Sundry Photography/iStock Editorial via Getty Images

The worldwide Digital Advertising industry was worth $350 Billion in 2020. It is forecasted to grow at a 13.9% CAGR and reach a staggering $786 Billion by 2026. The Display Advertising segment is expected to grow at an even faster 15.5% CAGR and reach over half a trillion dollars by 2026.

The two dominant players in the advertising market include Meta Platforms (Facebook) (META) and Alphabet (Google) (GOOG, GOOGL). These companies are industry titans, but both platforms are becoming saturated. In addition, increased privacy concerns and the “death of the ad cookie” is causing advertisers to look for alternative ad providers.

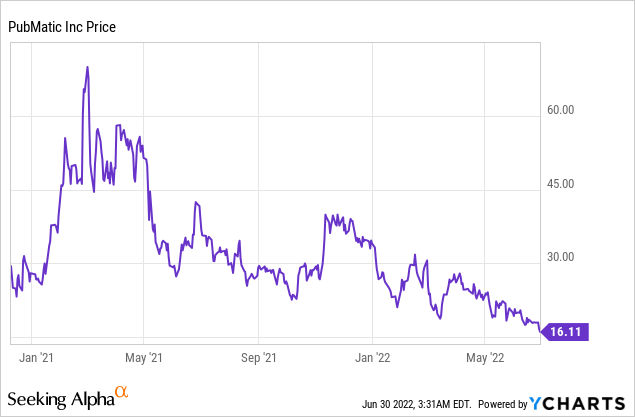

In this post we will dive into PubMatic, Inc. (NASDAQ:PUBM), a small cap Digital Advert provider company, which is disrupting the industry. PubMatic was founded in 2006, but didn’t IPO until 2020. Since then, the stock price has slid down by 72%, despite operating income nearly doubling over the same period. The nosedive in stock price was mainly caused by the high inflation and rising interest rate environment. This impacts growth stocks more so, as their valuation is weighted more towards future cash flows. The stock is now undervalued intrinsically and could at least double in average scenario and 3.5x in the best case. Let’s dive into the Business Model, Financials and Valuation for the juicy details.

Business Model

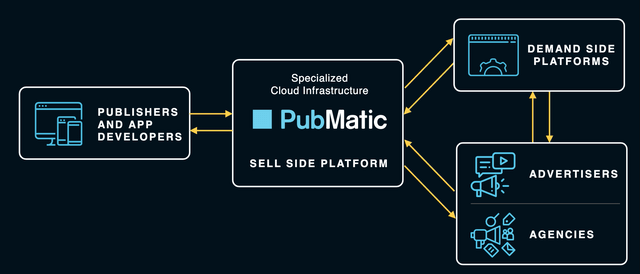

PubMatic is a Programmatic Advertising company which operates on the sell side. “Programmatic” basically means the automated buying/selling of advertising space. While, “Sell Side” refers to the Website publishers who want to “Sell” their advertising space. The name “PubMatic” is really a combination of “Publisher” and “Automatic.” It’s Advert placements are “omnichannel,” which means multi channel. These can be placed across three main areas:

-

Mobile App’s & Web

-

Connected TV

-

Online Video

It’s publisher customers include high quality websites such as; Yahoo, the Guardian, Business Insider, Forbes, the New York Times, ABC, BBC and many more.

Pubmatic Customers (Investor presentation)

The company then sells this high quality advertising space to Demand Side (Buy Side) Platforms such as Google or The Trade Desk (TTD). PubMatic makes its money by charging a percentage of the advertising impression value.

PubMatic Business Model (investor presentation)

As of the first quarter of 2022, they have over 60,000 advertisers on the platform, which include Fortune 500 companies such as Procter & Gamble (PG) and the world’s largest drinks brewer, Anheuser-Busch InBev (BUD). PubMatic is also partnered with the largest advertising agency in the world, WPP, in addition to the 5th-largest Global Ad Agency Dentsu, which offers great distribution for the platform.

