marchmeena29/iStock via Getty Images

SmartRent, Inc. (NYSE:SMRT) delivers not only impressive sales growth, but also promising 2022 guidance. In my view, if investments in research and development continue, and more M&A is reported, sales growth will likely continue. I agree with other analysts about when SMRT will deliver positive free cash flow for the first time and share its optimism. Even considering the risks from M&A failures and technological challenges, SMRT appears a buy at the current price mark.

SmartRent Targets A Massive Market, And Recently Noted Acceleration In The Demand Fueled By The Acquisition Of SightPlan

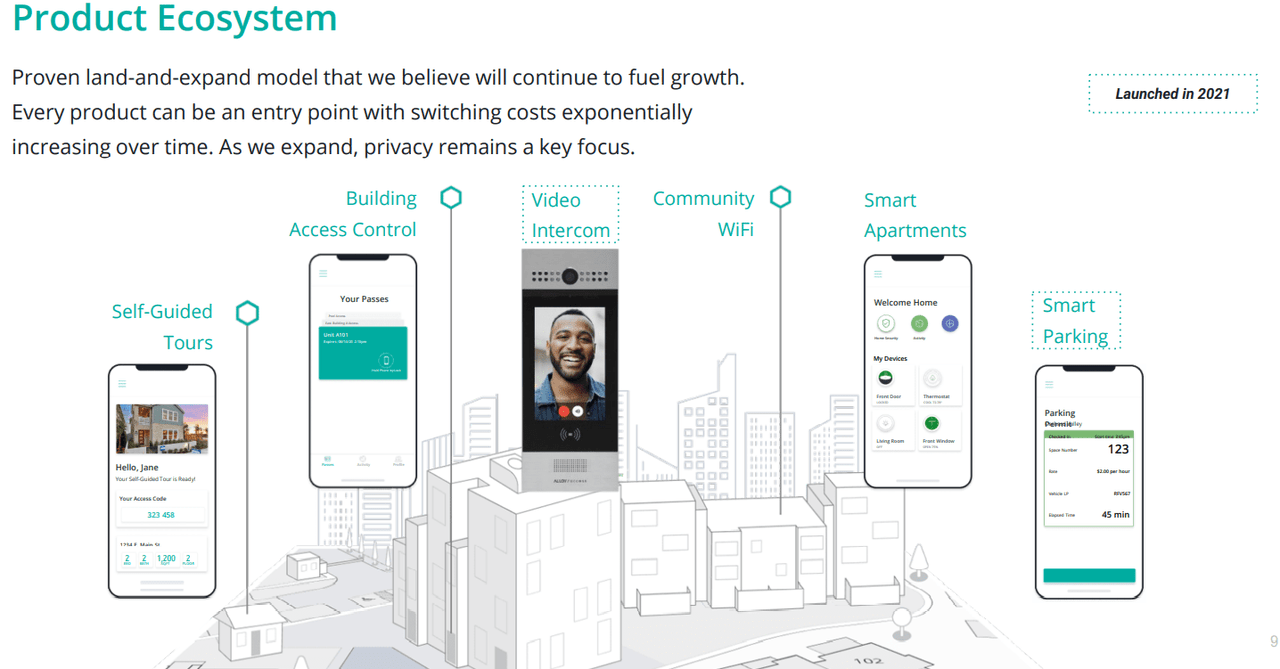

SmartRent offers software, hardware, and artificial intelligence solutions to players in the estate industry. The product ecosystem includes community Wi-Fi, smart apartments, smart parking, video intercom, and building access control. New products are launched every year, so that the target market keeps expanding.

