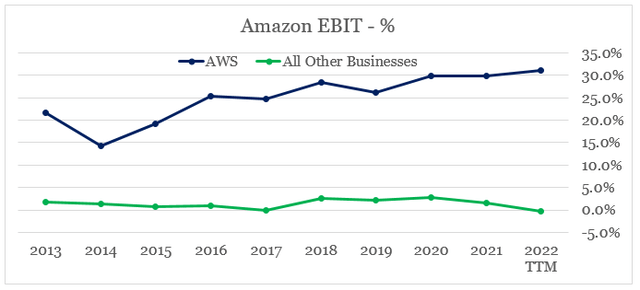

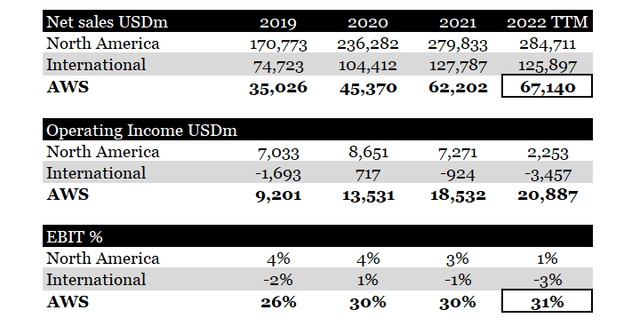

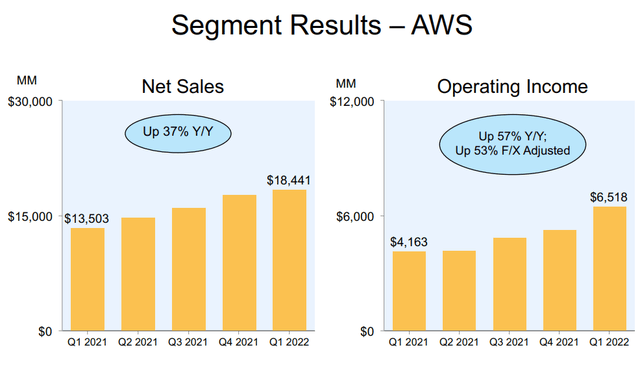

With operating margins of around 30%, AWS has become the crown jewel of Amazon in recent years and is now the sole reason why many investors have turned bullish on the company.

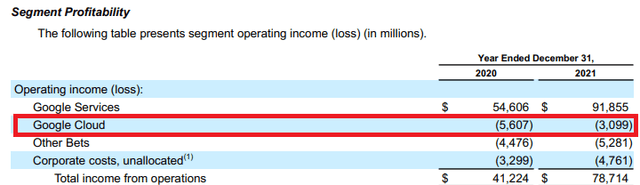

Google Cloud, for example, remains a loss-making segment of Alphabet (see below), which is in stark contrast with AWS operating income of $6.5bn during the last quarter alone (see the graph above).

- Newly emerging businesses

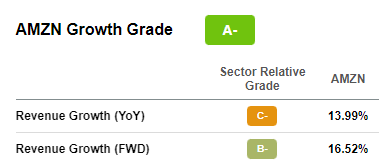

The advertising services and streaming are two examples of relatively new business lines where Amazon is getting its foot in the door. The digital advertising market, for example, is dominated by a duopoly between Google and Meta, which is now turning into a triopoly with the inclusion of Amazon. Although, AMZN still has a long way to catch up with Google and Meta in that field, it is turning advertising into yet another lucrative opportunity.

prepared by the author, using data from SEC Filings

Moreover, given the direct relationship with its Prime members, the company will likely continue to benefit from more stringent privacy requirements. A good example of this is Apple’s recent privacy changes that allow users to block advertisers from tracking their activity. As a result, data owned by AMZN will likely get even more valuable in the future.

In streaming, Amazon is also aiming to be among the major providers, although it will be far more difficult to sustain its position due to already stiff competition, unpredictable margins and the skyrocketing content costs.