Ad Agencies (Investor Presentation)

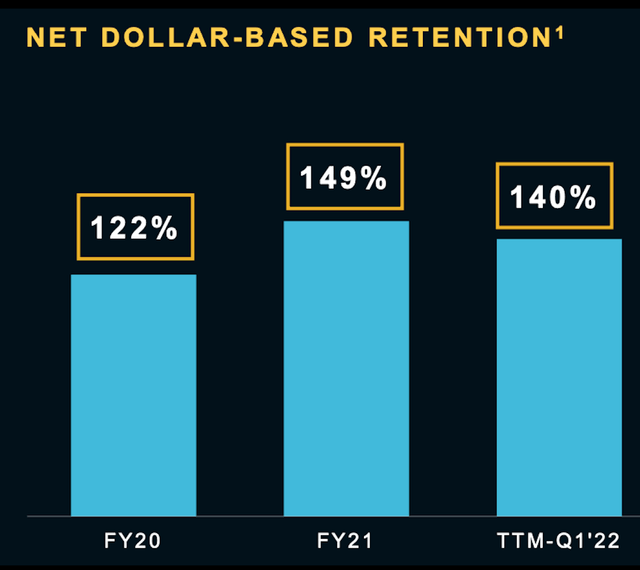

Publishers are finding value in the PubMatic platform, as shown by a super-high net dollar retention rate of 140% for the first quarter of 2022. This is a positive sign, as it shows customers are staying with the platform and spending more thanks to their “Land and Expand” strategy.

Retention Rate (Earnings report)

The “death of the ad cookie” is a widely talked about topic, as people are valuing their privacy more. Apple has already blocked third party cookies, which has seriously impacted the tracking of data for companies such as Meta Platforms (Facebook). While Google has also announced plans to phase out advert cookies on their Chrome browser.

The beautiful thing about platforms such as PubMatic is they specialize in “Contextual Targeting” which allows ad placements to be made based on context such as Sports or Finance from elite publishers. Ad buyers can also upload their own 1st party data such as their own customer or email list to the platform.

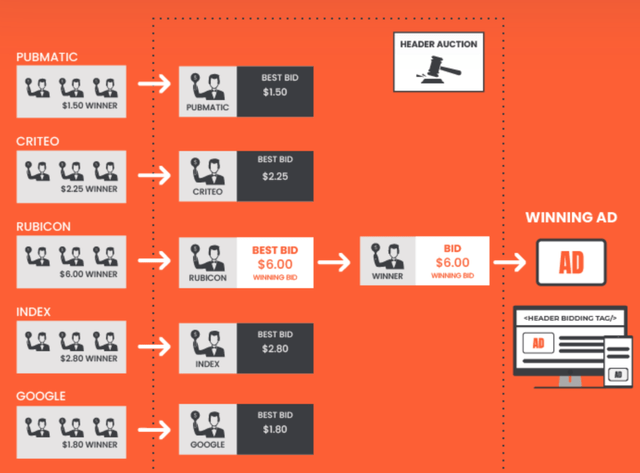

Header Bidding (Technical Part)

Header bidding is an advanced programmatic advertising process. The technique works by allowing multiple Sell Side Platforms (“SSPs”) such as PubMatic, Criteo, Rubicon, and even Google, to bid on the ad space for a publishers website. This occurs rapidly every time a page loads or whenever an advertising unit refreshes. The goal of this is really to make a fairer system for publishers and help to maximize their ad revenue. This is a great alternative to Google’s traditional Waterfall method which tends to favor ad networks with higher ranking’s and isn’t really a fair system.

Thus an increase in more publishers using “Header Bidding” will likely result in great revenue for platforms such as PubMatic. The trend towards “Header Bidding” being used for Connected TV is a major trend which is set to be an industry gamechanger. In traditional TV, a Network may sell its adverts at a fixed cost, but with connected TV and Header Bidding ads can be loaded in real time based on bids.