Investor Presentation

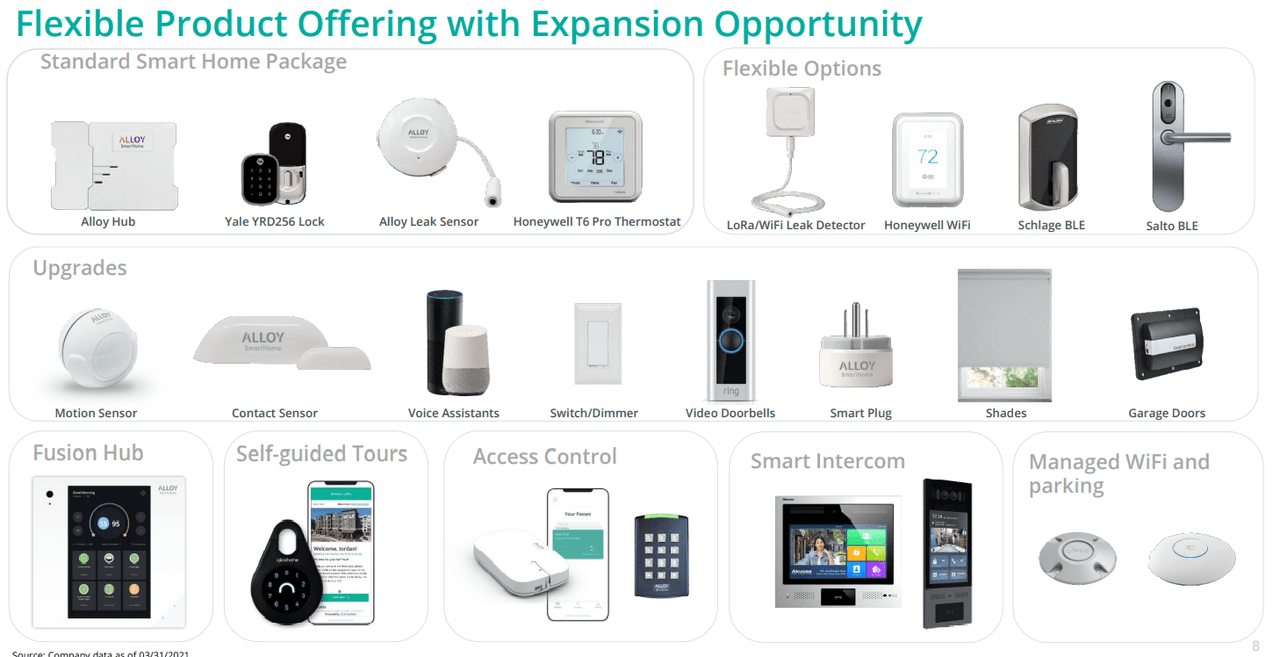

Investor Presentation

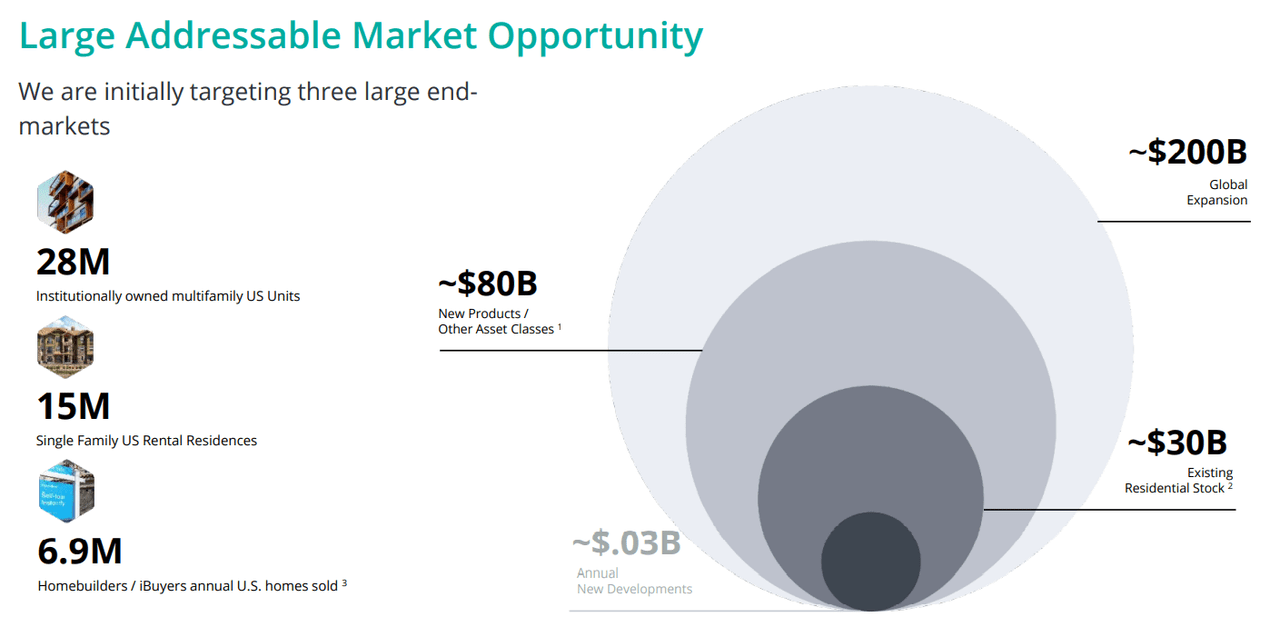

SmartRent targets institutionally owned multifamily units, single family residences, and homebuilders, which offer a total market opportunity of $200 billion.

Investor Presentation

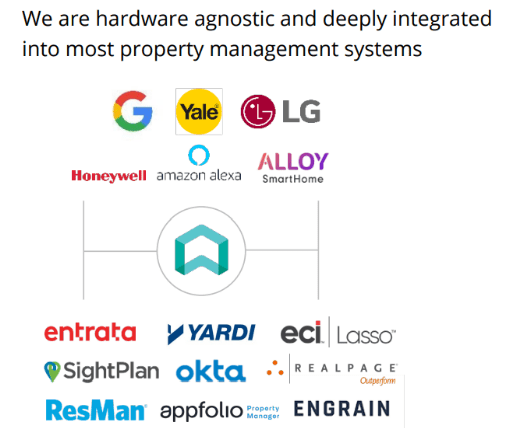

The company integrates its software in very different management systems and real estate software. In my view, the network effects from these practices will likely help SmartRent multiply the number of users.

Investor Presentation

With the previous information about its target market, SmartRent is even more interesting considering the acquisition of SightPlan. As a result, in the last quarterly report, management announced further demand for SmartRent’s solutions thanks to new capabilities obtained via the acquisition.

We achieved record revenue, deployed over 51,000 new units, added 41 new customers to the SmartRent platform and made the strategic step of acquiring SightPlan to further enhance our platform capabilities. Source: SmartRent Reports First Quarter 2022 Results

Demand for SmartRent’s solutions is accelerating, as evidenced by a record of over 91,000 Units Booked in the quarter and the expansion of our customer base to 290 customers. With the addition of SightPlan, we anticipate even more opportunities to sell our value-enhancing, comprehensive platform. Source: SmartRent Reports First Quarter 2022 Results