In a nutshell, everything said above boils down to the long-term vision of Amazon’s management. None of these businesses would have been possible, if the management was obsessed with meeting/beating short term analyst expectations. On the contrary, Jeff Bezos has often been criticized about his sometimes eccentric ideas and long-term vision, such as the below extract from a well-known business magazine back in 2006 regarding AWS.

In my view, this is by far the most important competitive advantage that Amazon has in the long run, in addition to its dominant positioning in e-commerce and cloud infrastructure. The reason being that industry leadership does not mean much, without the strategic long-term thinking. The fall of IBM (IBM) is a good example of what happens even to the most valuable and innovative companies when management becomes complacent with current standing.

What Is Amazon’s Bearish View?

Constructing a bearish view for a business like Amazon is not an easy task. This is not because there are no risks involved, but rather because the halo effect of the company is so strong that for most investors it is nearly impossible to conceive a bearish view. Nevertheless, it is worth mentioning that actual risk is usually the highest during periods when perceived risk is at its lows.

modelsandrisk.org

To begin with, the past two years were marked by extreme tailwinds for e-commerce and digitalization. However, even in that environment, Amazon still struggles to achieve profitability if we exclude AWS.

prepared by the author, using data from SEC Filings

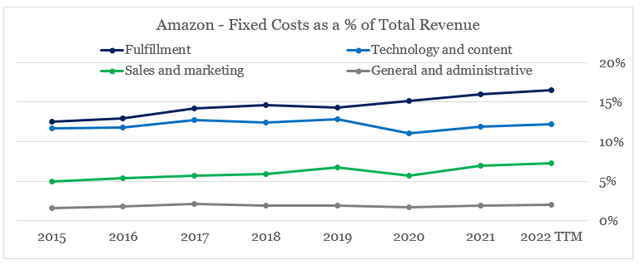

This is not good news as tailwinds are now turning into headwinds due to the high inflationary pressures that will put significant pressure on labour costs. As we saw in the number of employees graph in the beginning of this analysis, Amazon’s labour-intensive business model puts the company at a disadvantage to some of its peers in the cloud infrastructure space.

Given the wide profitability gap between AWS and the rest of Amazon, there is a risk that other businesses could become a drag on the highly profitable cloud infrastructure unit.

prepared by the author, using data from SEC Filings

AWS leadership in cloud infrastructure is also not a static event and even though it will likely remain a leader, competitive pressures will continue to intensify. To illustrate that, compare the graph below from 2017 to the same graph from 2021 we saw above.

The main difference between the two charts is that the gap between AWS and the rest of the cloud providers has narrowed down significantly and will likely continue to do so.

While Amazon is unlikely to be dethroned in cloud infrastructure anytime soon, it will be far more difficult for the company to establish itself among the leaders in media. Although there are significant synergies to be explored with digital advertising and Prime subscriptions, the media space is vastly different from the B2B business of cloud infrastructure.

Competition in streaming has significantly intensified and even Disney (DIS) with its almost century-long storytelling history is now struggling with rising costs. For now, having a highly profitable cloud business to subsidize these costs appears to be beneficial for AMZN, however, in the long-run pure play streaming companies could have a significant advantage.

Furthermore, it still remains to be seen whether Amazon Studios could create superior content to that of Netflix (NFLX), Disney, Warner Bros. Discovery (WBD) and Apple (AAPL).

In the meantime, the media venture of AMZN will put further pressure on the company’s rising fixed costs.

prepared by the author, using data from SEC Filings

Rising fixed costs are also accompanied by the need for higher capex in Amazon’s highly capital-intensive businesses. About half of that capex is needed to support currently high growth rates of the AWS business.

Capital investments were $61 billion on the trailing 12-month period ended March 31. About 40% of that went to infrastructure, primarily supporting AWS, but also supporting our sizable consumer business. About 30% is fulfillment capacity, primarily fulfillment center warehouses. A little less than 25% is for transportation. So, think of that as the middle and last-mile capacity related to customer shipments. The remaining 5% or so is comprised of things like corporate space and physical stores.

