-nelis-/E+ via Getty Images

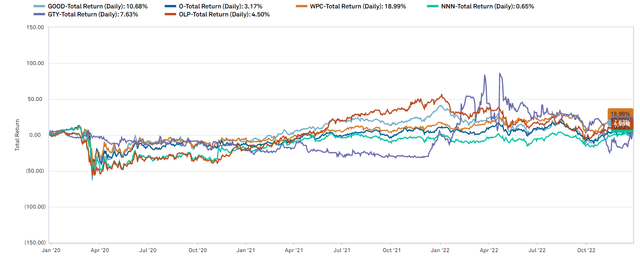

Realty Income (NYSE:O) has underperformed most of its peers for the past 3 years.

S&P Global Market Intelligence

In brief, the reason is that valuation matters and O has consistently been overvalued.

While I have long been bearish on O, I feel inclined to keep apprised of its every move as its behaviors are often representative of the entire triple net space, a sector in which 2CHYP, the Portfolio Income Solutions portfolio, is overweight.

For decades, Realty Income has derived its growth from a formulaic pattern of investment and the pieces required to execute that formula are no longer available. This article will explore the formula, why its opportunity has dried up and what this means for both O and the triple net sector.

The Formula

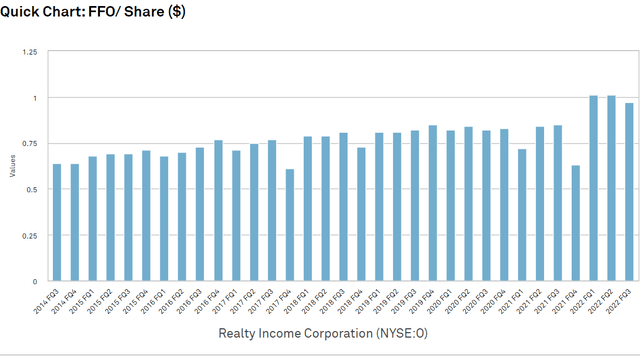

Realty Income is an impressive company. It has consistently grown dividends for decades by slowly and steadily increasing FFO/share which it uses to fund these dividends. Over the years nearly all of its growth has come from the same formula.

- Issue equity

- Issue debt

- Use the capital to finance acquisitions

- Acquisition cap rate exceeds WACC

- The spread accretes to FFO/share

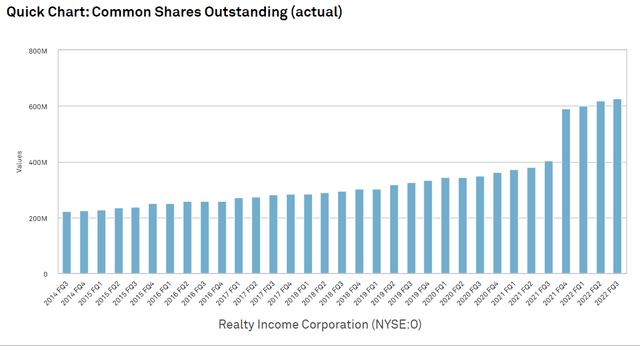

It may seem like an oversimplification, but it has been executed with amazing consistency. Every quarter shares are issued.

S&P Global Market Intelligence

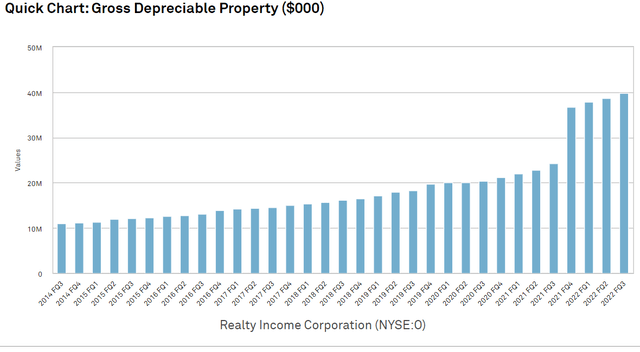

New properties are acquired every quarter:

S&P Global Market Intelligence

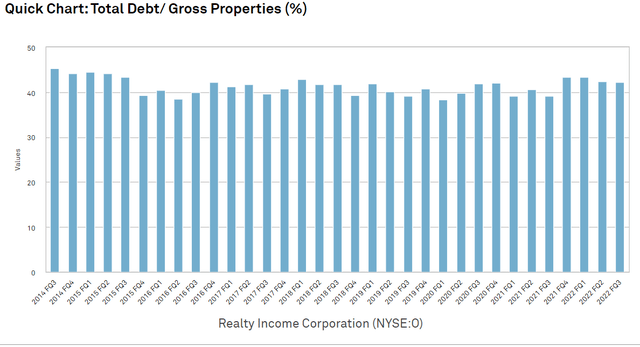

These properties are financed with a very consistent 60/40 split of equity and debt:

S&P Global Market Intelligence

Since O trades at a premium multiple, its cost of equity has been low and its strong balance sheet combined with the formerly low interest rate environment made cost of debt rather low.

Weighted average cost of capital was consistently somewhere between 100 and 300 basis points below acquisition cap rates.

Thus, when they executed the formula the incremental FFO above cost of capital accreted to FFO/share.

S&P Global Market Intelligence

There were some lumps based on timing of the bigger acquisitions, but the pattern is consistently upward sloping.

These were good times and O was doing exactly what a company in its position should do: using its overpriced equity to benefit existing shareholders.

However, growth engines such as these are not as durable as they may seem. The formula relies on factors that are outside of the company’s control.

Fragility of spread based investing

O’s overvaluation is often justified by the idea that as long as it remains overvalued it can keep growing in a similar fashion. When it is working, the overvaluation itself leads to faster growth and given enough time, shareholders can be rewarded even if they bought at a price that was a bit too high.

This is not quite true though.

O remains overvalued today at 16X forward FFO while many of its peers trade at 9X-14X. It would seem that its relative expensiveness should keep the formula going due to a relatively lower cost of equity capital.

Digging deeper into the spread between cap rates and WACC, however, reveals a different outcome.

The favorable acquisition spread O has achieved all these years was not a result of it being overvalued relative to peers, but rather it being overvalued relative to private market property values. It could raise capital at 120% of the value of its properties, acquire similar properties at 100% and they would be swiftly marked up to 120% (via market price action) for being part of this strong growing entity.

O was trading at a much lower implied cap rate than properties similar to those in its portfolio.

Today, that dynamic has flipped. Public REITs trade at a roughly 25% discount to private real estate. O being more expensive than its peers trades roughly in-line with private real estate. So, if they try to execute the same formula today, the value creation aspect is gone. WACC has risen dramatically due to the prevailing interest rate environment, but cap rates have barely budged.

If WACC = acquisition cap rates, there is no FFO/share accretion from acquisitions.

The formula is broken

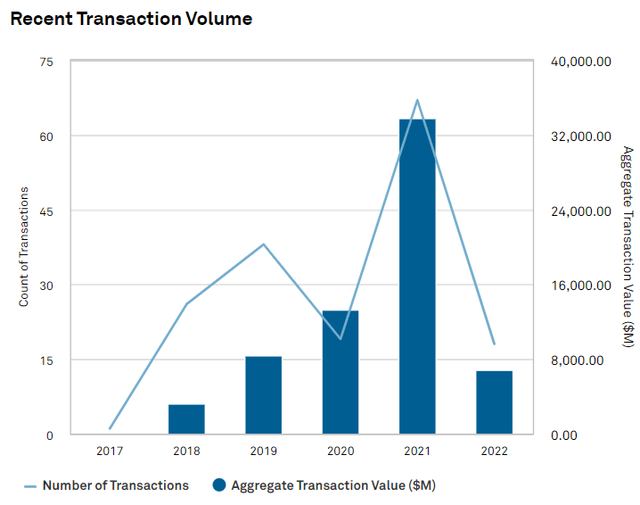

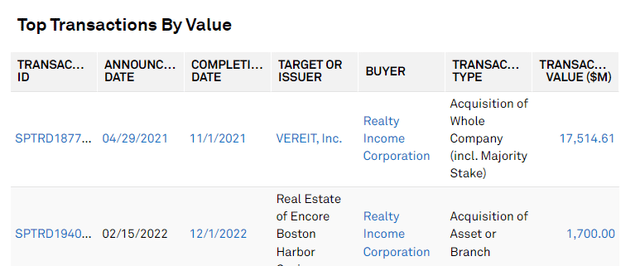

Some REITs would continue to run their heads into the wall and grow for the sake of growing, but O is a responsible company. It seems to recognize that its growth engine is broken at least temporarily and has shut off the spigot. Transaction volume has slowed to a crawl.