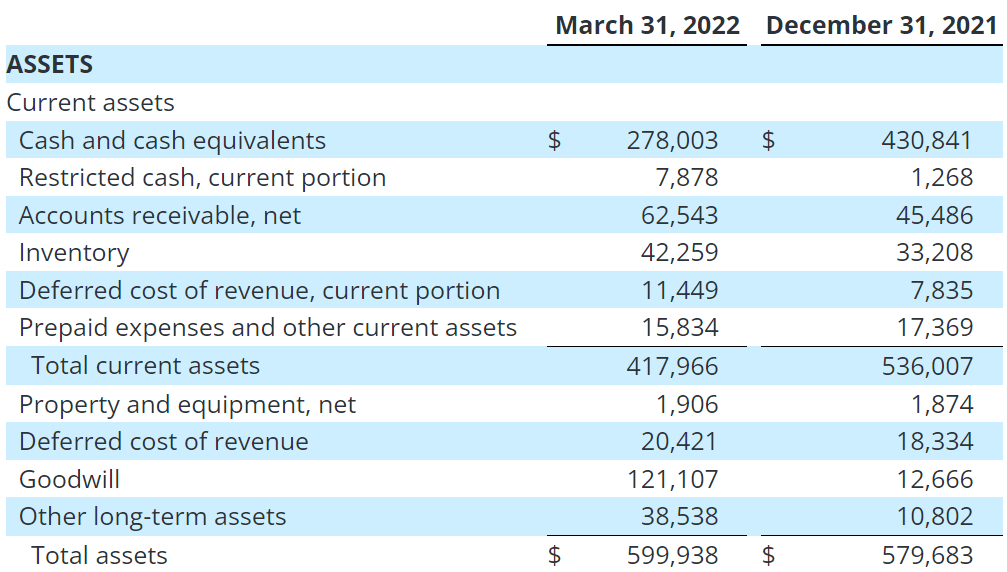

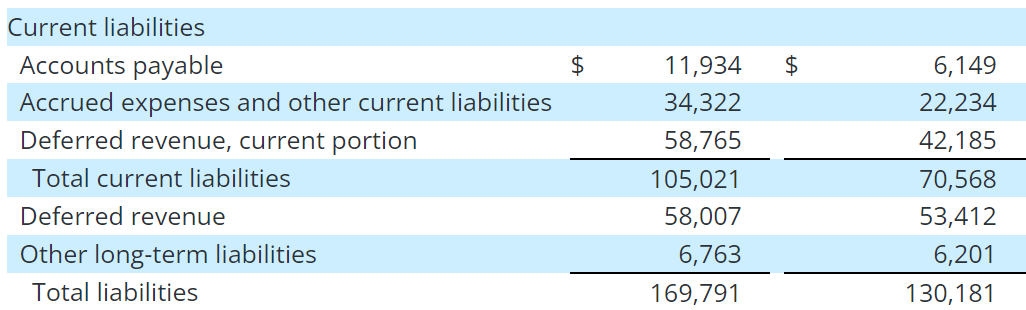

Balance Sheet: 46% Of The Total Amount Of Assets Is Represented By Cash In Hand

As of March 31, 2022, SmartRent reported $278 million in cash, $599 million in total assets, and liabilities worth $169 million. In my view, the company’s financial situation appears quite healthy.

10-Q

It is also quite beneficial that SmartRent reports deferred revenue, which means that clients are paying for services in advance. In sum, clients are financing the company’s operations. It explains why management does not have to talk to banks.

10-Q

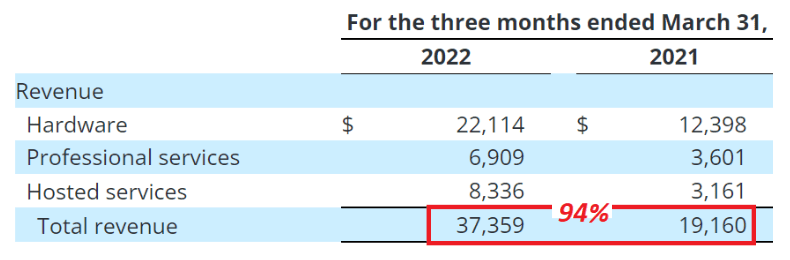

Outstanding Revenue Growth In The Last Quarter, And More Revenue Growth Expected For 2022

The demand for the company’s products described in the previous lines was confirmed in the most recent quarter. In the three months ended March 31, 2022, management reported 94% more revenue than that in the same period in 2021.

10-Q

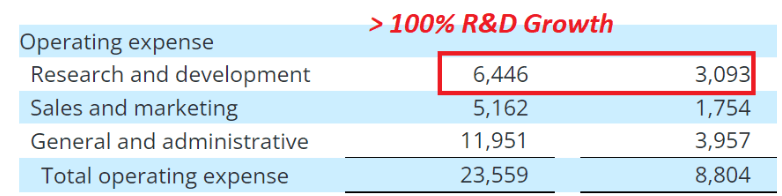

It is also worth noting that in the last quarter, SMRT reported significant R&D growth. It means that management is most likely designing new products, which may enhance sales generation in the coming years.

10-Q

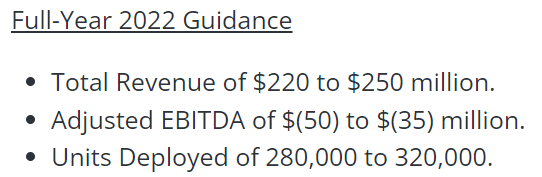

In the last quarterly report, SMRT offered guidance for the year 2022, which included revenue close to $220-$250 million and more than 280k units deployed.