For full year 2022, we do expect infrastructure spend to grow year-over-year, in large part, to support the rapid growth in innovation we’re seeing within AWS. We expect infrastructure should represent about half of our total capital investments in 2022.

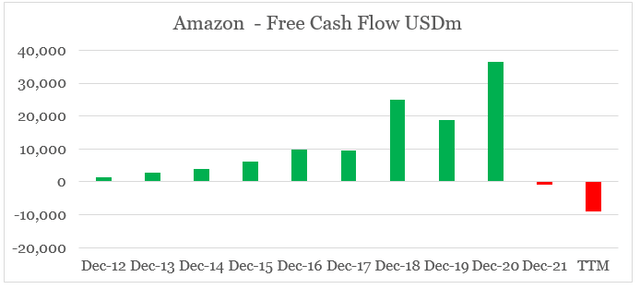

Usually this is good news as it indicates management’s confidence in future growth and also shows that Amazon does not lack internal investment opportunities. However, the risk here is that a large chunk of these capital expenditures are needed to support the business at a time when costs are rising and margins (excluding AWS) are falling. As a result, the trend of Amazon’s free cash flow is not encouraging.

prepared by the author, using data from Seeking Alpha

We should also take into account the aforementioned pressure on labour costs and the looming recession on the horizon. The combination of these two factors will put significant pressure on Amazon’s highly cyclical and labour-intensive e-commerce business and could eventually put AWS at a disadvantage by the need to subsidize the rest of Amazon’s ventures.

Is AMZN Stock A Buy, Sell, Or Hold?

After careful consideration of everything said so far, the answer to this question is hardly a straightforward one. Although I have already laid out my investment thesis for Amazon back in April, it is hard to make a solid bearish thesis without making certain speculative assumptions about the business.

On the other hand, even if we ignore the short to medium-term risks associated with the economy and equity markets, a case for investing in Amazon could not overlook all the idiosyncratic risks outlined in the last section.

The aggregation of different businesses does not make the task of valuing Amazon any easier. Comparing AMZN’s multiples to those of other companies in the consumer discretionary space does not tell us anything at this point.

Seeking Alpha

This is because there are no direct comparables to Amazon out there and secondly due to the fact that high quality businesses always trade at premium valuations.

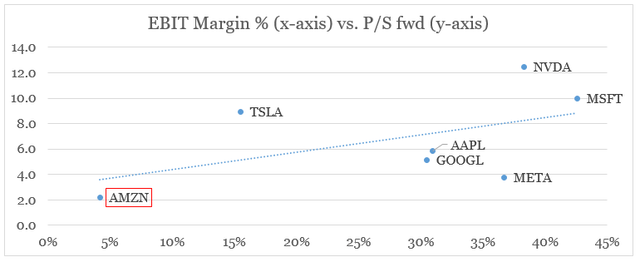

However, if we compare Amazon’s operating margins and price-to-sales multiple to those of the other big tech names, we could infer that it trades close to fair value based on achieved profitability

prepared by the author, using data from Seeking Alpha

On a segmented basis, AWS has about $67bn worth of sales as of the last twelve months and margins of around 31%.

prepared by the author, using data from SEC Filings

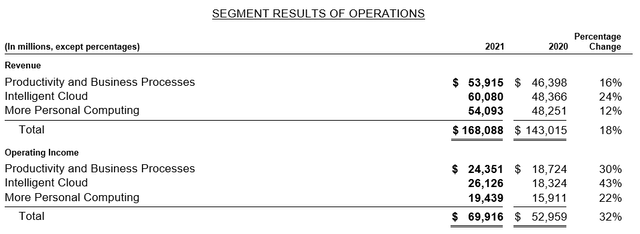

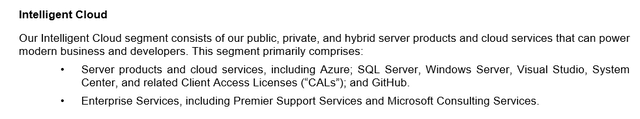

Assigning a proper multiple to AWS is still a speculative task and requires many assumptions. To avoid going into a rabbit hole of assumptions and speculations, I will use the closest we could get to a publicly traded comparable business to AWS – Microsoft. As we saw above, MSFT’s forward revenue growth rate is similar to that of Amazon and its Intelligent Cloud segment is a sizable proportion to the rest of the company.