Header Bidding (Neil Patel Digital)

Founder-Led Management

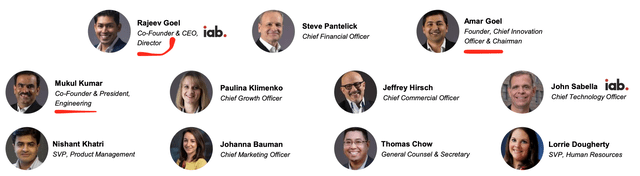

One of my core investment strategies is to invest into companies which are founder led. In this case, PubMatic’s core founding team are still heavily involved in the business. From the CEO (Rajeev Goel) to the Engineering President (Mukul Kumar) and CIO (Amar Goel). They all have “Skin in the Game” with the insiders mentioned above owning approximately 12% of the company’s shares.

PubMatic Management (Investor Presentation)

Growing Financials

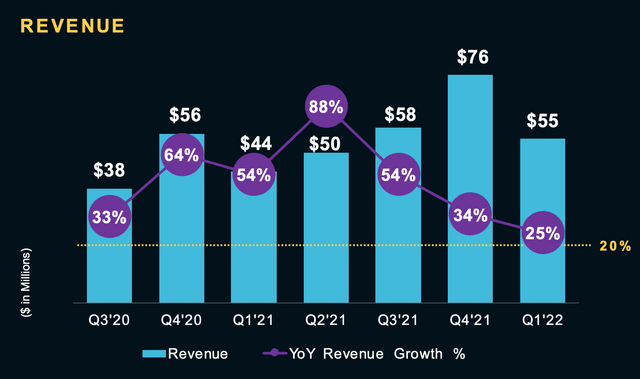

PubMatic has a strong track record of revenue growth, with 20%+ revenue growth for the 7th Consecutive quarter. For the first quarter of 2022, they achieved revenue of $55 million, up 25% year over. This is a positive sign, although it should be noted growth has slowed down quarter over quarter since Q3 of 2021. This could be driven by the rising interest rate environment and “Recession” fears causing advertising to reduce spending (more on that in the “Risks” section).

Revenue Growth (Earnings report)

The Revenue Growth for the first quarter of 2022, has been primarily driven by fast growing segments such as Mobile & Omnichannel Video (including Connected TV), which is up 41% year over year and made up 67% of revenue in the first quarter, while Connected TV (CTV) revenue 5X’d compared to the first quarter of 2021. The company now has 176 CTV Publishers and has recently signed up three out of five of the largest connected TV manufacturers.

Connected TV Growth (Earnings report)

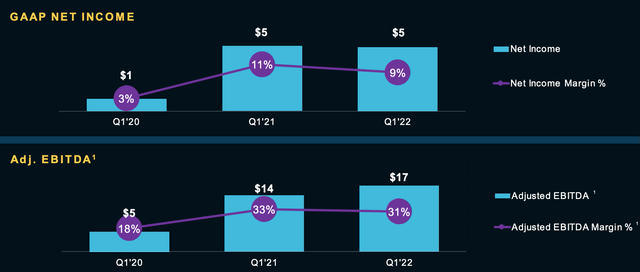

PubMatic generated GAAP net income of $4.8 Million at a 9% margin and flat compared to the first quarter of 2021. However, Adjusted EBITDA increased by 17% to $17 Million at a 31% Margin.

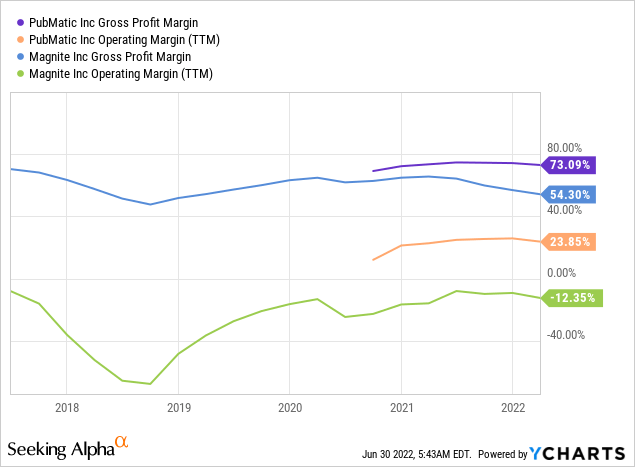

A comparison with competitor Sell Side Platform Magnite (MGNI) shows PubMatic has both a higher Gross Margin (73% vs 54%) and higher operating margin (24% vs -12%).