S&P Global Market Intelligence

In fact, The casino purchase was O’s primary acquisition of 2022 and even it was arguably overpriced relative to other casino deals as we discussed previously.

S&P Global Market Intelligence

What this means for O

With minimal external growth, O will have to rely on internal growth if they want to keep increasing their dividend.

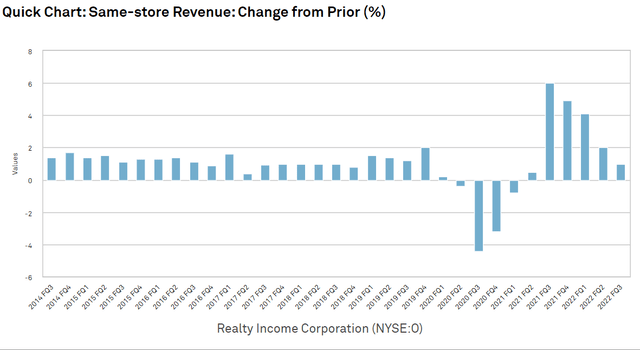

The challenge here is that the type of properties in O’s portfolio are not fast growing. Aside from rebound growth in 2021 making up for the negative growth in 2020, same store NOI has consistently been below 2%.

S&P Global Market Intelligence

2% same store NOI for a company like this is actually closer to breakeven because missing from the same store calculation are the properties that are no longer in the same store pool due to having been sold.

For every thousand properties bought in sale leaseback transactions at least a few do not work as intended. Leases expire and new tenants don’t always want the space. Realty Income has a fairly good track record of underwriting, but 100% retention is impossible because the future can only be estimated.

Perhaps the submarket went south or a previously good credit tenant defaulted or any number of unforeseen problems. When buying 1000 properties somewhere around 5 to 30 will not work, even with proper, responsible underwriting. That inherent failure rate needs to be weighed against the same store NOI figure which does not factor in such losses.

Just to be clear, this is not dirty accounting or anything tricky. It is proper practice for disposed assets to not be in the same store pool. A same store pool is assets that were owned and stabilized a year ago and still owned now. In many cases it under-accounts for growth if assets were sold favorably, but for most triple net the sales tend to be vacant or soon to be vacant properties.

Between the positive same store NOI and the typical churn, organic growth is likely to be somewhere close to 0%. O’s impressive historic growth does not appear possible in this environment with external growth largely not viable.

I see this as a problem for O given its valuation. At 16X forward FFO it needs to grow in order to deliver an equity level return for investors. Cashflows alone would result in a roughly 6% return per year (FFO yield). It is not a run for the hills situation by any means and O is indeed a better value than it has been previously. I just don’t see that as where I want to be when there are so many better opportunities available.

What it means for other triple nets

Many or even most of the other triple net REITs will experience a similar broken formula where acquisitions just don’t accrete to FFO like they used to.

I do think this is a temporary phenomenon and that cap rates will adjust upward to restore spreads to a more normal level, but at least for a while, external growth will be hard to find. There are 2 ways in which triple nets can still generate a strong return for investors even through this tough period:

- Simply being cheap enough

- Organic growth

As is a common refrain in my writing, valuation matters. At a 16X multiple O needs to grow, but a company trading at an 11X multiple can simply cashflow.

Spirit Realty (SRC), Gladstone Commercial (GOOD) and its preferred GOODO trade cheaply enough that they can deliver over 8% annual returns without any growth. This 0 spread environment is likely a temporary thing and they have all the mechanisms in place to resume growth when things normalize so I do still anticipate growth going forward.

Given the present environment, however, I find it particularly important to be buying companies trading at attractive valuations.

The other workaround is organic growth. Not all triple net properties are equal. I lean toward those that have properties that will naturally be able to increase rent over time. In terms of same store NOI growth: Industrial > retail > office.

Industrial heavy triple nets include:

Conclusion

When the standard triple net REIT growth formula is broken, it might be wise to sell the triple net REITs that are reliant on that formula.

There are plenty of options out there for better value and/or organic growth.

Be the first to comment