Microsoft 2021 10-K SEC Filing Microsoft 2021 10-K SEC Filing

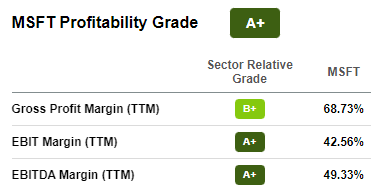

Microsoft margins, however, are much higher with the Intelligent Cloud segment achieving operating margin of 43% as of fiscal year 2021. Even on a company wide basis, Microsoft still has significantly higher margins.

Seeking Alpha

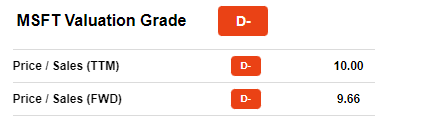

Nevertheless, by applying Microsoft’s P/S multiple of 10x (see below) to AWS sales, we could estimate a high-end implied market value of equity of $671bn.

Seeking Alpha

This is roughly 60% of Amazon’s current market cap of $1.1tn and leaves around $437bn for the rest of Amazon’s businesses that generated sales of around $411bn for the past twelve months. This results in sales multiple of 1.1x for the following revenue streams listed below (excluding AWS).

Unfortunately, however, these business segments are highly intertwined as we see from the note below and thus do not allow for a more detailed sum-of-the-parts valuation, without making a large number of assumptions.

(1) Includes product sales and digital media content where we record revenue gross. We leverage our retail infrastructure to offer a wide selection of consumable and durable goods that includes media products available in both a physical and digital format, such as books, videos, games, music, and software. These product sales include digital products sold on a transactional basis. Digital product subscriptions that provide unlimited viewing or usage rights are included in “Subscription services.

Source: Amazon 2021 10-K SEC Filing

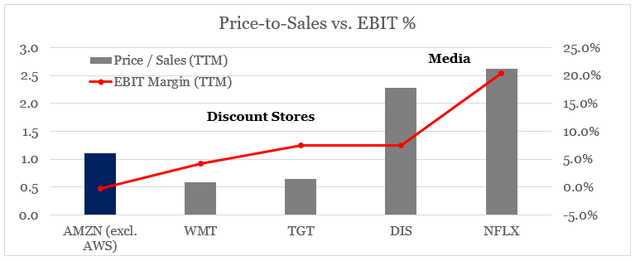

Therefore, by comparing Amazon (excluding AWS) to the large discount stores (Walmart and Target) and the leading streaming providers (Disney and Netflix), Amazon does not appear to be undervalued (see below).

prepared by the author, using data from Seeking Alpha

Of course, we should not forget the growing advertising services and third-party seller businesses that are also included within the rest of Amazon. However, these businesses are still relatively small and trade on long-term expectations of future growth. Within this value we should also include the 18% stake in Rivian (RIVN), which accounts for roughly $4bn as of the time of writing and still a tiny part of AMZN.

Conclusion

In the short-term there are significant outside risks weighing on Amazon. The risk of stagflation is significant. On one hand it will put enormous pressure on margins due to Amazon’s labour-intensive business model and on the other will impact the company’s cyclical operations. Additionally, as I highlighted a few months ago, Amazon has significant exposure to the fading momentum trade which creates additional short-term risks.

Looking past the short-term headwinds associated with exogenous risks, it is still hard to conceive a solid bullish thesis for Amazon. Although management seems to be making the right long-term decisions to steer the business in the right direction, it also takes significant risks. Growth in cloud infrastructure space should eventually cool off and competition remains strong. In the meantime, however, Amazon’s ambitious growth strategy relies heavily AWS subsidizing investments in a growing number of capital-intensive segments.

Be the first to comment