SmartRent Reports First Quarter 2022 Results

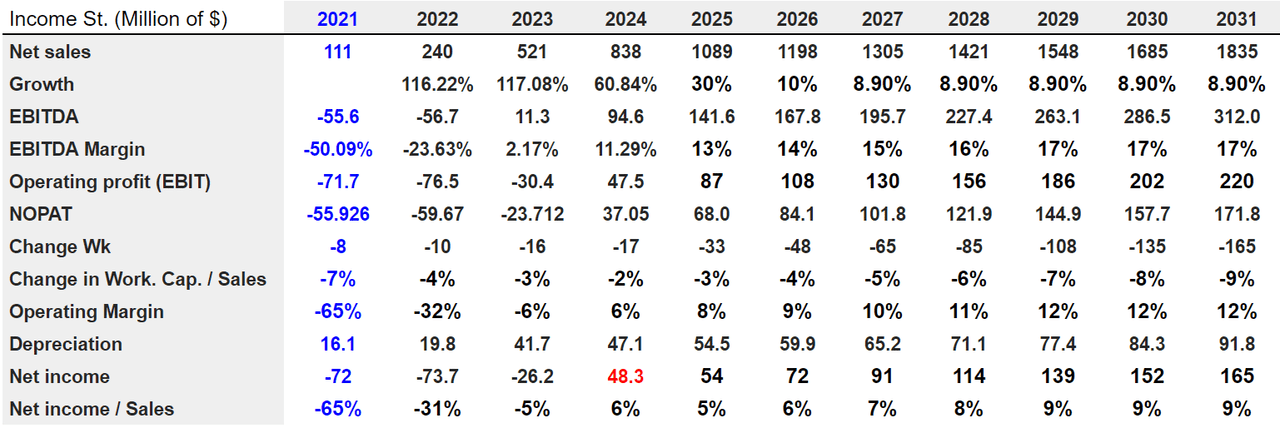

Income Statement Modeling Resulted In 2031 EBITDA Of $312 Million And 2031 EBITDA Margin Of 17%

SMRT signed contracts with large multifamily residential owners in the United States. These large companies will likely offer more agreements to SMRT, so we can expect future net sales. Under this case scenario, I assumed that SMRT would establish new connections with companies outside the United States.

Our customers included 15 of the top 20 multifamily residential owners in the United States. Moreover, many of our existing customers have demonstrated their satisfaction with our smart home operating system by installing our SmartRent solutions across their full operating portfolios over time. Source: 10-k

Besides, in my view, if management makes sufficient marketing efforts around the new parking solution, revenue will likely trend higher. Keep in mind that SMRT’s technology includes parking sensors for real-time occupancy management and custom parking signs to monetize guest parking.

Our Alloy Parking solution provides an integrated software system and single-source database that allows owners and operators to assign and re-assign parking spaces, review interactive maps for live parking space availability (based on parking sensors for real-time occupancy), implement a proactive enforcement process, monitor parking management with resident parking decals and license plate validation, and install custom parking signs to monetize guest parking. Source: 10-k

I also assumed that management will be able to acquire new technologies in the next decade. In my view, SMRT has sufficient cash in hand to make several acquisitions, which will improve SMRT’s portfolio.

As part of our ongoing effort to control and improve the quality of our products and solutions, in February 2020, we acquired Zenith Highpoint Inc., the supplier of our Alloy SmartHubs. We currently offer two different SmartHub models, the Alloy Smart Home Hub and our next generation SmartHub, the Alloy Fusion. These SmartHubs use reliable and secure Z-Wave communication for remote control of connected devices and allow users to remotely manage multiple device settings from one application. Source: 10-k

Under the conservative assumptions, I believe that SmartRent’s sales growth will likely stay close to 8.9%, which is the growth rate of the global real estate software market. Most investment analysts believe that sales growth will likely exceed 59% in 2024, so I assumed that sales growth will be around 8.9% from 2027.

The Global Real Estate Software Market size is expected to reach $15.8 billion by 2027, rising at a market growth of 8.9% CAGR during the forecast period. Source: ResearchAndMarkets.com

We are talking about a software company, so in my view, the EBITDA margin will likely increase as the number of customers increases. Yes, I believe that economies of scale could play a major role here. Under this assumption, I believe that SmartRent could deliver an EBITDA margin of 17% from 2029 to 2031. Finally, notice that my numbers also include negative changes in working capital, growing D&A, and positive net income from 2024.