Net Cash from operations was $19.3 million, which represented a rapid increase of 52% compared to $12.7 Million in the first quarter of 2021. PubMatic has a fortress balance sheet with $174 million in cash, cash equivalents and short term investments with no debt.

Valuation

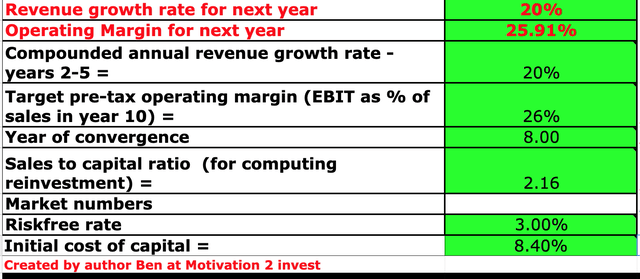

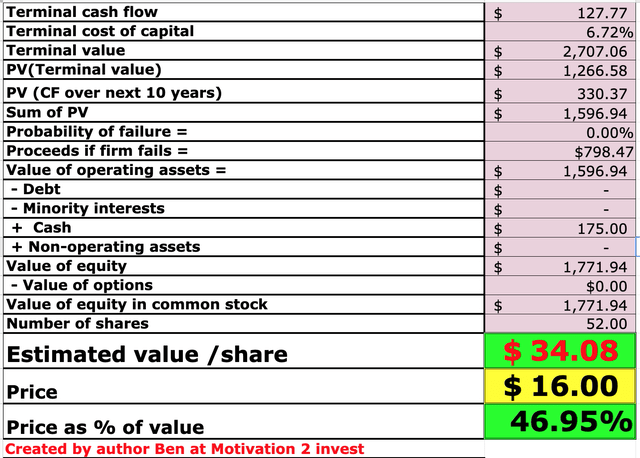

In order to value PubMatic, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 20% revenue growth per year for the next 5 years. This is conservative, given management’s guidance of between 24% and 26% revenue growth for the full year 2022.

PubMatic Valuation (created by author Ben at Motivation 2 Invest)

In addition, I have forecasted the operating margin (with R&D adjustments) to maintain stable at ~26%.

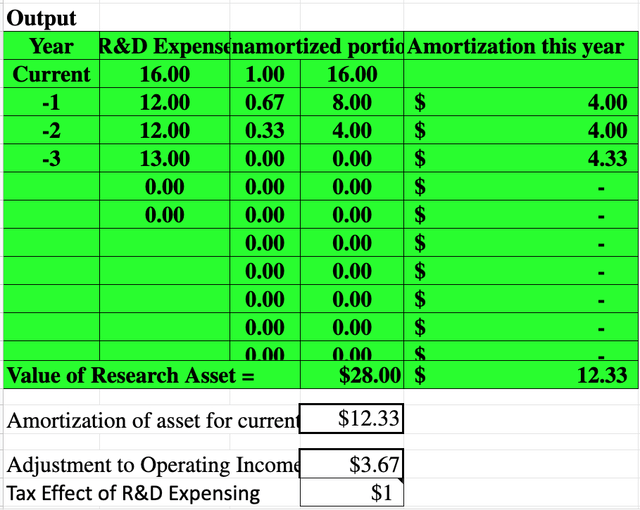

In order the increase the accuracy of the valuation I have capitalized R&D Expenses of $16M in 2021 and $12 M for the prior years.

PubMatic Stock Valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $34/share. The share price today is currently $16/share, and thus the stock is approximately 53% undervalued.

