Jasmin Pawlowicz/iStock via Getty Images

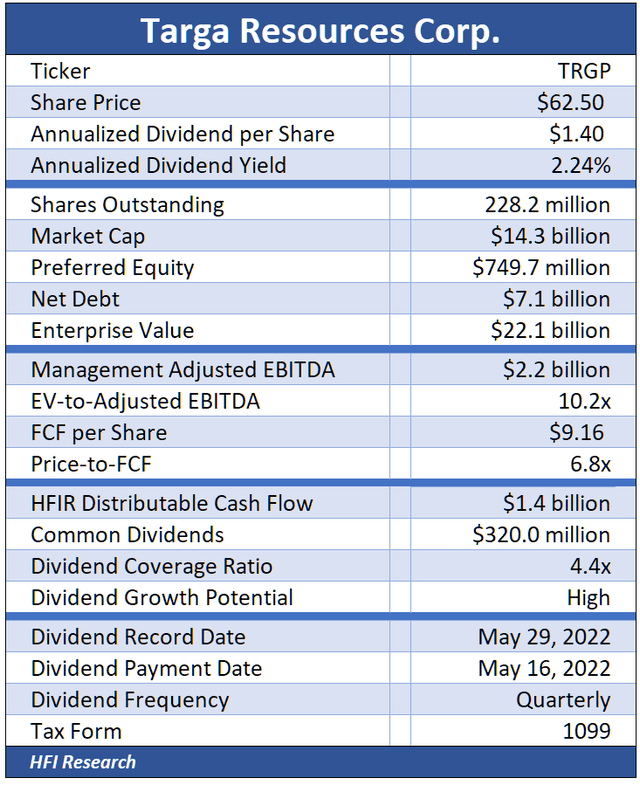

We’ve written a lot about Targa Resources Corp. (NYSE:TRGP) over the past few years. We originally purchased shares on April 6, 2021, for $33.40, expecting higher free cash flow as the company reaped the benefit of its multi-year infrastructure buildout. Since our purchase, we’ve been pleasantly surprised by management’s ability to grow shareholder value.

Management has been particularly good at building value through capital allocation. Management has been extra busy on the capital allocation front in recent months, so we thought we’d revisit our TRGP valuation.

TRGP in 2022: All About Capital Allocation

Recall that back in February 2018, TRGP formed three development joint ventures in partnership with Stonepeak Infrastructure Partners, which it dubbed “DevCo JVs.” These JVs funded the construction of the Grand Prix NGL pipeline, Gulf Coast Express Pipeline, and a 110 million barrel per day fractionator in Mont Belvieu. After forming the JVs, TRGP had a four-year window during which it could acquire the JVs for a predetermined sum.

In January of 2022, TRGP acquired the DevCo JVs, purchasing all of Stonepeak’s interests for $926.3 million. As a result of the purchase, TRGP owned a 75% interest in the Grand Prix Pipeline, a 100% interest in the Mont Belvieu fractionator, and a 25% equity interest in the Grand Prix NGL pipeline.

Then in February 2022, TRGP sold its 25% interest in Grand Prix for $857 million, recouping most of its expenditures related to the DevCo purchase.

In April, TRGP used some of the proceeds it received from selling Grand Prix to fund a $200 million bolt-on acquisition of complementary midstream assets and gathering and processing (G&P) contracts that it folded into its South Texas G&P operations.

TRGP’s Transformational Lucid Energy Deal

TRGP’s last major capital allocation initiative was its $3.55 billion acquisition of Lucid Energy Delaware, which it announced on June 16. The transaction is all-cash and will be financed through debt. TRGP has already announced the pricing of senior notes intended to fund the acquisition.

The Lucid acreage TRGP is acquiring has a 20-year drilling inventory. Half of the acquired acreage is located on federal land. However, this land is already under lease and is mostly held by production, so it would be largely unaffected by a ban on new federal leases.

Management reported that the acquisition of Lucid’s Delaware Basin G&P system will be immediately accretive to TRGP’s distributable cash flow. It expects the deal to add $465 million to Adjusted EBTIDA at a 6.5-times multiple and it expects TRGP to end the year with a 3.5-times leverage ratio, up from 3.4-times at the end of the first quarter.

This deal represents TRGP’s foray into the Delaware Basin G&P land grab that’s all the rage today among midstream players. Management expects the acquisition to add significant volumes to TRGP’s downstream fractionation and LPG export assets.

We’re lukewarm on TRGP’s Lucid acquisition. We’d rather management focus investment on the company’s higher-value downstream operations, which was its stated intent before the deal.

As for the market’s reaction, TRGP stock got a brief 5% pop after the announcement but then traded lower along with the rest of the midstream over the following two weeks. We suspect the market is also lukewarm on the deal and that market participants want to see more details before moving the shares either way.

Lucid’s Financial Impact

Assuming the deal adds $3.5 billion of long-term debt to our pre-acquisition expectation of $7.0 billion of year-end 2022 debt, and assuming further that the deal adds $450 million of Adjusted EBITDA to our $2.4 billion pre-acquisition full-year 2022 estimate, we estimate post-acquisition 2022 Adj. EBITDA to be $2.85 billion. Our estimate implies that TRGP ends the year with a leverage ratio of 3.68-times. However, in TRGP’s press release announcing the Lucid deal, management guided to a year-end leverage ratio of around 3.5-times. We’re guessing that the company’s Adj. EBITDA is running ahead of our Adj. EBITDA expectation, and that the figure is more likely to end the year closer to $2.5 billion. This would increase our post-acquisition Adj. EBITDA estimate to $2.95 billion.