Arie Investment Management

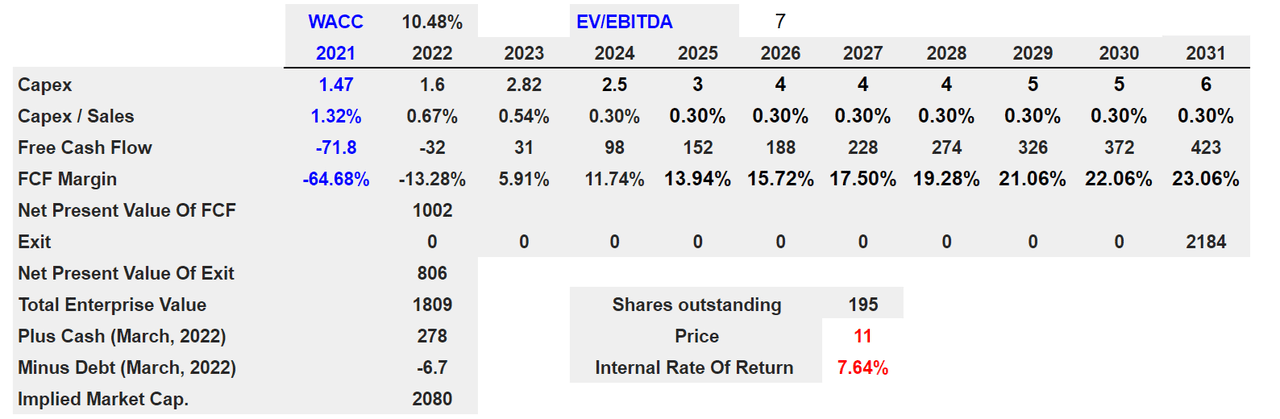

I assumed a cost of capital of 10.48%, which is close to the figure used by other investment analysts. My exit multiple is also quite conservative, 7x EBITDA. It is achievable for a company growing sales at 8.9% y/y, with an EBITDA margin of 17%. The results include an implied price of $11 and an internal rate of return of 7.6%.