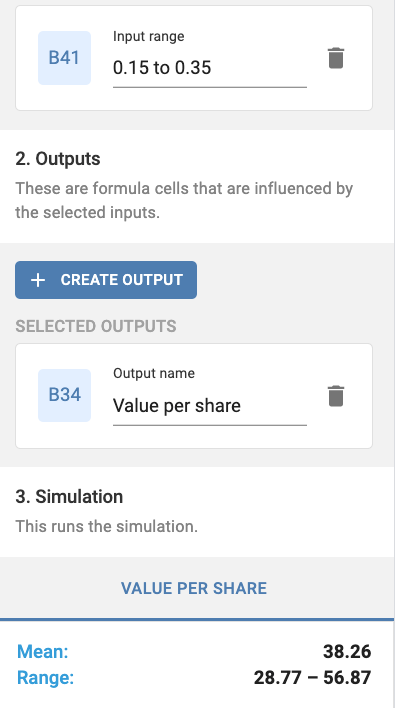

In order to analyze the stock under various scenarios, I have also done a Monte Carlo Simulation. This will run the valuation model at revenue growth rates between 15% to 35% for the next two to five years. This is represented by the (0.15 to 0.35) input range below.

Monte Carlo simulation (author model)

Given these factors, I get a mean Valuation of $38, which is substantially higher than the stocks $16 price today. In addition, the range is $28.7/share under the low growth (15%) scenario and up to $56/share under the higher growth (30%) scenario. At the high growth (but not unrealistic) scenario, the stock has the potential to 3.5x.

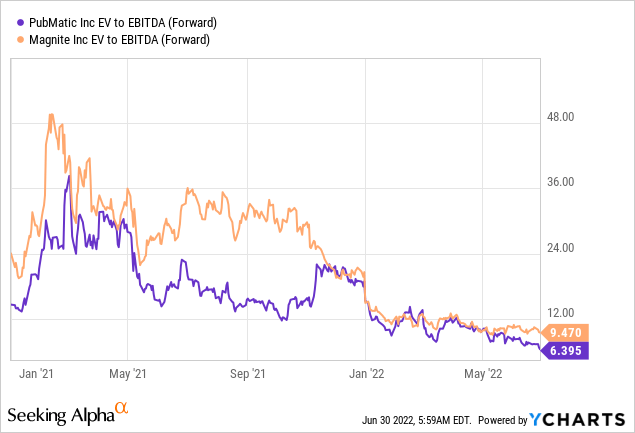

For a relative valuation, PubMatic has an EV to EBITDA (forward) = 6.4 which is cheaper than competitor Magnite which trades at an EV to EBITDA = 9.5.

Risks

Small Cap Volatility

PubMatic is classed as a “Small Cap” stock due to its Market Capitalization of $838 Million and operating income of just $58 million for the full year 2021. Small Cap stocks tend to be much more volatile than larger cap stocks, which large downswings but also upswings. This is just something to be aware off and diversification is advised (but not financial advice).

Competition

There are many programmatic advertising company’s in the industry, especially on the Sell Side. According to G2, there are 84 platforms which include Rubicon (now part of Magnite), Criteo and of course DoubleClick by Google. High competition means publishers have many options when choosing a sell side platform. This lack of moat could make it hard for PubMatic to differentiate itself in the industry.

Rising Interest Rates

The high inflation and rising interest rate environment, has compressed the valuation multiples for all growth stocks. In addition, high inflation increases input costs for businesses and squeezes the consumer with higher bills. If advertisers don’t get the ROI they desire or get spooked by economic conditions, they can pull advertising spend. We saw this happen with Alphabet during the pandemic and their stock price fell off a cliff. Now, although advertising budgets are cyclical and the general trend is increasing, it is just something to be aware of.

Final Thoughts

PubMatic is a fantastic company which offers an easy-to-use portal for a plethora of elite publishers. They have grown their financials at a rapid pace over the past few years and have a strong balance sheet with zero debt. The rising interest rate environment has been a driver of stock price decline, including many technology stocks. However, PubMatic stock is now undervalued intrinsically and relative to its main competitor. Thus, this stock is poised to be a great play on the decentralization of the online advertising industry.

Be the first to comment