Next, we’re assuming that the deal adds an incremental $400 million to TRGP’s cash flow. If the deal is funded through $3.5 billion of debt at a cost of 6.25%, for an annual interest cost of $222 million, we estimate net cash flow accretion of approximately $180 million. Adding this to our year-end cash flow estimates and we estimate acquisition-adjusted operating cash flow to be $2.8 billion.

With these figures worked out, we can turn our TRGP valuation.

Valuation

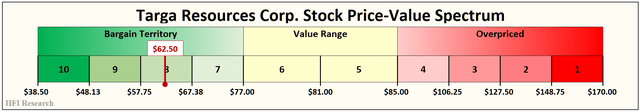

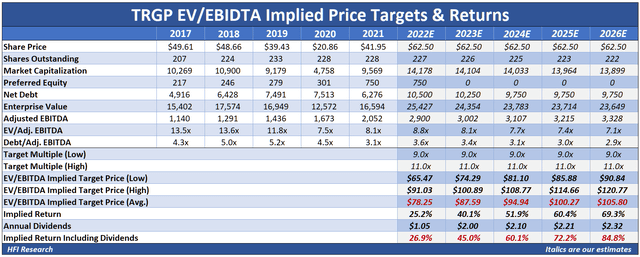

We value the shares in the range of $77 to $85. Our price target is the midpoint of the range, or $81.

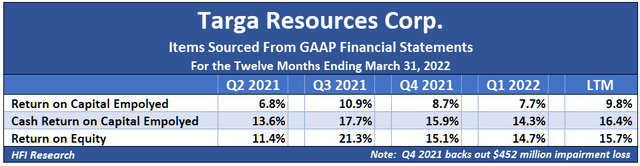

First, a word on the multiple we’re using to value TRGP shares. Most midstream operators generate a mid-single-digit return on capital and, at most, a low-double-digit return on equity. For these companies, we use a multiple of 8.0-times and 10.0-times. But look at TRGP’s returns over the past few quarters during which it has operated its completed integrated midstream system.

We believe these returns translate into a higher multiple for valuing TRGP shares, so we’re using a multiple range of 9.0-times and 11.0-times.

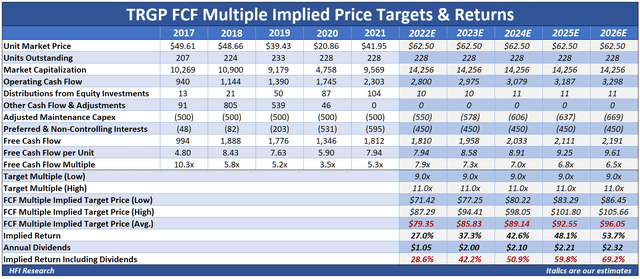

In our valuations, we assume management allocates the remainder of the proceeds from the Grand Prix sale toward redeeming its Series A preferred shares in late 2022. Doing so will boost annual cash flow by approximately $80 million in 2023. We also assume that management uses free cash flow to pay down $250 million of long-term debt in 2022 and $500 million of debt in 2023. From 2023 through 2026, we assume that Adj. EBITDA and operating cash flow increase by 3.5% and that dividends increase by 5.0%. Lastly, we assume management makes roughly $100 million of unit repurchases each year.

To be conservative in our valuations, we aren’t assuming that management allocates all of TRGP’s Adj. EBITDA and free cash flow back to shareholders in the form of debt paydown, repurchases, and/or dividend increases. Management appears to be more transactional than we had expected, and since we’re not particularly enthusiastic about the Lucid Energy acquisition, we’re concerned that management may allocate free cash flow to make similar marginally accretive G&P acquisitions in the future. A higher concentration in G&P and away from downstream-facing midstream activity would pull down TRGP’s trading multiple, particularly if it reduced the company’s return on capital.

Our EV/EBITDA valuation indicates the shares are worth $79.35 in 2022, which equates to a 28.6% implied return from the current price of $62.50. The valuation increases to $96.08 in 2026 for a 69.2% implied return after including dividends.

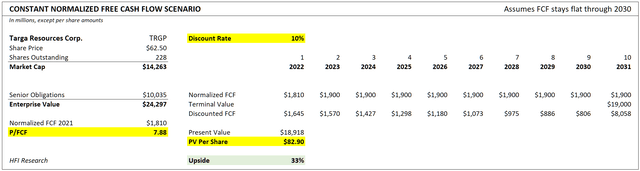

Our discounted cash flow scenario assumes that 2022 free cash flow receives a one-time bump in 2023 from the retirement of TRGP’s preferred stock and stays flat thereafter throughout 2031. It shows the shares are worth $82.90, slightly higher than our $81 price target.

Our EV/EBITDA valuation shows the shares are worth $78.25 in 2022, for an implied return of 26.9% after dividends. By 2026, it shows the shares are worth $105.80, which equates to an implied return of 84.8%.

Conclusion

TRGP management continues to execute well on behalf of shareholders. We hope that as we learn more about the Lucid deal, we’ll better understand management’s rationale and how it expects the new assets to bolster the company’s cash flow. Perhaps the additional color will turn us more positive on the deal’s prospects for shareholders.

In light of management’s past success in building shareholder value, TRGP remains one of our favorite G&Ps for the long term. Given the shares’ significant appreciation potential and the likelihood of future dividend increases, we rate the shares a Buy.

Be the first to comment