Arie Investment Management

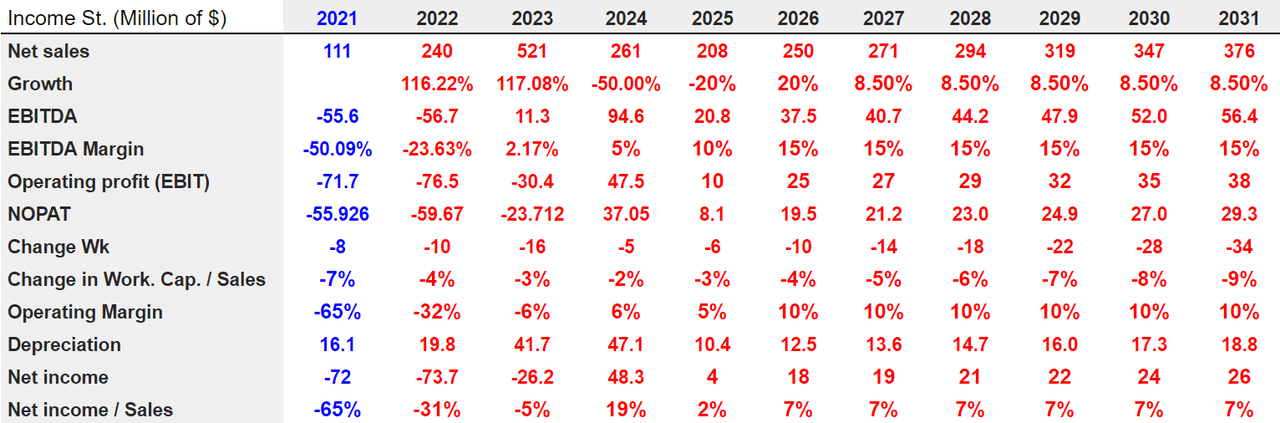

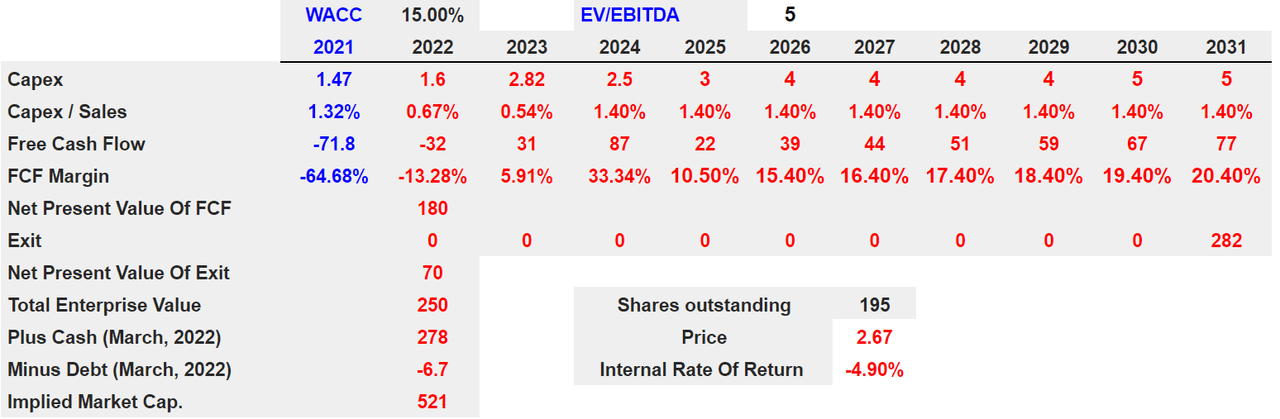

My Bearish Financial Model Results In A Fair Price Of $2.67

SMRT delivered significant sales growth in the past. Investors cannot expect the same growth pace for a long time. Let’s note that increasing the headcount from 50 to 100 employees is not as difficult as going from 1k to 2k. It is also quite important that SMRT may find technological challenges, or the market trends may change in the future. Without sufficient revenue growth, the company’s EV/EBITDA may decline.

We have experienced rapid growth since our formation in 2016. We have encountered and expect to continue to encounter risks and uncertainties frequently experienced by growing companies in rapidly changing markets. If our assumptions regarding these uncertainties are incorrect or change in reaction to changes in our markets, or if we do not manage or address these risks successfully, our results of operations could differ materially from our expectations, and our business could suffer. Source: 10-k

In the past, SMRT delivered significant inorganic growth. In the future, management may not find new acquisition targets suitable to integrate inside the organization. Besides, some of the previous acquisitions could fail. In the worst case scenario, SMRT may deliver impairment of goodwill, and free cash flow expectations may decline. As a result, the stock price may fall.

We cannot assure you that we will successfully identify suitable acquisition candidates, integrate or manage disparate technologies, lines of business, personnel and corporate cultures, realize our business strategy or the expected return on our investment, or manage a geographically dispersed company. Any such acquisition or investment could materially and adversely affect our results of operations. Acquisitions and other strategic investments involve significant risks and uncertainties. Source: 10-k

Under this financial model, regarding the growth, I used a decline of -50% in 2024 and -20% in 2025, which are pessimistic results. Then, from 2027 to 2031, I used sales growth of 8.5%. If we also include an EBITDA margin of 15% from 2026 to 2031, 2031 EBITDA would stand at $56 million, and 2031 net income would be $26 million.

Arie Investment Management

The previous results are so pessimistic that in my view, the cost of equity could increase dramatically. I used a discount of 15%, a capex/sales ratio of 1.4%, and an EV/EBITDA multiple of 5x. The results include an implied price of $2.67 and a negative internal rate of return.

Arie Investment Management

My Takeaway

Currently trading with a valuation of more than $1 billion, SmartRent recently delivered beneficial guidance, and most analysts are optimistic about future free cash flow. In my view, with more products being launched and further expenses in research and development, net sales will likely trend higher. In particular, I expect the future sales growth from the new parking solution and recent acquisition of SightPlan. I also see risks from M&A failures, decrease in the revenue growth pace, and technological challenges. However, even considering the risks, I believe that SmartRent is undervalued at the current price mark.

Be the first to comment